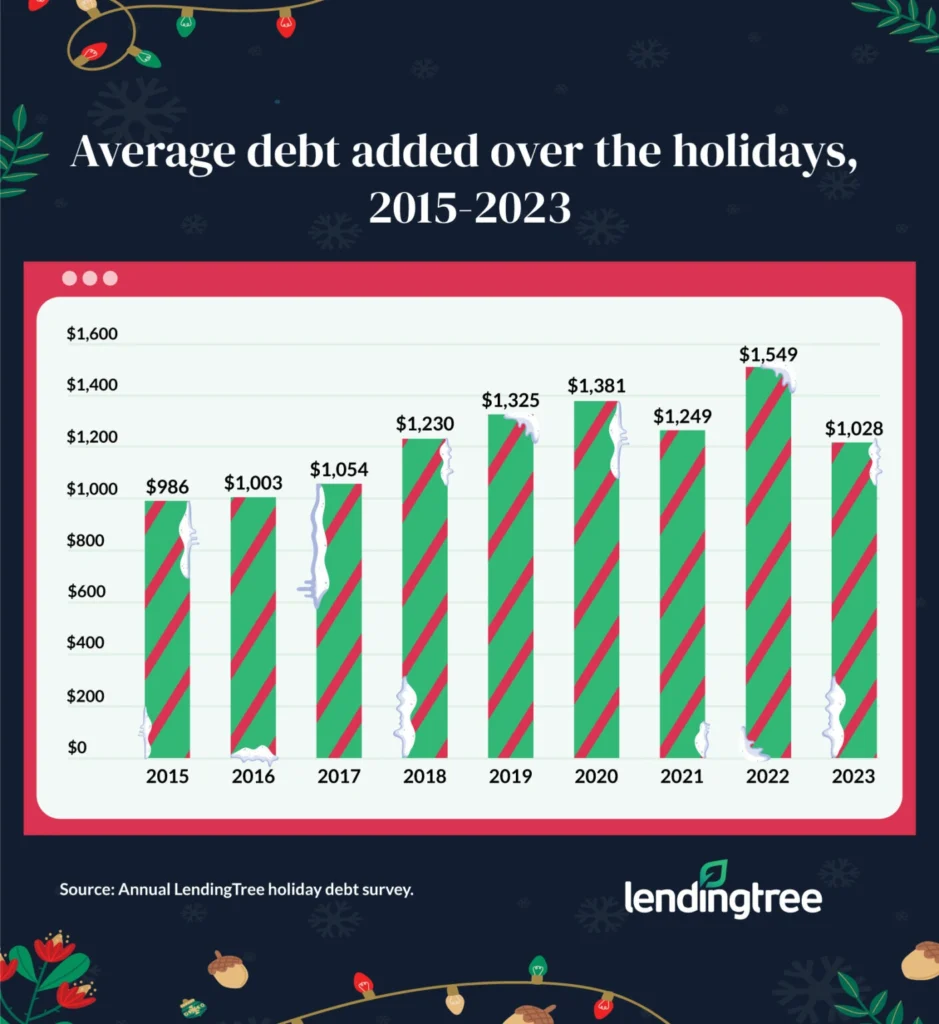

Average Holiday Debt Plummets to $1,028 — Down 34% From 2022 and the Lowest Since 2017

Santa may place presents under the tree, but the Grinch visits later with the bills.

According to the latest LendingTree survey of nearly 2,000 U.S. consumers, 34% of Americans went into debt this holiday season, but they’re carrying the lowest amount since 2017. Despite this holiday cheer, the majority used credit cards to pay for the holidays — many with significant interest rates.

Here’s what we found in our annual LendingTree holiday debt survey.

- Americans tapered their yuletide debt this year by a considerable amount. A little over a third (34%) of Americans went into debt this holiday season, down slightly from 35% in 2022. Most notably, those who took on debt are in the ho-ho-hole by an average of $1,028 this holiday season — a massive 34% decrease from last year’s record $1,549, and the lowest since 2017. 45% of parents with children younger than 18 amassed holiday debt — the highest across all demographics — at an average of $1,100.

- ’Tis the season for buyer’s remorse. Among those who took on debt this holiday season, 65% say they weren’t planning to do so. In addition, 57% are stressed about their holiday debt, led by parents with young children, millennials and women, all at 63%. Further, that buyer’s remorse is plaguing some, as 40% regret spending what they did.

