2025 Housing and Economic Outlook

A disconnect between economists’ and consumers’ views of the broader economy seems more prevalent in the past few years.

- Economists generally argue the U.S. economy is doing well. Unemployment is low, inflation has more or less returned to the Federal Reserve’s target level, wages are increasing faster than prices and gross domestic product (GDP) is growing.

- Consumers often argue the economy is anything but sunshine and rainbows. They point out that housing is prohibitively expensive for many, interest rates on everything from mortgages to auto loans remain relatively steep, debt delinquency rates are inching up, personal savings rates are low and household debt is high.

Both make valid points. The economy isn’t crashing; there’s no recession. All things considered, the U.S. post-pandemic economic recovery has gone more smoothly than in most, if not all, comparable nations. But pain points exist, from high interest rates to steep home prices.

It’s tough to say where the economy is headed in 2025. Many of President-elect Donald Trump’s proposed economic policies, such as tariffs and mass deportations, are likely to weaken the broader economy while pushing inflation and interest rates higher. Because his proposals are often vague and disjointed, it’s hard to pinpoint what the policies he enacts will look like.

Our predictions for the housing market and economy in 2025 were made in the face of more uncertainty than usual. They consider what might happen if things continue along their current course, and what could happen if Trump makes good on campaign-trail promises.

Read on to learn more about our predictions and get a sense of whether the “vibecession” felt by many will turn into an official recession.

Housing and economic predictions: 2025

Mortgage rates will remain relatively steep and erratic, and they may climb higher than current levels

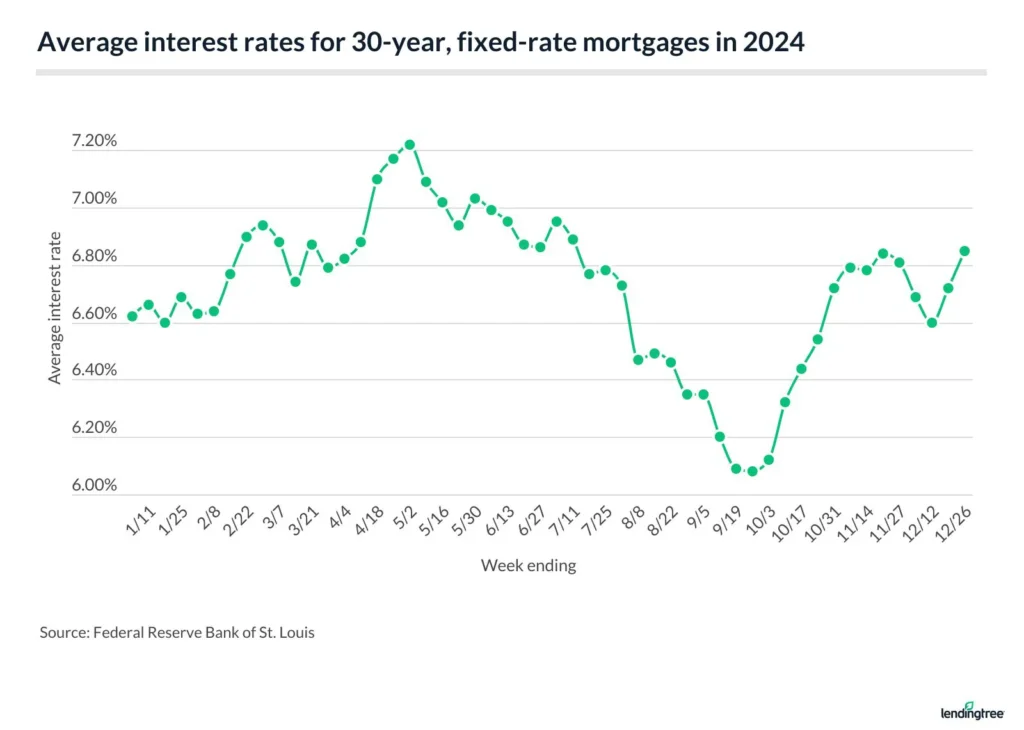

Mortgage rates were on a roller-coaster ride for much of 2024. They began on an ostensibly downward trajectory, started rising again in the spring, leveled off and fell during the summer, then roared higher in the fall. In early December, rates once again showed some temporary declines, but they have since climbed back to their highest level in five months.

We’ll likely see a continuation of this behavior to start 2025, at least until we get a sense of Trump’s policies. If he goes through with inflation-inducing policies such as tax cuts, blanket tariffs on key trading partners and mass deportations, mortgage rates will probably trend higher. Similarly, if he succeeds in ending Fannie Mae and Freddie Mac’s government conservatorships (something he tried in his first term), that would put significant upward pressure on mortgage rates. We might see the average rate on 30-year, fixed-rate mortgages trend well above 7.00% in 2025. We could also see fewer mortgage originations and stricter lending standards.

