Lending Between Family or Friends Results in Guilt, Hurt Feelings and Regret, Survey Finds

Mixing money with your personal relationships can get tricky. A recent LendingTree survey of over 1,000 Americans found that almost a third of respondents reported negative consequences from lending or borrowing money from family and friends.

Click below for a closer look at our findings:

Key findings

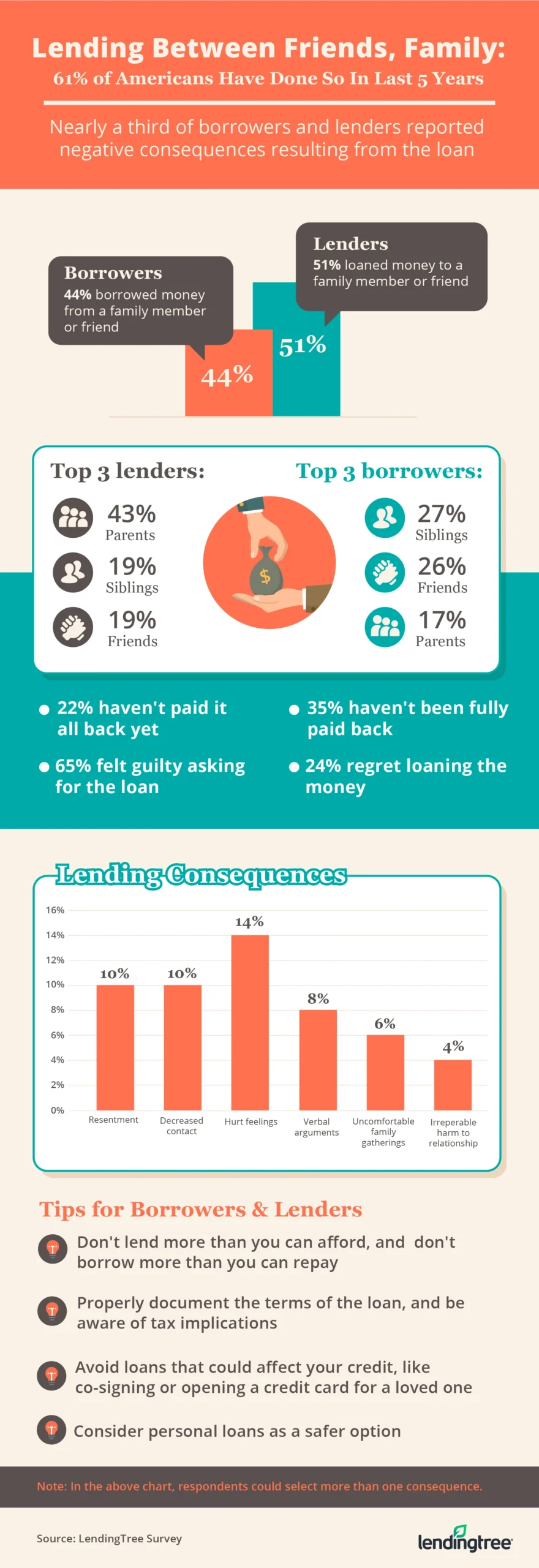

- 44% have borrowed money from a family member or friend in the last 5 years. Parents (43%), siblings (19%) and friends (19%) were the most common lenders among respondents.

- 51% have loaned money to a family member or friend in the last 5 years. Siblings (27%), friends (26%) and parents (17%) were the most common borrowers among respondents.

- Nearly a third of borrowers and lenders reported negative consequences resulting from the loan, with hurt feelings (14%) being the most common answer. Additionally, 1 in 10 reported resentment, and the same number also mentioned decreased contact.

- More than a third of lenders have not been paid back, and 24% said they regretted lending money to their family member or friend.

- More than 1 in 5 borrowers have not yet paid back their family member or friend. The costs of not paying back their loan could be adding up, as 11% said they were charged interest.

- 65% of borrowers felt guilty about asking their family member or friend for a loan. Despite the guilt, 67% said they wouldn’t hesitate about asking for another loan.

- Americans are more willing to lend to family members than they are to friends, and the same goes with borrowing. On the other hand, respondents were more hesitant to charge their friends interest and document the terms of the loan than they were when lending to family members.

Americans are more willing to lend and borrow from family than friends

When it comes to seeking and giving financial help, most people feel more comfortable doing so with a family member versus a friend — in fact, a quarter of survey respondents said they would not give their friend a loan, while only 17% said the same for family members. This may seem harsh, but the sentiment goes both ways. Similarly, respondents were less likely to ask friends for help when they need to borrow money than they were with a family member.

