3 in 4 Parents Say Raising Children Has Been Far More Expensive Than Expected, With Those With Young Kids Spending $11,505 a Year per Child

Raising kids is no walk in the park, especially financially. In fact, parents of kids younger than 18 spend a hefty $11,505 a year per child, according to the latest LendingTree survey of more than 2,000 U.S. consumers. Of course, most admit it’d be easier with more money.

Here’s what else we found.

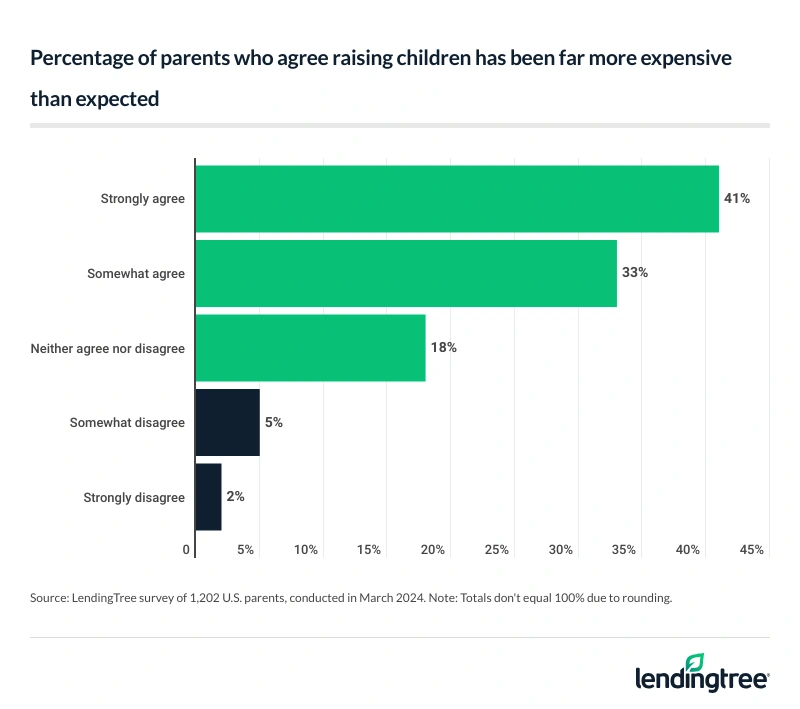

- Parents have the hardest job in the world, but most agree it would be easier if they had more money. Parents of kids younger than 18 estimate they spend $11,505 a year per child, and 90% acknowledge parenting would be easier if they had more money. Among all parents, 3 in 4 (75%) say having and raising children has been far more expensive than expected.

- Some admit to overspending to keep up with others. Over half (55%) of parents have gone into debt to pay for child-related expenses, but 72% of them say they don’t regret it. Those with young children say the child-related expenses that are the biggest financial burden are food (21%), child care (19%) and clothing (13%). Overall, 45% of parents (regardless of age) admit they’ve felt the need to overspend on their child to keep up with other parents or their child’s peers.

