What Is a 5/1 ARM?

A 5/1 adjustable-rate mortgage (ARM) is a type of home loan worth considering if you’re looking for a low monthly payment and don’t plan to stay in your home long. For the first five years, 5/1 ARM rates can be lower than 30-year fixed-rate mortgages. After that, the interest rate and payments can increase significantly. Understanding how and when the rate on a 5/1 ARM adjusts can help you decide whether the temporarily lower payment is worth it.

What is a 5/1 ARM loan?

A 5/1 ARM is a type of adjustable-rate mortgage that has a fixed rate for the first five years of repaying the loan. After that period, 5/1 ARM rates change based on your loan terms.

ARM loans may also be called “hybrid mortgages” because they start off with a fixed interest rate, but then turn into a loan with a variable rate. It’s common for homeowners to choose an ARM if they’re planning to sell or refinance their home before the ARM begins to adjust.

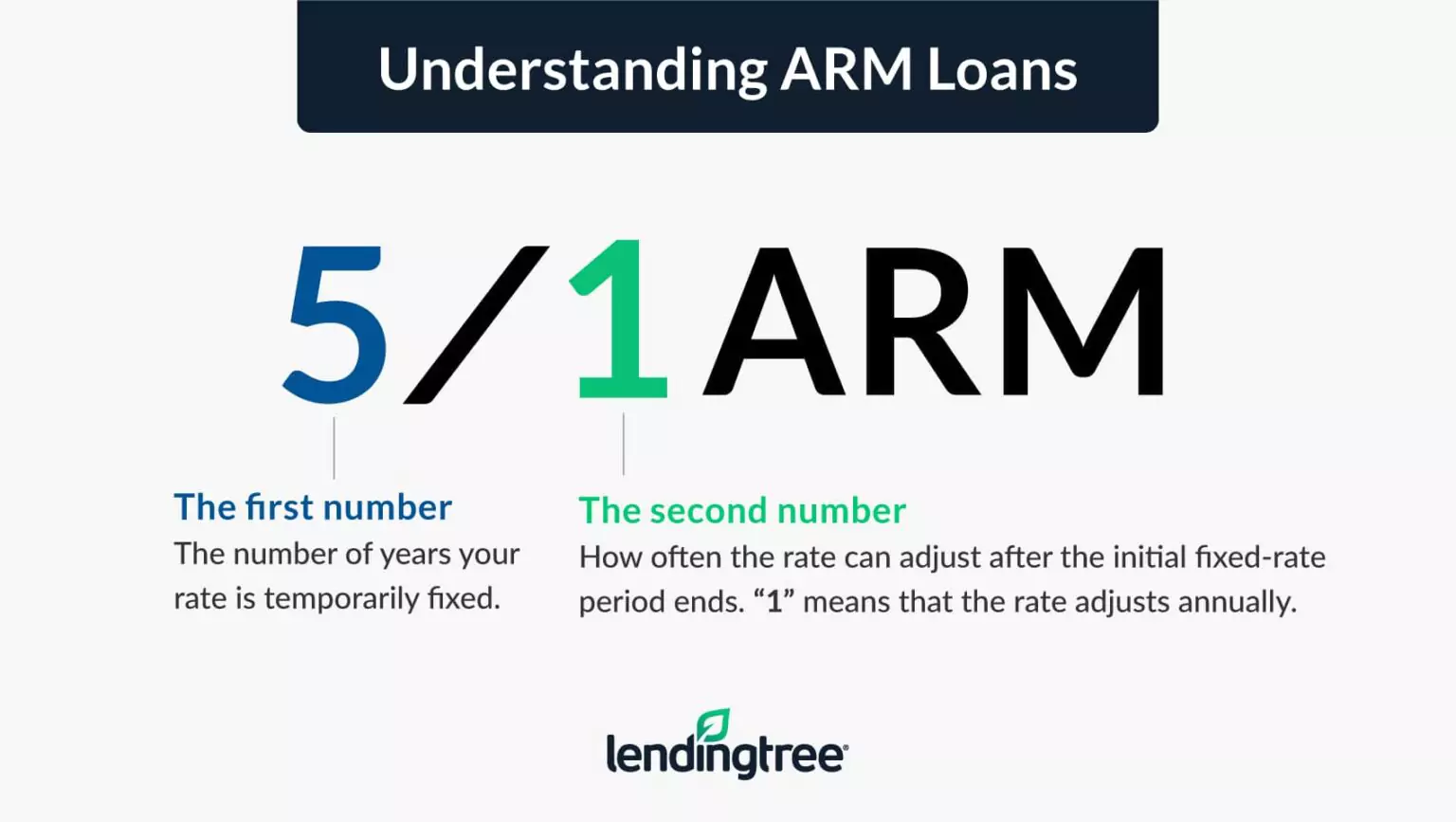

The “5” in a 5/1 ARM is the number of years your rate is temporarily fixed. The “1” is how often the rate can adjust after the initial fixed-rate period ends — in this case, the “1” represents one year, so the rate adjusts annually.

