26% of Americans Have Taken on Debt for the Latest Tech, Averaging $1,492 in the Red

Phones, computers and smartwatches are the Apple (brand or otherwise) of many consumers’ eyes — but shelling out for new technology isn’t exactly smart for one’s wallet.

According to the latest LendingTree survey of nearly 1,950 U.S. consumers, 26% of Americans have taken on an average of $1,492 in debt to purchase tech products — and some will even prioritize purchasing the latest technology over other financial obligations.

Here’s what else we found.

Key findings

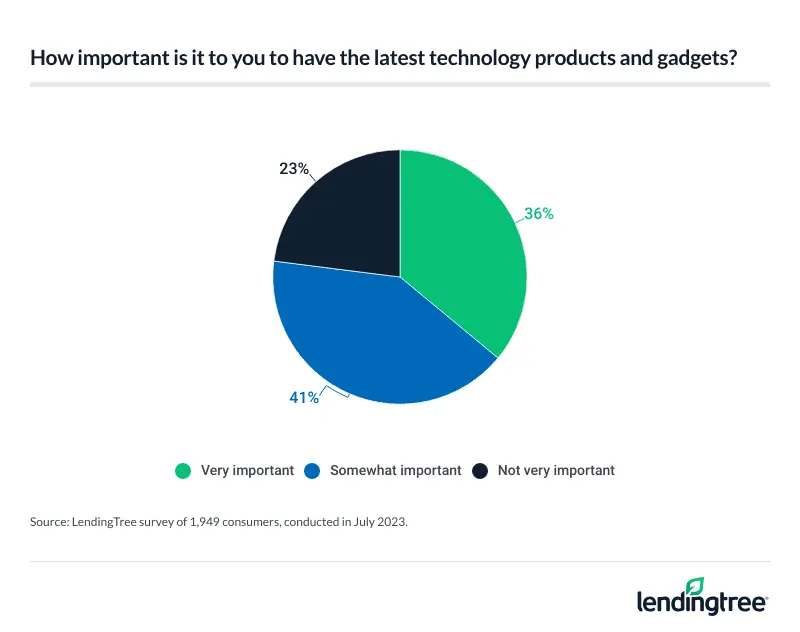

- Many Americans value hot new tech products — and some are going into debt over them. Over three-quarters (77%) of Americans say it’s important for them to have the latest technology products and gadgets. Overall, 26% of Americans have taken on an average of $1,492 in debt to purchase said products. When asked which items fuel overspending, 69% say phones, 41% say computers and 27% say smartwatches.

- Overspending on the latest tech gadgets leaves some buyers feeling remorse. 41% of Americans have experienced regret from spending more than they could afford on technology. Younger generations are much more likely to regret overspending, with 56% of Gen Zers and 46% of millennials saying so. Similarly, 18% of Americans have regretted being early adopters of new technology, with six-figure earners (28%) and Gen Zers (28%) the most likely to feel this remorse.

- Regrets or not, the allure of new technology is too strong for many. Almost half (45%) of Americans would pay out of pocket for a new version of their smartphone — even if their current phones were in good condition. Six-figure earners (66%), adults with children younger than 18 (66%), millennials (62%) and men (52%) lead the charge here. Among those who would pay out of pocket, 30% say they’d finance this purchase through a payment plan.

