Chase Offers Program Guide

Chase Offers, which has been around since 2018, helps Chase credit card customers get more bang for their buck. Plus, the incentives that apply through Chase Offers are given out on top of the rewards you earn. They can also be “stacked” with other shopping promotions, including eligible purchases made through the Chase Ultimate Rewards® portal.

Many other credit card issuers have similar programs to give their customers deals and discounts, including Amex Offers from American Express and the Capital One Offers program from Capital One. Each of these programs gives cardholders another way to earn more rewards or get extra cash back on eligible purchases.

What are Chase Offers?

Chase Offers is a program that lets Chase credit card customers earn additional cash back for spending at eligible retailers. These offers are targeted to consumers based on their normal spending habits, so they can vary from person to person.

Chase Offers give customers a way to earn more rewards than they normally would. For example, if you had a rewards credit card from Chase and used a Chase Offer, you would earn the normal amount of cash back and the extra cash back through the Chase Offers program.

How do Chase Offers work?

Chase Offers are made available in your Chase account, and you can check your options at any time. However, they don’t apply to your account automatically.

You will have to enroll in order to receive any Chase Offer you want to use. To enroll, you’ll need to click on the plus symbol at the bottom right hand corner of a Chase Offer. You’ll also need to follow the fine print in the offer for the promotion to apply — each individual offer has its own deadlines, spending requirements, reward caps and other restrictions or conditions.

How to use Chase Offers

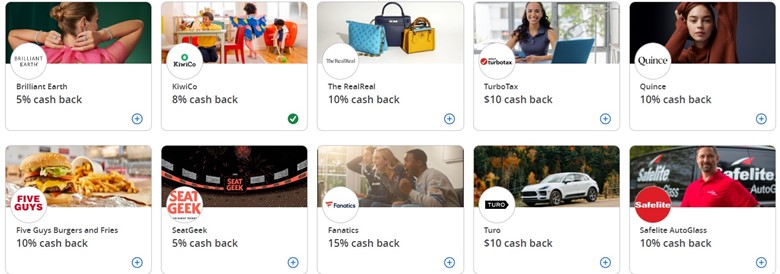

As just one example, you can see a Chase Offer for Five Guys Burgers and Fries in the screenshot below.

If you click on the plus symbol to add this offer to your card, the fine print says that you can earn 10% cash back on your Five Guys Burgers and Fries purchase, but only to a maximum of $3.00. The offer also features an expiration date, after which the additional cash back will no longer apply.

To use this Chase Offer or any others you find, there are only two things you need to do:

- Add the offer to your account.

- Make an eligible purchase with your card that meets the terms and conditions of the offer.

After that, you’ll receive your statement credit. Note that it can take between seven to 14 business days for your account to be credited.

Important

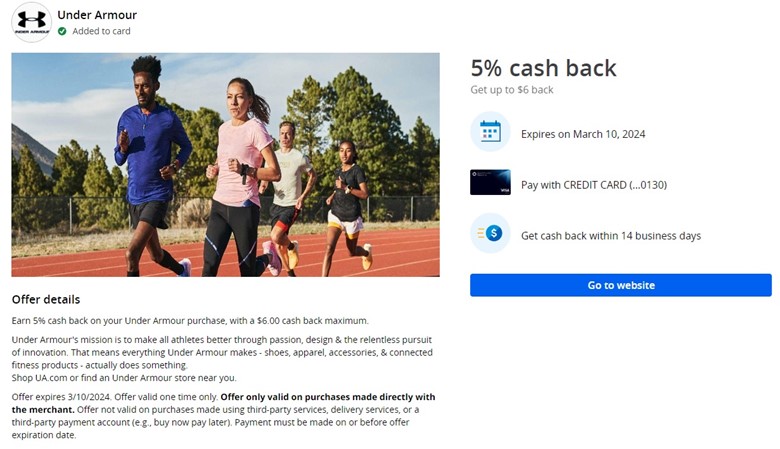

Below you’ll find an example of a Chase Offer for Under Armour that shows what the fine print and the terms and conditions of these offers can look like:

You should also be aware that you may have different Chase Offers for different Chase credit cards you have, and that you’ll need to use the right card for the offer to apply. If you add a Chase Offer to your Chase Sapphire Preferred, for example, you’ll have to use that card for the qualifying purchase to earn the additional cash back.