If Trump moderates some of his policies — say, imposing less stringent tariffs or backing off on mass deportation plans — inflation pressures may not be as severe, and mortgage rate growth could level off (and potentially even trend down). If he does a 180 on his campaign-trail proposals and allows the economy to continue along its path where inflation growth continues to cool, we might see average rates drop to 6.00% or lower and stay that way for some time.

Though Trump has promised to lower mortgage rates, borrowers shouldn’t expect them to fall to anywhere near their record 2021 lows or even as low as at the start of 2022, when the average rates for 30-year fixed mortgages were 2.65% and 3.22%, respectively. Regardless of the president-elect’s past promises, he (barring an act of Congress) won’t be able to unilaterally lower mortgage rates to their pandemic-era levels.

If President Trump’s economic policies look like candidate Trump’s proposals, expect inflation growth to reverse course, trend higher

Though it’s still a bit higher than the Fed’s target of 2% annual growth, the latest personal consumption expenditures (PCE) price index — the Fed’s preferred inflation measure — shows inflation grew by 2.4% from November 2023 to November 2024. This latest report and the Fed’s willingness to start cutting its benchmark rate in September indicate that inflation growth has largely been tamed compared to where it was in 2022 and 2023.

If the economy were to keep moving along its current path, inflation could continue to subside and the Fed might be incentivized to cut its benchmark even further. But this may not happen.

Depending on how the policies are implemented, tariffs and mass deportations could make it considerably more expensive for businesses to produce goods, from food to houses to cars. The higher the costs for businesses, the more incentive they’ll have to pass them to consumers via higher prices. If Trump’s policies are as severe as they sound, year-over-year inflation growth could climb to 3% or 4% over the year — and perhaps even higher in 2026 and beyond.

Of course, some of Trump’s other proposals, like tax cuts, could help make some of this easier by lowering costs for businesses and putting extra cash in consumers’ hands. But there’s no guarantee that potential tax cuts will be enough to offset higher prices caused by tariffs and mass deportations, especially if hypothetical cuts primarily benefit higher-income earners.

Home prices will rise slightly, while mortgage demand will remain stagnant

While Trump’s broadly inflationary policies could mean higher prices across the economy, housing might be especially hard-hit.

The construction industry is dependent on immigrant labor. About a third of U.S. construction workers are foreign-born, according to the National Association of Home Builders. While estimates vary, some studies suggest 15% to 23% of those foreign-born workers lack permanent legal status. Policies such as mass deportations could make it considerably more difficult and expensive for builders to construct homes. Should builders have to contend with extra costs, they’ll likely build fewer homes and charge higher construction prices. This will make new (and older) homes more expensive and decrease the overall U.S. housing supply.

Over the next year, inflationary pressure caused by tariffs, labor shortages and pent-up buyer demand should push home prices higher. However, high mortgage rates will dampen this demand somewhat and keep prices from spiraling out of control. Specifically, because mortgage rates are poised to stay high — barring any major policy reversals — purchase mortgage demand will likely remain relatively weak, with mortgage refinancing demand especially low.

Altogether, this could mean that annual home price growth in 2025 is roughly on par with where it was in much of 2024 — between 3% and 5%. Beyond 2025, an overall weakening of the economy caused by tariffs and mass deportations may push home prices down as a struggling economy will bring higher unemployment, lower wages and decreased homebuyer demand.

The Fed could end its current rate-cutting cycle earlier than expected

If the administration’s policies are inflationary, the Fed may have no choice but to prematurely end its rate-cutting cycle. This would mean that the target federal funds rate would remain between 4.25% and 4.50%, with rates on virtually all loan products remaining relatively steep.

The Fed is designed to pivot quickly in the face of new economic data. Owing to that, its agenda for this year isn’t set in stone. If policies like blanket tariffs and mass deportations aren’t implemented or are significantly limited in their scope, inflation growth could continue to subside, and the Fed might keep cutting as the year progresses.

The economy may weaken, but the U.S. could still avoid a recession — at least in the short term

In many ways, the broader economy has proven remarkably resilient over the past few years. Despite negative vibes, the U.S. has continued to grow. However, this period of economic growth may be coming to an end.

While tax cuts could stimulate economic growth in 2025, the disruption caused by tariffs and mass deportations will likely (eventually) cause the economy to slump. Even if we avoid an outright recession in 2025, one could still be on the horizon in 2026 or beyond.

