Best Southwest Credit Cards in 2025

Our winner for the best Southwest card

Our winner for the best Southwest card

Southwest Rapid Rewards® Priority Credit Card

The Southwest Rapid Rewards® Priority Credit Card is the best co-branded Southwest credit card, offering $300+ in Southwest benefits per year.

Best Southwest Credit Cards in 2024

Southwest is a favorite airline of many travelers thanks to its flyer-friendly change and cancellation policies and its extensive domestic route map. One of the best ways to earn Southwest Rapid Rewards points is by applying for and spending money on the various Chase Southwest credit cards. There are three personal and two business Southwest credit cards — each with its own array of benefits and perks.

The Southwest credit cards generally offer a hefty sign-up bonus, the ability to earn Rapid Rewards points on an ongoing basis and anniversary bonus points each year you hold the card. Signing up and being approved for one or more Southwest credit cards can be a great way to earn the points you need for the valuable Southwest Companion Pass. To find the best Southwest credit card, you should consider the value of the sign-up bonus, annual bonus, ongoing rewards earnings, and perks that you’re likely to use and compare them to the annual fee.

Winner: Best Southwest credit card

Southwest Rapid Rewards® Priority Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- Highest ongoing point earnings among the three Southwest consumer cards

- Annual bonus and travel statement credit cancel out most of the annual fee

- Highest annual fee of any Southwest credit card

- Low point earnings on regular purchases

The Southwest Rapid Rewards® Priority Credit Card is our favorite card for frequent Southwest flyers. The card offers a suite of perks that can more than justify the card’s $229 annual fee. Cardholders get a 7,500-point bonus each cardmember anniversary, a $75 Southwest annual travel credit and four upgraded boardings.

First year value: $1,532*

Second year value: $447

Savvy traveler tip: The 7,500-point bonus is the highest offered on a Southwest card and offsets 75% of the card’s $229 annual fee.

Savvy traveler tip: The 7,500-point bonus is the highest offered on a Southwest card and offsets 75% of the card’s $229 annual fee.*Based on LendingTree’s value methodology

- Earn 85,000 bonus points after you spend $3,000 in the first 3 months from account opening.

- 7,500 anniversary points each year.

- Earn 4 points per $1 spent on Southwest Airlines® purchases, including flights, inflight, and Southwest gift cards.

- Earn 2 points for every $1 you spend at gas stations and restaurants

- First checked bag free for Cardmembers and up to 8 additional passengers in the same reservation.

- Select a Preferred seat at booking, at no additional charge, when available.*

- Cardmembers and up to 8 passengers in the same reservation will board with Group 5 giving them earlier access to overhead bins.*

- No foreign transaction fees.

- Member FDIC

Best Southwest credit card with low annual fee

Southwest Rapid Rewards® Plus Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- Lowest annual fee of any Southwest credit card

- Still get some anniversary points

- Lower earning rates on Southwest and other purchases

- No upgraded boarding or ability to earn elite TQPs

The Southwest Rapid Rewards® Plus Credit Card offers the lowest annual fee of Southwest’s three personal credit cards. Understandably, that means the perks of the card are less than what you’d find on the other Southwest cards. Still, the Southwest Rapid Rewards® Plus Credit Card does offer a solid earning rate and an anniversary points bonus that helps offset the card’s $99 annual fee.

First year value: $1,412*

Second year value: $264

Savvy traveler tip: Use the two annual Early Bird Check-Ins® that come with this card to get earlier seat selection and boarding position.

Savvy traveler tip: Use the two annual Early Bird Check-Ins® that come with this card to get earlier seat selection and boarding position.*Based on LendingTree’s value methodology

- Earn 85,000 bonus points after you spend $3,000 in the first 3 months from account opening.

- 3,000 anniversary points each year.

- Earn 2 points per $1 spent on Southwest Airlines® purchases

- Earn 2 points for every $1 you spend at gas stations and grocery stores on the first $5,000 in combined purchases per anniversary year

- Cardmembers and up to 8 additional passengers in the same reservation can check their first bag at no additional cost.

- Select a Standard seat within 48 hours prior to departure, when available.

- Earn 1 point for every $1 spent on all other purchases.

- No foreign transaction fees.