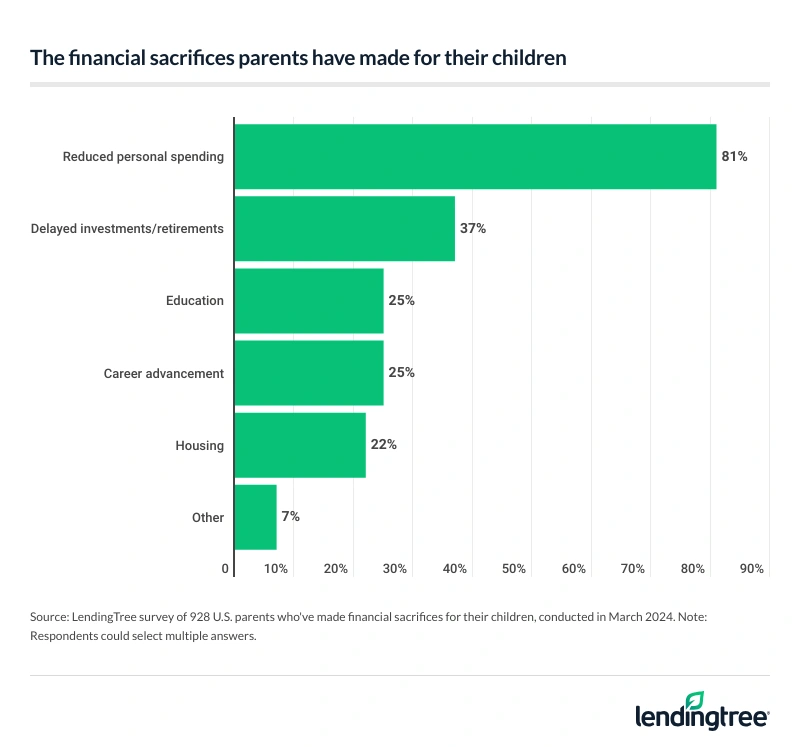

- Many parents have had to make sacrifices for their children, including careers and education. 77% of parents say they’ve had to make financial sacrifices for their children, most commonly by reducing personal spending (81%), delaying investments or retirement (37%) and sacrificing their own education or career (25% for both). When asked what they would increase spending on if they had more money for their kids, parents of young children most commonly answered clothing or extracurricular activities.

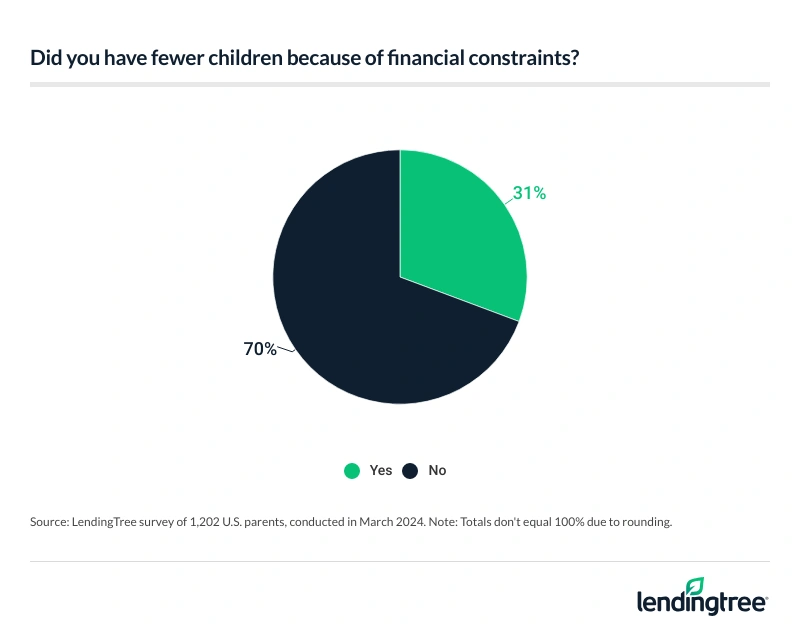

- Parenting is expensive, but the majority are happy with the family they have. Almost a third (31%) of parents say they have fewer children because of their financial situation. However, knowing what they know now about the cost of having and raising a child, 78% say they’re happy with the number of kids they have. That’s especially true among older parents, with 86% of baby boomers saying so.

Parents with young kids spend $11,505 a year per child

Raising a kid is costly. For parents of kids younger than 18, it costs an average of $11,505 a year per child. Men with young kids spend the most, at $13,901 a year per child. That’s followed by millennial parents ages 28 to 43, at $12,484.

With that figure in mind, 90% say parenting would be easier if they had more money. On the other hand, 14% of Gen X (ages 44 to 59) parents with young children say having more money wouldn’t make being a parent easier — the highest across available demographics.

Across all parents, though, 75% say having and raising children has been far more expensive than expected. That figure’s highest among those earning $30,000 to $49,999 in household income, millennials, six-figure earners and parents with kids younger than 18, at 77% for all four.

Most who overspend on their kids don’t regret it

About 55% of parents have gone into debt to pay for child-related expenses, and 16% are still in debt. Overall, millennials and men are the most likely to have gone into debt for their kids, at 60% for both.

Still, 72% of those who’ve gone into debt don’t regret it. Baby boomers ages 60 to 78 (91%) and those with children 18 or older (89%) are the most likely to share this sentiment. Additionally, women (80%) are significantly more likely to say they don’t regret overspending than men (64%).