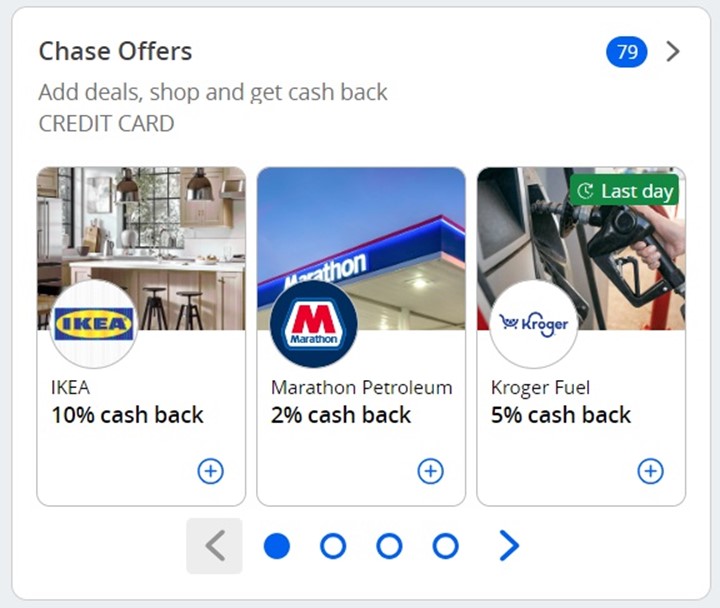

Chase Offers on your laptop

Chase Offers are easily found within your account dashboard when you log into Chase.com. You can find the offers available with your card at the lower right hand of the page.

The section of your account where Chase Offers are located will look something like this:

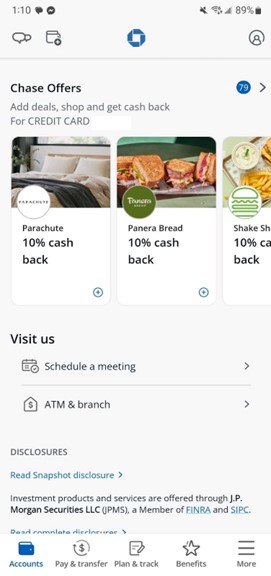

Chase Offers in the Chase Mobile App

You can also find Chase Offers in the Chase mobile app if you use it. These offers are found by scrolling past your account activity and rewards balance.

Chase Offers in the mobile app will look like this:

Which credit cards have Chase Offers?

Chase Offers are available through eligible credit cards from Chase. This includes cash back credit cards, travel credit cards and co-branded credit cards offered through Chase.

Credit cards that qualify for Chase Offers include:

| Credit card | Card rewards | Sign-up bonus | Annual fee | Best for |

|---|---|---|---|---|

| Chase Sapphire Preferred® Card | Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases | Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. | $95 | Travel rewards |

| Chase Sapphire Reserve® | Earn 8x points on all purchases through Chase Travel℠, including The Edit℠ and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases | Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening. | $795 | Luxury travel |

| Ink Business Preferred® Credit Card | Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. | Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. | $95 | Business |

| Chase Freedom Flex® | 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! Plus, earn 5% cash back on travel purchased through Chase Travel℠, 3% on dining and drugstores, and 1% on all other purchases. | Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. | $0 | Cash back |

| Chase Freedom Unlimited® | Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases | Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening | $0 | Groceries |

Chase Offers 2024

Chase Offers can vary by card and account, and they can also change over time. Here’s a sampling of Chase Offers that were available to certain customers at the beginning of February:

