Compare Current ARM Rates and Best ARM Lenders Today

Get ARM loan offers and compare rates in just 2 minutes

Current ARM loan interest rates

| Loan product | Interest rate | APR |

|---|---|---|

| 30-year 5/1 ARM | 4.90% | 5.66% |

| 30-year 5/1 ARM refinance | 5.66% | 5.89% |

Average rates disclaimer

Current ARM mortgage rates: Are they lower than fixed rates?

Adjustable-rate mortgages (ARMs) can come with starting rates that are lower than comparable 30-year fixed mortgage rates. When mortgage rates rise, borrowers are often drawn to the temporary payment savings offered by initial ARM rates.

But ARMs haven’t been reliably lower than 30-year fixed-rate mortgages in recent years, so it’s not safe to assume you’ll get a better rate with an ARM — this is why you need to shop around and compare rate offers.

Read more about whether rates are predicted to rise in our mortgage interest rates forecast.

Best ARM lenders of 2025

Rocket Mortgage

Rocket Mortgage is a good mortgage lender choice for borrowers with lower credit scores or specialty programs. The company provides specialized programs to meet the needs of various homebuyers, including reduced minimum down payments or closing cost credits to qualifying borrowers.

- No ARM prepayment penalties

- Provides a streamlined, 100% online process

- Publishes transparent information on rates and loan requirements

- Website doesn’t give ARM rates or loan options

- Interest rates are higher than many competitors

- Doesn’t offer 5-year ARMs

- No in-person branches

LendingTree experts gave Rocket Mortgage a 5-star rating because it provides all of the information below on its website, easily accessible for potential homebuyers:

- Publishes rates online

- Offers standard mortgage products

- Includes detailed product info online

- Shares resources about mortgage lending

- Provides an online application

AmeriSave Mortgage Corporation

AmeriSave Mortgage is a good choice for prospective homebuyers with a credit score under 620. It also offers jumbo ARM loans and home equity loans and lines of credit for borrowers hoping to tap into their equity down the road.

- A wide variety of mortgage products

- No origination fees

- Robust digital platform and online support

- Limited rate and fee information on the lender’s website

- Higher loan costs than many competitors

- No brick-and-mortar locations

LendingTree experts gave AmeriSave Mortgage Corporation a 4.5-star rating because it offers the following information on its website for potential homebuyers to use when deciding on a home loan:

- Publishes some rates online

- Offers standard mortgage products

- Includes some detailed product info online

- Shares resources about mortgage lending

- Provides an online application

Because AmeriSave does not publish all mortgage rates on its website, it received a half-star deduction from its star rating.

How we chose our best ARM lenders for 2025

To determine our top ARM lenders, we reviewed data collected from more than 30 lender reviews completed by the LendingTree editorial staff. In order to appear on our list, lenders had to be licensed to lend in nearly all states, offer multiple ARM loan products and earn a star rating of 3 or higher on LendingTree’s mortgage rating system.

What is an adjustable-rate mortgage (ARM)?

An adjustable-rate mortgage is a home loan that features an interest rate that changes over time. Most lenders offer ARMs with initial rates that are fixed for three, five or seven years.

When the initial fixed-rate period ends, the adjustable-rate repayment period begins. The ARM’s rate can then rise, fall or stay the same, depending on the movements of the broader market.

Ready to estimate your monthly payment? Use our mortgage calculator.

ARM requirements are similar to the minimum mortgage requirements for fixed-rate loans, but with a few significant differences.

- Credit score: 500 to 640 minimum. Conventional ARM loans usually require a 620 to 640 credit score, though lenders can set a higher minimum if they choose. If you need a more accessible credit requirement, FHA loans and VA loans can offer the chance to qualify with a 500 to 580 score.

- Down payment: 0% to 5% minimum. You may be able to put zero down with a VA loan, however you’ll need at least 3.5% with an FHA loan and 5% with a conventional loan. You may need to come up with an even higher down payment — 10% to 15% — if you’re buying a home you won’t live in full time, like a vacation home or investment property.

- DTI ratio: 41% to 45% maximum. As with fixed-rate loans, you can qualify for a VA loan with no more than a 41% debt-to-income (DTI) ratio. FHA ARM loans offer a little more wiggle room, allowing up to a 43% DTI, and conventional ARMs are the most generous with a 45% DTI ratio maximum.

