75% of Americans Will Tune Into the Super Bowl (Taylor’s Version), Spending $116 on Average

Taylor Swift fans are coming out of the woods and into the end zone.

As the Kansas City Chiefs prepare to play the San Francisco 49ers in Super Bowl LVIII on Feb. 11, Americans everywhere are gearing up for the game — and many Swifties may tune in for the first time.

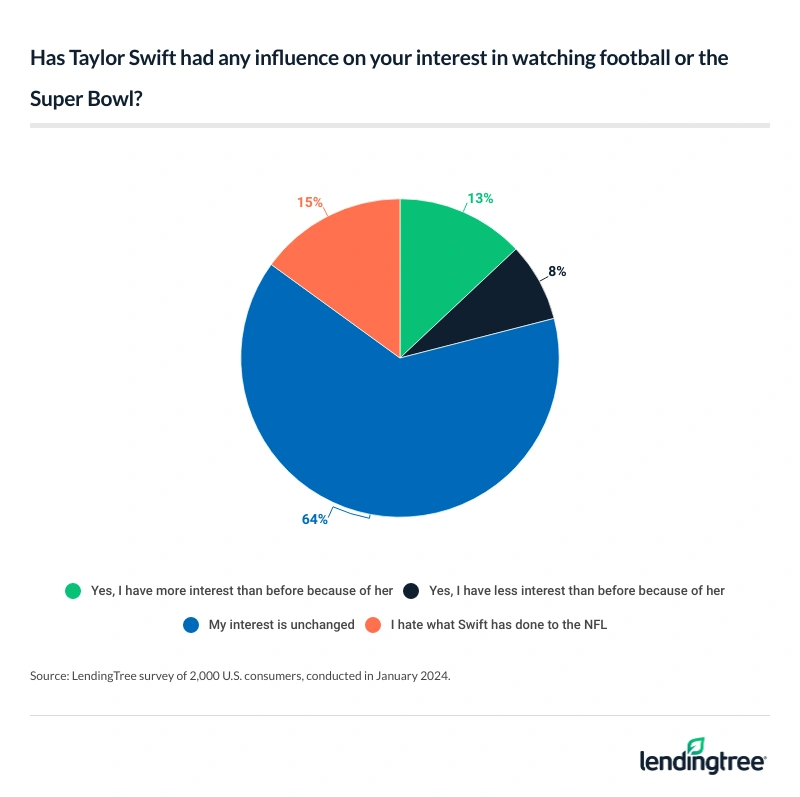

According to the latest LendingTree survey of 2,000 U.S. consumers, 24% of Gen Zers and 20% of millennials have an increased interest in football this year due to Swift’s influence. However, that increased interest could also mean an increase in spending for the game, too.

Here’s what else we found.

- The biggest television event of the year will have some new fans in 2024: Swifties. Three-quarters (75%) of Americans plan to watch the Super Bowl this year — and 24% of Gen Zers and 20% of millennials have an increased interest in football this year due to Swift’s influence. 31% of Gen Zers said they’d root for the Chiefs in the NFL’s title game because of Swift, and now they’ll get the chance.

