Consumers Sought Smaller Personal Loan Amounts for Medical Expenses in 2023, Though Gen Xers Requested the Most

Medical issues can take a toll on your health and your finances. Even with insurance, deductibles and copays can be significant. Without insurance, costs can be extreme.

As a remedy, some consumers turn to personal loans for medical expenses. In 2023, the average request for this type of personal loan on the LendingTree platform was $7,176 — down 17.6% from 2022.

We dig deeper into the averages over the past four years and the share of inquiries for medical expenses, dissecting them nationally, generationally and by state.

Key findings

- Consumers seeking personal loans for medical expenses on the LendingTree platform in 2023 requested $7,176 on average. That’s down 17.6% from an average request of $8,706 in 2022 but up from $6,758 in 2021 and $5,892 in 2020.

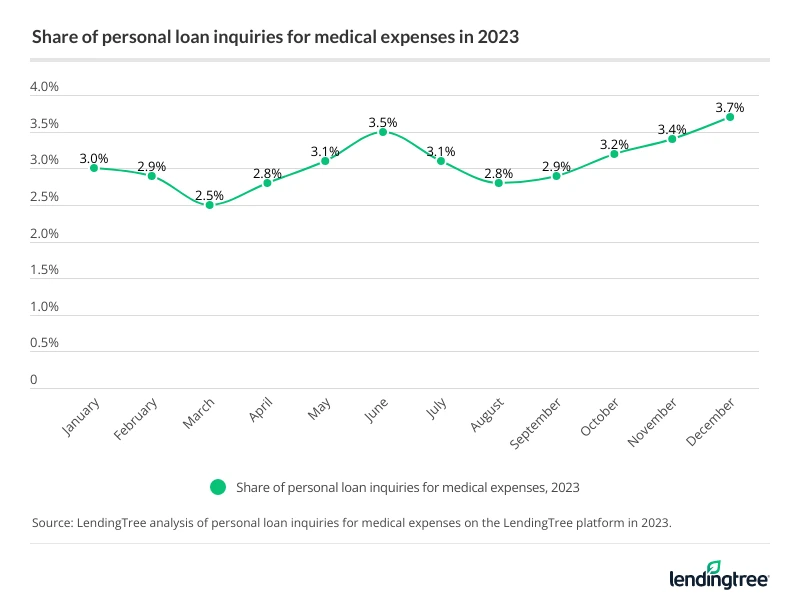

- The share of loan inquiries for medical expenses on our platform in 2023 was 3.1%. That ranged from 2.5% in March to 3.7% in December. 2023’s share was down from 3.8% in 2022, 4.4% in 2021 and 3.9% in 2020. In the four years analyzed, medical loan inquiries reached a peak share of 5.0% in December 2020.

- Gen Xers requested the highest loan amounts for medical expenses on the LendingTree platform in 2023. They asked for an average of $7,801 in 2023, followed by millennials ($7,279) and baby boomers ($7,200). However, the silent generation had the highest share of loan inquiries for medical expenses, at 6.0%.

- The percentage of personal loan inquiries for medical expenses in 2023 on our platform was highest in South Dakota (4.7%) and Wyoming (3.9%). Three states were tied next at 3.7%. Meanwhile, the percentage was lowest in Vermont (2.4%), with four states tied at 2.5%.

Average personal loan request for medical expenses down in 2023

Taking a temperature on personal loans for medical expenses, our analysis found that people requested significantly less money on the LendingTree platform in 2023 than in 2022 — $7,176, 17.6% less than the average request of $8,706 in 2022.

Does that mean Americans were healthier physically … or fiscally? Matt Schulz, LendingTree chief consumer finance analyst, says it’s hard to know precisely, but economics undoubtedly played a role.

“With overall debt rising, inflation sticking around and interest rates reaching record highs, it’s possible that people weren’t as willing to take on bigger loans in 2023, even if they needed it,” he says. “Remember that debt isn’t always a sign of struggle. It can be a sign of confidence. If people feel good about their financial situation, they may not mind taking out a big loan because they know they’ll be able to pay it off. If their finances are iffy, however, they may shy away from borrowing even if they need to.”