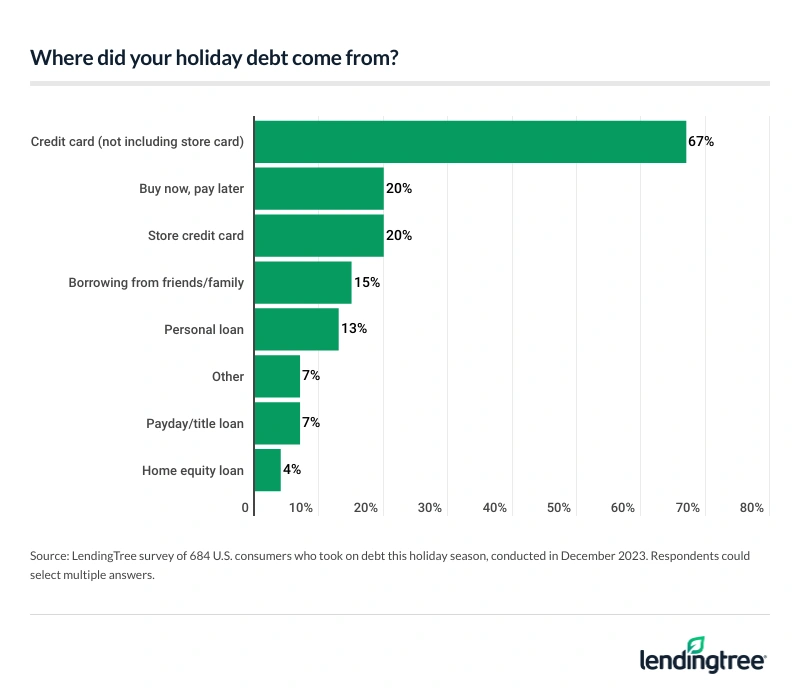

- Overall, most Santas spend with plastic — and they’re facing high interest rates. Two-thirds (67%) of debtors used credit cards to pay for the holidays, while 20% used store credit cards. To make matters worse, a third (33%) of those who went into debt are paying interest rates of 20.00% or higher — 6% of which have interest rates of 30.00% or higher. When asked when they’ll pay off their holiday debt, 20% said they only make minimum payments and 22% said they’ll take five or more months.

- Some are buying now and paying later to fill their sleigh. Among all holiday gift buyers, 28% say they used a buy now, pay later (BNPL) loan for at least one present this year. That percentage spikes to 45% among Gen Zers, 41% among parents of young children and 37% among millennials.

