52% of Americans Would Skip Valentine’s Day if They Could, but Those in Relationships Will Spend an Average of $180 This Year

Wallet, meet heart.

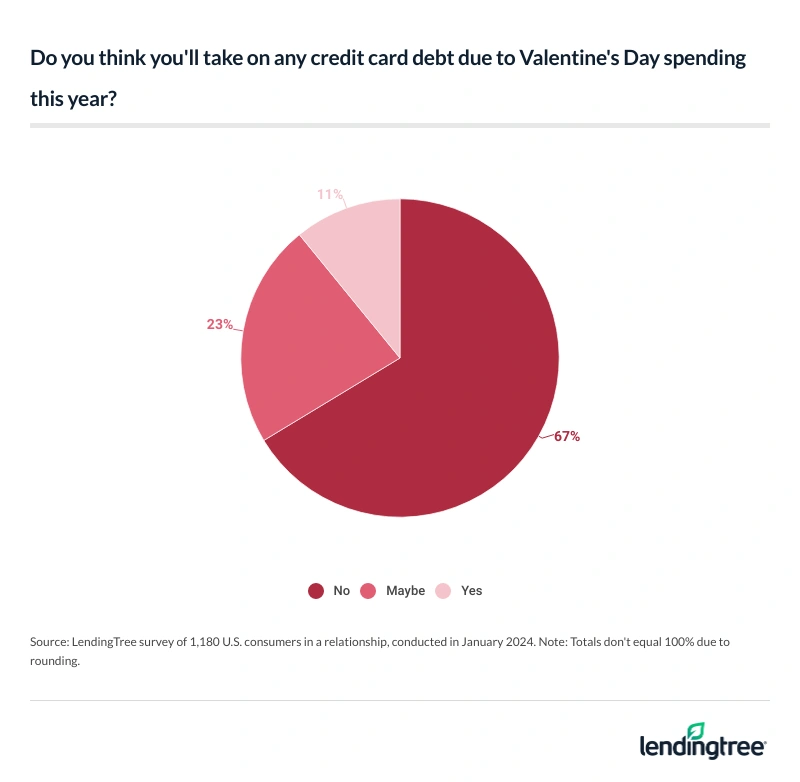

Valentine’s Day is rapidly approaching, and while many Americans are in the mood for love, their pockets may not be ready to take the hit. According to the latest LendingTree survey of 2,000 U.S. consumers, those in relationships plan to spend an average of $180 on gifts this holiday — and a third (33%) may take on credit card debt because of it.

Here’s what else we found.

- Love was made for me and you — and the 82% of coupled Americans who plan to purchase gifts for their significant others this Valentine’s Day. Those in relationships plan to spend an average of $180 on gifts this holiday, just shy of last year’s $187. Men expect to spend an average of $248 on their significant others, while women expect to spend only $115. Meanwhile, those in relationships expect their partners to spend an average of $166 on them this year, which rises to $255 among millennials.

- Some have lost their love for the heart-shaped holiday. 37% of Americans in relationships believe that spending more than they can afford on Valentine’s Day is worth it to show their partner they care. That’s especially true among Gen Zers (53%) and millennials (51%). However, that mentality doesn’t hold true for all: 45% of Americans say they’ve skipped the holiday to save money, and over half (52%) say they’d avoid it altogether if they could.

- It’s easy to overspend on your special someone, but the debt that could stick around might take your breath away. A third (33%) of those in relationships say they may take on Valentine’s Day credit card debt this year. Among this group, 48% wouldn’t tell their significant other. Men are more likely to hide their gift-giving debt than women (50% versus 44%). Of those potentially taking on debt this year, 64% plan to pay it off within three months.