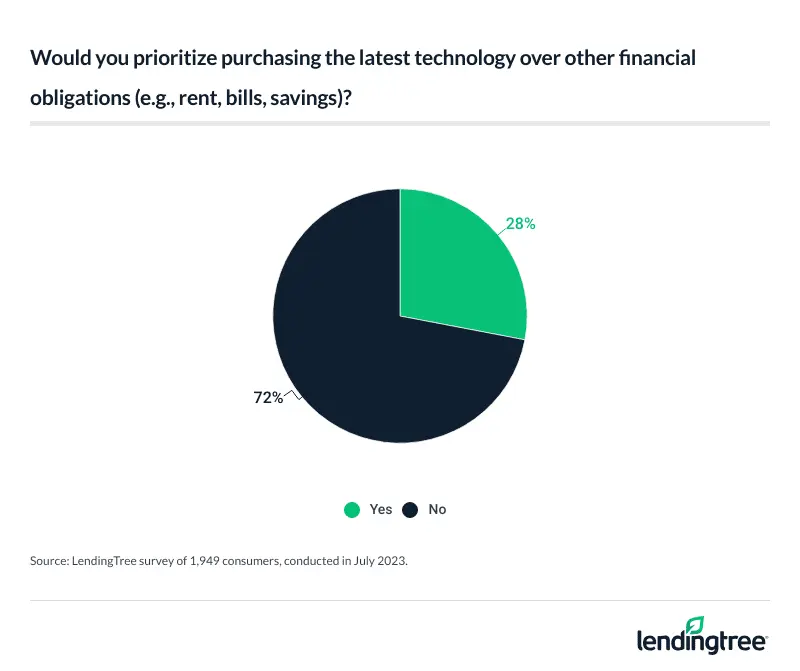

- Some Americans deprioritize other financial obligations to have the newest gadget or technology. 28% of Americans say they’d prioritize purchasing the latest technology over other financial obligations such as rent or bills. Younger generations are more likely to forgo their financial responsibilities, with 45% of millennials and 38% of Gen Zers agreeing. However, out-of-date technology still does the trick for many, as 54% of Americans say they’re using out-of-date devices.

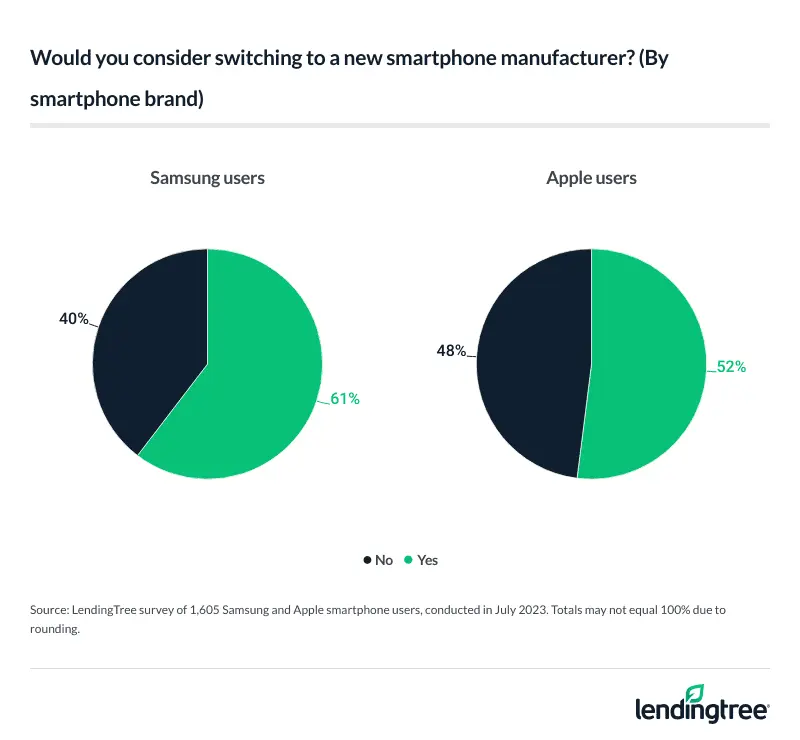

- Certain phone brands have loyal fans, influencing consumer behavior. 53% of those surveyed are iPhone users, while 29% use a Samsung device. Samsung users are more likely to consider switching manufacturers (61% versus 52%), while iPhone users are more than twice as likely to get a new phone when the latest version is released (9% versus 4%).

Some Americans are going into debt over new tech products

Money comes and goes, but fulfillment is forever — at least in theory. As new tech products roll out, Americans are willing to shell out for the latest and greatest. In fact, 77% say it’s important for them to have the latest technology product.

The more money one makes, the more likely they value new tech products. Six-figure earners are the most likely to say it’s important to have the latest technology product, at 91%. Comparatively, 67% of those making less than $35,000 agree — the lowest by income group.

By age group, that figure’s highest among Gen Zers (ages 18 to 26) (88%). That’s followed by:

- 86% of millennials (ages 27 to 42)

- 75% of Gen Xers (ages 43 to 58)

- 62% of baby boomers (ages 59 to 77)

Perhaps influenced by the youngest group of Americans, those with kids younger than 18 (88%) are much more likely to value having new technology than those without kids (75%) and those with adult children (65%). In addition, men (81%) are more likely to share this sentiment than women (74%).

And how far are consumers willing to go for the newest tech? Enough to take on a sizable amount of debt. Just over a quarter (26%) of Americans have taken on an average of $1,492 in debt to purchase new tech products.

