2024 Credit Card Predictions

After a second straight year of record debt, lingering inflation and frequent rate hikes, credit cardholders weren’t sad to see 2023 go.

But what’s ahead for credit cards this year?

While waiting for my crystal ball to be delivered, I have some predictions about what lies ahead for cardholders and the industry, in what’s shaping up to be a significantly different year.

Credit card rates will finally fall, but not by much

LendingTree data shows that the average APR on a new credit card offer has risen every month since March 2022, a streak of 22 consecutive months, driven by the Federal Reserve’s frequent rate hikes. During that time, the average APR climbed from 19.53% to 24.59% — more than 5 percentage points. That’s a big, big deal for those who carry a balance on their cards.

That streak will end in the first half of this year. The decrease will likely be small, but cardholders will welcome any reprieve after nearly two years of increases.

Average APRs on new credit card offers during the 22-month streak

| Month | Average APR |

|---|---|

| December 2023 | 24.59% |

| November 2023 | 24.56% |

| October 2023 | 24.46% |

| September 2023 | 24.45% |

| August 2023 | 24.37% |

| July 2023 | 24.24% |

| June 2023 | 24.06% |

| May 2023 | 23.98% |

| April 2023 | 23.84% |

| March 2023 | 23.65% |

| February 2023 | 23.55% |

| January 2023 | 23.39% |

| December 2022 | 22.91% |

| November 2022 | 22.40% |

| October 2022 | 22.21% |

| September 2022 | 21.59% |

| August 2022 | 21.40% |

| July 2022 | 20.82% |

| June 2022 | 20.17% |

| May 2022 | 19.90% |

| April 2022 | 19.68% |

| March 2022 | 19.62% |

| February 2022 | 19.53% |

To be clear, this doesn’t mean I think the Fed will lower rates in the first half of 2024. There’s a growing expectation it’ll reduce rates at some point during the year, maybe even multiple times. But even if it doesn’t, I still expect to see credit card rates tick down this year.

Cardholders shouldn’t get too excited, though — I don’t expect massive decreases. During times when the Fed isn’t actively moving rates, credit card APRs tend to rise or fall a bit from month to month as issuers tinker with rates to try to get an edge in the marketplace.

Before the Fed starts cutting rates, I think some issuers will lower theirs — even by a small fraction of a percentage point — to shake things up a bit in an attempt to one-up the competition. It only takes a few issuers doing that to move the national average a little bit. I think we’ll see that sometime in early to mid-2024.

Hockey-stick-shaped growth will continue for credit card debt

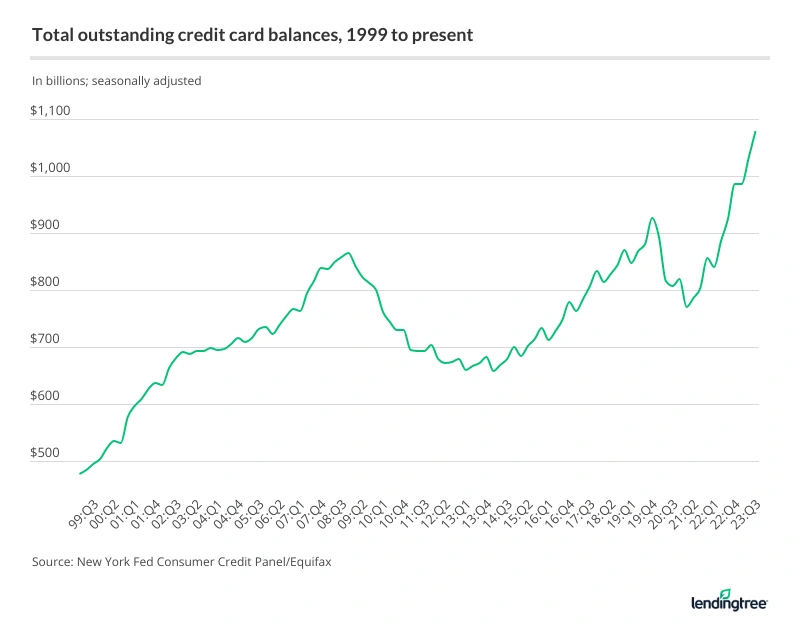

A trillion dollars was only the beginning.

Debt may dip slightly in the first quarter as consumers pay down their holiday debts, but it’ll almost certainly climb again throughout the year.

Why? Outside of massive economic calamity — the Great Recession and the onset of the coronavirus pandemic, for example — credit card debt just keeps climbing. There’s no reason to think 2024 will be any different.