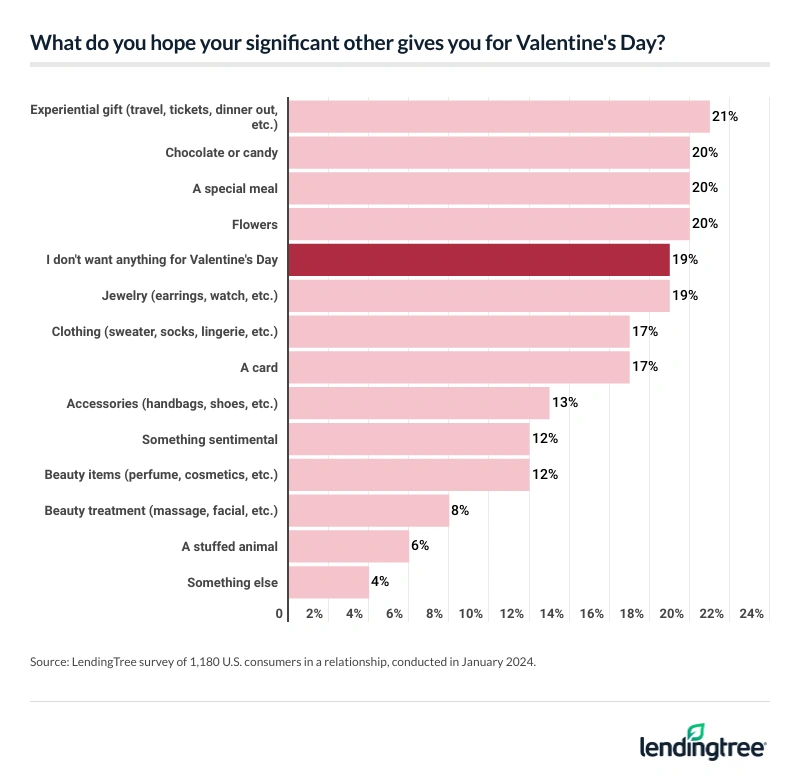

- Throw away the cheesy card — experiences are the way to your loved one’s heart. Experiential gifts like travel or a dinner out are the most wanted gifts for those in relationships, and 24% of significant others plan on gifting just that. Women prefer a bouquet of flowers (31%), while Gen Zers prefer candy or chocolate to mark the special occasion (35%).

Heartfelt expenses: Cupid’s arrow costs an average of $180

Nearly 6 in 10 Americans are in romantic relationships, and half of them have been together for more than 10 years. Among the 82% of coupled Americans planning to buy their partner a gift this year, they plan to spend an average of $180 on gifts. Last year, that figure was $187.

LendingTree chief consumer finance analyst Matt Schulz says it’s a little surprising that Valentine’s Day spending has fallen.

“Inflation and rising interest rates are playing a role,” he says. “The unfortunate truth is that you’ll likely have to spend more this year to get the same things you got for last Valentine’s Day, so the small reduction in spending we’re seeing is a bit bigger pullback than it might appear. It’s understandable, though. High prices and tight budgets require sacrifices, and some people may see Valentine’s Day as an opportunity to dial back their spending.”

Men ($248) plan to spend more on their significant others than women ($115). By generation, millennials ages 28 to 43 plan to spend the most, shelling out an average of $262 on their special someone. That’s followed by:

- Gen Zers ages 18 to 27 ($201)

- Gen Xers ages 44 to 59 ($138)

- Baby boomers ages 60 to 78 ($81)

Meanwhile, those with children younger than 18 ($275) plan to spend significantly more than those without children ($150) and those with children older than 18 ($83). Perhaps unsurprisingly, six-figure earners ($275) are the income group planning to spend the most on average this Valentine’s Day. On the other hand, those earning $35,000 to $49,999 ($112) plan to spend the least.

How does that stack up to prior spending? More than half (54%) of Americans plan to spend about the same this year as last year, while 25% plan to spend less. That leaves 21% planning to spend more, though that figure jumps to 40% among Gen Zers and 38% among those with children younger than 18.

Although spending is high, most don’t expect that much from their loved ones. In fact, those in relationships expect their partners to spend an average of $166 on them this year. Spending expectations are highest among six-figure earners ($279), those with children younger than 18 ($259) and millennials ($255). Men expect their partners to spend $201 on gifts this year, while women expect their significant others to spend $134.

Notably, six-figure earners and women are the only groups that expect their partners to spend more than they plan to spend, though the discrepancy is small. While six-figure earners plan to spend $275 on their partners, they expect their partners to spend $279 on them. For women, those figures are $115 and $134, respectively.

Love on a budget may mean skipping Valentine’s Day for some

For some, Valentine’s Day is a financially flirtatious holiday. In fact, 37% of Americans in relationships believe that spending more than they can afford on Valentine’s Day is worth it to show their partner they care. Gen Zers (53%), millennials (51%) and those with children younger than 18 (50%) are the only groups with at least half believing this sentiment.

Schulz says it’s understandable to want to go all out on Valentine’s Day, especially in the early days of a relationship, but taking on significant debt over the holiday likely just isn’t wise.

