Navigating Unwritten Rules: Just 28% of Peer-To-Peer Payment App Users Have Discussed Etiquette, While 41% Have Denied Requests After Receiving Them

Peer-to-peer (P2P) payment apps have transformed how we settle debts, split expenses and share costs. This technology has simplified financial transactions, but it is creating new etiquette dilemmas.

According to the latest LendingTree survey of 2,000 Americans, 38% of P2P users who’ve received a request to split expenses say at least one was unnecessary or unfair.

In addition to going over our findings, stick around for tips on navigating payment apps — including etiquette and whether you should consider signing up for a P2P app credit card.

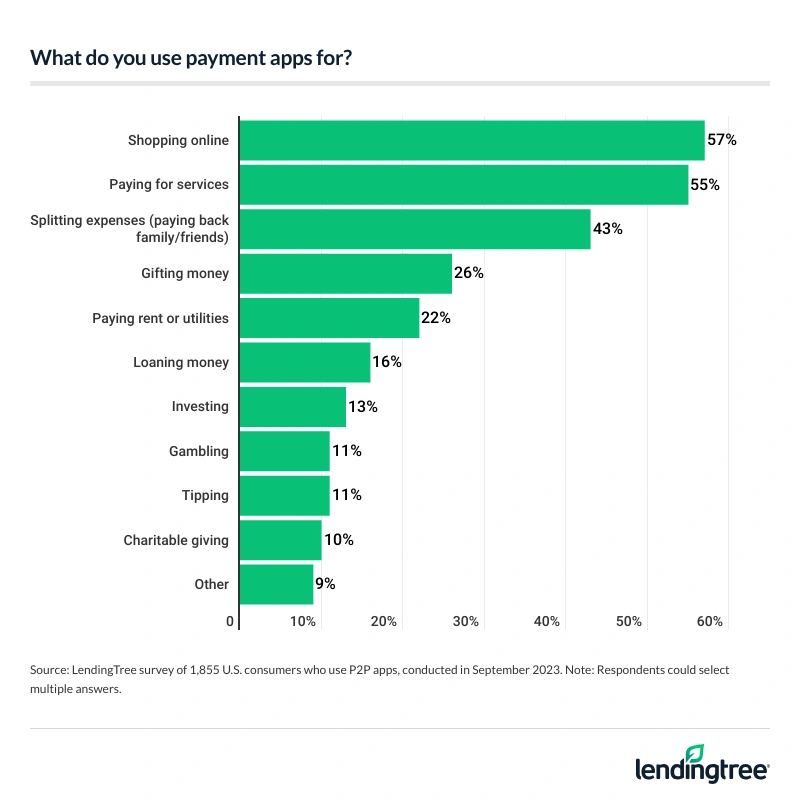

- Peer-to-peer (P2P) payment apps let Americans easily split expenses, but some feel nickel and dimed. Almost all Americans (93%) report using P2P services, with online shopping (57%), paying for services (55%) and splitting expenses (43%) as the top reasons for using them. However, while 93% of users agree these apps have made it easier to split expenses, 38% who’ve received a request to do so say at least one was unnecessary or unfair.

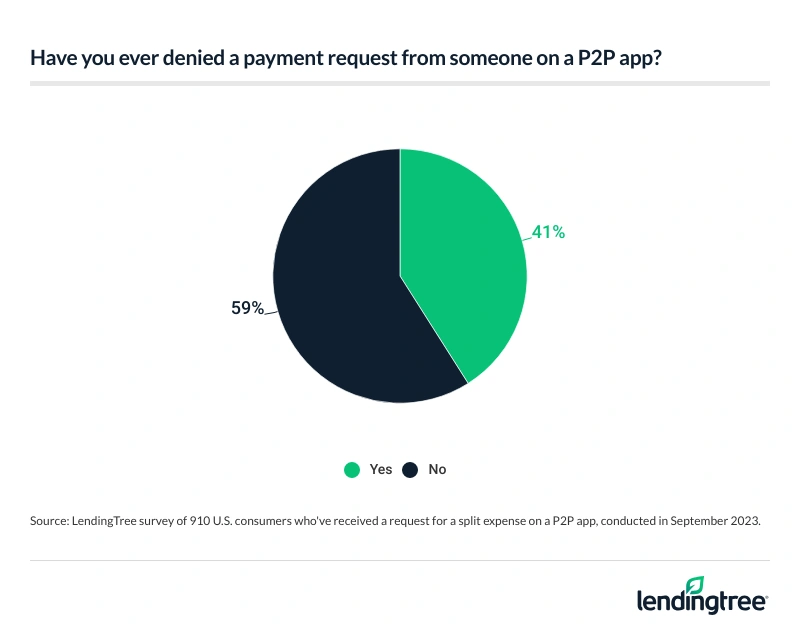

- Many app users will deny payment requests with which they disagree. Among the nearly half (49%) of users who’ve received a split payment request, 41% have denied at least one. Additionally, 17% of app users have fought or disagreed with someone over a payment request. Of the 63% of Americans who’ve requested money from someone else, 24% say they’ve upset someone by doing so.

