Single Dads Are Less Common Than Single Moms, but They’re More Likely to Be Homeowners

Homeownership is a common dream, but it’s often difficult to achieve. This can be especially true for single parents, who typically have less income to buy a house than married couples.

We’ve previously highlighted single-parent struggles, finding that a majority of single mothers don’t own a house. With Father’s Day around the corner, LendingTree is revisiting single-parent homeowners, focusing on single fathers. We utilized the latest U.S. Census Bureau American Community Survey data to analyze homeownership rates among men who live without a spouse in a household with children younger than 18.

We found there are fewer single-dad households in the nation’s 50 largest metros than single-mom ones. Further, single dads are not only likely to earn higher incomes than single moms, they’re also more likely to be homeowners.

Key findings

- Across the nation’s 50 largest metros, 1.53 million households are occupied by single fathers and their children younger than 18. Of those households, about 754,000 are owner-occupied. That means the homeownership rate among single dads is about 49%.

- Comparatively, 4.23 million households are occupied by single mothers and their under-18 children. However, the homeownership rate among this group is lower, at about 34%. In other words, while there are more single-mom households in the U.S. than single-dad ones, single dads are more likely to be homeowners relative to the size of their population. That said, the homeownership rate among single mothers and fathers is considerably lower than the 76% among married couples with children.