“First of all, if they’re the right person for you, they shouldn’t want you to take on too much debt just to shower them with presents,” he says. “If they want you to do that, consider it a major red flag. That said, going above and beyond every once in a while can be fine. If it’s a milestone anniversary for you, go for it. Be planful and cautious. Taking a couple of extra months to pay off a big occasion may not be a big deal. Paying that debt off over six months to a year probably is.”

Some are saving green by skipping the red holiday. Across all Americans, 45% have skipped Valentine’s Day to save money, and just over a quarter (26%) plan to do so this year. Meanwhile, 52% would avoid the holiday altogether if they could, with those earning less than $35,000 (61%) among the most likely to agree with this sentiment.

Conversations are important to guarantee there’s no love lost — only bills. Across all Americans, 32% have set a spending limit with their partner for Valentine’s Day, and 1 in 4 (25%) haven’t but will do so this year or consider it in the future.

The price of passion can come with debt

You may have found your soulmate, but it isn’t always pretty when love and wallets collide. Across those in relationships, 33% say they may take on Valentine’s Day credit card debt this year. For Gen Zers, that figure rises to 52%.

Among these lovebirds planning to take on debt, 48% wouldn’t tell their significant other. That’s especially true for those without children (58%). Additionally, men (50%) are more likely to hide their gift-giving debt than women (44%).

According to Schulz, that’s not necessarily a red flag.

“If it’s only going to take an extra month or two to pay off and you’ve got plenty of savings and are generally in a good place financially, you may not need to tell your partner,” he says. “However, if you’re on a tight budget, living paycheck to paycheck and that debt is going to cause you to make other sacrifices, you need to be honest and open with your partner. Significant secret debts can cause real issues in a relationship when they come to light, so it’s better to be transparent about it.”

Of those potentially taking on debt this year, 64% plan to pay it off within three months, with 41% planning to pay it off within two. Meanwhile, 30% plan to pay off their potential debts within between three and six months and 6% expect to pay it off in six months or longer.

Lovers want experiences more than flowers or chocolate

When it comes to what coupled Americans want for Valentine’s Day, 21% are hoping for experiential gifts like travel or a dinner out — making it the most wanted gift. That’s followed by chocolate or candy and a special meal, at 20% for both.

Women prefer a bouquet of flowers (31%), while Gen Zers prefer candy or chocolate to mark the special occasion (35%). Meanwhile, 21% of Gen Xers prefer a special meal for Valentine’s Day and 21% of baby boomers simply want a card — though both age groups are equally or more likely to say they don’t want anything.

Experiences are also the top gift partners plan to give: Just under a quarter (24%) of significant others plan on gifting experiences. By gender, 30% of men plan to gift their significant other flowers for the special day and 24% of women don’t plan on buying a gift for their partner. Also worth noting, 39% of Gen Zers plan to gift clothes to their significant other and 31% of millennials plan to gift jewelry.

Besides gifts, how do couples plan to mark the occasion? Over half (53%) of couples plan to go out to a special dinner, the most popular celebration method. That’s followed by a dinner at home (31%) and going out for drinks (18%). Beyond that:

- 15% plan to go out to the movies

- 14% plan to go on a short getaway

- 7% don’t celebrate Valentine’s Day

Top expert tips for navigating Valentine’s Day price tags

Cupid’s delivering bills this year, but yours don’t have to be longer than your first love letter. To help cut back on Valentine’s Day spending, Schulz recommends the following:

- Consider setting a spending limit with your partner. “It’s not a sexy Valentine’s Day topic, but if you and your partner are on a tight budget and you’re comfortable talking about money, this may be a conversation worth having,” he says. “That’s especially true if both partners have similar incomes. Maybe you set an exact dollar amount or a broad range. Either way, having an idea of what the other plans to spend can be helpful. (And if one of the partners goes a little bit over, it’s probably OK. They just shouldn’t go too crazy with it.)”

- Get creative. You don’t have to spend a ton of money and get reservations at a fancy restaurant to have a romantic dinner. A freshly cooked meal at home with a favorite dessert, fresh flowers and a handmade card can be amazing, too — without worrying about noise, parking or traffic.

- Leverage credit card rewards. “The right credit card, used wisely, can make a real difference in your Valentine’s Day budget,” Schulz says. “For example, you might be able to get a free night at a hotel as a sign-up bonus and use it for a romantic getaway, even if it’s just in your hometown. But before you apply, be sure to shop around and make sure you’re getting a card that’s a good fit for you beyond that big bonus.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from Jan. 2 to 8, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78