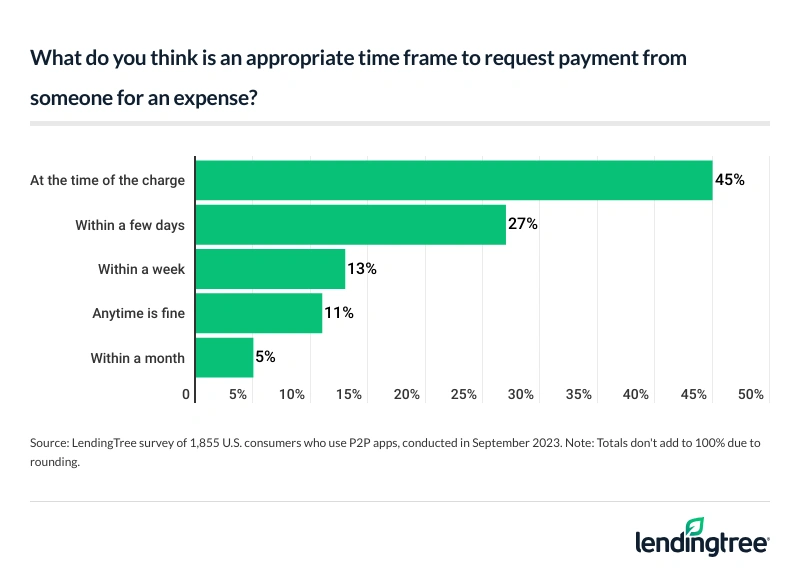

- While some app users have discussed etiquette with their friends and family, many still disagree on time frames for requests and reminders. Overall, 28% of users have discussed app etiquette. When it comes to what it means, 45% of app users think a payment should be requested immediately after splitting an expense and 27% think it should come within a few days. Meanwhile, another 11% believe anytime is fine. Additionally, 41% think it’s important to remind someone if they haven’t paid their share of an expense, 33% say it depends on the situation and 13% feel uncomfortable about it.

- Time is money, and many are paying to access their dough quicker. Over half (52%) of P2P app users have paid a fee to immediately transfer their money to their bank account rather than wait the standard one to three business days. That’s especially true among Gen Zers (67%) and millennials (65%). Additionally, 40% of users will transfer money anytime they have a balance and 21% transfer weekly. As far as waiting for a friend to repay a debt, most have little patience as 49% expect repayment within a week, while a quarter (25%) expect it within a day.

Despite convenience, P2P users struggle with splitting expenses

P2P apps are common nowadays — in fact, 93% of Americans say they use these services. As far as the most popular payment app, PayPal — the first in the industry — still reigns supreme, with 72% of Americans using it. Following that, the most popular services are:

- Cash App (45%)

- Venmo (37%)

- Zelle (31%)

- Apple Pay (25%)

- Google Pay (19%)

- Samsung Pay (7%)

- Other (3%)

Of those who use P2P apps, 35% use these services weekly, 24% use them monthly and 22% use them daily. Meanwhile, 20% say they use P2P apps infrequently.

What do consumers use these apps for? Online shopping is the most popular use, with 57% of users citing this. That’s followed by paying for services (55%) and splitting expenses (43%).

Convenience is a key reason for P2P app usage, and most (93%) users agree these apps have made it easier to split expenses — however, it’s not so cut-and-dried. In fact, 38% of users who’ve received a request to split costs say at least one request was unnecessary or unfair.

Men (46%) are much more likely to say they’ve received an unfair request than women (29%). Additionally, younger users are more likely to feel jaded by a request, with 44% of Gen Zers ages 18 to 26 and millennials ages 27 to 42 reporting an unfair request. That compares with just 26% of Gen Xers ages 43 to 58.

Additionally, users with children younger than 18 (46%) are more likely than users with no children (35%) and users with adult children (20%) to report an unnecessary or unfair request to split expenses.

Users prefer accurate, emoji-free payment descriptions

With some apps allowing users to write payment descriptions, users generally have the freedom to enter whatever they want. Still, though, most prefer to keep their descriptions simple. Among users, 59% say their descriptions are mostly accurate, 27% say they’re somewhat accurate and 15% say they’re irrelevant.

Meanwhile, just 35% of users say they use emojis when giving payment descriptions, with Gen Zers (52%), millennials (51%) and users with children younger than 18 (46%) the most likely to do so.

Zelle-ing it like it is: Users will deny payment requests

Users aren’t afraid to reject a request they find unfair. Nearly half (49%) of users have received a request to split a payment with someone — and of this group, 41% have denied at least one request. Those with children younger than 18 (49%) and millennials (48%) are particularly likely to have done so.

Additionally, men (45%) are much more likely than women (36%) to stand their ground against a request.

While denying a request could cause friction, 17% of app users say they’ve fought or disagreed with someone over a payment request. This time, Gen Zers (28%) are the most likely to do so, though users with children younger than 18 (25%) aren’t far behind. Meanwhile, men (23%) are nearly twice as likely to get into a clash about payment requests than women (12%).