- Proof you can qualify for a range of payment amounts. Some ARM programs require proof that you can qualify for a range of monthly payment amounts, or even the maximum payment amount allowed over the life of the loan — not just the lower payments you’ll see in the initial period. Check with your loan officer to make sure you know the guidelines.

How do ARM loan rates work?

Unlike a conventional mortgage, ARMs have two distinct phases: an initial phase with a fixed, low interest rate, and an adjustable phase where your mortgage rate (and payment) will fluctuate based on market conditions.

ARM rates are calculated using two numbers:

- The index. This is a rate that’s used in banking and fluctuates with financial markets. It’s added to your margin to determine your interest rate once the fixed-rate period ends.

- The margin. This is a set percentage added to the index to calculate your rate when an ARM adjusts. This number doesn’t change during the entire loan term.

When do ARM rates adjust?

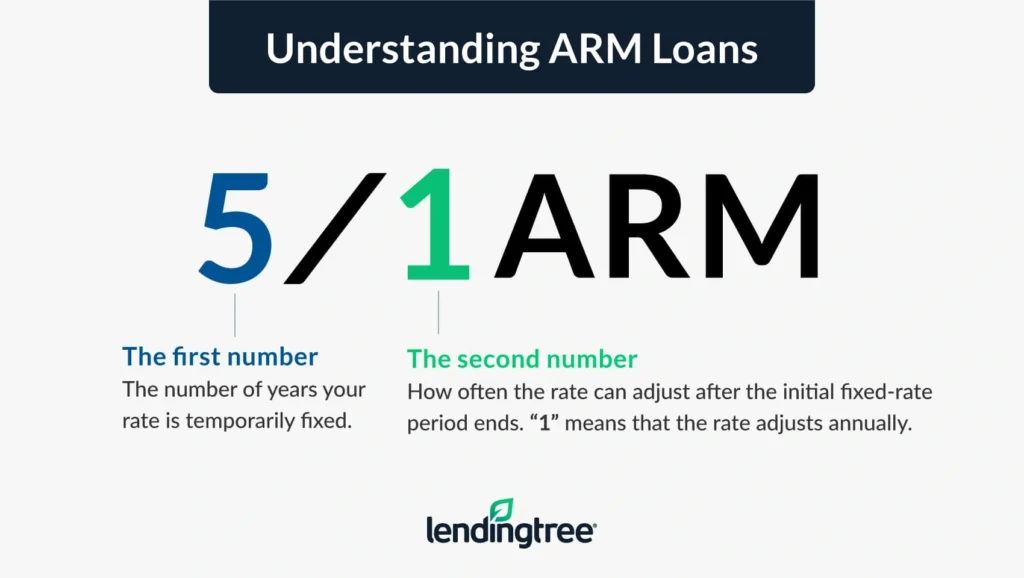

ARMs have names that tell you how and when the rate will adjust. A 5/1 ARM, for example, comes with a five-year initial period during which the rate is fixed. After that, the rate will adjust once per year.

How do ARM rates adjust?

