Fans Shake off High Ticket Prices for the Love of Rock and Roll, With Concert Hopefuls Planning To Spend Nearly $800 on Their Favorite Artists This Year

With concert season in full swing, live music fans are grappling with the ticket industry.

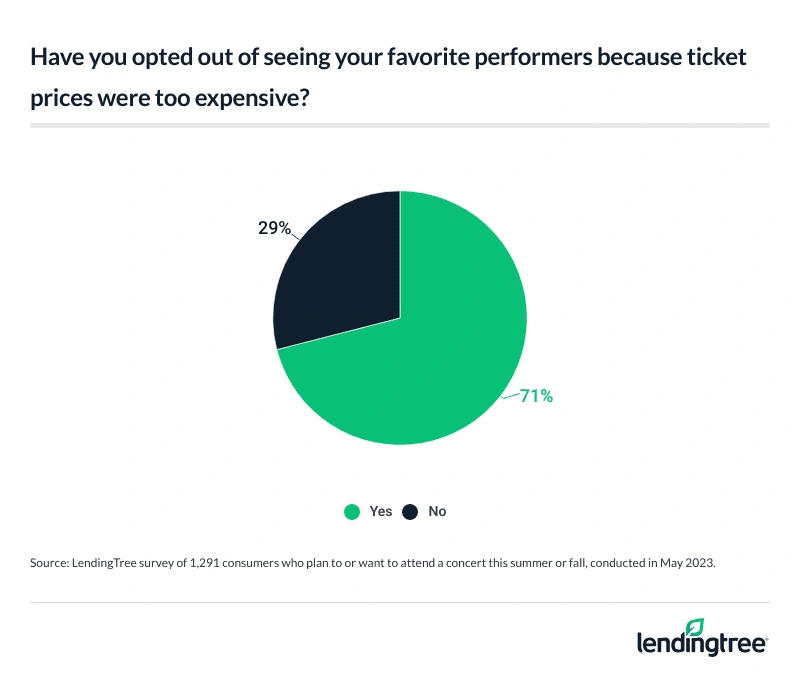

According to the latest LendingTree survey of nearly 2,000 U.S. consumers, 41% of concert hopefuls say they regret overspending for a show — and 71% have opted out of seeing their favorite performer because of exorbitant ticket prices.

We asked consumers about their ticket price limits, buyer’s remorse and the financial strains associated with attending live music shows. Here’s what we found.

- Concertgoers may have bad blood with the ticket industry, but love for the music is letting the good times roll. 65% of Americans plan to (or would like to) attend a concert or live show this summer or fall. These fans say they’re willing to shell out a maximum of $323, on average, for a ticket to see their favorite artist. However, 41% also admit buyer’s remorse for overspending on a concert or show.

- Although some fans are willing to cough up multiple Benjamins, others balk at soaring face value and resale ticket prices. 71% of people who plan to or want to attend a concert this summer or fall have had to “let it be” and opt out of seeing their favorite performers because of steep ticket prices. For some, a secondary market for tickets offers an alternative experience. But beware: Among the 37% of fans who turned to secondary markets or questionable sites to purchase tickets, 11% were scammed.

- Even with a ticket in hand, you’ve only just begun. Adding up travel, lodging and other expenses, concert hopefuls plan to spend an average of $795 on live performances this year, with millennials at the top among age groups at $959. The most commonly cited additional expenses include food and beverage (46%), followed by vehicle transportation (33%) and lodging and merchandise (both at 29%).

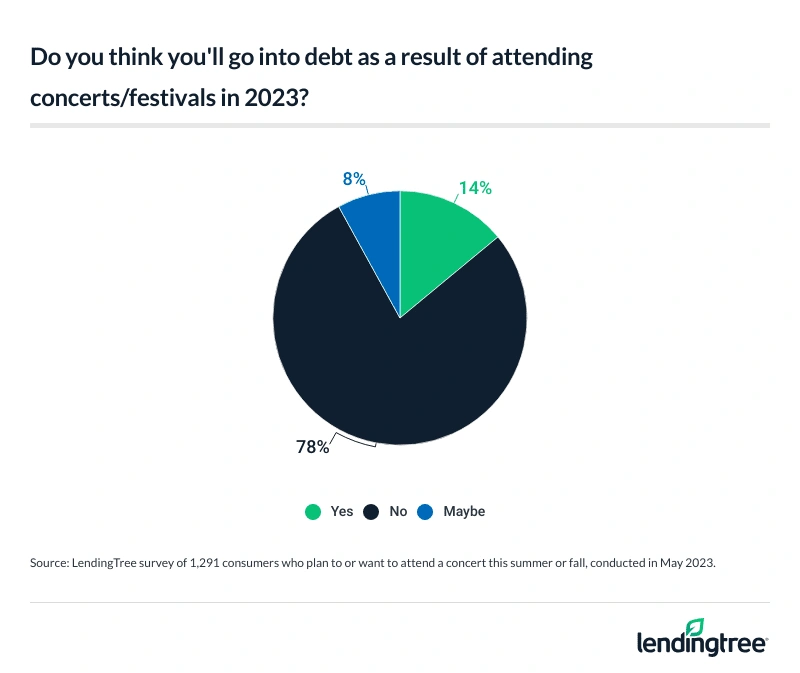

- With the all-in cost being so substantial, it shouldn’t be surprising that 22% of live music fans admit these shows could send them right into the danger zone (aka debt). Gen Zers and millennials are the most likely age groups to say these shows will put their finances in the red at 30% and 27%, respectively.

