Home Equity Line of Credit (HELOC) Rates As Low As 6.24%

Based on offered rates for home equity lines of credit of at least $100,000 offered to LendingTree customers in October 2025. Excludes offers of fixed-rate terms.

Compare your best HELOC rate offers today on LendingTree – when banks compete, you win.

Average HELOC rates offered on LendingTree

| Loan amount | Average APR

Based on offered rates for home equity lines of credit for the respective loan amounts offered to LendingTree customers in September 2025. Excludes offers of fixed terms.

|

|---|---|

| $25,000 to $49,999 | 8.37% |

| $50,000 to $74,999 | 8.86% |

| $75,000 to $99,999 | 8.94% |

| $100,000 to $149,999 | 8.32% |

| $150,000+ | 9.20% |

- HELOC rates are typically variable, which means your monthly payments can fluctuate.

- You’ll know you’re getting a good HELOC rate if it’s below or at least on par with the national average.

- Shopping around for a HELOC can help you find the best deal.

- HELOC rates are generally lower than credit card and personal loan rates.

Use our HELOC calculator to find out how much your credit line could be

Average 30-year HELOC monthly payments

Your HELOC rate and monthly payments will depend on various factors, including your credit line amount, loan-to-value (LTV) ratio, credit score and debt-to-income (DTI) ratio.

| Loan amount | Monthly payment | APR as low as

Home equity rates disclaimer: Rates are calculated based on conditional offers for both home equity loans and home equity lines of credit with 30-year repayment periods presented to consumers nationwide by LendingTree’s network partners in the past 30 days for each loan amount. Rates and other loan terms are subject to lender approval and not guaranteed. Not all consumers may qualify. See LendingTree’s Terms of Use for more details.

|

|---|---|---|

| $25,000 | $166.16 | % |

| $50,000 | $332.32 | n/a% |

| $100,000 | $664.63 | n/a% |

| $150,000 | $985.39 | n/a% |

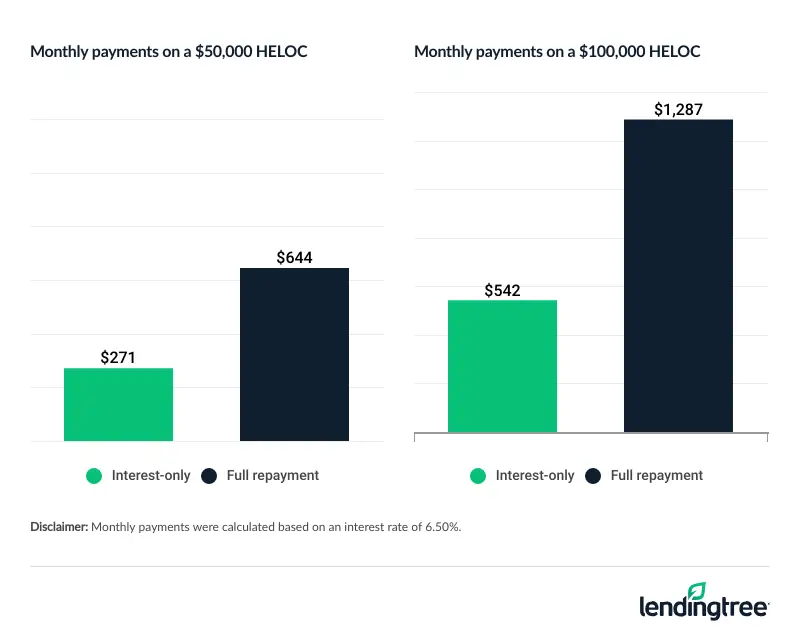

Your HELOC monthly payment also depends on whether you’re making interest-only payments or full payments. For example, if you borrow $100,000, the interest-only payments would be $542 a month and the full payment would be more than $1,000, as shown in the chart below.

Interest-only vs. full repayment HELOC monthly payments

HELOC rate trends and LendingTree insights on how it affects you

Although the prime rate has shown an overall upward trend for several years, it has dipped slightly over the past year. Rates are expected to remain steady or slightly decrease in the near term, making it a good time to consider a HELOC if it fits in with your overall goals and finances.

Interest rate vs. APR

Our expert insights: The next few months may be a good time to get a HELOC

The average HELOC rate offered to LendingTree customers on a $100,000 home equity line of credit was 8.68% in October this year, which is much lower than the average of 10.76% in October 2024.

There’s good news for HELOC shoppers: The Fed has already cut rates twice recently (in September and October) and could be poised to do it again in December, so rates should continue to fall in the short term.

Why you can trust LendingTree with your HELOC

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

What factors affect my HELOC rate?

