Capital One Transfer Partners: What You Need to Know

Capital One has a variety of travel rewards cards that allow you to rack up miles that you can use for travel at home and abroad. You can transfer Capital One miles to more than 15 airline and hotel loyalty programs to get the most value out of your rewards. While Capital One doesn’t partner with any major U.S. airlines, there are a few valuable programs in the list, including Avianca and Aeroplan.

This guide explains how to transfer your miles from your Capital One credit card to their transfer partners as well as which partners offer the most valuable rewards.

Capital One transfer partners

Capital One currently partners with 18 travel loyalty programs. That includes 15 airline partners and four hotel partners with one program — Virgin Red — being in both categories. Most Capital One transfer partners offer a 1:1 transfer ratio, so you won’t lose any miles as you transfer them.

Current list of Capital One airline partners

Capital One has 15 airline partners that represent the three major airline alliances — Oneworld, SkyTeam and Star Alliance.

Two airlines, Emirates and Etihad, aren’t part of an airline alliance, but you can move your Capital One miles to either of these airlines. They partner with various international airlines, which means you can, for example, transfer miles to Emirates if you want to use them to book with Japan Airlines.

| Partner | Airline Alliance | Transfer Ratio |

|---|---|---|

| Aeromexico Club Premier | SkyTeam | 1 : 1 |

| Air Canada Aeroplan | Star Alliance | 1 : 1 |

| Asia Miles (Cathay Pacific) | oneworld | 1 : 1 |

| Avianca LifeMiles | Star Alliance | 1 : 1 |

| British Airways Executive Club | oneworld | 1 : 1 |

| Emirates Skywards | N/A | 1 : 1 |

| Etihad Guest | N/A | 1 : 1 |

| Finnair Plus | oneworld | 1 : 1 |

| Flying Blue (Air France/KLM) | SkyTeam | 1 : 1 |

| Qantas Frequent Flyer | oneworld | 1 : 1 |

| Singapore Airlines KrisFlyer | Star Alliance | 1 : 1 |

| TAP Miles&Go | Star Alliance | 1 : 1 |

| Turkish Airlines Miles&Smiles | Star Alliance | 1 : 1 |

| Virgin Red | N/A | 1 : 1 |

| EVA Air Infinity MileageLands | Star Alliance | 1000 : 750 |

Current list of Capital One hotel partners

Four hotel partners are eligible for Capital One miles transfers.

| Partner | Transfer ratio |

|---|---|

| ALL - Accor Live Limitless | 1000 : 500 |

| Choice Privileges® | 1 : 1 |

| Virgin Red | 1 : 1 |

| Wyndham Rewards | 1 : 1 |

The best Capital One travel partners

| Air Canada | ||

|---|---|---|

| Home Country: Canada | Major hubs: Toronto, Montreal, Vancouver | Airline alliance: Star Alliance |

| Air Canada’s Aeroplan points are versatile, letting you use them to book air travel as well as car rental, hotel packages and more. You’ll find good value on flights to Europe or those within North America. A weekend Aeroplan flight from Chicago to London costs 52,600 miles and $34 each way. Considering the cash price for the same date and flight, that's a value of around 2 cents per mile. If you’re flexible with when you fly this route, prices can go as low as 32,000 miles. | ||

| Avianca LifeMiles | ||

|---|---|---|

| Home Country: Colombia | Major hubs: Bogota, San Salvador | Airline alliance: Star Alliance |

| Avianca LifeMiles has excellent pricing on international flights with Star Alliance partners. A United flight from New York to Paris is just 30,000 LifeMiles plus $28 each way in economy. Another perk is that you won’t pay fuel surcharges or taxes when you redeem your miles for international travel. | ||

| British Airways | ||

|---|---|---|

| Home Country: England | Major hubs: Heathrow Airport, Gatwick Airport, London City Airport | Airline alliance: oneworld |

