Consumer Interest In Store Cards Falls to 5-Year Lows As Average APR Nears 30.00%

Just 27% of Americans say they’re likely to apply for a store credit card this holiday season, according to new LendingTree data, the lowest percentage since 2018.

This comes as the average APR on a store card nears 30.00%, though survey data shows those sky-high rates may not be scaring away as many people as expected.

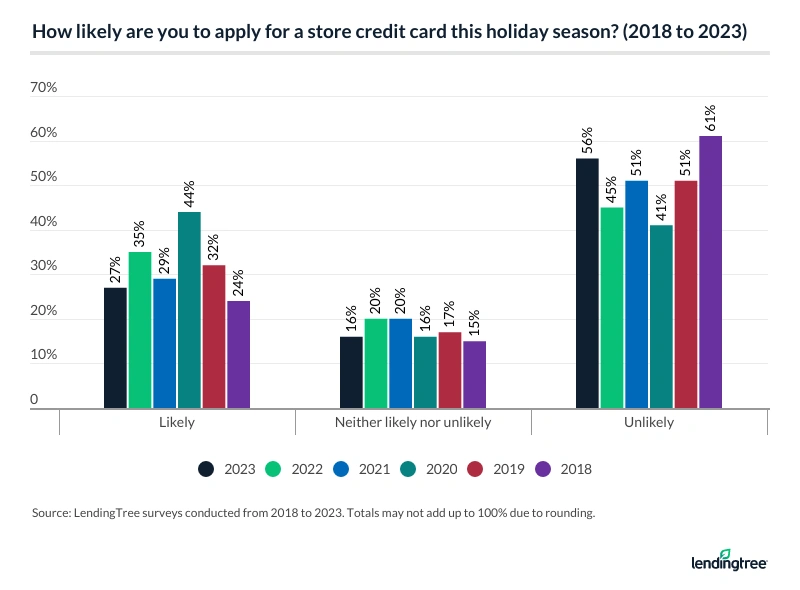

- Consumer interest in store cards has fallen to its lowest level since 2018. Just 27% of consumers are at least somewhat likely to apply for a store credit card this holiday season. That’s down from 35% in 2022 and is the lowest percentage since 2018.

- Nearly 2 in 3 store cards have possible APRs of 30.00% or higher — and some top 35.00%. Of the 101 cards we reviewed, 64 had possible APRs of 30.00% or higher. 11 of those reached 33.00% or higher and 3 charged 35.00% or higher — rates previously reserved for subprime credit cards. The average APR on a store card today? 29.31%.

- Record-high rates aren’t necessarily scaring people away from store cards. Among those who say they’re at least somewhat likely to apply, 69% would consider applying for a card with an interest rate of 30.00% or higher.

Consumer interest in store credit cards plunges to 5-year low

Americans have a love-hate relationship with store credit cards. We love the same-day discounts, unique perks and easy availability — but we hate the sky-high interest rates and the potential debt.

We started tracking consumer interest in store credit cards in 2018, with the love affair reaching its peak in 2020. As the coronavirus pandemic raged, 44% of consumers said they were at least somewhat likely to apply for a store credit card that holiday season. That’s still the highest number we’ve seen.

That percentage has decreased in two of the subsequent three years, including this year, when rates fell to levels not seen since 2018.

Just 27% of consumers say they’re likely to apply, down 8 points from 2022. That includes 11% who say they’re very likely to apply and 16% who say they’re somewhat likely.

Men are more likely than women (30% versus 25%) to say they’re likely to apply. Gen Zers ages 18 to 26 (42%) are the most likely age group to say so, and interest in applying for a card decreases with age. Meanwhile, just 7% of baby boomers ages 59 to 77 say they’re likely to apply.

Parents with kids younger than 18 are three times more likely than those with older children (43% versus 13%) and nearly 20 points more likely than those without children (43% versus 24%).

Many store card APRs reach 30.00% or higher

Even by credit card standards, store cards have really high interest rates. In the six years we’ve done this report, the average store card APR has been 4 to 5 percentage points higher than the average for all new credit card offers each year. This year is no exception.

That doesn’t mean this is a typical year for store credit cards, however. It most certainly isn’t, as store card APRs have smashed anything we’ve seen since beginning tracking in 2018.