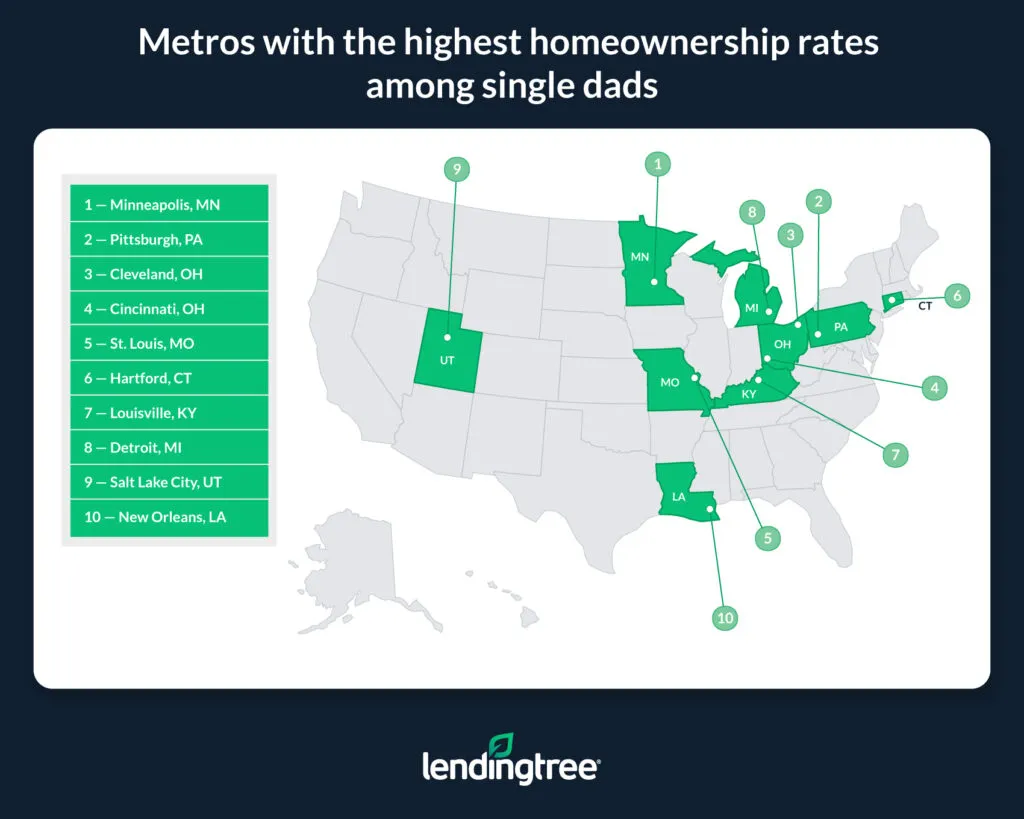

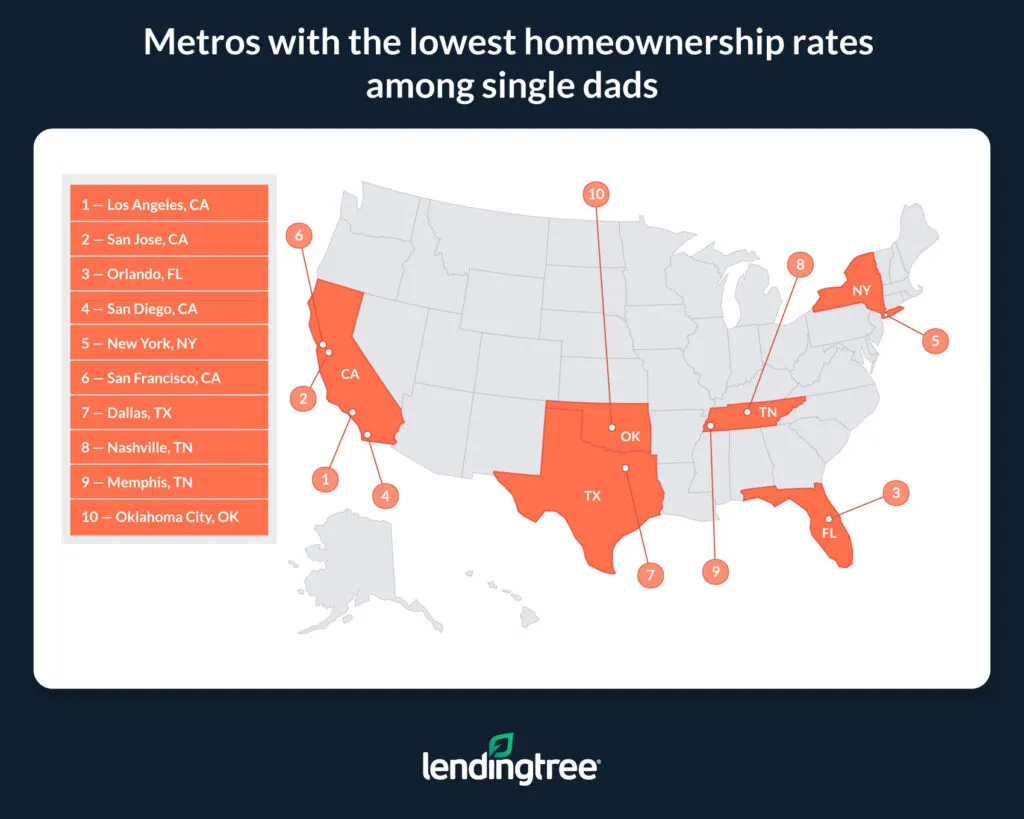

- Homeownership rates are highest among single fathers in Minneapolis, Pittsburgh and Cleveland. The homeownership rate for single dads in these metros averages 68.70%. Conversely, homeownership rates among single dads are lowest in Los Angeles, San Jose, Calif., and Orlando, Fla., averaging 32.53%.

- New York, Chicago and Los Angeles have the most single-dad homeowners. 126,107 single dads across these metros live in owner-occupied homes. That’s 113,201 more than the number of single-dad homeowners in Birmingham, Ala., San Jose, Calif., and Raleigh, N.C.

- Incomes for single-dad households are highest in San Jose, Calif., Washington, D.C., and San Francisco. The median incomes for households headed by single dads in these metros are $87,426, $79,027 and $77,698, respectively. In contrast, median incomes for single-dad households are lowest in Birmingham, Ala., Oklahoma City and Memphis, Tenn., at $37,760, $42,308 and $46,932, respectively.