HELOC lenders may calculate your HELOC interest rate slightly differently, but the same general factors will apply:

A fixed vs variable rate

Most HELOCs have variable interest rates that can change over time. The margin your lender charges and economic factors can impact your rate.

Your LTV ratio

Your LTV ratio can affect your HELOC rate. Borrowing 80% or less of your home’s value is likely to get you a lower HELOC rate.

Your credit score

Borrowers with a 780 credit score or higher tend to receive the lowest HELOC rates. However, some lenders will allow a minimum 620 score.

Your DTI ratio

Your DTI ratio measures your gross monthly income versus your monthly debt. Lenders usually allow a maximum 43% DTI ratio. A lower DTI ratio can help secure you a better HELOC rate.

Tip: All HELOCs come with a “ceiling,” which sets a limit on how high your rate can rise at any time during the loan term.

Average HELOC rates by credit band

Homeowners with a 740 credit score or higher will get the best home equity line of credit rates, but most lenders only require a minimum 620 score to qualify for a HELOC loan. While this loan is accessible to those with lower credit, it’s important to consider whether you can afford the more expensive monthly payments that come with higher interest rates.

| Credit score | Average APR

Based on offered rates for home equity lines of credit of of any offered to LendingTree customers in October 2025. Excludes offers of fixed terms.

| LendingTree expert tips |

|---|---|---|

| 800+ | 7.32% | A HELOC may be a good option for you now. You’ll most likely get rate offers well below the average market rate. |

| 740 – 799 | 8.45% | A HELOC may be a good option for you now. You’ll most likely get rate offers under the average market rate. |

| 670 – 739 | 8.96% | A HELOC could be a decent option for you. You’ll probably get above-average rate offers if you apply now, but rates have fallen considerably since earlier in the year. Still, you may get better rate quotes by taking time to improve your credit score. |

| 580 – 669 | 10.32% | A HELOC may not be a better option for you than a cash-out refinance. Cash-out refinance rates are lower than HELOC rates, so if you can cover refinance closing costs, a refi will likely cost you less each month. |

Get your free credit score and personalized credit recommendations with LendingTree Spring.

LendingTree expert picks for the best HELOC lenders in 2025

Read more about how we chose our best HELOC lenders.

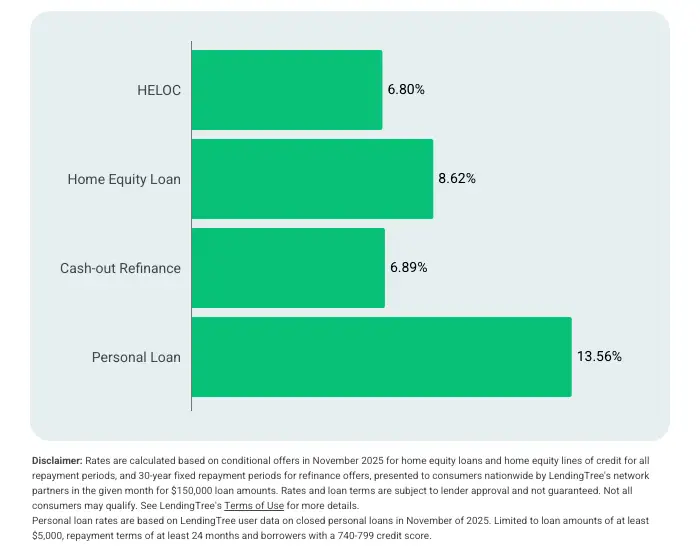

Home equity lines of credit compared to other ways to access cash

Here are the rates you can expect to pay for a HELOC, home equity loan, cash-out refinance and personal loan this month:

Home equity loans and cash-out refinances can be better options than HELOCs in some situations:

- A home equity loan may be best for borrowers who want to fund a single purchase and prefer fixed monthly payments.

- A cash-out refinance can be a good fit for those looking to secure a lower mortgage rate and access a cash lump sum.

If you’re still on the fence, here’s a breakdown of each option:

| HELOC | Home equity loan | Cash-out refinance | Personal loan | |

|---|---|---|---|---|

| Interest rate type | Usually variable | Usually fixed | Fixed or adjustable | Usually fixed |

| Loan term | 5- to 10-year draw period and 10- to 20-year repayment | 5 to 30 years | Up to 30 years | Typically between 2 to 5 years |

| Equity needed | 15% | 15% | 20% | N/A |

| Closing costs | 2% to 5% of credit line amount | 2% to 5% of loan amount | 2% to 6% of loan amount | Varies by lender |

| Monthly payments | Can fluctuate | Stable for the entire term | Can change or stay the same | Remain stable |

| Mortgage type | Second mortgage | Second mortgage | First mortgage | Not a mortgage |

Need help deciding which option is best for you? Read our guide on cash-out refinances vs. home equity loans vs. HELOCs.