- Member FDIC

Best Southwest credit card with mid-range annual fee

Southwest Rapid Rewards® Premier Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- Ability to earn tier-qualifying points toward Southwest A-List elite status

- Mid-range annual fee

- No $75 annual Southwest travel credit

- Higher annual fee than some of the other Southwest cards

If the annual fee on the Southwest Rapid Rewards® Priority Credit Card is too pricey and the perks on the Southwest Rapid Rewards® Plus Credit Card too limited, the Southwest Rapid Rewards® Premier Credit Card may a better choice for you. Cardholders get a 6,000-point bonus each cardmember anniversary and foreign transaction fees of $0. Plus, spending on the card will help boost you toward A-List elite status.

First year value: $927*

Second year value: $311

Savvy traveler tip: This card also comes with two EarlyBird Check-In®s each year, which provide earlier boarding positions and seat selection.

Savvy traveler tip: This card also comes with two EarlyBird Check-In®s each year, which provide earlier boarding positions and seat selection.*Based on LendingTree’s value methodology

- Earn 85,000 bonus points after you spend $3,000 in the first 3 months from account opening.

- 6,000 anniversary points each year.

- Earn 3X points on Southwest® purchases.

- Earn 2X points on grocery stores and restaurants on the first $8,000 in combined purchases per anniversary year.

- First checked bag free for Cardmembers and up to 8 additional passengers in the same reservation.

- Complimentary or Standard or Preferred seat within 48 hours prior to departure, when available

- No foreign transaction fees.

Best Southwest credit card for business

Southwest® Rapid Rewards® Performance Business Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- Only Southwest credit card to offer reimbursement for Global Entry or TSA PreCheck

- Highest amount of anniversary points of any Southwest credit card

- Highest annual fee of any Southwest credit card

- No $75 annual Southwest travel credit

The Southwest® Rapid Rewards® Performance Business Credit Card is easily our favorite Southwest card for small businesses. It charges a hefty $299 annual fee, but the perks are incredible. Cardholders get a 9,000-point anniversary bonus, a reimbursement for Global Entry or TSA PreCheck application fees, four upgraded boardings each year and up to 365 in-flight Wi-Fi credits.

First year value: $1,220*

Second year value: $100

Savvy traveler tip: The 4 points per $1 spent on Southwest® purchases is the highest earning rate offered by a Southwest credit card.

Savvy traveler tip: The 4 points per $1 spent on Southwest® purchases is the highest earning rate offered by a Southwest credit card.*Based on LendingTree’s value methodology

- Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

- 9,000 bonus points after your Cardmember anniversary.

- Earn 4X pts on Southwest® purchases.

- Earn 2 points for every $1 you spend at gas stations and restaurants

- Earn 2X points on hotel accommodations booked directly with the hotel

- Earn 2X points on local transit and commuting, including rideshare.

- First checked bag free for Cardmembers and up to 8 additional passengers in the same reservation.

- Cardmembers and up to 8 passengers in the same reservation will board with Group 5 giving them earlier access to overhead bins.*

- Member FDIC

Best Southwest business credit card with low annual fee

Southwest® Rapid Rewards® Premier Business Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- Lower annual fee than the Southwest® Rapid Rewards® Performance Business Credit Card

- Has fee reimbursement for transferring Southwest points unlike the personal Southwest credit cards

- Low earnings rates on most types of purchases, especially when considered to other general travel credit cards

- No upgraded boardings unlike the Southwest® Rapid Rewards® Performance Business Credit Card

If you can’t justify the $299 annual fee of the Southwest® Rapid Rewards® Performance Business Credit Card, perhaps the annual fee on the Southwest® Rapid Rewards® Premier Business Credit Card may be a better fit for your small business. It comes with a lower earning rate and lacks airline perks like in-flight Wi-Fi credits. However, it still offers decent point earnings, including 3X points on Southwest purchases and 6,000 points each year on your card anniversary.

First year value: $997*

Second year value: $157

Savvy traveler tip: Want to consolidate debt without restricting your travel? This card doubles as a balance transfer card and cardholders will earn 1 point per dollar on the first $15,000 in balance transfers in the first 90 days from opening a Southwest® Rapid Rewards® Premier Business Credit Card.