Metros with the highest homeownership rates among single dads

No. 1: Minneapolis

- Total households occupied by single dads: 31,501

- Total households owned and occupied by single dads: 22,187

- Homeownership rate among single dads: 70.43%

- Median household income for single-dad households: $71,157

No. 2: Pittsburgh

- Total households occupied by single dads: 17,212

- Total households owned and occupied by single dads: 11,682

- Homeownership rate among single dads: 67.87%

- Median household income for single-dad households: $58,128

No. 3: Cleveland

- Total households occupied by single dads: 18,078

- Total households owned and occupied by single dads: 12,254

- Homeownership rate among single dads: 67.78%

- Median household income for single-dad households: $52,981

Metros with the lowest homeownership rates among single dads

No. 1: Los Angeles

- Total households occupied by single dads: 111,185

- Total households owned and occupied by single dads: 32,315

- Homeownership rate among single dads: 29.06%

- Median household income for single-dad households: $56,189

No. 2: San Jose, Calif.

- Total households occupied by single dads: 12,903

- Total households owned and occupied by single dads: 3,990

- Homeownership rate among single dads: 30.92%

- Median household income for single-dad households: $87,426

No. 3: Orlando, Fla.

- Total households occupied by single dads: 22,874

- Total households owned and occupied by single dads: 8,599

- Homeownership rate among single dads: 37.59%

- Median household income for single-dad households: $47,400

Single dads may have some economic advantages over single moms, but challenges remain

As our study shows, homeownership rates are higher among single fathers than among single mothers. This is despite the fact that single-mom households outnumber single-dad ones.

One reason for this is that single fathers tend to earn higher incomes than single moms. The median income for a single mother in the U.S. is $36,393; for single dads, it’s $18,906 higher at $55,299. Similarly, single fathers are more likely to be employed than single mothers.

But like any other demographic, single dads aren’t a monolith. Though some may thrive financially, that doesn’t mean others aren’t struggling. On the contrary, owing to factors like today’s high housing and child care costs, contending with the expenses of raising a child is likely going to be challenging for many single parents, regardless of their gender.

Moreover, societal stigmas (outside of financial considerations) can also make parenting difficult for single dads. For example, single fathers who apply for social services often report that they feel unfairly treated or have to jump through more hoops to receive help than single mothers.

Tips for single dads looking to buy a home

Though today’s high home prices and mortgage rates mean that buying a house is often easier said than done — especially for families relying on one income — the following tips could help would-be buyers save money and make owning a home more manageable.

- Consider different loan programs. While a conventional 30-year, fixed-rate mortgage might be a good option for some, it isn’t the only type of home loan. For example, mortgages insured by the Federal Housing Administration (FHA) may be easier to qualify for and come with lower rates than conventional loans. Other types of home loans like Veterans Affairs (VA) or U.S. Department of Agriculture (USDA) mortgages can offer similar advantages to those who qualify.

- Shop around for a mortgage before buying. Because different lenders can offer different rates to the same borrowers, shopping around for a mortgage and comparing offers from different lenders before making a purchase could help homebuyers get a lower rate on their loans. The lower the rate offered, the lower the monthly payment and the more affordable buying a house is likely to be. Regardless of the kind of mortgage, shopping around for a lender could help you save money.

- Make sure you’re prepared for your housing payments. A mortgage payment isn’t the only regular expense you’ll encounter as a homeowner. You’ll also have to pay property taxes and homeowners insurance. And depending on where you live and the kind of mortgage you have, you may need to deal with other costs like private mortgage insurance (PMI) or homeowners association (HOA) fees. A mortgage calculator that factors in additional costs like those can help you better budget and prepare for the financial realities of owning a home.

Methodology

Data for this study came from the U.S. Census Bureau 2022 American Community Survey with one-year estimates — the latest available at the time of writing — and was compiled at the metropolitan statistical area (MSA) level.

Single-father households were defined as households headed by male householders without a spouse present who were living with their children younger than 18.

The homeownership rate for single fathers was calculated by dividing the number of households owned and occupied by single fathers by the number of households occupied by single fathers.

View mortgage loan offers from up to 5 lenders in minutes