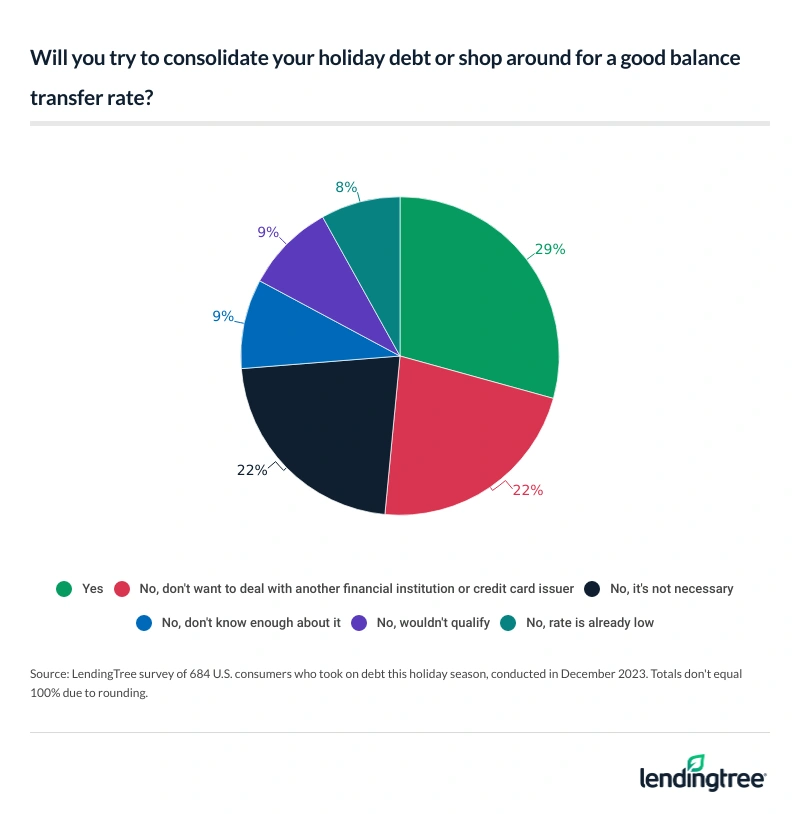

- Debt consolidation can help those with high payments, but many aren’t interested. The majority (71%) of those with holiday debt say they won’t try to consolidate or shop around for a good balance transfer card. Among those not interested in lowering their burden, 22% say they don’t want to deal with another financial institution, 22% say it isn’t necessary and 9% say they don’t know enough about it.

Americans are giving themselves the gift of less debt this year

What might be the greatest gift of all? A debt-free holiday season. As it turns out, many consumers are giving themselves this gift: Just over a third (34%) of Americans went into debt for the holidays, continuing a downward trend from 35% in 2022 and 36% in 2021.

But that’s not even the most noteworthy figure falling: The average amount of holiday debt has plummeted. Americans who took on holiday debt this year accumulated an average of $1,028 — a steep 34% drop from last year’s record of $1,549. That’s also the lowest it’s been since 2017, when consumers with holiday debt owed an average of $1,054.

Even though prices have risen, LendingTree chief consumer finance analyst Matt Schulz isn’t surprised people took on less debt this holiday season.

“Debt can be a sign of financial confidence,” he says. “Someone who feels great about their financial situation may be willing to take on a little extra debt because they know they’ll be able to pay it off and aren’t worried about paying a little bit of interest. On the other hand, someone who feels shaky financially may try to minimize debt or avoid it altogether because they’re not sure they can handle it. I’d bet the latter has happened in a lot of American households this holiday season.”

Parents with children younger than 18 (45%) are most likely to take on holiday debt, averaging $1,100. That compares with 32% of those with children older than 18 and 29% of those with no children, averaging $976 and $983, respectively.

By income group, six-figure earners (41%) are most likely to accumulate holiday debt, averaging $1,220 — the highest across all demographics. Meanwhile, just 30% of those earning less than $35,000 took on debt, spending $833. By age group, millennials (ages 27 to 42) (40%) are the most likely to take on debt, putting themselves in the hole by an average of $1,093.

While women (35%) and men (34%) are almost equally likely to take on debt, the amount spent differs: Women added an average of $937 in debt, while men added $1,123.

Of course, gift-giving plays a large role in spending. In fact, 71% of Americans are participating in holiday gift-giving this year. However, just 52% of those surveyed had completed their holiday shopping at the time of the survey. (While more could accumulate debt between the end of the survey and the holidays, we field the survey around the same time each year to get consistent results.)

When asked what kind of gifts they plan to buy, clothing (61%), electronics (43%) and gift cards (40%) top the list. They’re followed with:

- Toys or games (36%)

- Food or drink (29%)

- Jewelry (25%)

- Books or educational material (24%)

- Beauty or personal care (22%)

- Home goods (15%)

- Money (12%)

- Household appliances (8%)

- Experiences (8%)

- Travel-related gifts (7%)

- Other (7%)

When asked who they bought their most expensive gift for, 32% said they shelled out for their child; that’s particularly true for parents of young children (62%). Meanwhile, 29% bought their most expensive gift for a spouse or significant other and 11% bought it for a parent.

Most expensive doesn’t mean they broke the bank, though: 71% spend less than $250 on the most costly gift.

Buyer’s remorse dampens the holiday spirit for 40% of Americans

What’s worse than coal in your stocking? Unexpected debt and regret. Among those who took on debt this holiday season, 65% say they hadn’t planned on it. That’s especially true among those earning less than $35,000 (73%), those without children (69%) and those earning $50,000 to $74,999 (69%). Women (69%) are more likely to take on unplanned debt than men (60%).

According to Schulz, the consequences of unexpected debt can be massive.

“It can keep you from being able to pay down debts you already have,” he says. “It can reduce the amount of money you have available to invest in retirement funds or save in a high-yield savings account. It can force you to make sacrifices such as dining out less, reworking travel plans or canceling streaming services or gym memberships. In extreme cases, it can lead to late payments on loans, which can damage your credit and cause a cascade of issues no one wants to face.”