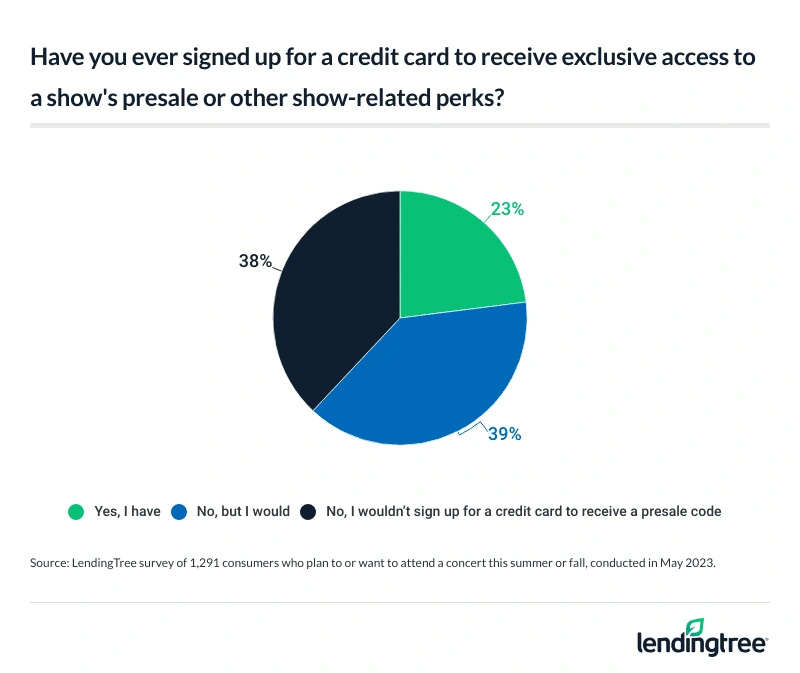

- Many are using credit card perks to help put them back in black. More than 4 in 10 people (44%) who plan to or want to attend a concert this summer or fall are planning to cash in on rewards, points or miles. Additionally, 23% of these live music fans say they’ve signed up for a credit card to receive perks like exclusive access to a show’s presale, with another 39% saying they would consider doing so.

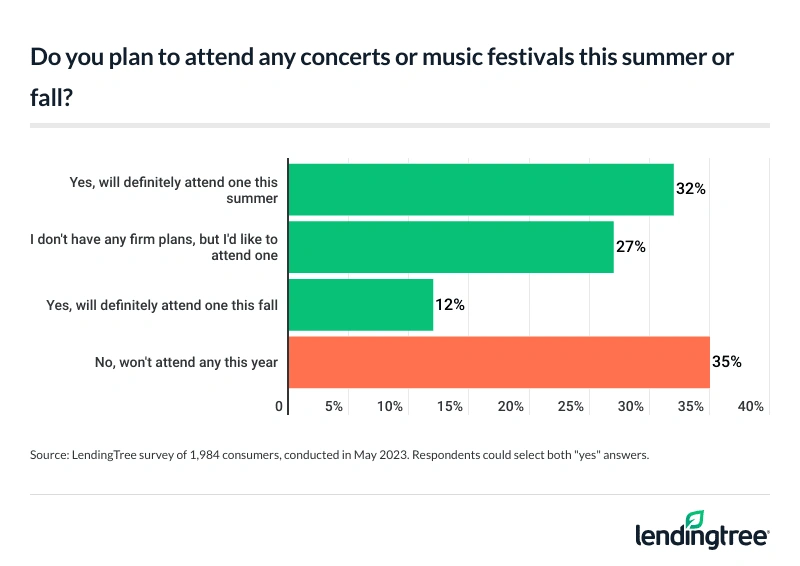

65% of Americans plan to or want to attend a concert or festival this summer or fall

With icons like Taylor Swift and Beyoncé on tour this year, it’s no surprise that 65% of Americans plan to (or would like to) attend a concert or live show this summer or fall. By age group, Gen Zers ages 18 to 26 are most likely to plan or want to attend a show at 78%. That’s followed by:

- Millennials ages 27 to 42 (75%)

- Gen Xers ages 43 to 58 (60%)

- Baby boomers ages 59 to 77 (49%)

Breaking it down even further, 32% of Americans say they’ll attend a concert or music festival this summer, while 12% will go to one this fall.

These fans are willing to shell out big bucks to see who they love. On average, concert hopefuls are willing to spend a maximum of $323 for one ticket to see their favorite artist. Spending big might come at an emotional cost, though, as 41% of these live music fans also admit buyer’s remorse for overspending on a concert or show.

According to LendingTree chief consumer finance analyst Matt Schulz, balancing concert-going with financial responsibility isn’t easy.