How does a 5/1 ARM work?

During the initial fixed-rate period, the rate can be quite low. That low rate is also called your “introductory rate” or, sometimes, a “teaser rate.” After that, the rate can change based on six factors:

- The initial adjustment cap. Once the fixed rate expires, the initial adjustment cap limits how much the interest rate can rise. The initial adjustment cap is generally 2% or 5%, meaning the new rate can’t rise by more than 2 or 5 percentage points.

- The adjustment period. Rate changes to an ARM loan are scheduled according to the adjustment period. For example, a 5/1 ARM will adjust annually after the initial five-year fixed-rate period ends. Lenders may offer adjustment periods ranging from monthly to every five years.

- The periodic cap. This is a cap on the number of percentage points your rate can increase with each adjustment after the first one.

- The index. An index is a benchmark variable rate that fluctuates based on market and economic conditions. The margin is added to your index to determine your rate with each adjustment period, and lenders should provide information to illustrate how the chosen index has changed over time.

- The margin. A margin is a fixed number set by the lender and added to the index to determine your rate when it adjusts.

- The lifetime cap. Many ARMs have a 5% lifetime cap, which means your rate can never be more than 5 percentage points higher than the initial rate.

Some 5/1 ARM programs may come with an interest-only mortgage option, which allows qualified borrowers to pay only the interest due on the loan for a set time. That means very low payments for a time period that usually ranges between three and 10 years. This may be a good choice for borrowers trying to save as much money as possible on their monthly payment for a certain period. However, you won’t build home equity or reduce your principal balance while making interest-only payments. This can leave you with large payments — or a single, very large balloon payment — when the interest-only period expires.

When does a 5/1 ARM interest rate adjust and by how much?

As we covered above, when an ARM adjusts is right there in its name. A 5/1 ARM adjusts once per year after an initial five-year period. To fully understand how these adjustments work, though, you need to understand your ARM’s cap structure.