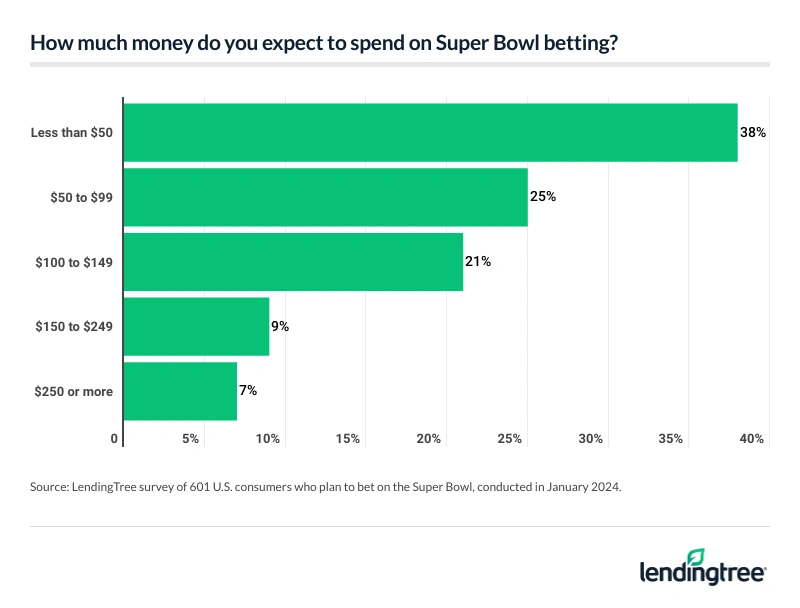

- The stakes are high, and bettors are hoping to score big. 30% of Americans will place a Super Bowl bet this year, particularly those with children younger than 18 (44%), Gen Zers (41%) and men (40%). Among those placing bets, 63% will cap their wager at less than $100. However, not all are using cash: 29% will place a bet on a credit card. Half (50%) are placing bets informally between friends and family, while 52% will use betting sites.

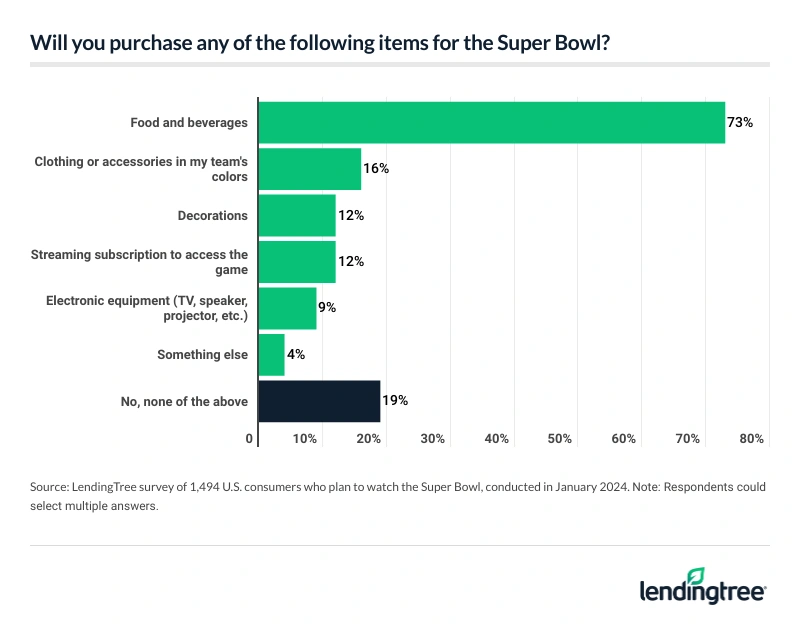

- Super Bowl spending can add up. Americans planning to watch the Super Bowl will spend $116 on average, with top expenses being food and beverages (73%), clothing or accessories (16%), decorations (12%) and streaming services to watch the game (12%). Additionally, 39% of Gen Zers admit they’ve been influenced by Swift to spend more money on football — mostly by purchasing jerseys and memorabilia or a streaming service to watch a game.