You’ll typically pay HELOC closing costs ranging from 2% to 5% of your credit line amount, though the fees will ultimately vary from lender to lender. Some of these expenses include:

- Appraisal fee. Some HELOC lenders require a home appraisal to verify your home’s value. Appraisal costs vary by location and property type (such as single-family or multifamily) but typically range from $300 to $500.

- Origination fee. This fee covers the cost of processing your loan application. It’s typically a flat fee or a percentage of your loan amount, such as 1%.

- Early withdrawal penalty. Closing your account too early may result in early termination charges, typically ranging from $0 to $500.

Checklist: How to decide if a HELOC is a good idea for you

If you answer “yes” to at least four of these questions, a HELOC could be a good option for you:

- Does a HELOC make sense for your funding needs?

- Do you have sufficient home equity?

- Do you understand the consequences of defaulting on a HELOC?

- Is your credit in decent shape?

- Can you afford the payments at both the loan’s lowest and highest possible rates?

- Do you prefer ongoing access to funds, versus a lump sum?

Best uses for a HELOC loan

Home improvements

Use your home equity to make upgrades or renovations that could increase your home’s value.

Debt consolidation

If you have high-interest credit cards or personal loans, you can use a HELOC to consolidate that debt and save on monthly interest charges.

Medical expenses

A HELOC can help you repay costly medical debt without dipping into your savings or retirement accounts.

No matter what you plan to use your HELOC for, LendingTree can help you find the best lender for your situation. Follow these three simple steps to start comparing rates from our network of vetted lenders — when banks compete, you win

- Provide your details. Share a little bit about yourself so we can match you with offers. It’s simple, free and secure.

- Compare offers. Review your quotes and compare your available HELOC options.

- Get your HELOC. Choose your best offer and finalize your HELOC application.

Frequently asked questions

Financial institutions that offer HELOC rate discounts include:

Bank of America

- 0.25% interest rate discount for setting up automatic payments from a Bank of America account

- 0.10% interest rate discount for each $10,000 withdrawn when you open the credit line (up to 1.50%)

- 0.125% to 0.625% interest rate discount for members of Bank of America’s Preferred Rewards program

Flagstar

- 0.25% interest rate discount for setting up automatic payments from a Flagstar account

TD Bank

- 0.25% interest rate discount for setting up automatic payments from a TD Bank checking account

BMO Harris

- 0.25% interest rate discount for setting up automatic payments from a BMO account

- 0.50% interest rate discount for new HELOC accounts when you withdraw $50,000 or more at closing

While repayment terms can vary by lender, most HELOCs follow a similar structure:

- Draw period. During the draw period — typically the first five to 10 years — you can borrow from the credit line as needed, up to the limit. Many lenders allow you to make interest-only payments during this time.

-

Repayment period. Once the draw period ends, the repayment stage begins — this usually lasts 10 to 20 years. At this time, you can no longer use the HELOC for purchases, and you’re required to start repaying both interest and principal.

If you’re interested in refinancing a HELOC you already have, you can typically do so during either the draw or repayment period.

An interest-only HELOC can be a great way to access cash and enjoy low monthly payments for an initial period. However, once the draw period ends, your payments could skyrocket. That’s why it’s only a good idea to use an interest-only HELOC if you have a solid plan in place — one in which there’s no doubt that you can afford the monthly payments even if they adjust up to the rate cap.

If you’re not sure, ask your lender to help you crunch the numbers on your highest and lowest possible payments.

Yes, but you’ll likely pay a higher interest rate — that means your payment on the amount you draw will be higher than a comparable, variable-rate HELOC. But you won’t have to worry about rising rates in the future, which is especially important if you’re living on a fixed income.

There may be a slight drop in your score when you apply for a HELOC. However, if you apply with multiple lenders within a 45-day window, the credit checks usually count as one inquiry, according to the Consumer Financial Protection Bureau (CFPB).

How our home loan experts chose our best HELOC lenders

To determine the best HELOC lenders, we reviewed data collected from more than 30 lender reviews completed by the LendingTree editorial staff. Each lender review receives a rating between zero and five stars based on several HELOC features, including home equity product features and variety, digital application processes and the availability of product and lending information online. To be eligible for a “best of” HELOC title, lenders must have a lender review rating of at least four stars.

We awarded extra points to lenders who:

- Publish HELOC rates online

- Provide detailed information about one or several different HELOC loan options

- Offer a loan-to-value (LTV) ratio above the 85% industry standard

- Offer fast closing options

- Offer products with rate discounts or no closing costs

Our editorial team brought together the data from our lender reviews, as well as the scores awarded for HELOC-specific characteristics, to find the lenders with a product mix, information base and guidelines that best serve the needs of HELOC borrowers.