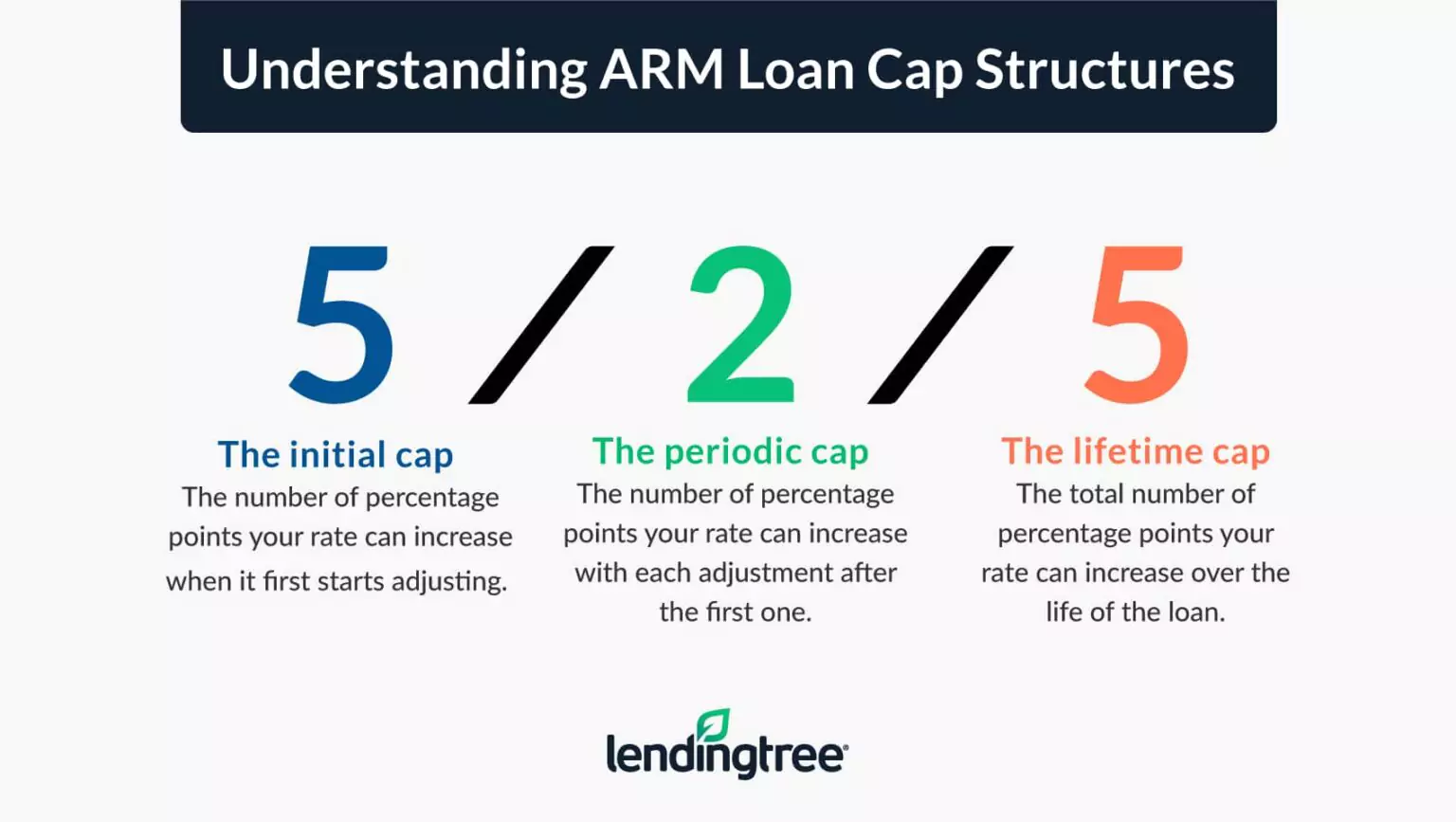

When you read about ARMs, you might see their caps listed as a combination of three numbers. For instance, an ARM with a “5/2/5 cap” means the following:

- The first number is the initial cap: Your rate can increase by no more than 5 percentage points when it first adjusts.

- The second number is the periodic cap: Your rate can increase by up to 2 percentage points with each adjustment after the first one.

- The third number is the lifetime cap: Your rate can adjust up to 5 percentage points above the initial rate over the life of the loan.

Which index is used with a 5/1 ARM?

Your lender decides which index they’ll use to calculate your rate. Many ARM programs use the Cost of Funds Index (COFI) or the one-year Constant Maturity Treasury (CMT) securities index, but some lenders set their own index. The index is important to understand because it’s the “moving” part of your adjustable rate — it fluctuates with changes in the market.

You may hear the term “fully indexed,” which simply refers to how much your rate will be when your margin and index are added together. To find out what your fully indexed rate would be, you simply add the current index rate to your margin (you can find your margin in your loan paperwork). For example, if the index rate is currently 2%, and your margin is 5%, then your fully indexed rate would be 7%.

When you apply for an ARM, you’ll receive a 21-page Consumer Handbook on Adjustable-Rate Mortgages (CHARM) disclosure booklet and a loan estimate that details how much your rate and payment can change over time. The booklet can help you better understand the loan you’ve applied for, but as a supplementary example, here’s how a 5/1 ARM with 2/2/5 caps could adjust if you’re borrowing $400,000 with an initial 7.84% rate.

| ARM adjustment period | Interest rate | Monthly payment (principal and interest) | Description |

|---|---|---|---|

| Initial five-year fixed rate | 7.84% | $2,890.57 | Your monthly payment for the first five years |

| First adjustment cap (2 percentage points above the initial rate) | 9.84% | $3,418.62 | The highest your monthly payment could be after the first adjustment |

| Lifetime adjustment cap (5 percentage points above the initial rate) | 12.84% | $4,233.77 | The highest your monthly payment could be at any adjustment |

In this example, if you don’t refinance to a fixed rate before your ARM resets, you could pay an extra $528.05 per month on your mortgage payment with the first adjustment. In the worst-case scenario, the monthly payment would jump up by $1,343.20.