That could be why 57% report feeling stressed about their holiday debt. Parents with young children (63%) and millennials (63%) are particularly likely to share this sentiment. Women are also much more likely to feel stressed than men, at 63% versus 50%.

What can be worse than unexpected debt? Overspending. In fact, 2 in 5 (40%) who took on holiday debt regret how much they’ve spent on the holidays this year. That figure rises to 45% among millennials, 44% among those earning $35,000 to $49,999 and 42% among parents with young children.

Santa prefers plastic over milk and cookies, and it comes at a cost

Christmas gifts aren’t the only things filling the sleigh this year — interest rates are taking up space in the carriage. In fact, two-thirds (67%) of debtors used credit cards to pay for the holidays, making it the most popular spending option. Meanwhile, 20% used store credit cards.

Regardless of the source of their debt, a third (33%) are paying interest rates of 20.00% or higher. Worse, 6% of that group have an interest rate of 30.00% more. If those figures aren’t scary enough, 20% say they only make minimum payments, while 22% think they’ll pay it off in five or more months.

Schulz says that these numbers are a big deal.

“Many don’t have a choice to make, but paying only the minimum amount required is a sure path to financial struggles because of how much interest you’ll pay,” he says. “Minimum payments are always a problem, but never more so than when credit card interest rates are at record highs.”

Buy now, pay later is attractive to some Christmas shoppers

Across all those participating in holiday gift-giving, nearly 3 in 10 (28%) say they used a buy now, pay later (BNPL) loan for at least one gift this year. That’s particularly true among young gift-givers, at 45% among Gen Zers (ages 18 to 26) and 37% among millennials.

In addition, 41% of parents of young children took advantage of BNPL loans. That’s significantly higher than the 24% of those without children and the 16% of those with adult children who say similarly. Meanwhile, 35% of six-figure earners utilized BNPL loans — the highest by income group.

Finally, men (35%) are significantly more likely to use a BNPL loan for at least one gift than women (22%).

Those with holiday debt aren’t interested in consolidating

Although interest rates are high and the average holiday debt is four figures, the majority (71%) of those in holiday debt say they won’t try to consolidate or shop around for a good balance transfer card.

“Credit card debtors who don’t consider a 0% balance transfer credit card are doing themselves a disservice, plain and simple,” Schulz says. “These cards are about the best weapon you have in the battle against credit card debt because they can save you serious money, shorten your payoff time and reduce the number of bills you have to pay each month. You’ll need pretty good credit to be able to get one, but it’s worth considering if you can.”

Among those not interested in lowering their burden, 22% say they don’t want to deal with another financial institution and 22% don’t feel it’s necessary — the most common responses. Meanwhile, 9% say they don’t know enough about it and 9% know they wouldn’t qualify.

Managing holiday debt once the snow melts: Top expert tips

The Christmas decorations may soon come down for some, but that holiday debt will linger for much longer for many Americans. To avoid adding the stress of debt to your post-holiday blues, Schulz offers the following advice:

- Reassess your budget. “A budget is an enormously powerful tool, especially when you’re fighting debt,” he says. “An up-to-date budget allows you to shift spending based on your priorities, so when unexpected debt appears, you’re more easily able to find some extra funds to put toward paying that debt down more quickly. However, if you haven’t tinkered with your budget in a while, it may not give you an accurate picture of your financial situation anymore. That’s because inflation has likely blown a lot of your previous spending assumptions out of the water. Taking some time to review it for accuracy is well worth your time.”

- The most important move is to just get started. “There’s so much advice about paying down debt that it can be confusing,” Schulz says. “Different experts swear by different methods and have all sorts of tricks and suggestions, but none of it matters if you don’t take that first step. It may not seem like much, but those few dollars you put toward that debt can build an empowering and motivating habit. If you can stick with it, amazing things can happen.”

- Leverage technology. “Automating those debt payments can ensure you’re never late, and it can also help ease the pain of paying those bills each month,” he says. “It’s an out-of-sight, out-of-mind thing. No one likes paying bills, especially when you’re struggling with debt, but automating the process can make it a bit easier on you.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,991 U.S. consumers from Dec. 11 to 16, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77