According to LendingTree chief consumer finance analyst Matt Schulz, that high debt figure is likely due to our reliance on technology.yst Matt Schulz, that high debt figure is likely due to our reliance on technology.

“The truth is that technology has become an indispensable — yet expensive — part of our lives,” he says. “That was true long before inflation became an issue in this country, and that’s certainly still true today. Not to mention, most Americans’ financial wiggle room is tiny. An unexpected $500 expense is a big deal for many people. It often just becomes debt. However, when you need a new phone, the cost often goes way beyond that. Worse, you may not even see the need coming. Accidents can happen, turning a perfectly good phone into a brick in a moment.”

Younger consumers are more willing to take on debt than older consumers. While 36% of millennials and 32% of Gen Zers have taken on debt for technology, just 20% of Gen Xers and 13% of baby boomers say similarly. Meanwhile, 39% of those with kids younger than 18 have taken on debt. For comparison, 17% of those without kids and those with children older than 18 say similarly.

High-income consumers are more willing to take on debt than low-income ones. While 41% of six-figure earners say they’ve taken on debt for new tech, just 18% of those making less than $35,000 say similarly. That could be because high earners are more confident about paying off that debt.

When it comes to amounts, it’s also worth noting that men take on more debt than women, at an average of $1,704 versus $1,224.

When asked which items fueled the debt, 69% said phones — the most common response. That’s followed by:

- Computers (41%)

- Smartwatches (27%)

- Gaming consoles/accessories (21%)

- Wearable technology, like Fitbits or Oura Rings (15%)

- Cameras (11%)

- Tech accessories, like chargers or protective cases (10%)

- Home automation systems, like Google Nest or Amazon Echo (10%)

- Audio/visual equipment (7%)

- Appliances (7%)

41% regret overspending on technology

Overspending takes a financial and emotional toll. In fact, 41% of Americans have experienced regret from spending more than they could afford on technology. Younger generations are much more likely to regret overspending: While 56% of Gen Zers and 46% of millennials say they regret shelling out more than they could afford, 39% of Gen Xers and 25% of baby boomers agree.

According to Schulz, younger consumers are more likely to regret overspending because their budgets are typically tighter. “When you’re 50 and making six figures, dropping a few hundred dollars on a device that you eventually get bored with and let collect dust in the closet doesn’t hurt you much financially,” he says. “When you’re 25 and just scraping by, it’s a big, big deal.”

By income group, consumers earning between $75,000 and $99,999 (46%) are the most likely to share this sentiment, while those earning less than $35,000 (38%) are the least likely. Meanwhile, those with children younger than 18 (50%) are significantly more likely By income group, consumers earning between $75,000 and $99,999 (46%) are the most likely to share this sentiment, while those earning less than $35,000 (38%) are the least likely. Meanwhile, those with children younger than 18 (50%) are significantly more likely to regret overspending than those without children (38%) and those with adult children (30%).

Similarly, 18% of Americans have regretted being early adopters of new technology. Six-figure earners (28%) and Gen Zers (28%) are the most likely to feel this remorse, while baby boomers (5%) are the least likely. That may boil down to a lack of desire or opportunity, though: While 35% of consumers say they’ve never been early adopters of new technology, that figure is highest among baby boomers at 54%.

Still, that won’t stop many consumers from grabbing the hottest new tech. When asked if there’s any upcoming technology they plan to be early adopters of, 45% say phones — making it the most common response. That’s followed by:

- Computers (25%)

- Smartwatches (21%)

- Gaming consoles/accessories (16%)

- Wearable technology (12%)

- Home automation systems (10%)

- Cameras (9%)

- Tech accessories (9%)

- Appliances (8%)

- Audio/visual equipment (5%)

Meanwhile, 31% say they don’t plan to be early adopters of any upcoming technology.

Americans prefer new phones — even at a cost

The old Taylor can’t come to the phone right now. Why? Because she’s getting a new one. Overall, 45% of Americans would pay out of pocket for a new version of their smartphone — even if their current phones were in good condition and they weren’t eligible for a free or reduced-price upgrade.

Six-figure earners (66%) are the most likely income group to say so, while those earning less than $35,000 (36%) are least likely. Adults with children younger than 18 (66%) are significantly more likely to shell out for a new phone than those with no children (37%) and those with adult children (24%).

By age group, millennials are the most likely to pay full price for a new phone despite having a working phone, at 62%. That’s followed by:

- Gen Zers (51%)

- Gen Xers (42%)

- Baby boomers (20%)

Meanwhile, men (52%) are much more likely to say they’d pay out of pocket for a new phone than women (38%).