What’s more, this potential recession might not be a regular downturn. Because the Trump administration’s policies appear poised to cause inflation while weakening the broader economy, they could result in a stagflation. Stagflation — which the U.S. hasn’t experienced since the late 1970s/early 1980s — is a period in which inflation rises while economic growth slows and unemployment rises. For consumers and businesses, stagflation is unpleasant because it means people will need to contend with higher prices while wages/revenues decline.

Potential economic positives in 2025

- The housing market likely won’t crash this year. Even if continued high rates and prices keep many from buying, the housing market is still unlikely to crash this year. The reason is because a majority of current homeowners are sitting on relatively low mortgage rates that help keep their monthly payments affordable. Because these homeowners are unlikely to default on their loans or otherwise try to sell their houses, the housing market is unlikely to be flooded with enough supply to cause prices to collapse. In the long term, a weakening economy could push mortgage defaults higher and increase the risk of a crash, but that doesn’t mean one is right around the corner.

- We may avoid a recession. Though the Trump administration’s policies are likely to weaken the economy in the long run, the U.S. could still avoid a recession in 2025. One reason is that the economy is typically slow moving. Even if negative policies are implemented quickly, it can take a while for people to feel their impact. The short-term benefits of tax cuts may be enough to counteract negative shocks caused by tariffs and mass deportations, and businesses may continue chugging along their current path for some time before making serious changes. We could see another year of growth in 2025, even if more cracks in the economy are likely to appear.

- Taxes might fall. Trump and Republicans in Congress have consistently expressed support for tax cuts. What that looks like is still up in the air, but lower taxes could help offset some of the pain that could be caused by inflation and higher interest rates. If tax cuts are primarily centered on high-income earners, positive impacts will be lessened.

- Wages in some industries could rise. Because labor shortages give workers more bargaining power, they can result in higher wages. While wages won’t rise uniformly across the board (and labor shortages can weaken the overall economy in the long run), 2025 may provide some good opportunities for workers to negotiate a raise.

Potential economic negatives in 2025

- The housing market will remain prohibitively expensive for many. In light of the policies Trump has proposed, housing prices and mortgage rates could both climb. This will make the nation’s already challenging housing market more unaffordable to many. Even if home prices and mortgage rates don’t climb this year, they probably aren’t going to plummet, and the national housing market will likely remain anything but cheap.

- Inflation may reverse course. Mass deportations, tariffs and tax cuts are likely to drive inflation higher. And a global trade war spurred by tariffs could complicate supply chains and further increase prices. We might not see 2022 levels of annual inflation growth this year, but there’s a strong chance inflation will be worse in 2025 than in 2024.

- Savings will stay depressed. Americans managed to build an impressive amount of savings through the height of the pandemic. But these savings have all but evaporated in the face of high inflation and rates. If 2025 brings with it a resurgence in inflation and higher interest rates, expect these savings to continue to dwindle.

- Total debt will stay high, and delinquencies will rise. U.S. households are currently sitting on $17.94 trillion worth of household debt. Higher inflation and interest rates that may be in the cards for 2025 could push this even higher. If this happens, we’ll likely continue to see debt delinquency and default rates climb. Of course, this doesn’t mean that 2025 default rates are going to hit levels typically seen during a recession.

- The broader economy could weaken faster than expected. Trump’s proposals are largely unprecedented. If he manages to quickly implement them, a recession might happen sooner rather than later.

How consumers could set themselves up for success in 2025

Based on our predictions for the year ahead, most people don’t need to worry about the sky falling. But there are things to consider or keep an eye on as the year progresses.

- Don’t be afraid to fight for your finances. While it may be harder to negotiate a raise as the economy slows, you should never stop advocating for yourself. The more you can get from an employer, the easier it’ll be to save. The more you save, the easier it’ll be to weather an economic downturn. Even if you can’t negotiate a raise, strengthening your finances in whatever way you can — from cutting back on eating out to buying a less expensive car — can help you better prepare for what the future might bring.

- Be prepared for change. Uncertainty is likely to be one of the defining features of this year’s economy. People should be prepared to react quickly to sudden changes in places like the housing or job market. This could mean trying to set aside more money if you’re laid off or being ready to snatch up a good deal on a home. Though it’s often easier said than done, you should try your best to roll with any punches you’re dealt.

- Don’t panic. Hearing about an impending economic downturn or uncertainty around the broader economic picture might be scary. But it’s always worth remembering that even if the economy turns sour, you’ll probably be OK in the long run. One of the worst things you can do when faced with uncertainty is panic. Doing so can lead you to make foolish decisions like paying too much for a home or dumping all your long-term stocks. The more levelheaded you are, the better off you’ll generally be.

View mortgage loan offers from up to 5 lenders in minutes