Before 2023, the average requested loan amount for medical expenses increased steadily for years, starting in 2020, when the average request was $5,892. That rose to $6,758 in 2021 and $8,706 in 2022.

Average personal loan amount requested for medical expenses

| Year | Avg. requested amount |

|---|---|

| 2020 | $5,892 |

| 2021 | $6,758 |

| 2022 | $8,706 |

| 2023 | $7,176 |

COVID-19 likely played a part in the climbing amounts requested. While overall spending on health care costs dipped in 2020 (the first year of the pandemic), according to the U.S. Bureau of Labor Statistics, it rebounded as people sought vaccines and telemedicine options and then returned to in-person treatment.

Annual per-capita health spending rose to $13,493.12 in 2022 from $13,012.38 in 2021, according to KFF. Also, nationwide out-of-pocket expenditures increased to $471.4 billion in 2022, up 6.6% from $442.2 billion in 2021.

Percentage of inquiries for medical expenses in 2023 highest in December, lowest in March

Does weather affect loans related to people feeling under the weather?

There are some trends regarding the time of year people most frequently consider loans to cover medical expenses (compared to other loan types), with December at the top. In December 2023, the percentage of loan inquiries for medical expenses on the LendingTree platform was 3.7%, 19.4% above the average in 2023. In March 2023, on the other hand, the percentage was 2.5%, or 19.4% lower than average.

This trend wasn’t limited to 2023, either. Based on our four-year averages, the pattern has generally been the same, with December leading with the highest percentage of loan inquiries for medical expenses (4.2%) and March among the lowest (3.7%).

Why the seasonal swing? There could be health reasons. After all, plenty of people get sick in the cold of December, and fewer might in March as spring arrives and the weather warms. However, Schulz says the biggest reasons likely have to do with people’s finances.

“December is the height of the holiday shopping season and one of the spendiest times of the year for people,” he says. “People are buying gifts, traveling, throwing parties and running up debt. That means that when they get sick during that time, they may need to lean on a personal loan to help them with their costs. In March, those holiday debts are probably paid off, and bank accounts may be more flush thanks to the arrival of tax refunds, so the need for a big personal loan may not be as acute.”

Overall, the share of personal loan inquiries for medical expenses has declined since 2020, except for a jump in 2021 from 3.9% to 4.4%. Again, that’s likely connected to COVID-19 and the associated increased costs after the first year of the pandemic, when the share of personal loan inquiries for medical expenses peaked. After that, the share dropped year over year to a four-year low of 3.1% in 2023.

Share of personal loan inquiries for medical expenses, 2020 to 2023

| Year | Share of personal loan inquiries for medical expenses |

|---|---|

| 2020 | 3.9% |

| 2021 | 4.4% |

| 2022 | 3.8% |

| 2023 | 3.1% |

Gen X requests highest amounts, while silent generation has highest share of inquiries for medical expenses

It’s not the oldest or the youngest generations seeking the highest amounts of cash to cover medical expenses. Rather, midlife Gen Xers (ages 43 to 58 in 2023) requested the most in 2023 — $7,801. Gen Zers (18 to 26 in 2023) requested the least — $5,738. The other generations fell somewhere in between:

- Silent generation (78 to 95 in 2023): $6,539

- Baby boomers (59 to 77 in 2023): $7,200

- Millennials (27 to 42 in 2023): $7,279

Why do Gen Xers take the lead? Schulz says they’re often dealing with expenses on multiple fronts.

“They’re possibly dealing with their kids’ medical expenses and their elderly parents’ medical expenses, as well as their own,” he says. “That can lead to big bills and big debt. Plus, I suspect Gen X may also be among the most likely to seek some elective cosmetic surgeries as they age, and those procedures can be prohibitively expensive and are not usually covered by insurance.”