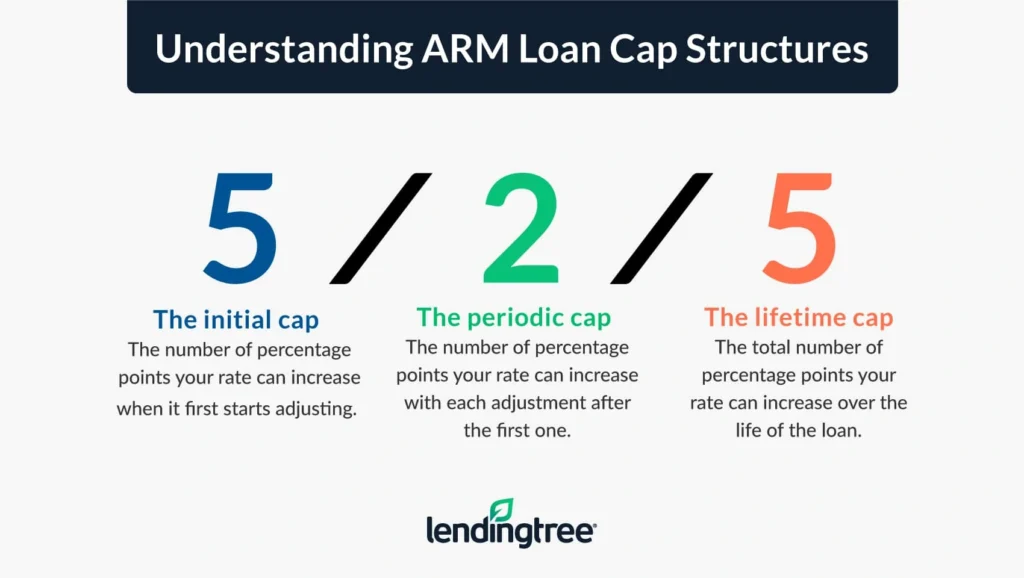

An ARM’s interest rate adjustments are governed by three limits, called rate caps. You’ll usually see them listed out with slashes between them, for example: 2/2/5.

-

Initial adjustment cap

This sets the limits for how much your rate can increase the very first time it adjusts.- As an example, if your ARM has a 2/2/5 rate cap structure, the first “2” shows that your rate can’t rise by more than 2 percentage points at its first adjustment.

-

Periodic (aka “subsequent”) adjustment cap

Any ARM adjustment after the first one is subject to this cap.- In a 2/2/5 cap structure, the second “2” reflects that your rate can’t rise by more than 2 percentage points at any one adjustment after the first.

-

Lifetime adjustment cap

This number shows the maximum amount of percentage points your rate could rise by over the life of the loan.- A 5/1 ARM with 2/2/5 caps can raise a maximum of 5 percentage points from the rate it started at.

Learn more about how ARM loans work by reading the Consumer Handbook on Adjustable-Rate Mortgages, which lenders are required to provide to ARM borrowers.

Pros and cons of ARM rates

Pros

-

Lower initial rates

The initial rate for an ARM may be lower than fixed-rate loans. -

Lower monthly payments at first

Low initial rates can translate to lower monthly payments during the first few years of your mortgage. -

Extra cash can be used to pay down your loan balance

You can use the savings to pay off your mortgage faster and build home equity. Alternatively, you can use the funds for other financial goals, like saving for college or retirement.

Cons

-

The rate could spike after the teaser-rate period ends

If you still have the ARM loan when the adjustment period begins, your rate could increase. -

The payment could become unaffordable

An ARM payment increase could stretch your budget thin, especially if your income has dropped or you’ve taken on other debt. Defaulting on the loan could lead to foreclosure. -

The qualifying standards may be more stringent

ARM lenders may require a higher credit score, larger down payment or restrict the amount of equity you can tap.

Can you refinance an ARM loan?

Can you refinance an ARM loan?

Yes, you can refinance an ARM just as you can any other mortgage loan. Doing so makes the most sense when you can get a lower ARM rate.

LendingTree’s senior economist, Jacob Channel, recommends that you aim for a rate that’s 50 to 100 basis points

Yes, you always have the option to refinance an ARM into a fixed-rate loan — as long as you can qualify based on your credit, income and debt.

It’s common for homeowners to refinance into a fixed-rate mortgage before their ARM’s first adjustment. That way, they never have to deal with the risk of expensive rate adjustments and can enjoy stable payments over the life of the loan.

When should you choose an ARM?

ARM rates can help if you’re looking to save money over a short period of time. It makes sense to choose an adjustable-rate mortgage if:

- You have savings goals you can accomplish before the initial fixed-rate period ends

- You plan to sell your home or refinance before the first rate adjustment

- You can afford the maximum payment

When to avoid an ARM:

- You live in your “forever” home or don’t plan to sell before the fixed-rate period ends

- You won’t be able to afford the payments if your ARM rate adjusts upward

- You receive variable income such as commission or self-employment earnings

Frequently asked questions

A hybrid ARM is an ARM with an initial period during which the rate is fixed, and an adjustment period during which the rate may change. It’s considered “hybrid” because it has those two, distinct payment schedules during the term: A fixed-rate schedule at first, followed by an adjustable payment schedule for the remaining loan term. A traditional ARM doesn’t come with an initial fixed-rate period — its rate is always on an adjustable payment schedule.

A 5/1 ARM rate gives you an initial rate that’s fixed for five years, and then adjusts every year for the rest of the loan’s term.

Yes, the rate on an ARM can go down when it adjusts. In order for this to happen, mortgage rates would need to drop, bringing the index used to calculate your ARM’s rate down in tandem.