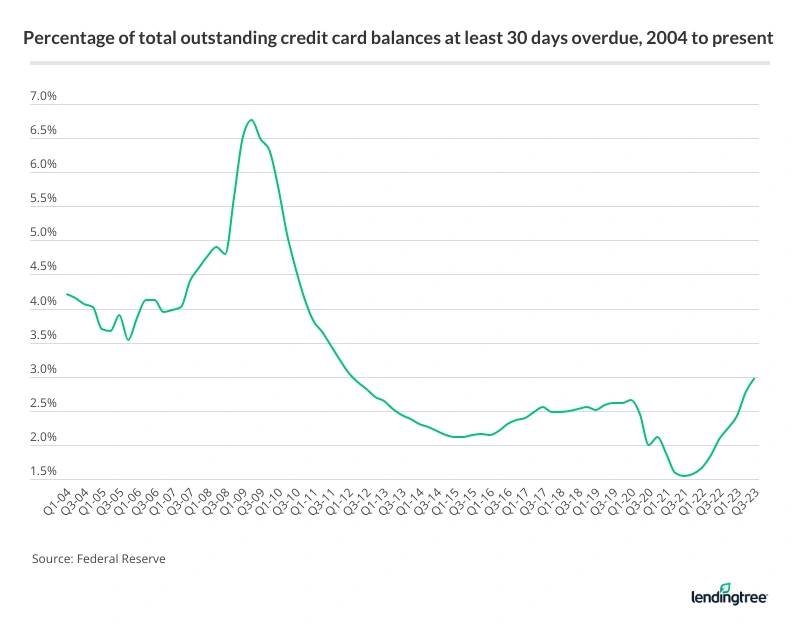

Delinquencies will grow, though credit scores will remain high

As debt has risen, we’ve seen credit card delinquencies rise slowly in the past year, especially among those with imperfect credit. These increases, at least to this point, amount to some normalization in the industry after years of historic lows. That certainly doesn’t mean the growth is good, but it probably shouldn’t be something to panic about either.

I suspect we’ll see late payments continue to rise slowly, even as inflation continues to wane. That’s because sky-high interest rates will continue to take a toll, as will the late 2023 resumption of student loan payments.

That said, I think credit scores will remain at record highs despite the increase in delinquencies, in part because some of those delinquencies won’t be reported for most of the year. Under a grace period granted by the Biden administration, late payments on student loans aren’t set to be reported until October 2024. That’s a massive help for those with big student debts.

Still, perhaps the biggest question surrounding credit scores today is when buy now, pay later loans will be included in credit-scoring formulas. These loans generally don’t factor into consumer credit-scoring formulas, meaning scores give at best an incomplete picture of many Americans’ financial situations and don’t allow consumers to build a positive payment history by successfully using these loans.

That’ll change at some point — we may even learn more this year about how it’ll play out — though the “when” and “how” are unclear. When it does, however, and people are able to start using BNPL loans to improve their credit scores, the popularity of these loans is likely to rocket into the stratosphere.

0% balance transfer cards will become harder to get, and their fees will continue to slowly rise

Zero-interest balance transfer credit cards are still super-popular and remain widely available for those with good credit. While their popularity isn’t going to change this year, their availability might.

That’s not to say these cards will disappear — far from it. However, issuers may continue to become more selective with who they give them to. We’ve seen lending standards tighten for some time now, as banks wrestle with how to deal with growing debt, rising delinquencies and overall economic uncertainty. Given that, it only makes sense that banks wouldn’t be super-eager to take on more transferred balances.

I don’t expect the typical length of the 0% introductory periods to decrease significantly. However, I think the slow trend of rising balance transfer fees — the one-time fees you pay when you transfer a balance — will continue. The most common fee is still 3% of the transferred balance, and I suspect that’ll continue, but I think we’ll see more cards begin to charge 4% and 5% for these transfers. That’s a significant thing for cardholders.

Credit card late fees will decrease

In 2023, the Consumer Financial Protection Bureau — the federal government’s consumer watchdog agency — proposed a regulation that would dramatically reduce what banks can charge for a late payment on a credit card.

Currently, the limit is $30 for a first offense and $41 for subsequent ones within six billing cycles of the first. The new rule would knock that maximum down to $8 and would no longer allow issuers to periodically adjust that maximum for inflation. That’s a big, big drop. (One exception: If an issuer can prove that the collection costs incurred as a result of late payments are more than $8, it may be allowed to charge a higher fee, but not more than 25% of the minimum required payment.)

It’s possible that the particulars of the rule might change some based on public comment gathered in 2023, but massive changes probably aren’t likely. Expect the final rule to be published in the first half of 2024 and implemented sometime after that. We could also see some card issuers get in front of the change to use the lower fees as a differentiator from the competition.

Still, credit card late fees won’t be the biggest question mark around the CFPB this year.

