LendingTree Survey: More Than Half of Homeowners Expect Home Values to Rise in 2020

With home prices rising and the economy firing on all cylinders, homeowners are sitting on a record amount of equity. LendingTree recently commissioned a survey of more than 1,500 Americans to gauge their expectations of home values as the new decade begins.

The survey found that homeowners are generally optimistic about home prices, but worry about upcoming repair needs. More than half of respondents say that homes are becoming less affordable in their neighborhoods. As homeowners plan to stay in their homes longer, it’s no surprise that renovations are top of mind.

Key findings

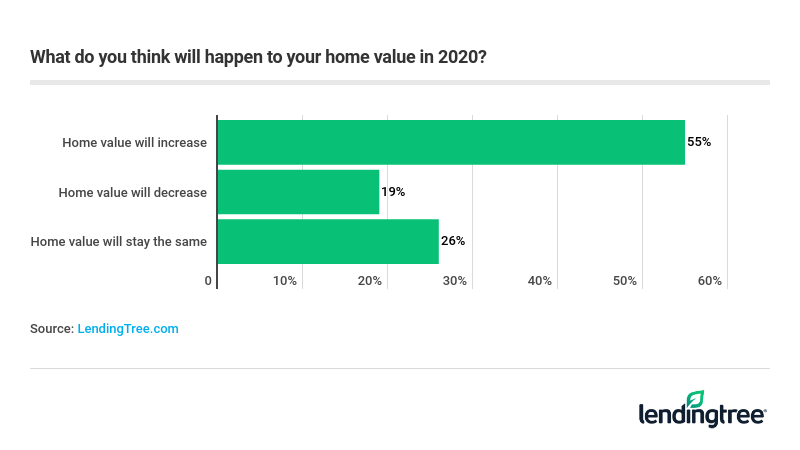

- A majority (55%) of surveyed homeowners think their home’s value will improve this year. However, 19% think values will go down.

- Overall, 68% of surveyed homeowners believe that homeownership is a good investment, with 65% anticipating that homeownership will continue to be a good investment by 2030. Only 4% of homeowners said homeownership isn’t worthwhile at all.

- Despite the positive sentiments about home values, 53% of respondents predict housing will be less affordable over the next 10 years. Gen Xers (53%) and baby boomers (57%) are the most pessimistic about the affordability outlook, while one-third of millennials actually believe housing will become more affordable.

-

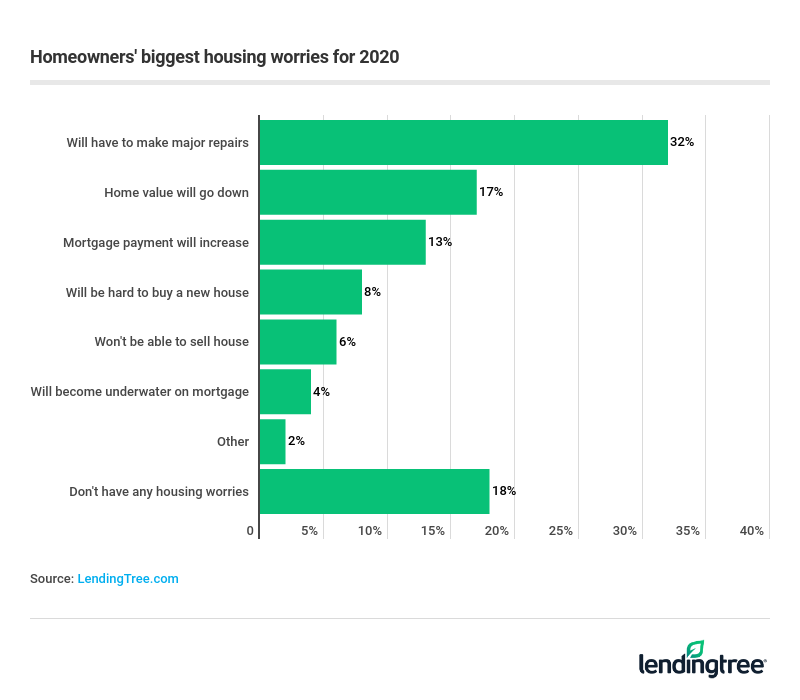

Nearly one-third of surveyed homeowners cite major home repairs as their top housing-related worry. Other concerns on the minds of those homeowners surveyed include:

- Home values dropping (17%)

- Mortgage payments increasing (13%)

- Difficulty buying a new home (8%)

- Being unable to sell their current home (6%)

- Becoming underwater on their mortgage, or owing more than the home is worth) (4%)

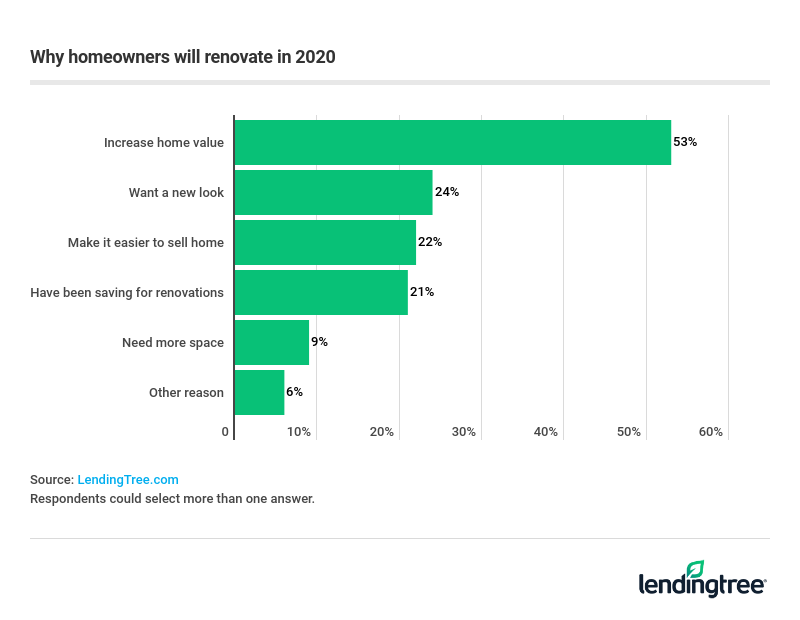

- Nearly 3 out of every 4 of surveyed homeowners are considering renovations in 2020. Of those, 53% said they were doing so to increase their home’s value. Other reasons varied: giving the home an updated look (24%), making the home easier to sell (22%) and adding more space to their home (9%).

- Another 21% of surveyed homeowners said they had been saving up for a renovation, one they were likely interested in and appear to have decided to undertake this year.

How to finance home improvements

If you don’t have the cash to pay for renovations, there are a number of home improvement loans to choose from. Here’s an overview of the most common ones:

- Home equity loan. A home equity loan is a good option if you want a predictable payment for one big project. You’ll receive funds in a lump sum and make a fixed payment for the life of the loan.

- Home equity line of credit. A home equity line of credit (HELOC) works like a credit card — you can withdraw funds as needed and pay the balance off. The payment is based on what you charge, but the rate is variable. Consider a HELOC if you have a series of small projects to finance and plan to pay the balances off quickly.

- Cash-out refinance. With current mortgage rates sitting at historic lows, you may want to borrow more than you currently owe and pocket the difference with a cash-out refinance. You’ll want to stay in your home long enough to break even on refinancing costs to make this option worth the cost.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,552 Americans, with the sample base proportioned to represent the overall population. The survey was fielded Dec. 13 to 16, 2019.

View mortgage loan offers from up to 5 lenders in minutes