Entertainment

- ESPN+: 15% cash back on your first payment for an ESPN+ subscription (up to $18.75) through Feb. 15, 2024

- Disney Plus: 15% cash back (up to $21) when you subscribe by Feb. 15, 2024

- SeatGeek: 5% cash back when you spend $50 or more (up to $31) through Feb. 14, 2024

Food & Drink

- Home Chef: 25% cash back (up to $22.50) when you subscribe to meal delivery service by Feb. 6, 2024

- Kroger: 10% cash back (up to $9) through Feb. 18, 2024

- Panera Bread: 10% cash back (up to $2.50) through Feb. 18, 2024

Retail

- Office Depot: 10% cash back (up to $11) through Feb. 17, 2024

- ThredUp: 10% cash back (up to $13) through Feb. 15, 2024

- Ulta Beauty: 5% cash back (up to $5) through Feb. 29, 2024

Travel

- Turo: 10% cash back when you spend $100 or more through March 7, 2024

- Zipcar: 10% cash back on your first payment of a Zipcar membership when you spend $18 or more (up to $10 back) through Feb. 29, 2024

Redeeming Chase Offers

In order to redeem Chase Offers, you simply add them to your account and make a qualifying purchase using your Chase card. You’ll earn additional cash back in the form of a statement credit, which will be automatically added to your account within seven to 14 business days.

Maximizing Chase Offers

Getting the most out of Chase Offers isn’t difficult, but you do have to remember that they exist and manually add the offers you want to your account. The following moves can help you get more cash back through Chase Offers throughout the year:

- Add every Chase Offer to your card you might use. Adding these offers to your card is easy and entirely risk-free, so you should add any and all offers you think you can use. If you don’t use a Chase Offer before the deal expires, there aren’t any consequences that come into play. The offer simply disappears from your account, and that’s that.

- Check your offers regularly. The fact Chase Offers can change all the time means you’ll want to check on your offers regularly, so you know what they are. We suggest checking your account for new offers at least once a week to make sure you don’t miss out.

- Note the offers’ expiration dates and other fine print. Remember that each offer has stipulations that apply, including a cash back maximum and an expiration date. Make sure you know the terms for the offers you plan to use, so you don’t make additional purchases you don’t need or try to use an offer after its expiration date.

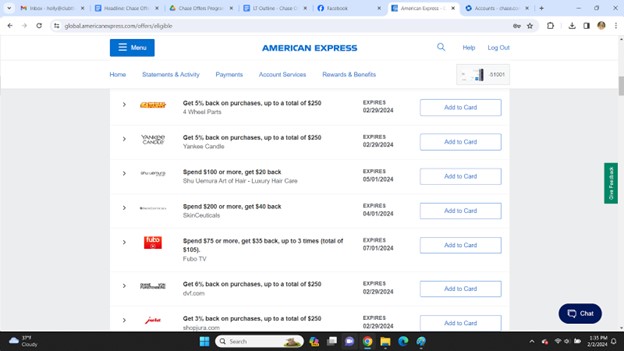

Amex Offers

Amex Offers is a very similar program to Chase Offers in some ways. Chase Offers and Amex Offers are available for almost all cardholders (from the respective issuers) in the U.S., and both programs require cardholders to manually add the offers to their account for the promotion to apply.

The biggest difference between Amex Offers and Chase Offers is that offers from American Express tend to be more lucrative, although they may require you to spend more to earn the rewards. In addition, Amex Offers often last a lot longer, with a lot more time to use them before they expire.

Capital One Offers

Capital One Offers is essentially an online shopping portal where you can earn statement credits on your purchases. This means that unlike Amex Offers or Chase Offers, you won’t have to add the offer to your card — however, you will need to make sure you follow the correct link (from the shopping portal) to make the purchase.

You can see offers from Capital One on the Capital One mobile app or through your online account.

The information related to the Chase Sapphire Reserve®, Ink Business Preferred® Credit Card and Chase Freedom Flex® has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.