| British Airways uses a distance-based award chart which offers great value for direct travel as it will “cost” less than a less direct route. As part of the oneworld alliance, British Airways Avios points can be used to book flights with American Airlines. You can fight great deals by using Avios for domestic airfare, especially since domestic flights don't have the high fees that British Airways charges for overseas flights. For example, a one-way economy flight from New York to Chicago is 11,000 Avios points and $5.60. |

||

| Turkish Airlines Smiles and Miles | ||

|---|---|---|

| Home Country: Turkey | Major hubs: Istanbul, Ankara | Airline alliance: Star Alliance |

| Turkish Airlines is part of the Star Alliance program and has some attractive flight options. You can find U.S. domestic flights starting at 10,000 miles and even get business class seats on flights to the Middle East for as little as 25,000 miles each way. |

||

The least valuable Capital One transfer partners

Choice Privileges Hotels

You’ll generally lose value on your Capital One miles by transferring them to the Choice Privileges program, where points are typically worth less than 1 cent apiece. Furthermore, while many travelers are seeking to redeem points for aspirational travel, the majority of Choice hotel locations are on the budget end of the spectrum.

ALL Accor Live Limitless

As the only hotel program whose points transfer at a ratio less than 1:1, Accor offers less value than its counterparts. For 2,000 miles Accor Live Limitless deducts 40 Euros from your bill. This appears to be a good deal until you remember this requires 4,000 Capital One miles due to the 1: 0.5 transfer ratio. At this rate, you’re better off booking your stay with Capital One Travel and paying with cash or using your miles for a statement credit.

EVA Infinity MileageLands

EVA Air is the only Capital One airline partner that transfers at a lower ratio. For every 1,000 Capital One miles you transfer, you only get 750 EVA Infinity miles. It also features a more expensive award chart. You’re better off transferring miles to a different Star Alliance program, like Air Canada Aeroplan or Avianca LifeMiles.

How to transfer Capital One miles

The process to transfer your Capital One miles is simple.

Here’s how to do it, step by step:

- Log into CapitalOne.com.

- Select your eligible Capital One credit card.

- Click on “View Rewards.”

- Choose the option you want to use.

- Follow the prompts to complete the transfer.

- Receive a confirmation email and save it for your records.

Note that the minimum number of miles you can transfer is 1,000. You must also transfer miles in increments of 1,000. For example, if you need 15,500 miles to book an award flight, you’ll need to transfer 16,000 Capital One Miles to the partner airline. The remaining 500 miles won’t go to waste; they can be used on your next trip.

Transfers aren’t always instant but you can generally expect them to be completed within 24 hours. Remember that transfers are final and cannot be reversed.

Why transfer to Capital One travel partners?

Transferring your Capital One miles to an airline or hotel loyalty program partner is likely to get the most value. You can find deals that make your miles worth up to 2 cents each — much higher than the 1 cent value you get from redeeming miles through the Capital One Travel portal.

Plus, adding your Capital One miles to an existing balance helps you earn rewards faster. Occasionally transfer bonuses are offered and give you even more value.

Capital One Travel vs. transfer partners

To illustrate the value of booking miles with one of the Capital One airline transfer partners, we’ll compare a flight through the Capital One Travel portal versus using British Airways Avios. We’ve chosen a one-way flight on Jan. 2, 2025.

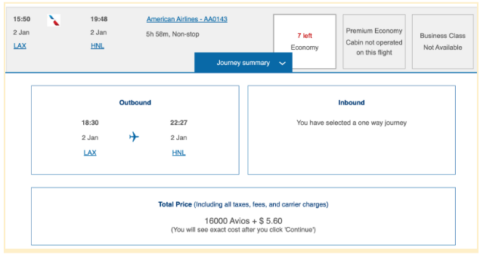

The flight, operated by American Airlines, costs 16,000 Avios plus $5.60. Since Capital One Miles transfer at a 1:1 ratio to British Airways, you would have to transfer 16,000 Capital One Miles to book this award.