Among the 63% of Americans who’ve requested money from someone else, 24% say they’ve upset someone by doing so — led by Gen Zers (35%), men (31%) and users with children younger than 18 (30%).

According to LendingTree chief consumer finance analyst Matt Schulz, disputes over money can devastate relationships — regardless of how they occur.

“Whether you’re talking about friends, co-workers, romantic partners or anyone else, disputes over money are tough,” he says. “Often, money isn’t even the real issue. It’s just the final straw on top of other issues that have been festering unresolved. Everyone draws the line in different places depending on how much money is involved and who the other person is. Ultimately, it’s up to you to decide when splitting a charge is worth the effort or if it’s better to just walk away.”

Scams and mistakes still threat to users

When money’s involved, scammers are, too — and P2P apps offer plenty of scam opportunities. Among users, 28% say they’ve been scammed on a payment app, with Gen Zers (47%) and millennials (38%) particularly likely to fall victim. Of course, ensuring nobody else can see your transactions may help prevent scammers from finding you. And users prefer this security blanket: In fact, 53% of users say they make their transactions private with apps that display it publicly.

Mistakes also put money at risk. Just over a quarter (26%) of users have accidentally sent money to the wrong person. Although most payment apps won’t reverse a transaction, 59% of those who’ve sent their money to the wrong person say they were able to get their money back — likely by sending a request to the user or filing a dispute with their bank.

Not only have users sent money to the wrong person, but they’ve also incorrectly received cash. In fact, 21% of users say they’ve received money from the wrong person.

What’s app-propriate payment etiquette? Users are split

Money has always been a delicate topic, meaning there’s some etiquette involved — and payment apps are no exception. Still, just 28% of users have discussed app etiquette with their family or friends.

One part of etiquette is timely payment requests — though users are split on what’s considered timely. The majority (45%) of app users think payment requests should come immediately after splitting an expense, while 27% think it should come within a few days. Another 11% believe anytime is fine.

How late is too late? Among users, 29% say waiting to charge someone more than a week after covering their share of the expense is too late, while 28% say more than a month is too late and 43% say it’s never too late to charge.

Timeliness goes both ways, though, and 41% of users think it’s important to remind someone if they haven’t paid their share of an expense. Meanwhile, 33% say it depends on the situation and 13% feel uncomfortable doing so.

Schulz says when in doubt, talk it out.

“Communication is always important, especially when it comes to money,” he says. “The sooner you can set expectations, the better. Many times, all it takes is saying, ‘I’ll get this, and you can get the next one’ or ‘How about we go halfsies on this?’ and the other person easily agrees. The problems tend to arise more when those things aren’t said upfront, and people feel blindsided.”

Users prefer quicker access to their cash

Generally speaking, users want immediate access to the money they’ve received — even if it comes at a cost. In fact, 52% of P2P app users have paid a fee to immediately transfer their money to their bank account, which generally ranges from 0.5% to 1.75% of their balance (though most apps cap the transfer fee between $15 and $25). The standard transfer time is between one to three business days.

While Schulz believes it’s OK to use instant transfer every once in a while, those fees tend to add up. “There’s nothing wrong with paying a convenience fee if you need the money more quickly,” he says. “You shouldn’t make a regular habit of it because it can eat away at your cash, but there’s no question that there can be times during which it makes sense to pay a little extra to get that money in a hurry.”

Gen Zers (67%), parents with children younger than 18 (66%) and millennials (65%) are particularly likely to request an instant transfer.

How often are consumers moving money into their bank accounts? Among users, 40% will transfer money anytime they have a balance and 21% transfer weekly.

That lack of patience extends beyond transferring cash: Most users expect others to fill payment requests quickly. Almost half (49%) expect to be repaid within a week, while a quarter (25%) expect it within a day. Meanwhile, 22% expect it within the month and 5% believe any time is fine.

Navigating P2P app etiquette: Top expert tips

It’s often difficult to discuss money with others, and P2P apps add a new layer of uncertainty — plus, interacting online often leaves room for miscommunication. To help set boundaries and avoid payment hiccups, Schulz offers the following tips:

- Be very careful. “If you make a mistake with a P2P payment, perhaps accidentally sending it to someone you don’t know, you might never see that money again,” he says. “It’s one thing to have to talk with a friend, relative or co-worker about getting paid back, but trying to get money back after inadvertently sending it to a stranger is something else entirely. Often, there’s no amount of etiquette or kind words that can make that happen, unfortunately.”

- Think about your privacy settings. “Just because you’re fine with all your P2P transactions being public doesn’t mean that the person you’re paying or getting paid by feels the same way,” he says. “This won’t always be an issue, but if in doubt, go ahead and ask the other person’s preferences.”

- Consider signing up for a P2P credit card to help mitigate costs. If a tight budget adds tension to your payment requests, a P2P card may give you some wiggle room. “As with store credit cards and hotel and airline credit cards, if you are a loyal and frequent user of one of these P2P apps, their card may be worth considering because they tend to give rewards specifically targeted to people who use the app all the time. However, for most people, a general purpose cash back card that gives you 2% on everything you buy might be a better choice.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 77 from Sept. 14 to 18, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77