Savvy traveler tip: Want to consolidate debt without restricting your travel? This card doubles as a balance transfer card and cardholders will earn 1 point per dollar on the first $15,000 in balance transfers in the first 90 days from opening a Southwest® Rapid Rewards® Premier Business Credit Card.*Based on LendingTree’s value methodology

- Earn 85,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

- 6,000 bonus points after your Cardmember anniversary.

- Earn 3X points on Southwest Airlines® purchases.

- Earn 2 points for every $1 you spend at gas stations and restaurants on the first $8,000 in combined purchases per year

- First checked bag free for Cardmembers and up to 8 additional passengers in the same reservation.

- Select a Standard or Preferred seat within 48 hours prior to departure, when available.*

- Cardmembers and up to 8 passengers in the same reservation will board with Group 5 giving them earlier access to overhead bins.*

- No foreign transaction fees.

- Member FDIC

Best General Travel Credit Card for Southwest

Chase Sapphire Preferred® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.- Chase points transfer to 12-plus airline and hotel partners, including Southwest

- Points are worth 25% more when redeemed through Chase TravelSM

- Solid travel protections and coverage

- $0 foreign transaction fee

- No Southwest specific benefits

- $95 annual fee

The Chase Sapphire Preferred® Card is a great option if you are looking for a general travel credit card that can be used on both Southwest and other travel purchases. This card has extremely flexible points that are worth 25% more when redeemed through the Chase TravelSM portal. You’ll also get travel benefits like a yearly hotel credit, travel insurance and purchase protections.

First year value: $2,332*

Second year value: $832

Savvy traveler tip: With a Chase travel credit card, you can transfer points at a 1:1 rate to 12-plus travelpartners. See our Chase Ultimate Rewards guide for a full list of partners.

Savvy traveler tip: With a Chase travel credit card, you can transfer points at a 1:1 rate to 12-plus travelpartners. See our Chase Ultimate Rewards guide for a full list of partners.*Based on LendingTree’s value methodology

- Click APPLY NOW to apply online.

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases

- Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

- 10% anniversary points boost - each account anniversary you'll earn bonus points equal to 10% of your total purchases made the previous year.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

- Member FDIC

- Rates & Fees

Side-by-side comparison of the best Southwest credit cards

| Credit Cards | Our Ratings | Annual Fee | Welcome Offer | Rewards Rate | |

|---|---|---|---|---|---|

Southwest Rapid Rewards® Priority Credit Card*

|

Best Southwest credit card overall

|

$229 | Earn 85,000 bonus points after you spend $3,000 in the first 3 months from account opening. | Receive 7,500 anniversary points each year. Enjoy benefits including 4X points on Southwest Airlines® purchases, 2X points at gas stations and restaurants, First checked bag free, 10,000 Companion Pass® qualifying points boost each year, and more. | |

Southwest Rapid Rewards® Plus Credit Card*

|

Low annual fee

|

$99 | Earn 85,000 bonus points after you spend $3,000 in the first 3 months from account opening. | Receive 3,000 anniversary points each year. Enjoy benefits including 2X points on Southwest Airlines® purchases, First checked bag free, 10,000 Companion Pass® qualifying points boost each year, and more. | |

Southwest Rapid Rewards® Premier Credit Card*

|

Mid-range annual fee

|

$149 | Earn 85,000 bonus points after you spend $3,000 in the first 3 months from account opening. | Get 3X points on Southwest® purchases, 2X points on grocery stores and restaurants on the first $8,000 in combined purchases per anniversary year and 1X points on other purchases. | |

Southwest® Rapid Rewards® Performance Business Credit Card*

|

Business

|

$299 | Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. | Earn 4 points per $1 spent on Southwest® purchases. Earn 2 points per $1 spent on gas station and restaurant purchases. Earn 2 points per $1 spent on hotel accommodations booked directly with the hotel. Earn 2 points per $1 spent on local transit and commuting, including rideshare. Earn 1 point per $1 spent on all other purchases. | |

Southwest® Rapid Rewards® Premier Business Credit Card*

|

Business with low annual fee

|

$149 | Earn 85,000 points after you spend $3,000 on purchases in the first 3 months your account is open. | Receive 6,000 anniversary points each year. Enjoy benefits including 3X points on Southwest Airlines® purchases, First checked bag free, 10,000 Companion Pass® qualifying points boost each year, and more. | |