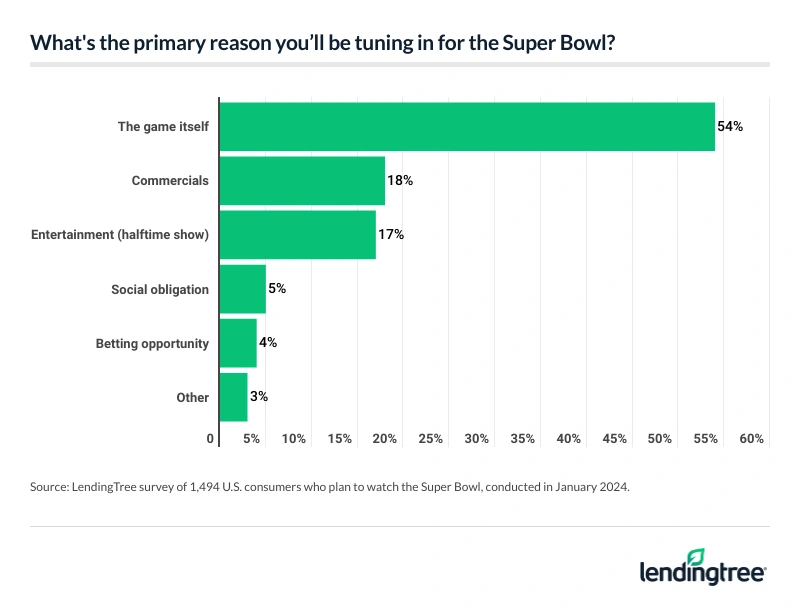

- Unsurprisingly, not everyone is tuning in for the game. Among those planning to watch, just over half (54%) say they’re primarily tuning in for the game. Meanwhile, 18% will watch because of the commercials, 17% will watch for the halftime show and 5% admit they’ll watch out of social obligation.

Shake it off(side): Swifties say they’re more interested in the Super Bowl

As the big game approaches, three-quarters (75%) of Americans plan to watch this year’s Super Bowl. Those earning $75,000 to $99,999 (84%), men (83%) and six-figure earners (83%) are particularly likely to tune in this year.

Nearly half (49%) of Americans plan to watch the Super Bowl at their house — the most popular response. Following that:

- 11% plan to watch it at someone else’s house

- 6% aren’t sure where they’ll watch yet

- 4% plan to watch it at a bar or restaurant

- 2% plan to attend the game in person

- 2% plan to watch it somewhere else

Of course, Travis Kelce will play in the game, meaning Swift might be there (if she makes it back from her Tokyo concert on time) — and many of her fans will tune in, some for the first time. In fact, 13% of Americans have an increased interest in football this year due to Swift’s influence. That figure rises to nearly a quarter (24%) among Gen Zers ages 18 to 27 and 20% among millennials ages 28 to 43.

Those with children younger than 18 (24%) are much more likely to say Swift sparked an increased interest in football than those without children (11%) and those with children older than 18 (6%).

Meanwhile, six-figure earners (21%) are significantly more likely to say they’re more interested in football or the Super Bowl because of Swift than any other income group. That compares with just 9% of those earning less than $35,000. Additionally, men (15%) are slightly more likely to say they’re more interested in football or the Super Bowl because of Swift than women (12%).

According to LendingTree chief consumer finance analyst Matt Schulz, no one should be surprised that the Swift effect has extended to football.

“If there’s one thing that people should’ve learned all too well by now, it’s that you should never be surprised by the enormity of Swift’s influence,” he says. “We’ve seen it with her records and concerts, of course, but we’ve also seen it in movies, politics and now football. She’s an absolute force to be reckoned with economically, and while her grip on the American public isn’t going to last forever, no one should bet on it fading much anytime soon.”

Swifties aren’t just tuning in to see the singer — 18% said they’ll root for the Chiefs in the title game because of Swift. That figure rises to 31% among Gen Zers, 30% among those with children younger than 18, 30% among six-figure earners and 26% among millennials.

Swift’s influence isn’t entirely positive, though. Across all Americans, 15% hate what she has done to the NFL, while 8% say they’re less interested in football because of her. Still, Americans are more loyal to football than the singer: Overall, 77% of Americans would rather have the best tickets to the Super Bowl than the best tickets to a Swift concert.

Bettors are watching for touchdowns and turnovers

For some Americans, the Super Bowl is more than a game — it’s a chance to win some cash. In fact, 3 in 10 (30%) Americans will place a Super Bowl bet this year. Those with children younger than 18 (44%), Gen Zers (41%) and men (40%) are most likely to bet.

Additionally, those whose favorite team is in the AFC (47%) are more likely to place a bet than those whose favorite team is in the NFC (43%).

Among those placing bets, 63% plan to put less than $100 on the line. Meanwhile, 21% will bet between $100 and $149 and 16% will bet $150 or more. Perhaps unsurprisingly, six-figure earners are the most likely to put big bucks on the line, with 16% betting $250 or more.

When it comes to what they’re using for their bets, 29% will place a bet on a credit card. That figure rises to 47% among six-figure earners, 41% among those with children younger than 18 and 38% among millennials.

According to Schulz, there are big risks in using credit cards for bets. “Credit cards make it so easy to spend more and more and go well beyond your means, and that’s scary,” he says. “It’s one thing to lose a bet. It’s something else entirely to lose a bet and have to pay interest on top of it because you couldn’t pay off your credit card at the end of the month. That’s a recipe for trouble.”

Not every bet is entirely official, though. In fact, 50% of bettors are placing bets informally between friends and family, while 52% will use betting sites and 25% will place a bet in person.

Some Americans may feel emboldened after last year’s game. Last year, 15% of Americans won money on bets during the Super Bowl, while 6% lost money. Generally, though, most (77%) Americans didn’t place any Super Bowl bets.

That being said, not everyone’s interested in betting on the big game. While two-thirds (66%) would rather bet on the Super Bowl, just over a third (34%) of Americans would rather bet on the Puppy Bowl.

The Super Bowl means super spending

Super Bowl spending goes beyond betting, though. Among those who plan to watch the Super Bowl, they expect to spend $116 on average. Men ($145) plan to spend more than women ($80). By generation, millennials plan to spend the most, shelling out $171 on average for the big game. That compares with:

- Gen Zers ($159)

- Gen Xers ages 44 to 59 ($78)

- Baby boomers ages 60 to 78 ($40)

Those with children younger than 18 ($181) plan to spend much more than those without children ($101) and those with children older than 18 ($57). Meanwhile, those whose favorite team is in the NFC ($141) will spend more than those whose favorite team is in the AFC ($130).

By income group, those earning $75,000 to $99,999 ($169) and six-figure earners ($168) plan to spend the most.

What are Super Bowl fans spending their money on? Nearly three-fourths (73%) plan to buy food or beverages for the game — making it the top expense. That’s followed by clothing or accessories (16%), decorations (12%) and streaming services to watch the game (12%).

Swift’s influence has an effect on Americans’ pockets, too, as 16% of Americans admit Swift has influenced them to spend money on football — with most purchasing jerseys and memorabilia or a streaming service to watch a game. Gen Zers (39%) are the most likely to say Swift has influenced their football spending.

Those tuning in aren’t only watching for the game

Not everyone’s watching the game for the game — in fact, only 54% say they’re primarily tuning in for the football itself.

Meanwhile, 18% will watch because of the commercials — the next most popular reason to watch. Following that, 17% will watch for the halftime show, 5% admit they’ll watch out of social obligation and 4% plan to tune in for the betting opportunities.

Gen Zers (32%) and women (23%) are particularly likely to watch the Super Bowl for the halftime show, while baby boomers (69%) and men (64%) are in it for the game.

Chips, dips and winning tips: Expert advice on tackling Super Bowl spending

When it comes to Super Bowl spending, you don’t have to take on super large amounts of debt to make it a memorable game. To help reel in costs, Schulz recommends the following:

- Let others help. “If you’re throwing a Super Bowl party, don’t feel like you have to take on all the costs yourself,” he says. “Turn it into a potluck. Let everyone bring an entrée, drinks or dessert. It’ll keep costs down and let people get creative.”

- Newer isn’t always better. Those extra football-themed napkins and paper plates you didn’t use at last year’s party will be fine for this year’s get-together. So will that old jersey and T-shirt from your favorite team.

- Take advantage of credit card rewards. “Plenty of cards are offering $100 or more in bonuses to new cardholders who spend a certain amount on their new card,” Schulz says. “If you’re planning to pay cash for your Super Bowl festivities, consider using a new card instead and then use your cash to pay off that balance at the end of the month. That extra $100 can certainly help extend your budget. Or if you’re not comfortable with that, use a good, old 2% cash back card to help defray the costs a bit.”

- Make a plan and stick to it. “When you’re shopping, things are much less likely to go off the rails if you bring a well-thought-out list with you,” he says. “Rather than browsing and looking for inspiration, you’re on a mission to find what you want. That makes it much easier to forgo all those possible impulse buys that can trip you up.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from Jan. 2 to 8, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78