The CFPB will get a reprieve in the courts, but its long-term impact remains in doubt because of the election

A case in front of the U.S. Supreme Court challenges the constitutionality of the CFPB’s funding. The issue is that the agency is funded primarily through the Federal Reserve, unlike other agencies funded by congressional appropriations. Critics contend that the CFPB has too much unchecked power without congressional oversight via appropriations.

A ruling against the agency could have a huge impact, including potentially nullifying rules set forth by the CFPB and threatening the very existence of the bureau itself.

I think the CFPB will survive this threat, though it’s far from certain. However, even if it survives in the courts, potential troubles remain — that’s because a new Republican administration in the White House would likely put the agency in its crosshairs.

At a minimum, I’d expect the bureau to take a far more hands-off approach under that administration, the way it did under the Trump administration. However, the new administration could also go much further, potentially gutting the agency as part of a larger move to reduce the size of government and ease burdens on businesses.

Your credit card rewards aren’t going away

There’s been a lot of money spent on advertising by those who support and oppose the Credit Card Competition Act.

The bipartisan proposal would change the credit card business significantly by requiring the nation’s biggest card issuers to include more than one card network option on all their cards. (For example, instead of your Chase card only having a Visa logo, it may have both Visa and Discover logos.)

The idea behind the bill is to introduce more competition among credit card networks and, in theory, save retailers a fortune by driving down the fees they pay for accepting credit cards, called interchange or swipe fees.

Not surprisingly, retailers are all for it, while the credit card and travel industries are vehemently opposed. The latter say that it’ll mean, among other things, the end of credit card rewards as we know it. That’s because swipe fees are the primary funding that makes credit card rewards possible. If these fees are dramatically reduced, it stands to reason that rewards may also be reduced. (When swipe fees on debit card transactions were capped more than a decade ago, that is what happened — debit card rewards basically went extinct overnight.)

Looking ahead this year, I think it’s very unlikely that credit card rewards will suffer the same fate. First, I doubt the bill will get passed in 2024 — if ever. However, even if it did, I don’t think the sky would fall completely as it relates to rewards.

Yes, things might change significantly. But because the act attempts to reduce swipe fees through competition rather than through a hard cap on how high these fees can go, I don’t think it would be the doomsday event that some foresee.

2.5% or 3% cash back on everything?

For many years, a card that gave you 2% cash back on everything was an amazing outlier. Citi was one of the few issuers offering that. Several other issuers have now jumped into the pool, including Wells Fargo, PNC Bank, TD Bank, PenFed Credit Union and others.

So now that 2% isn’t particularly unusual anymore, will any issuers choose to push that rate a little bit higher to stand out in the crowded credit card marketplace? Don’t count on it.

Every extra fraction of a percent in cash back means a lot of extra expense for banks. That’s not a great option for banks, especially with delinquencies increasing, debt rising and Washington attempting to reduce bank interchange fees — the financial engine that drives the rewards space.

Rather than bumping up the cash back percentage, you might see more of these cards offer sign-up bonuses (which aren’t always offered with these cards), eliminate foreign transaction fees or take other smaller steps to attract new applicants.

Cardholder confidence will trend slightly down before a volatile second half of the year