Average APR for new store cards vs. average APR for all new credit cards (2018 to 2023)

| Avg. APR for all new credit cards | Avg. APR for new store credit cards | |

|---|---|---|

| 2018 | 20.62% | 24.97% |

| 2019 | 20.59% | 25.41% |

| 2020 | 19.29% | 24.24% |

| 2021 | 19.47% | 24.27% |

| 2022 | 22.21% | 26.60% |

| 2023 | 24.46% | 29.31% |

Over the past year, the average store card APR rose from 26.60% to 29.31%, a jump of 2.71 percentage points. While a massive increase was expected given the 11 rate hikes from the Federal Reserve since March 2022, that jump is still eye-opening. It’s especially true when you consider that 29.00% was once an APR reserved only for people who paid their bills late or cards for people with poor or thin credit — but that’s definitely no longer the case.

Consider this:

- Of the 101 store cards we reviewed this year, 64 had possible APRs of 30.00% or higher. That’s nearly 2 in every 3 cards we saw.

- 11 of those 64 reached 33.00% or higher.

- 3 charged 35.00% or higher. Those types of rates have traditionally been reserved for folks with badly damaged credit.

Think that’s bad? Eighteen other cards had an APR of 29.99%. That means 82 of the 101 cards we reviewed had a potential APR of 29.99% or higher.

The two companies with store card APRs above 35.00% were online retailer Fingerhut and women’s wear outlet Ann Taylor. Ann Taylor had one co-branded card and one non-co-branded card with an APR above 35.00%. All three of these cards had a single possible APR, meaning you’d get the same rate whether your credit score is 850 or 550.

At the other end of the spectrum, Bass Pro Shops, Amazon and the Army and Air Force Exchange Service offered the lowest store card APRs.

Record interest rates aren’t scaring away as many people as you might expect

With APRs pushing 30.00%, it’s easy to see why someone might be reluctant to apply for a store credit card, even with the sometimes steep discounts offered at sign-up. You don’t have to be an accountant to understand that when you pay 30% to save 15%, the math doesn’t work in your favor.

Our survey, however, shows that these 30.00% interest rates — historically high, jarring round numbers that they are — aren’t going to deter as many Americans from applying as you might imagine. More than two-thirds (69%) of those who say they’re likely to apply for a store credit card this holiday season say they’d consider applying for a card with an interest rate of 30.00% or higher.

The most likely to apply for a 30.00% APR card are Gen Zers (84%), those making $100,000 or more a year (78%), men (74%) and parents with young kids (73%).

While it might seem odd to have the youngest and the richest among us as the most likely to accept a 30.00% APR credit card, it speaks to the vastly different roles credit cards can play in American households. Some, such as those with large incomes, may be willing to get the card because they’re confident they’ll be able to pay off the balance in full when the first bill comes due. That makes the interest rate a moot point, which should ultimately be the goal of every cardholder.

However, others may get the card because they don’t have many other options. They need help extending their budgets, and these cards are often more easily available than other types of cards. Plus, even with the crazy-high APRs, a store card’s rate still is far more palatable than those of payday loans and other less-desirable options.

If you carry a balance, steer clear of store cards

If you’re struggling to decide this holiday season whether you should apply for that new store credit card and take advantage of that big discount you’re being offered, there’s only one question you need to ask yourself: Will I be able to pay off the bill in full?

If your answer is a confident yes, it’s OK to consider getting the card. You should still find out as much as you can about the card’s fine print before applying — what you don’t know can cost you. But if you do your homework and like what you see, applying may be the right choice for you. (And if you’re still unsure, it’s OK to say no and research the card more at home. Everything you’d liked about the card will probably apply the next time you go to the store, but then you’d be making a much more informed decision.)

But if your answer is no, walk away.

Even if your answer is a not-very-confident yes, you’re probably better off walking away.

Why? The interest rates are just too high. If you really need a new card, shop around for other general-purpose cards. In doing so, you might be able to save yourself 5 percentage points or more off your interest rate.

The answer isn’t always quite that cut-and-dried, of course. If that 15% discount means you’ll be able to pay all but a few dollars of that first bill, it’s probably OK to consider getting the card. However, if you’re going to carry a sizable balance for several months, a store credit card is a bad choice.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,045 U.S. consumers from Oct. 12-15, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

LendingTree also reviewed 101 credit card offers — including co-branded and non-co-branded cards – from 73 of the nation’s biggest retailers, including brick-and-mortar and online-only stores.

We reviewed basic terms and conditions, including APRs, online through issuers’ publicly available websites. Credit card offer data is accurate as of Oct. 25, 2023.

Recommended Articles