5/1 ARM pros and cons

Pros

- Your interest rate is lower for the first five years.

- Your monthly payment is lower for the first five years.

- You can use the extra monthly savings to pay off your mortgage faster.

- You could opt for interest-only payments to save extra money each month.

- Your payment is likely to decrease if an economic recession hits.

Cons

- Your interest rate is likely to rise after the first five years.

- Your payments might become unaffordable after the rate adjusts.

- Your home’s value could drop, leaving you stuck in an ARM longer than you planned.

- You’ll make less when you sell your home if you choose an interest-only option.

- If you make interest-only payments and home values take a dive, you could find your mortgage underwater.

Is a 5/1 ARM a good idea?

The risk of an ARM is that your monthly payments could rapidly increase if mortgage interest rates shoot up. However, your lender must disclose the index and cap structure they’ll use to calculate your ARM rates, which lets you know the maximum amount you could pay. That’s why the possibility that your ARM will adjust up to a wildly high interest rate doesn’t have to scare you — as long as you know that the ARM fits your life and financial situation.

Consider a 5/1 ARM if you:

- Plan to sell or refinance before the fixed-rate period expires. It may be hard to time a home sale exactly with a pending ARM adjustment. Give yourself plenty of lead time to market your home, or make room in your budget for the first payment adjustment.

- Know your income will grow. If you’re expecting a raise or windfall, you don’t have to worry as much about payment increases because you’ll have the means to rapidly pay down your loan’s principal balance if necessary.

- Put down more than the minimum at closing. A lower loan amount and monthly mortgage payment may soften the impact if you can’t pay off an ARM loan before the rate adjusts.

- Can afford the maximum payment. In the example above, your payment could jump by more than $1,300 when the loan adjusts. Avoid choosing an ARM if the higher payment would strain your budget.

Is now a good time for an ARM mortgage?

ARMs tend to grow in popularity when interest rates are high, since they can sometimes offer lower interest rates than comparable fixed-rate mortgages. However, right now ARMs aren’t reliably outcompeting 30-year fixed-rate mortgages.

Back in 2022, for example, ARM rates were lower than fixed rates by a substantial 89 basis points on average. That translated to borrowers saving about $157 on their monthly mortgage payments if they went with an ARM instead of a fixed-rate loan. However, when the Federal Reserve started increasing rates in 2022, this affected ARM rates more directly than it did 30-year fixed-rate loans. That’s when ARM rates were pushed up, exceeding 30-year fixed-rate loans in many cases.

As of mid-2024, an ARM certainly isn’t guaranteed to be cheaper. Make sure you compare loan offers carefully before settling on a loan.

How do fixed-rate mortgages compare to 5/1 ARM loans?

Most homeowners prefer a fixed-rate mortgage simply because the payments are stable and predictable. However, if current 30-year mortgage rates are too high and 5/1 ARM rates are outcompeting them, it can make sense to go with an ARM — especially if you’re planning to sell your home within five years. You may even want to stash the savings from your five-year ARM payment into a moving expense account.

Below is a side-by-side look at the features of a fixed-rate mortgage versus a 5/1 ARM.

| Features of a 5/1 ARM | Features of a fixed-rate mortgage |

|---|---|

|

|

Frequently asked questions

A 7/1 ARM offers an initial fixed rate for seven years, which is two years longer than the five years you get with a 5/1 ARM.

A 5/1 ARM offers an initial fixed rate for five years, while a 10/1 ARM comes with a fixed rate for 10 years.

Some 5/1 ARM loans allow you to switch to a fixed-rate mortgage before your ARM’s initial fixed-rate period ends. You’ll receive a new interest rate and you may be charged a fee to convert.

Some mortgage lenders specialize in ARMs, while others focus their best pricing on 30-year fixed-rate mortgages. Gather mortgage quotes from three to five different lenders to find your best 5/1 ARM mortgage rate options.

You’ll find 5/1 ARM loan options with most loan programs, including conventional loans and mortgages backed by the Federal Housing Administration (FHA loans) and the U.S. Department of Veterans Affairs (VA loans). FHA ARMs can work for borrowers who have lower credit scores and may struggle to qualify for a conventional ARM.

Lenders will qualify you based on the maximum rate at the first adjustment or the fully indexed rate, whichever is greater. For example, if your initial rate is 6.80% and your first adjustment maximum is 2%, you’d need to qualify for the loan based on a 8.80% interest rate.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles