Back-to-School Shoppers Plan to Spend an Average of $700, and 68% Are Stressed About Paying for It

Summer break is already fleeting for some. As another school year draws closer in various parts of the country, many consumers have turned their attention to back-to-school shopping — and it’s causing stress. In fact, 68% of back-to-school shoppers feel stressed about paying for school supplies this year.

The latest LendingTree survey asked more than 1,900 U.S. consumers about their back-to-school shopping plans. Plus, stick around for tips on cutting costs this year — including how credit cards may help you save money.

- Class may be over for now, but back-to-school shopping stressors are right around the corner. Almost half of Americans (46%) will go back-to-school shopping for someone this summer, and they plan to spend an average of $702. Prepping for these expenses is leaving 68% of back-to-school shoppers feeling stressed, with consumers making between $35,000 and $49,999 (77%) and those making between $50,000 and $74,999 (74%) feeling the most pressure.

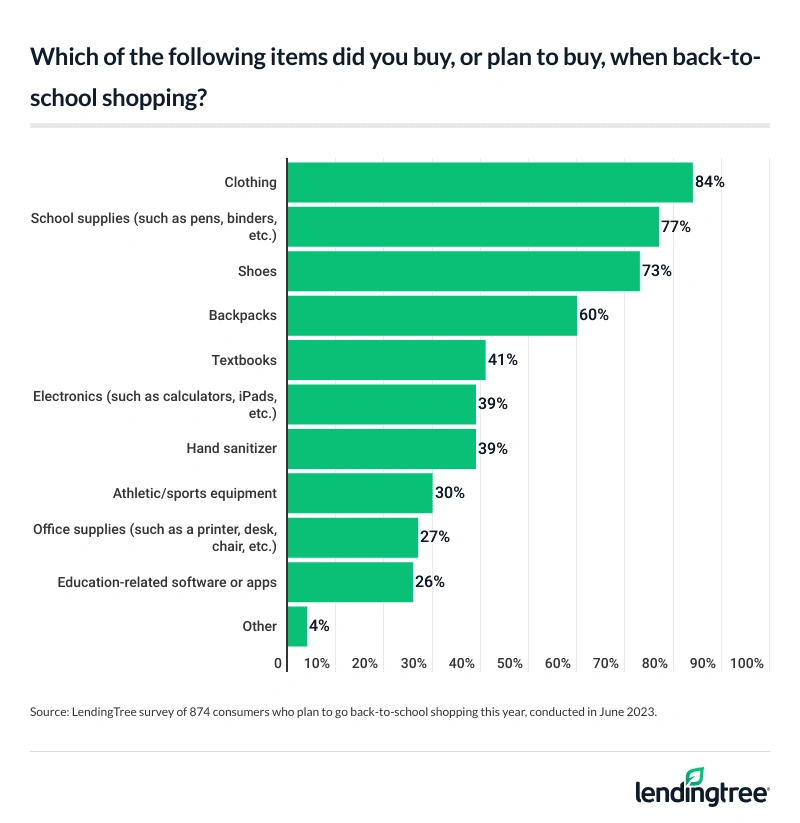

- The possibility of going into debt may be a cause of that stress. A third of shoppers (33%) think they’ll go into debt to pay for the shopping, and 34% expect to spend more this year due to inflation. The items most plan to buy include clothing (84%), school supplies (77%), shoes (73%) and backpacks (60%).

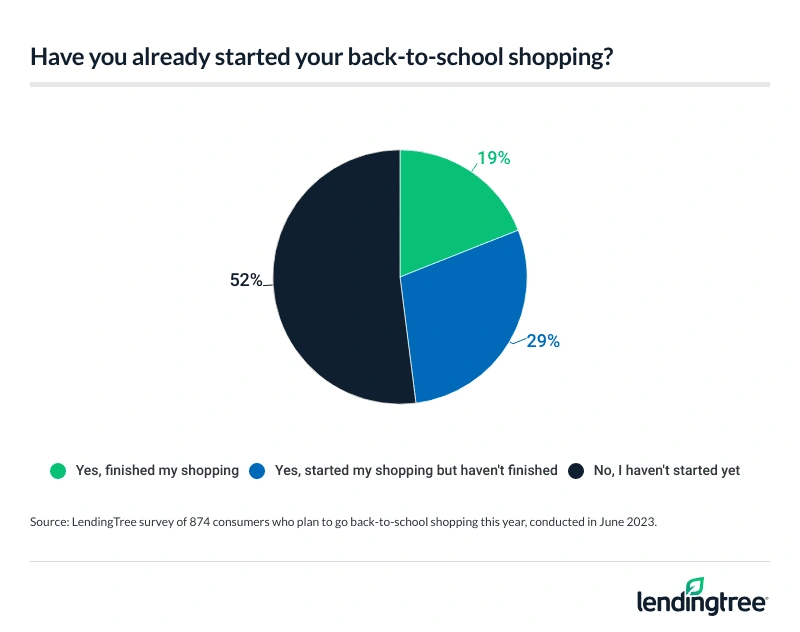

- Many Americans are getting a head start on their shopping in hopes of beating the rush — and to spread out expenses. Almost half of shoppers (48%) had already started their shopping at the time of our survey at the end of June, with 19% already finished. Many are starting early to combat product shortages (40%) and spread out costs (36%). In addition, 1 in 4 shoppers (25%) plan to pay using buy now, pay later to spread out expenses.

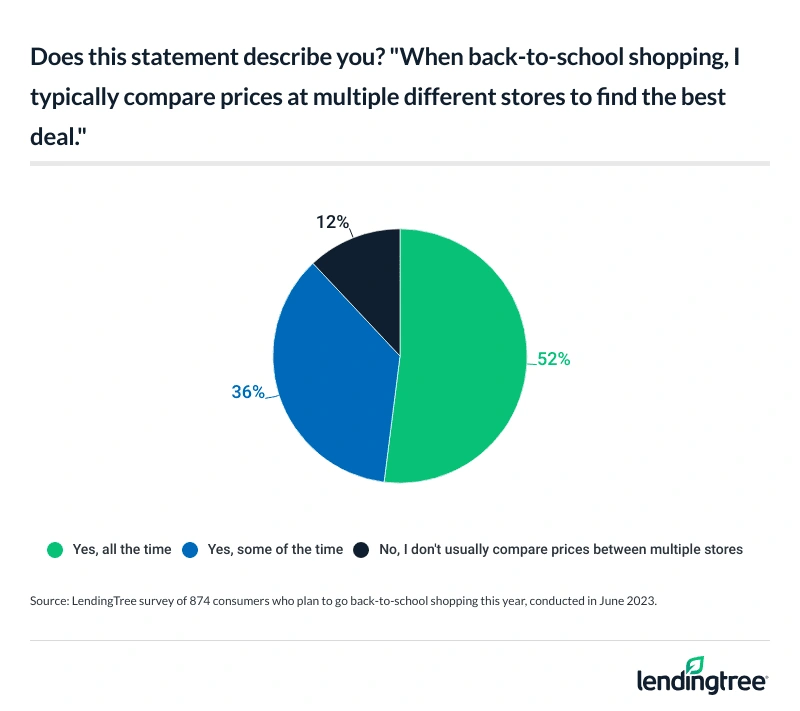

- Aside from spreading out payments, many are shopping sales. A whopping 88% of shoppers compare prices at multiple retailers to find the best deal, and 20% are shopping exclusively online for school supplies. Cutting costs can go a long way, particularly as 61% of back-to-school shoppers have experienced a time when they were unable to afford supplies.

- Back-to-school shopping can be a burden for teachers as well, but parents are here to help. 87% of parents say they’ll also purchase items for their child’s preschool or K-12 classroom. It’s clear that teachers need the support, as 63% of parents with kids younger than 18 say the school requires shopping for their classroom. In addition, an overwhelming 89% of parents with young children agree that school systems should provide more supplies for students and teachers.

Back-to-school shoppers plan to shell out $702, on average

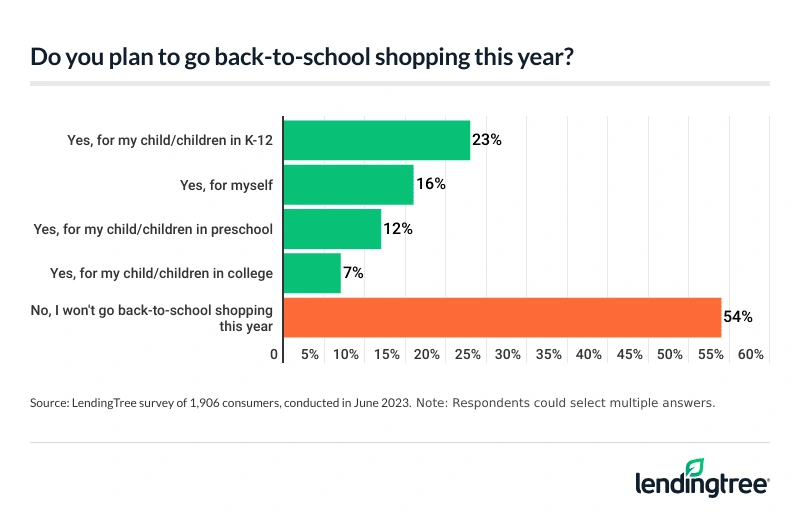

Although school may feel like it just ended, it won’t be long before classes start again — and that means back-to-school shopping is in full swing. This year, 46% of Americans will go back-to-school shopping for someone.

Breaking it down even further, nearly a quarter (23%) say they’re shopping for a kid in kindergarten through 12th grade, though that’s particularly true of parents with underage children (59%), millennials (ages 27 to 42) (40%) and six-figure earners (37%). Following that, 16% will shop for themselves — though that figure’s highest among Gen Zers (ages 18 to 26) (40%) — while 12% will shop for a child in preschool and 7% will shop for their college-aged child.

These shoppers plan to spend an average of $702 on school expenses — that’s significantly more than the $374 shoppers planned to spend last year. By age group, millennials plan to spend the most this year, shelling out $780, on average. That’s followed by:

- Gen Zers ($650)

- Gen Xers (ages 43 to 58) ($612)

Unsurprisingly, six-figure earners plan to spend the most at $904. Comparatively, those earning less than $35,000 plan to spend $452 — the least by income group. Meanwhile, men ($902) plan to spend significantly more than women ($517).

Given these high costs, prepping for these expenses is leaving 68% of back-to-school shoppers feeling stressed — 30% of which say they’re really stressed. Breaking that down even further, consumers making between $35,000 and $49,999 (77%) and those making between $50,000 and $74,999 (74%) say they’re feeling the most pressure.

According to LendingTree chief consumer finance analyst Matt Schulz, inflation likely plays a role in this stress — though it’s not the only factor to blame.

“Even in the best of economic times, back-to-school shopping can cost a fortune,” he says. “Mix in inflation and things can get pretty dicey. But back-to-school shopping stress isn’t just about costs. It’s also about the time it takes to make sure you or your kids have everything they need to be ready for the school year. In short, it’s a mess and something most don’t look forward to.”

Meanwhile, parents of younger children are feeling the pressure ease slightly. Of parents with kids under 18 that are shopping for back-to-school supplies, 70% say they’re stressed. That’s down from 75% last year, though it’s still higher than the 67% who said they were stressed in 2021.

Possible debt, rising costs may cause stress

As shoppers pile on the expenses, a third (33%) think they’ll go into debt to pay for the shopping. Men (40%) are significantly more likely to think this than women (25%). Following that, millennials (39%), shoppers earning between $75,000 and $99,999 (37%) and those making less than $35,000 (36%) are the most likely to think they’ll take on debt.

Meanwhile, 34% expect to spend more this year due to inflation. Once again, men (41%) are much more likely to feel this way than women (28%).

But what are shoppers buying? Most plan to buy clothing (84%), though school supplies (77%), shoes (73%) and backpacks (60%) aren’t far behind on the checklist.

Almost half of shoppers got a head start by June — here’s why

Of course, getting your shopping done early may help ease the stress — and many have already started. Of back-to-school shoppers, 48% had already started making purchases when our survey was fielded in late June — and of this group, 19% were already finished.

Men (67%) are more than twice as likely to have started shopping than women (30%). Six-figure earners (65%), millennials (59%) and parents with underage children (52%) are the only other groups where more than half have already begun shopping.

Men are also most likely to have finished their shopping at 28%. That compares with 10% of women. Six-figure earners (26%) and millennials (23%) are among the most likely to have already finished shopping.

According to Schulz, shopping early can help mitigate the financial burden of back-to-school shopping.

“If nothing else, it allows you to shop around more to find the lowest prices and the best deals on all the school supplies you need,” he says. “Also, while many stores may advertise back-to-school deals on certain items as the new school year draws near, other items may become a little more expensive as the summer draws to a close and stores attempt to make the most of increased demand.”

The reason for shopping early? Of those getting a head start, 40% say they’re doing so to combat product shortages — making it the most likely reason. Meanwhile, 36% say they’re doing so to spread out expenses.

It’s also worth noting that 36% of shoppers said they’ve faced difficulty obtaining supplies or products they need due to shortages and supply chain issues this year — which may be encouraging early shopping habits.

Many may be shopping early to spread out expenses, but that’s not the only way to mitigate big bills. In fact, 1 in 4 shoppers (25%) plan to pay using buy now, pay later to spread out the expense. However, most plan to pay with debit cards (56%), followed by credit cards (51%) and cash (45%).

Shopping sales and buying online help cut costs

When it comes to making ends meet before the school season begins, there are a few things shoppers do to help save. In fact, 88% of shoppers compare prices at multiple retailers to find the best deal — 52% of which say they do it all the time.

One in 5 (20%) is shopping exclusively online for school supplies, though that’s particularly true of tech-savvy Gen Zers (29%). Meanwhile, 31% say they’re exclusively shopping in-store and about half (49%) say they shop both equally.

Cutting costs is important for many, particularly as 61% of back-to-school shoppers have experienced a time when they were unable to afford school supplies. Those earning between $35,000 and $49,999 (73%) are the most likely to say they’ve been unable to afford school supplies before. In addition, men (65%) are more likely to say they’ve been unable to afford supplies than women (57%).

Notably, 26% say they’re unable to afford school supplies this year. That figure’s highest among millennials, men and those earning less than $35,000 annually (all 32%).

Majority of parents purchase supplies for their children’s teachers

It’s not just students and parents who’re feeling the stress: Teachers are also feeling the brunt of back-to-school shopping. Parents are here to help, though — 87% of parents say items for their child’s preschool or K-12 classroom are on their shopping lists this year.

Of this group, 62% say it’s required by their child’s teacher or school, a figure that’s highest among men (77%). This comes as 72% of those with kids in K-12 schools have children in public schools.

Still, parents are more than happy to help. In fact, an overwhelming 89% of parents with young children agree that school systems should provide more supplies for students and teachers. Regardless of parenthood status, 87% of back-to-school shoppers agree — and millennials (90%) are the most likely to say so.

According to Schulz, the unfortunate necessity of buying classroom supplies could play a role in back-to-school shopping stress.

“It’s great that parents are willing to step up, but that this is necessary is tragic,” Schulz says. “Our hardworking teachers deserve far better. That said, it’s possible that this could increase the financial burden of back-to-school shopping. However, these results seem to indicate that parents are willing to do their part.”

Back-to-school shopping? Here’s how to cut costs this year

If you’re gearing up for school again, you may be dreading back-to-school shopping — particularly with costs so high this year. However, you don’t have to break the bank to prepare yourself or your children for the coming school year. To help cut costs, Schulz recommends the following:

- You don’t always need new things. “If last year’s lunchbox and backpack are still in great shape, keep using them,” Schulz says. “If your younger child can use hand-me-downs from an older sibling, relative or friend, take advantage of that opportunity. Of course, that doesn’t mean you shouldn’t buy anything new. You just need to be thoughtful and planful. For example, you could let your kids choose which item they’d like to get new, so they can be involved in the process and have some say.”

- Credit card rewards can make a difference. Even the 2% you earn on that cash back can help extend your budget, but other options exist. “For example, if you’ve saved a bunch of cash for back-to-school shopping, consider getting a new credit card, using the card to do your shopping and then use the saved cash to pay off the card,” Schulz says. “That way, you can earn credit card rewards while knowing you’ll have the money to pay off your balance in full when you’re done.”

- Reassess your budget. If you haven’t looked at your household budget in a while, it’s probably time to do so again. That’s because many of those assumptions you made about spending three to six months ago have been blown out of the water by inflation, leaving you with an inaccurate picture of your financial situation — which could make it tough to make a meaningful plan for back-to-school shopping.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,906 U.S. consumers ages 18 to 77 from June 26-27, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Recommended Articles