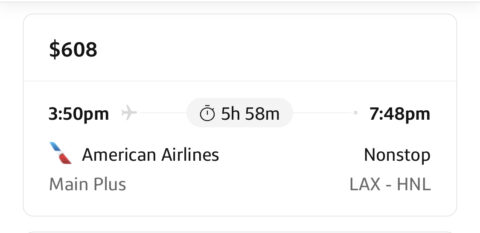

The same flight is available through Capital One Travel. It costs $608 (or 60,000 miles) — that’s 375% more miles. Transferring miles is a much better option in this case.

Another option is to book the flight through Capital One Travel with a Capital One Venture X Rewards Credit Card to earn 5x miles on the purchase. For the above example, you would earn 3,040 miles — so it wouldn’t outmatch the savings you would get from transferring the miles. But it could be worth it in other cases.

Cards that earn Capital One miles

Capital One has six travel cards for consumers and business owners. Two cards have no annual fee while the others have fees and include various travel perks and protections.

Welcome bonuses and earning rates vary among the cards. With the Capital One Venture X Rewards Credit Card, you can earn up to 10x miles on hotels and rental cars booked through Capital One Travel.

| Card | Welcome offer | Earning rate | Annual fee |

|---|---|---|---|

| Capital One Venture Rewards Credit Card | Earn up to $1,000 towards travel once you spend $4,000 on purchases within the first 3 months of account opening | 2 Miles per dollar on every purchase, every day; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel | $95** |

| Capital One VentureOne Rewards Credit Card | Earn 20,000 Miles once you spend $500 on purchases within 3 months from account opening | 1.25 Miles per dollar on every purchase, every day; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel | $0** |

| Capital One Venture X Rewards Credit Card | Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening | 2 Miles per dollar on every purchase, every day; 10 Miles per dollar on hotels and rental cars booked through Capital One Travel; 5 Miles per dollar on flights and vacation rentals booked through Capital One Travel | $395** |

| Capital One Venture X Business* | Earn 150,000 Miles once you spend $30,000 in the first 3 months from account opening | 2 Miles per dollar on every purchase; 5 Miles per dollar on flights and vacation rentals booked through Capital One Business Travel; 10 Miles per dollar on hotels and rental cars booked through Capital One Business Travel | $395 |

| Capital One Spark Miles for Business | Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening. | 2 Miles per $1 on every purchase, everywhere; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One's travel booking site | $0 intro for first year; $95 after that** |

| Capital One Spark Miles Select for Business* | One-time bonus of 50,000 miles once you spend $4,500 on purchases within 3 months from account opening | 1.5 Miles per $1 on every purchase | $0 |

Important tips for transferring Capital One miles

- Sign up for the loyalty program before transferring your miles if you’re not already a member. Have your ID on hand if a passport or driver’s license information is needed to register.

- Verify that a flight has plenty of award space before transferring your miles.

- Some airline programs allow you to put an award flight on hold to give you time to transfer miles. You should investigate whether this is an option for your chosen airline program.

- Your name and important contact information must match those in your loyalty program and Capital One account. Addresses and phone numbers are generally easy to update. However, if there’s an error in your birthdate or your ID, you may need additional customer service support.

- Rewards can’t be transferred back to your Capital One account, so be sure you want to make the transaction.

- Put as much of your spending on your Capital One travel credit card as possible to accumulate more miles.

Frequently asked questions

You can transfer Capital One Venture miles to another person if they also have a Capital One card that earns miles. You can transfer them online through your travel portal.

No, Delta Air Lines is not a transfer partner of Capital One. However, since Delta is part of the SkyTeam Alliance, you can transfer Capital One miles to one of its partners in order to book a flight on Delta. AeroMexico, Air France and KLM are Capital One’s SkyTeam partners.

Capital One has 15 airline transfer partners to choose from. The airline partners are AeroMexico, Air Canada, Air France/KLM, Air Portugal, Avianca, British Airways, Cathay Pacific, Emirates, Etihad, EVA Air, Finnair, Qantas, Singapore Airlines, Turkish Airlines and Virgin Atlantic.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Capital One Spark Miles Select for Business has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.