Chase Sapphire Preferred® Card

on Chase's secure site Rates & Fees |

General travel

|

$95 | Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. | Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases |

on Chase's secure site Rates & Fees |

Alternative credit card recommendation: The Chase Trifecta

If your goal is to maximize the number of Southwest points that you have, you could also consider signing up for the Chase trifecta. The Chase Trifecta consists of three Chase Ultimate Rewards® cards: the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®, Chase Freedom Flex® and Chase Freedom Unlimited®. These three cards offer better earning rates in more categories and a much better set of travel benefits. With the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®, you can transfer your points 1:1 to Southwest Airlines if you want, or you can use one of Chase’s other hotel or airline transfer partners. This can net you a much higher average value for your points (around 2 cents per point by our estimates) as well as the ability to redeem points for premium cabins and international travel.

Second year value: $740

You can sign up for all three of these Chase cards in the same year to earn all the sign-up bonuses and benefits at once.

*Based on LendingTree’s value methodology

Is a Southwest credit card worth it?

The Southwest credit cards can be worth their annual fees if you travel on Southwest at least a few times a year. However, there are other travel credit cards that can offer better travel perks. There are two main reasons to consider applying for a Chase Southwest card:

-

Earning a Southwest sign-up bonus

The Southwest credit cards often offer large sign-up bonuses, which can be a good incentive to sign up. Note that the bonuses on these cards frequently fluctuate, so you’ll want to monitor and time your application for when the bonuses are elevated.

What is Chase 5/24? The 5/24 rule is an unwritten but well-documented rule from Chase that says that if you have applied for five or more credit cards (from any issuer) in the past 24 months, you’re unlikely to be approved for a Chase credit card. So if you’re looking to apply for a Southwest credit card, you’ll want to pay attention to how many credit cards you’ve opened recently. -

Earning the Southwest Companion Pass

One of the best perks of flying Southwest is the Southwest Companion Pass. The Companion Pass allows you to designate a travel companion who can fly with you for free (only paying taxes and fees) on any Southwest flight for up to two years. In 2023, you can earn the Companion Pass by flying 100 one-way qualifying flights or earning 135,000 qualifying points. The points you earn from the Southwest credit cards (including the sign-up bonus) count as qualifying points for the Companion Pass. So signing up for a Southwest credit card can get you a good way toward the points you’ll need to earn the Southwest Companion Pass.

Most of the personal Southwest credit cards have a restriction where you can’t earn the sign-up bonus if you’re a current cardholder of ANY of the personal Southwest credit cards. However you can sign up for both a personal and a business Southwest credit card in the same year and earn both cards’ sign-up bonuses. This may give you all the points you need to earn the Southwest Companion Pass.

Southwest cards vs. general travel cards

While a Southwest credit card may be the right option for frequent Southwest flyers or travelers looking to earn the valuable Southwest Companion Pass, a general travel card may be the best option for most travelers. General travel cards (such as the Chase Sapphire Preferred® Card) often offer higher earnings rates in more categories, better perks and more flexibility in redeeming rewards. As you can see from the comparison below, the Chase Sapphire Preferred® Card might be able to provide you a higher rewards value and better benefits. If you’re not focused on earning the Southwest Companion Pass, you may want to look at another rewards credit card.

| Feature | Southwest Rapid Rewards® Premier Credit Card | Chase Sapphire Preferred® Card |

|---|---|---|

| Earning rate | Get 3X points on Southwest® purchases, 2X points on grocery stores and restaurants on the first $8,000 in combined purchases per anniversary year and 1X points on other purchases. | Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases |

| Annual bonus | 6,000 | 10% of total purchases made the year before |

| Points earned on $2,000 Southwest flights | 6,000 | 4,000 |

| Points earned on $2,000 dining | 2,000 | 6,000 |

| Points earned on $14,000 other purchases | 14,000 | 14,000 |

| Total points earned | 28,000 | 24,000 |

| Redemption options | Southwest airfare | Chase Travel portal for 25% more value, cash back for 1 cent per point, transfer to 13 travel partners, including Southwest |

| Annual fee | $149 | $95 |

| Average point value | 1.4 cents | 2 cents |

| Value of rewards | $392 | $480 |

| Other benefits | Foreign transaction fee: $0, Auto rental collision damage waiver (secondary), lost luggage reimbursement, baggage delay insurance, two Early Bird Check-Ins® per year | $50 annual hotel credit, foreign transaction fee: $0, Auto rental collision damage waiver (primary), trip cancellation/interruption insurance, baggage delay insurance, trip delay reimbursement |

Other good cards for Southwest Airlines

Which Southwest credit card should you choose?