Among those who would pay out of pocket, 30% say they would finance this purchase through a payment plan — making it the second most common response. A third (33%) would pay full cost with a debit card and 16% with cash. Another 15% would pay the full cost with a credit card.

How often are Americans getting new phones? Overall, 44% get a new phone every few years and 31% get one when their phone breaks. Following that, 19% get a new phone annually and 7% get one when the latest version is released.

Some forgo financial responsibilities for new tech

It’s not just phones: More than a quarter (28%) of Americans say they’d prioritize purchasing the latest technology over other financial obligations, like their rent or other bills. However, Schulz cautions that spending too much on tech makes it harder to reach financial goals.

“Those hundreds of dollars you spend on a new gaming system or drone could’ve been invested in a college fund, stashed in a high-yield savings account for emergencies or helped lower your credit card debt,” he says. “That said, there can be times when technology spending can be good debt. If that new phone or other type of gadget will allow you to work more efficiently, run your small business more smoothly or otherwise provide a significant financial return on investment, that can be a great thing. That’s often not the case, however.”

Younger generations are more likely to forgo their financial responsibilities than older generations. While 45% of millennials and 38% of Gen Zers share this sentiment, just 21% of Gen Xers and 5% of baby boomers say similarly.

Those with children younger than 18 (46%) are much more likely to say this than those with no children (21%) and those with adult children (11%). Meanwhile, 52% of six-figure earners are willing to prioritize the latest technology over their other responsibilities — the highest overall. That compares with just 18% of those earning less than $35,000.

Further, men (35%) are more willing to make new tech their top priority than women (21%).

When asked which technologies they prioritize, 78% say they put phones first. That’s followed by:

- Computers (47%)

- Gaming consoles (21%)

- Smartwatches (20%)

- Tech accessories (11%)

- Appliances (11%)

- Wearable technology (9%)

- Home automation systems (9%)

- Cameras (8%)

- Audio/visual equipment (4%)

Still, out-of-date technology works for most consumers. In fact, 54% of Americans say they’re using out-of-date devices, with those earning between $50,000 and $74,999 (60%) and Gen Zers (58%) the most likely to use older tech.

Samsung users are less likely to have brand loyalty

When it comes to the smartphone brand wars, Apple comes out on top. Among those surveyed, 53% are iPhone users and 29% use a Samsung device.

Not only that, but Apple users are more likely to stay loyal to the brand. While 57% of consumers say they’d consider switching to a different smartphone manufacturer, Samsung users (61%) are more likely to say so than iPhone users (52%).

In addition, iPhone users are more than twice as likely to get a new phone when the latest version is released, at 9% versus 4%. Meanwhile, Samsung users are more likely to wait until their current phone breaks, at 35% versus 24%.

iPhone users may also be more attracted to the latest and greatest. While 43% of Samsung users say they’d pay out of pocket for the newest version of their phone, that figure rises to 50% among iPhone users. And while Samsung users are most likely to pay in full for a new phone with a debit card (38%), Apple users are more likely to finance their phone through a payment plan (34%).

Curb tech overspending: Top expert tips

You don’t have to be a child to enjoy getting a shiny new toy — it only happens to be more expensive as you get older. But while it’s easy to overspend on technology, it may set you back financially — particularly if you’re forgoing your other financial responsibilities. To help rein in your technology spending, Schulz recommends the following:

- Budget. “It’s OK if gadgets are your thing,” Schulz says. “You just have to be smart about it. Consider carving out some space in your budget for a gadget fund the way others might save for travel or concert tickets. Stashing a little bit away each paycheck so that you have some money set aside for your next tech splurge can be the difference between avoiding and falling into debt.”

- Consider debt consolidation. If you’re struggling with tech debt, you have options,” he says. “A low-interest personal loan can help minimize the amount you pay over the life of the balance and help you pay it off faster. A 0% balance transfer credit card can be an amazing option if you have really good credit, but if you don’t, the right personal loan can still save you significant money compared to your current credit card.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,949 U.S. consumers ages 18 to 77 from July 17-24, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles

Despite What You May Read, the Debt Avalanche and Debt Snowball Methods Can Be Equally Effective — Here’s the Data That Proves It

BNPL Tracker: More Than 1 in 3 Considering Applying for Buy Now, Pay Later Loan This Month

56% of Americans Are Fearful of Their Future Financial Situations, With 35% Losing Sleep Over Money