Personal loan inquiries for medical expenses by generation, 2023

| Generation | Share of personal loan inquiries for medical expenses | Avg. requested amount |

|---|---|---|

| Silent generation | 6.0% | $6,539 |

| Baby boomer | 4.4% | $7,200 |

| Generation X | 3.2% | $7,801 |

| Millennial | 2.8% | $7,279 |

| Generation Z | 2.4% | $5,738 |

Things change a bit when it comes to the stage of life when people are most likely to seek loans to cover medical expenses. The silent generation was most likely to seek them in 2023, with 6.0% of inquiries for medical expenses, while Gen Z was the least likely with 2.4% of inquiries. The percentage increased with each generation in between:

- Millennial: 2.8%

- Gen X: 3.2%

- Baby boomer: 4.4%

Schulz says this isn’t surprising as health is such a concern for older Americans. They’re also less likely than their younger counterparts to start a business, remodel a home, plan a vacation or wedding or even refinance credit card debts, so it makes sense a bigger proportion of their loan inquiries would be to cover medical expenses. Also, younger generations may be more likely to turn to alternative options, such as crowdfunding, to pay for medical treatments.

Percentage of inquiries for medical loans highest in South Dakota, lowest in Vermont

Looking at inquiries for medical loans geographically, South Dakotans topped the list with 4.7% of inquiries for medical loans in 2023. That was 51.6% above average.

Why the peak in the Mount Rushmore State? It may be linked to the amount of medical debt people in South Dakota carry. According to a recent study by Peterson-KFF, South Dakota had the highest share of adults with medical debt (17.7%) between 2019 and 2021.

In our analysis, South Dakota was followed by Wyoming — 3.9% of inquiries for medical loans — and a three-way tie between Arkansas, Louisiana and North Dakota — at 3.7%.

While Arkansas and Louisiana had higher-than-average percentages of adults with medical debt (10.7% and 11.1%, respectively), according to the Peterson-KFF study, North Dakota had one of the lower rates of medical debt in the country (5.6%). North Dakota, however, ranked fourth in the nation for states where people had the highest average nonmortgage debt, according to a 2023 LendingTree study.

Personal loan inquiries for medical expenses by state, 2023

| Rank | State | Share of personal loan inquiries for medical expenses | % above or below average (3.1%) |