Lending money to others seems easier for most respondents to stomach than borrowing it. Overall, more than half of respondents have not borrowed money from a friend or family member in the past five years — but more than half have lent money.

And how much they would borrow and lend is higher with family

When it comes to borrowing, the amount someone is willing to borrow increases when borrowing from a family member. For amounts more than $20,000 they were more likely to request help from a family member than a friend.

However, survey respondents were also more likely to lend larger amounts of money to family members. Respondents were twice as likely to be willing to lend an amount over $20,000 to a family member than to a friend.

For small amounts of money it does seem people are more willing to turn to their friends for a little help. Respondents were more likely to borrow amounts of less than $500 from friends than family members. They were also more likely to lend amounts of less than $500 to a friend than a family member.

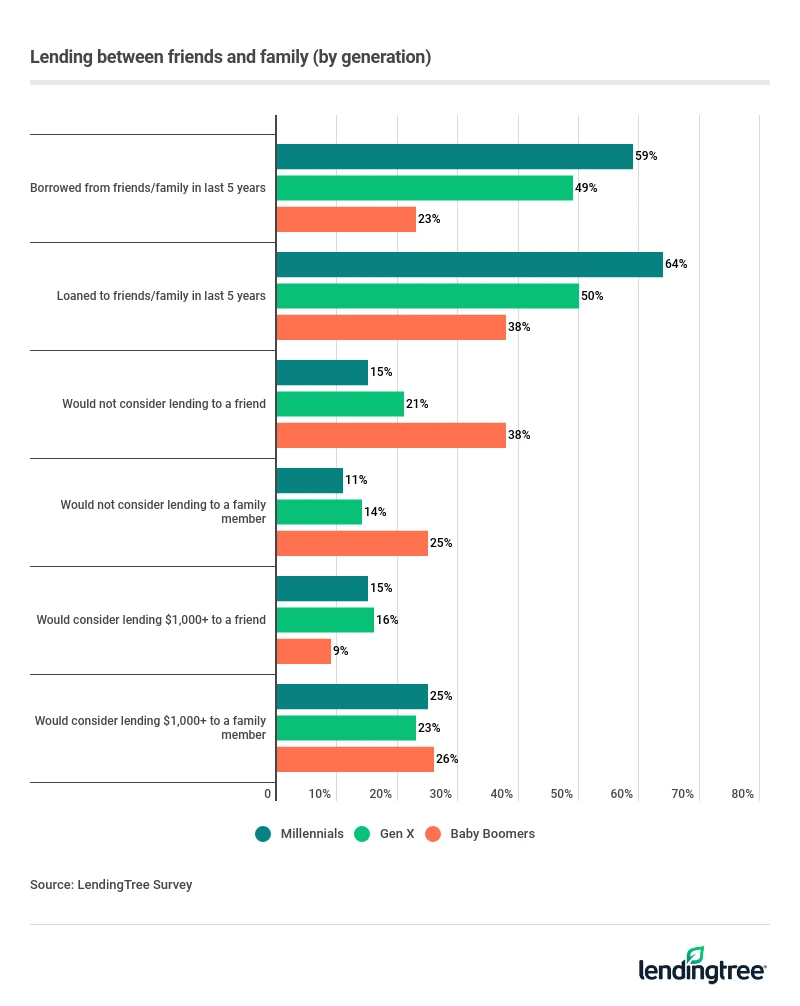

Generational differences in lending and borrowing money

Although all generations were more likely to lend money to a family member than a friend, there were different views held amongst each generation. For example, when it comes to lending money to friends, millennials were the most generous. They were the most likely of any generation to say they’d be okay lending money to a friend, and nearly 20% of millennials would consider loaning up to $1,000.

Millennials take a more lax approach to loans amongst loved ones, as they were the most likely to both lend and borrow money. Millennials are likely more sympathetic due to dealing with their own financial hurdles. From 2016 to 2019, millennials saw the greatest spike in overall debt amounts among each generation. During that three-year period, their total debt balances rose by an average of $16,714, at an almost 29% growth rate, during that time period.

Gen Xers, however, are carrying more debt than millennials and baby boomers. Despite this, they were slightly more likely than millennials to consider lending $1,000 or more to a friend. Interestingly, they were slightly less likely to consider loaning the same amount of funds to family.

Baby boomers have lent out money less frequently than millennials and Gen Xers in the past five years. This may, in part, be due to the fact that baby boomers are at or close to retirement age, and thus living on limited incomes.