If you’re looking to earn Southwest Rapid Rewards points, you might be wondering which Southwest credit card you should choose. It mainly comes down to point earnings and a few key benefits in picking the best consumer card. In most cases, the Southwest Rapid Rewards® Priority Credit Card offers the best value.

As you can see from the chart below, the increased annual benefits will offset the higher annual fee. However, depending on how much you value the Early Bird Check-Ins, upgraded boarding and Southwest points, you may find a different Southwest card is right for you.

Southwest credit card benefits vs. annual fee

| Benefits and fees | Southwest Rapid Rewards® Plus Credit Card | Southwest Rapid Rewards® Premier Credit Card | Southwest Rapid Rewards® Priority Credit Card |

|---|---|---|---|

| Benefits |

|

|

|

| Value of benefits | $72 | $120 | $300 |

| Annual fee | $99 | $149 | $229 |

| Value minus annual fee | $2 | $21 | $151 |

How to choose a Southwest credit card

Since the sign-up bonus is often the same across all of the Southwest consumer cards, the choice usually comes down to comparing a few key benefits:

One of the things you’ll want to look at is considering which perks, including the annual bonus, you are likely to use. If you assign a dollar amount to each benefit, you can easily compare the total value of the benefits you’ll receive against the annual fee. The chart above shows one sample benefit valuation, which you can adjust based on your own preferences. In our sample valuation, the Southwest Rapid Rewards® Priority Credit Card came out as the best consumer card option when comparing the perks to each card’s annual fee.

Another factor to consider is how many Rapid Rewards points you will earn from your everyday spending. The Southwest Rapid Rewards® Premier Credit Card and Southwest Rapid Rewards® Priority Credit Card have the highest earning rates on Southwest purchases, which make them a better choice for buying flights. Another factor is that the two Southwest business cards have additional bonus categories. Look at the earning categories on the different cards and compare that to your own spending patterns to find which card will earn you the most points.

A-List is Southwest’s elite status program. If you fly Southwest enough to potentially earn A-List status, you should consider getting a Southwest credit card to help you toward qualifying. The two levels of A-List status are:

A-List: 25 one-way flights or 35,000 Tier Qualifying Points (TQP)

A-List Preferred: 50 one-way flights or 70,000 Tier Qualifying Points (TQP)

Four Southwest credit cards offer cardholders a way to earn Tier Qualifying Points through spending. Cardholders earn 1,500 TQP for every $10,000 in purchases made on the following cards, with no cap on the amount of TQPs earned:

- Southwest Rapid Rewards® Premier Credit Card

- Southwest Rapid Rewards® Priority Credit Card

- Southwest® Rapid Rewards® Premier Business Credit Card

- Southwest® Rapid Rewards® Performance Business Credit Card

You can earn a total of 15,000 TQP through credit card spending — but that doesn’t even get you halfway to A-List status. So, you should only consider this way of earning Tier Qualifying Points if you plan to earn plenty of TQP through flying Southwest.

If you’re making purchases overseas, foreign transaction fees can really add to the total cost of your trip. Thankfully, there are plenty of cards that don’t charge foreign transaction fees, including almost all of the Southwest co-branded credit cards.

Only the Southwest Rapid Rewards® Plus Credit Card charges a foreign transaction fee, so you’ll want to avoid this option if you plan to use your Southwest points-earning card for overseas purchases.

All Southwest credit cards offer solid travel protections through Visa. These include:

- Auto Rental Collision Damage Waiver (personal cards): Secondary in the U.S., primary in international destinations

- Auto Rental Collision Damage Waiver (business cards): Primary for business-related purposes

- Roadside dispatch

- Lost luggage replacement

- Baggage delay insurance

- Travel accident insurance

You’ll find even better travel protections on the Chase Sapphire Preferred® Card. In addition to these benefits, the Chase Sapphire Preferred® Card provides Trip Cancellation/Interruption Insurance and Trip Delay Reimbursement, not to mention a primary Auto Rental Collision Damage Waiver.