|---|---|---|---|

| 1 | South Dakota | 4.7% | 51.6% |

| 2 | Wyoming | 3.9% | 25.8% |

| 3 | Arkansas | 3.7% | 19.4% |

| 3 | Louisiana | 3.7% | 19.4% |

| 3 | North Dakota | 3.7% | 19.4% |

| 6 | District of Columbia | 3.6% | 16.1% |

| 7 | Kansas | 3.5% | 12.9% |

| 7 | Mississippi | 3.5% | 12.9% |

| 7 | Texas | 3.5% | 12.9% |

| 7 | Utah | 3.5% | 12.9% |

| 11 | Nebraska | 3.4% | 9.7% |

| 11 | Oklahoma | 3.4% | 9.7% |

| 13 | Alabama | 3.3% | 6.5% |

| 13 | Georgia | 3.3% | 6.5% |

| 13 | Idaho | 3.3% | 6.5% |

| 13 | Iowa | 3.3% | 6.5% |

| 13 | Montana | 3.3% | 6.5% |

| 13 | New Mexico | 3.3% | 6.5% |

| 19 | Colorado | 3.2% | 3.2% |

| 19 | Illinois | 3.2% | 3.2% |

| 19 | Nevada | 3.2% | 3.2% |

| 19 | Washington | 3.2% | 3.2% |

| 23 | Alaska | 3.1% | 0.0% |

| 23 | Florida | 3.1% | 0.0% |

| 23 | New Hampshire | 3.1% | 0.0% |

| 23 | North Carolina | 3.1% | 0.0% |

| 23 | Oregon | 3.1% | 0.0% |

| 23 | South Carolina | 3.1% | 0.0% |

| 23 | Tennessee | 3.1% | 0.0% |

| 30 | Arizona | 3.0% | -3.2% |

| 30 | California | 3.0% | -3.2% |

| 30 | Connecticut | 3.0% | -3.2% |

| 30 | Indiana | 3.0% | -3.2% |

| 30 | Maryland | 3.0% | -3.2% |

| 30 | Minnesota | 3.0% | -3.2% |

| 30 | Missouri | 3.0% | -3.2% |

| 30 | Virginia | 3.0% | -3.2% |

| 38 | Massachusetts | 2.9% | -6.5% |

| 39 | Rhode Island | 2.8% | -9.7% |

| 39 | West Virginia | 2.8% | -9.7% |

| 39 | Wisconsin | 2.8% | -9.7% |

| 42 | Kentucky | 2.7% | -12.9% |

| 42 | New Jersey | 2.7% | -12.9% |

| 42 | Pennsylvania | 2.7% | -12.9% |

| 45 | New York | 2.6% | -16.1% |

| 45 | Ohio | 2.6% | -16.1% |

| 47 | Delaware | 2.5% | -19.4% |

| 47 | Hawaii | 2.5% | -19.4% |

| 47 | Maine | 2.5% | -19.4% |

| 47 | Michigan | 2.5% | -19.4% |

| 51 | Vermont | 2.4% | -22.6% |

Vermont was at the bottom of the list, with just 2.4% of loan inquiries for medical expenses — 22.6% below average. Surprisingly, however, Vermont ranked as one of the states with the highest share of adults with medical debt, at 12.2%.

Vermont was surpassed only slightly by Michigan, Maine, Hawaii and Delaware — each had an inquiry rate of 2.5% for medical loans.

5 tips to ease medical debt burden

If you’ve taken on debt to pay medical expenses, here are some things you can do to help tackle it and avoid racking it up in the future:

- Consolidate your debt: A personal loan or a 0% balance transfer credit card can greatly help consolidate medical debt or any other debt. You’ll likely need good credit to get that 0% card, but it can save you a tremendous amount of money if you can get it.

- Avoid medical credit cards: Just because your medical provider offers a medical credit card doesn’t mean it’s a wise way to go. Instead, ask your medical provider about a no-interest payment plan you can use to pay off what you owe. You could even try negotiating that bill down to a lower amount. It works more often than you’d think.

- Build savings while paying down your debt: Yes, it may make it take longer and cost more to get that medical debt down to $0. However, once your debt is paid off, that savings means the next unexpected expense won’t automatically have to go on your credit card. That’s a big deal because that can go a long way toward breaking the cycle of debt that so many people find themselves in.

- Seek second opinions: Don’t be afraid of second opinions regarding your health. Just because one doctor says you need $9,000 worth of procedures and services doesn’t mean you need them. If something seems off, tell your doctor you’d like to get a second opinion and go from there. It may not ultimately make a difference, but it can bring you peace of mind knowing you’re not getting taken advantage of and getting another take on your situation.

- Review your insurance coverage: Insurance plans change over time, with shifting premiums and coverage for various medications and procedures. One year something may be covered, and the next it’s not. Review your plan annually to make sure you’re not hit with surprise costs, and adjust it as necessary.

Methodology

LendingTree researchers analyzed tens of millions of personal loan requests on the LendingTree platform from Jan. 1 to Dec. 31, 2023. We also analyzed personal loan requests from Jan. 1, 2020, through Dec. 31, 2022. We focused on personal loan inquiries for medical expenses.

To define generations, LendingTree analysts used the following ranges from the Pew Research Center:

- Generation Z (born between 1997 and 2005; ages 18 to 26 in 2023)

- Millennial (born between 1981 and 1996; ages 27 to 42 in 2023)

- Generation X (born between 1965 and 1980; ages 43 to 58 in 2023)

- Baby boomer (born between 1946 and 1964; ages 59 to 77 in 2023)

- Silent generation (born between 1928 and 1945; ages 78 to 95 in 2023)

Get personal loan offers from up to 5 lenders in minutes