Gen Xers fell

Why Americans are borrowing and lending money to others

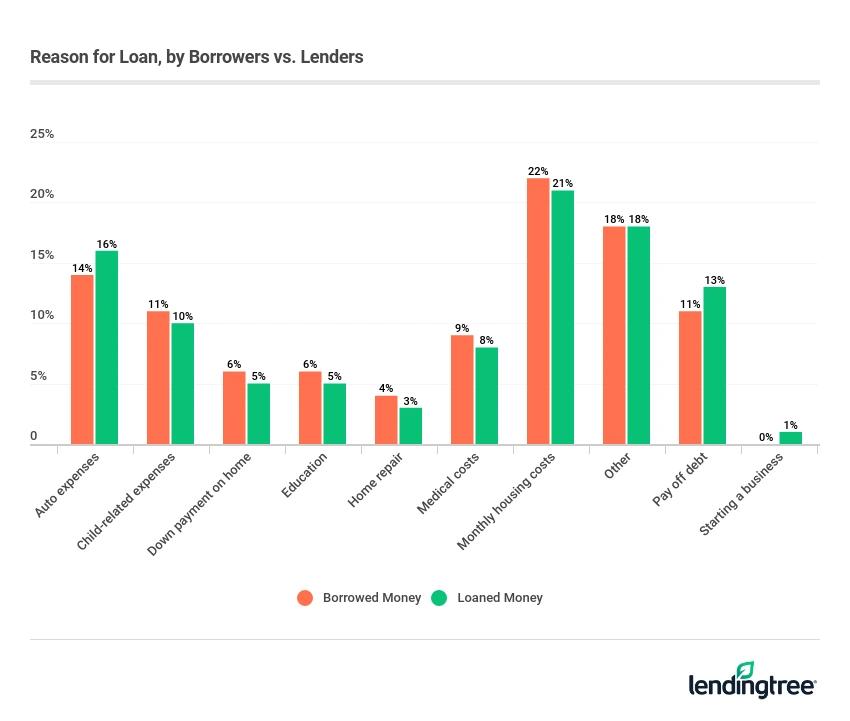

Needing to borrow money from a loved one is usually not something you expect to happen. But sometimes, it may be the most practical and affordable option for borrowing money. The following are just some of the reasons why Americans are lending or borrowing money:

- Auto expenses

- Child-related expenses

- Down payment on a house

- Education

- Home repair

- Medical costs

- Monthly housing costs

- Pay off debt

- Starting a business

Monthly housing costs and auto expenses were found to be the two primary reasons given for why people borrow money. Auto loans make up the second-biggest share of non-mortgage debt for millennials, although anyone from any generation can struggle to pay their monthly auto loan payment. Sixteen percent of Americans reported they’ve lent money to help cover the costs of of auto expenses.

While there is overlap among generations in each of these categories, some struggle more than others with specific costs. For example, it’s worth noting that student loans make up the majority of millennial debt, with auto loans falling close behind. So it makes sense that 7% of millennials reported that they borrowed or lent money for education expenses. And 16% of millennials did so to cover auto expenses.

Baby boomers, in contrast, generally have less mortgage debt and less of a need for expenses relating to caring for a child. Only 7% of baby boomers reported partaking in a loan with a friend or family member to assist with child-related expenses, compared to 15% of millennials.

3 quick tips for borrowing from or lending money to friends and family

If a time comes where you need to borrow money from a friend or family member, or are going to lend money, then you’ll want to proceed with caution and consider the following tips. Doing so can help you avoid feelings of resentment, decreased contact, verbal arguments, uncomfortable family gatherings, irreparable harm to relationships, and hurt feelings, all of which Americans reported as negative outcomes of borrowing or lending money.

- Learn more about the loan: Start by asking what the funds are for ahead of time. Knowing why you are lending someone money is important because you may feel that the need is less important than they do. In order to avoid frustration or disappointment, it’s fair to ask how the money you lend will be used. You should also ask for evidence of how the asker will be able to repay the debt. For example, if you find out they want the money to help start a business, it’s safe to assume you may not see your money for many years.

- Come up with a repayment plan. An open ended loan is generous, but not practical if you want to ensure you get your money back. Many people see personal loans as a gift and know there is a chance they won’t be paid back. But if you want or need to receive your money back by a certain time period, it’s best to set a plan that both parties can follow.

- Come up with a written agreement both parties will sign: Only 19% of Americans properly documented the terms of their loan and repayment agreement. It may seem formal to set such an agreement in writing with a loved one, but doing so can help keep both parties’ expectations clear and manageable. You can include the payback date, outline a monthly installment policy, or include interest terms in this agreement.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,022 Americans — 620 of whom borrowed and/or loaned money to a friend or family member within the last five years.

For the purposes of this survey, generations are defined as:

- Millennials are ages 22-37

- Generation Xers are ages 38-52

- Baby boomers are ages 53-72

Get personal loan offers from up to 5 lenders in minutes