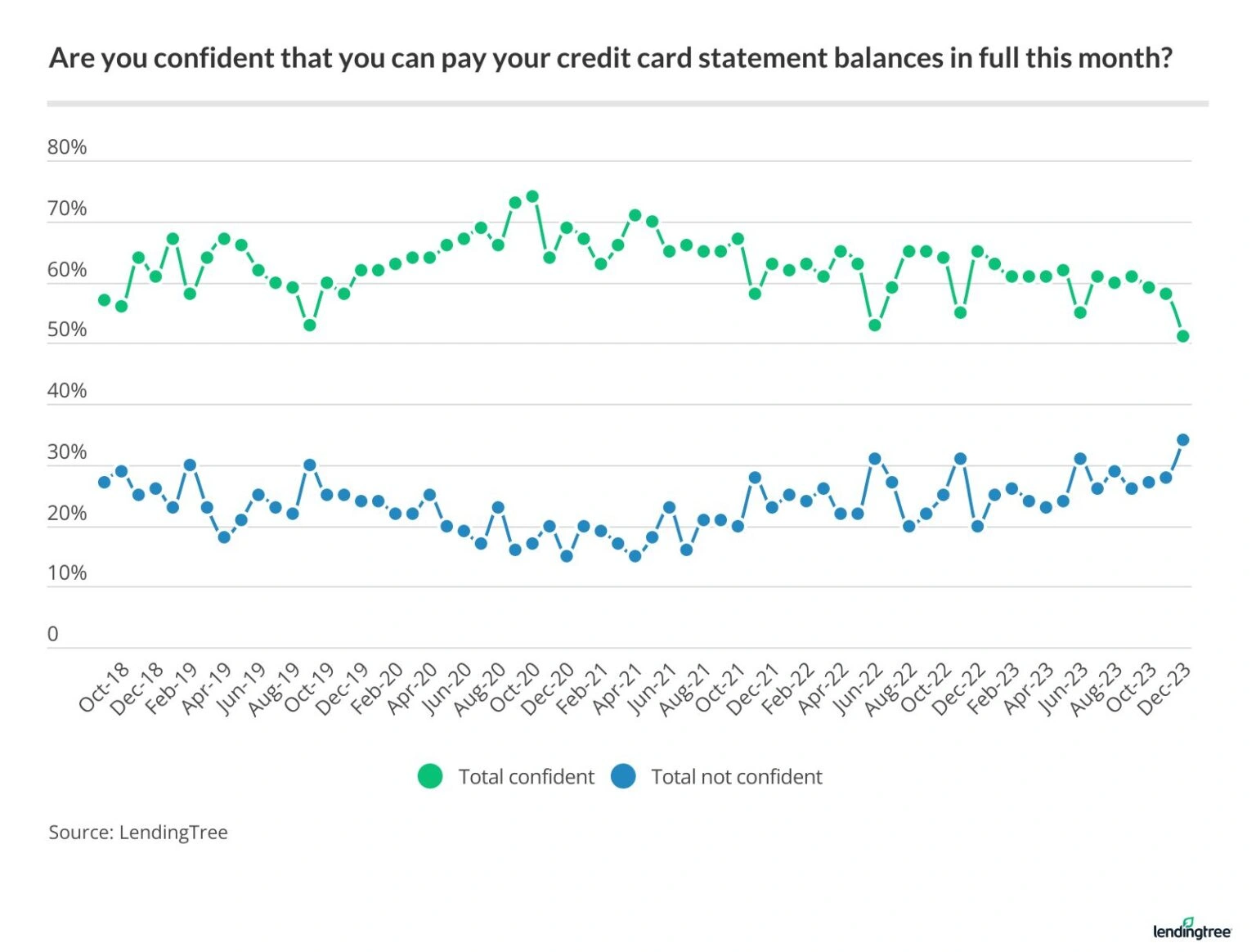

The monthly LendingTree Credit Card Confidence Index has shown that cardholders’ confidence — as measured by how they rate their ability to pay their cards’ monthly statement balance in full in a given month — has been falling slowly for several years. In December 2023, it fell sharply, helping the index end the year at the lowest level in its five-plus-year history, with just 51% of cardholders expressing confidence.

While the year will likely start on a somewhat upbeat note — as confidence bounces back a bit from December’s sharp decline — I think recent years’ downward trend will continue through much of 2024. Yes, the Fed may be done raising rates. Yes, inflation seems to have peaked. And, yes, unemployment is still low. However, the triple whammy of lower-but-still-present inflation, sky-high interest rates and restarted student loan payments — along with other financial headwinds — will continue to take a toll on cardholders’ sense of financial stability.

The back half of the year could see cardholders’ perceptions shift significantly, though. For example, a rate cut from the Fed could energize cardholders and immediately lead to greater confidence. Of potentially even greater significance is the presidential election of 2024.

Cardholder confidence was highly volatile around the 2020 presidential election. It spiked to still-record-high levels in September and October 2020, only to see a massive decrease in November that began the slow decrease in confidence we’ve seen since. I think we could see significant volatility again as the 2024 election plays out, especially if the election is as highly contested as it was in 2020 and the results drag out for a long time.

The big takeaway: As the calendar changes, consider whether you need to as well (spoiler: you may not need to)

A new year has long been a time of reflection and looking forward. Millions of Americans commit — at least for a little while — to losing weight, sticking to a budget, being a better parent, improving their careers and making countless other moves that we see as a step toward being a better version of ourselves.

There are numerous options for getting rid of credit card debt. You could consider:

- Getting a 0% balance transfer credit card or refinancing credit card debt with a personal loan

- Talking to a credit counselor

- Tweaking your budget or selling items of value to find more money to put toward paying off your debt

- Asking for that promotion or raise that you’re overdue for

- Building your savings with a high-yield savings account — so when you finally pay off that debt, you won’t have to put the next emergency expense on your credit card

- Calling your issuer and asking them to lower your interest rate or waive your annual fee

That’s just a small sample of the possibilities, all of which could help you make 2024 better than 2023. However, it’s also important to remember that not everything has to change.

If you’re moving toward your goals and are comfortable with your progress, it’s OK to leave things as they are. Positive change is great. Change for change’s sake, on the other hand, isn’t always great. Sometimes, as the saying goes, if it ain’t broke, don’t fix it — just stay the course and keep moving forward.

That’s the key after all: making progress. It may not come as simply, easily or quickly as we’d like — but if we’re doing the right things, it’ll come.