Are Closing Costs Tax-Deductible?

Anyone who buys or refinances a home is familiar with closing costs. But come tax time, you might wonder: Are closing costs tax-deductible? The good news is that some closing costs can count as tax deductions for homeowners, if you itemize your tax bill.

We’ll cover which closing costs are tax-deductible and where to find the information in your closing paperwork.

What does tax-deductible mean?

If an expense is tax-deductible, it simply means that the Internal Revenue Service (IRS) allows it to be subtracted from your income when you calculate the taxes you owe. In a nutshell, the lower your taxable income, the lower your tax bill.

Most homeowners are familiar with two popular tax benefits of buying a home — the mortgage interest deduction and the property tax deduction — but some of the more confusing federal tax deductions are related to closing costs. Let’s explore the most common tax questions about closing cost tax deductions for homeowners.

Which closing costs are tax-deductible?

When you’re determining what to claim on taxes, it helps to know that the IRS rules for homeowners set out three categories of tax-deductible closing costs:

- Costs you can deduct in the year they are paid.

- Costs you can deduct over the life of the loan.

-

Costs you can add to your basis

when you sell the home.Your home’s basis is usually the amount you paid when you purchased it, though technically it’s the total amount of capital you have invested into the home.

Closing costs you can deduct in the year they are paid

-

Origination fees or points paid on a purchase. The IRS considers “mortgage points” to be charges paid to take out a mortgage. They may include origination fees or discount points, and they represent a percentage of your loan amount. To be tax-deductible in the same year they are paid, you have to meet these, and other conditions:

1. The mortgage must have been used to buy or build your primary home.

2. The points paid were normally priced for the area.

3. You can prove that you or the seller paid the points.

4. The amount is shown on your closing disclosure or settlement statement. You can find these and additional IRS rules for homeowners at IRS.gov. - Points paid on a home improvement cash-out refinance. If you used a cash-out refinance loan to pay for home improvements, the refinance points may be deductible. You’ll have to document that all of the refinance cash was used for renovations on your primary residence or second home.

Closing costs you can deduct over the life of your loan

- Points paid on a purchase loan. If you didn’t qualify to deduct these costs in the year they were paid, or didn’t itemize your deductions that year, a portion may still be deductible for as long as you have the mortgage.

- Points paid on a home improvement refinance loan. In cases where you used only a portion of your loan proceeds for home improvement, any additional points can be deducted over the remaining loan term.

Closing costs you can deduct when you sell your home

Some closing costs may be used to reduce the taxes on selling a house, usually by adding to your home’s basis. These may include:

- Owner’s title insurance. An owner’s title insurance policy protects you against prior ownership claims on the property.

- Property taxes. This is only applicable if you paid any share of the seller’s taxes when you bought your home.

- Abstract and title search fees. These are costs related to researching the full history of your house and its ownership.

- Recording fees. Fees charged by a third party for documenting the transaction in public records.

- Survey fees. A survey confirms the property’s boundaries.

- Transfer or stamp taxes. These are the taxes charged by a state, city or county when real estate changes hands.

-

Distressed property expenses. If you purchased a home from a distressed seller and paid for any of the following items, you may be able to add them back to your basis:

- Costs of improvements or repairs

- Any back taxes or past due interest paid

- Recording or mortgage fees

- Sales commissions

You won’t be able to add these expenses to the basis if the seller paid any of them when you bought your home. Check your closing disclosure to confirm who paid which closing costs to be sure.

Which closing costs aren’t deductible?

You can’t deduct all of your housing-related expenses from your tax bill. Here’s a list of items that are not tax-deductible under any circumstances:

- Lender’s title insurance

- Homeowners insurance premiums

- Homeowners or condominium association fees

- Utility costs (gas, water, electric)

- Home appraisal fees

- Notary fees

- Mortgage insurance premiums, including FHA mortgage insurance, VA funding fees and USDA guarantee fees

- Document preparation fees

Although the costs listed above aren’t tax-deductible, you can use them to reduce the amount of capital gains tax you pay when you sell your home. To do this, you need to include them when calculating the cost basis of your home, which is the amount you paid for the home — including most settlement and closing costs.

Need help understanding or filing your taxes? Head to irs.gov/help or reach out to a tax preparer.

Where can I find my closing cost information?

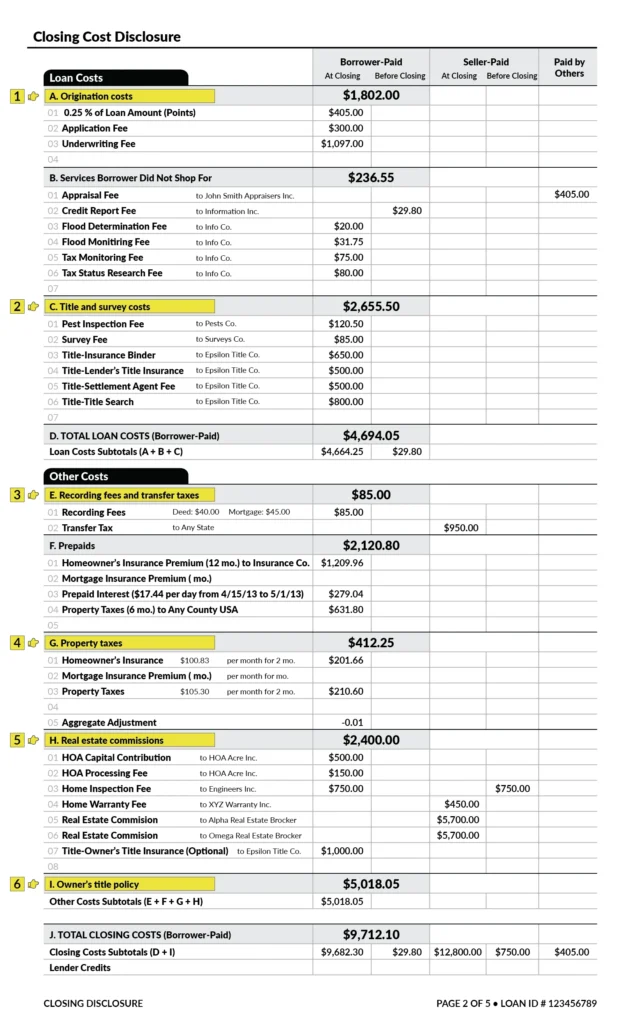

The mortgage tax form 1098 you receive from your mortgage company provides information only about the mortgage interest and property taxes paid in the prior year. You’ll need a copy of the closing disclosure from your closing paperwork to verify tax-deductible closing costs. The graphic below shows where you can find the closing costs we discussed.

View mortgage loan offers from up to 5 lenders in minutes