LendingTree chief consumer finance analyst Matt Schulz says these parents may be right to feel this way. “Others may disagree, but I think there’s good debt,” he says. “Good debt is that which brings a significant return on investment. Sometimes that return is financial, but sometimes it’s in the form of personal growth, family bonding, memories to last a lifetime or other things that can’t be accounted for on a spreadsheet.”

Of course, good borrowing can be bad when done too often or to too large of a degree. That’s possible with kids. However, a little bit of debt to help your kids reach their goals and become better people who can eventually make their own way in the world can be money well spent.

For those with young children, food (21%) is the biggest child-related financial burden. That’s followed by:

- Child care (19%)

- Clothing (13%)

- School-related costs (10%)

- Extracurricular activities (9%)

- Health care (9%)

- Toys/entertainment (4%)

- Travel (2%)

- Special occasions (2%)

- Personal care products (2%)

- Child support to the other parent (2%)

- Baby gear (1%)

According to a LendingTree study on where families spend the most on child care, those who pay for child care spend nearly a fifth of their income on it. Meanwhile, another LendingTree survey on extracurricular spending found that those with kids in extracurriculars spend a yearly average of $731 per child on activities.

Across all parents, 45% feel the need to overspend on their child to keep up with other parents or their child’s peers. Those with children younger than 18 and millennials are particularly likely to feel the urge to overspend for this reason, at 56% for both. Additionally, men (51%) are more likely to share this sentiment than women (40%).

Parents have sacrificed personal spending, investments and more

Sacrifices are part of parenthood for many, and financial sacrifices are no exception. In fact, 77% of parents say they’ve had to make financial sacrifices for their children, though that’s especially true for Gen X parents (80%), men (79%), those earning $30,000 to $49,999 (79%) and those with children younger than 18 (79%).

What do these sacrifices include? Personal spending is the most common sacrifice, at 81%. That’s followed by delaying investments or retirement (37%) and sacrificing their own education or career (25% for both).

While those sacrifices are sometimes necessary, Schulz says it’s possible for parents to juggle these financial obligations alongside raising a kid. “For some, it won’t be possible because of their financial situation, but it can be done for many others,” he says. “It won’t be easy, it’ll require discipline and sacrifice, and you may not be able to do them to the degree you would’ve been able to if kids weren’t in the picture, but it can happen.”

If they had more money to spend on their kids, parents of young children would most commonly spend more on clothing (45%) or extracurricular activities (38%). That’s followed by:

- Food (35%)

- Special occasions (32%)

- Toys/entertainment (31%)

- School-related costs (29%)

- Child care (24%)

- Health care (23%)

- Personal care products (20%)

- Baby gear (11%)

With costs in mind, parents are happy with the number of kids they have

Though parenting is expensive, finances aren’t the only cost. In fact, 31% of parents have fewer children because of their financial situation, particularly millennials (44%) and those with young children (41%). Men (37%) are more likely to share this sentiment than women (25%).

Still, that’s not necessarily bad. In fact, 78% are happy with the number of kids they have, knowing what they know now about the cost of raising kids. That’s especially true among older parents, with 86% of baby boomers sharing this sentiment. Meanwhile, 11% of parents say they’re done having kids but wish they had more.

How many kids do parents have? Across those with young kids, 42% have one child, 38% have two, 13% have three, 5% have four and 3% have five or more.

Cutting costs while raising kids: Top expert tips

Everything feels more expensive nowadays, and raising a child is certainly a major financial commitment. For parents looking to improve their financial situations, Schulz recommends the following:

- Seek out and be willing to accept help. “Raising kids takes a village,” he says. “If you have trusted friends and family willing to help with things like child care or hand-me-downs or an occasional shoulder to cry on, let them help. If you don’t have that, many organizations in your area and around the country aim to assist people struggling. It can be hard and scary to admit you’re struggling and that things have gotten out of control, but if you’re willing to make yourself vulnerable, people are more often than not willing to help.”

- Make and update a budget. “You can’t make any meaningful financial plan for your household unless you know how much money is going in and out of it each month,” Schulz says. “Take a few weeks to track your spending and earnings and use that knowledge to craft a budget aligning with your values and goals. And if you have a budget but haven’t updated it in a while, do it. Chances are a lot of the assumptions you’ve made have been made obsolete by stubborn inflation, so that budget may not be as accurate a picture of your financial situation as you think.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from March 15 to 18, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Recommended Articles