“Concert ticket prices have been high for years, but it seems as if they’ve shot into the stratosphere in just the last year or so,” he says. “That makes planning so important. If you know that your favorite artist is going on tour soon and you know you have to go, start to put a little bit of money away each month to help with the costs. Call it your Taylor Swift or Beyoncé fund. You’ll be glad you did.”

Americans with concert plans expect to attend an average of three shows this year, down from four last year. While 34% say their planned shows are in state, 23% plan to travel to another state for a show and 4% plan to travel to another country. Another 12% say they plan to do both. These plans aren’t set in stone for many, though. In fact, 28% say they’re not sure if they’ll have to travel for a show yet.

High ticket costs, resale prices leading concertgoers to opt out of shows

Who’s the antihero this year? For many, it’s the ticket industry. Of concert hopefuls, 71% have opted out of seeing their favorite performers because the ticket prices were too high.

And 57% say recent events over limited ticket availability and high resale prices have made them hesitant to try to get tickets for their favorites.

Meanwhile, others have turned to secondary markets or websites to try to score better deals, but that doesn’t always work out either. Of the 37% of fans who bought tickets from resellers, 11% say they were scammed.

Caution is crucial when buying from a reseller, Schulz says.

“If the deal seems too good to be true, it probably is,” he says. “As much as it might hurt to buy from some of the big-name ticket resellers, sometimes there’s no other way to go. Paying a little bit more for the tickets there is a whole lot better than crossing your fingers that your bargain tickets bought from that sketchy site are legitimate.”

Schulz also advises using your credit card when making these purchases. If you get scammed, your credit card issuer’s fraud department can help you get your money back.

But it’s not just the ticket industry holding fans back. Among those who want to or plan to attend a concert this summer or fall, 73% at least somewhat agree that inflation is making it too expensive to attend the concerts and festivals they want to. Meanwhile, 7% at least somewhat disagree and 21% have neutral feelings.

Music fans plan to spend an average of $795 on concert expenses — which may mean taking on debt

It’s not just the ticket prices stretching music fans’ budgets — travel, lodging and other expenses add up. California king bed or not, concertgoers (and concert hopefuls) plan to spend an average of $795 on live performances this year. Men ($838) plan to spend more, on average, than women ($737). By age group, millennials plan to spend the most at an average of $959.

Perhaps unsurprisingly, six-figure earners plan to shell out the most of any demographic group at an average of $1,090.

What, exactly, are consumers budgeting for? Food and beverage (46%) top the list, followed by vehicle transportation (33%) and lodging and merchandise (both at 29%). Still, priorities vary by demographic. Gen Zers would rather spend money on a new outfit (39%) for the occasion over food and beverages during the concert (31%). Additionally, Gen Zers are significantly more likely to spend on VIP passes at 26%, compared with 17% across concert hopefuls.

Given the high costs of attending a concert, it’s not surprising that 22% of live music fans admit these shows could put them in debt. By age group, Gen Zers (30%) and millennials (27%) are the most likely age groups to say these shows could put them in the red. And men are much more likely to admit they could go into debt as a result of attending shows this year than women (26% versus 18%).

While Schulz is concerned with the thought of young Americans taking on debt, he says debt isn’t necessarily a bad thing.

“I’m a believer in the idea of good debt,” he says. “That’s debt that eventually brings a strong return on investment. That includes debt that creates memories that last a lifetime. If you take on a little debt to take a dream trip to Paris, to watch Taylor Swift or Bruce Springsteen in concert or to take your family to Disney, I think it can be OK. Of course, you don’t want to do it too often or go into too much debt in doing so, but a little bit of debt handled wisely can be worth it if it’ll bring you a ton of joy.”

Concertgoers are leaning on card perks to help offset debt (plus additional expert tips)

While many concertgoers are willing to take a financial hit for their favorites this year, they’re also leveraging credit card rewards to help ease the dent. In fact, 44% of this year’s concert hopefuls plan to cash in on credit card rewards, points or miles.

That’s not where it ends, as nearly a quarter (23%) of these live music fans say they’ve signed up for a credit card to receive perks like exclusive access to a show’s presale, with another 39% saying they would consider doing so.

For those looking to utilize credit card rewards, Schulz offers the following advice:

- Save your money, then pay with plastic. “Many credit cards come with sign-up bonuses of $100 or more for spending a set amount of money in a given period,” he says. “That extra cash can extend your budget, and it can do so without causing any extra debt. You can do that by buying your tickets with your credit card and then paying the purchase off with the money you have in savings. That way, you can hit the minimum spending threshold needed to get that sign-up bonus and do so knowing you’ll be able to pay your bill off immediately.”

- Choose your rewards based on your spending. “If you’re road-tripping to the big festival, look for a card that gives you big discounts on gas,” Schulz says. “If you know you’ll be spending a lot on concert tickets, consider a card that gives extra rewards for entertainment purchases. If you’ll be flying to your destination, try to find cards that can give you extra miles for your trip or other perks such as free checked bags, discounts on in-flight purchases and more. Concert-going is expensive. These moves may not make it a bargain by any stretch, but every little bit helps.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,984 consumers from May 3-4, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77