How much are Southwest points worth?

Southwest Rapid Rewards points are worth around $0.014 per point when redeemed for Southwest reward flights.

However, the Southwest points value varies due to taxes and fees. Most flight redemptions provide between $0.013 and $0.017 per point in value.

The number of Rapid Rewards points required for a flight varies depending on the base fare of the flight and the type of fare, but it typically hovers around 83 points per dollar of base fare.

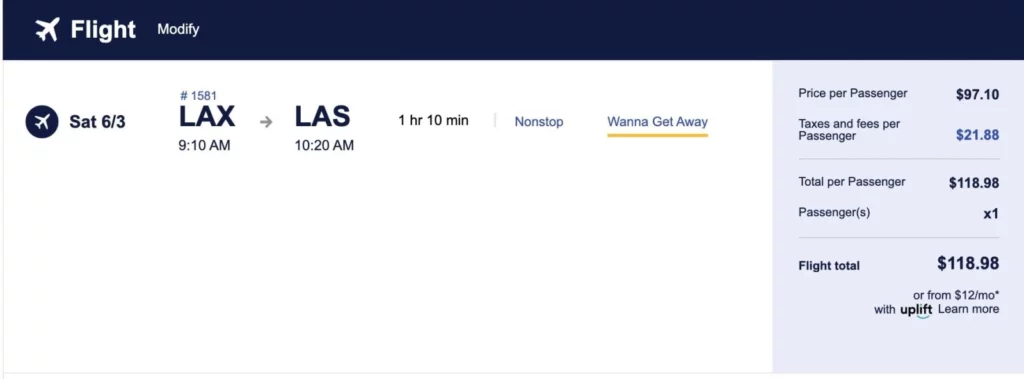

Example: Let’s take a flight from Los Angeles (LAX) to Las Vegas (LAS) on June 3, 2023 that costs $118.98. After subtracting $21.88 in taxes and fees, the base fare is $97.10:

To book this flight with points, you’ll need to pay 8,060 Rapid Rewards points (83 points per $1 of base fare) plus $5.60 of taxes/fees.

After factoring in the taxes/fees on the reward flight, booking a reward flight saves you $113.38 of out-of-pocket cost. That’s a value of $1.41 cents per point for this redemption.

Point value for fare = Cash price (minus taxes and fees) / Number of points needed for fare

How to use a Southwest credit card

- Save your Southwest credit card to your Southwest account. Southwest lets flyers save credit card information in their Rapid Rewards account for ease in purchasing flights.

- Add your Southwest credit card to a mobile wallet. Chase credit cards can be added to mobile wallets such as Google Pay, Apple Pay or Samsung Pay. This is a great way to still use your Southwest credit card even if you happen to forget your purse or wallet.

- Utilize your credit card benefits. This may seem obvious, but it’s important to keep in mind that credit card perks are only valuable when used. The Southwest® Rapid Rewards® Performance Business Credit Card may offer up to $2,920 in reimbursements for in-flight Wi-Fi purchases, but if you rarely use this perk, it’s not worth much to you.

Frequently asked questions

Southwest credit cards require an excellent/good credit score, which means you need a credit score of at least 680 to qualify for a card.

You can only have one personal Southwest card at once. Chase won’t approve you for a new personal Southwest credit card if you are a current cardholder of a personal Southwest card, or a previous cardholder who’s received a new bonus in the last 24 months. Chase will approve dual ownership of a Southwest business and consumer card.

The easiest way to cancel a Southwest credit card is by calling the customer service number on the back of your credit card. The good news is that you won’t lose your Southwest Rapid Rewards points if you cancel your Southwest credit card. Those points will still be in your Southwest account, even if you call Chase to cancel your Southwest credit card.

While Chase does not typically give you your card number upon a successful application, you may still be able to use your Southwest card before it arrives. Chase does have a program called Spend Instantly, where you can add a Chase credit card to a digital payment network (like Apple Pay or Google Pay). You can set that up in the Chase mobile app.

There is not a way to upgrade a Southwest credit card online. Instead, you will need to call the customer service number on the back of your credit card. Keep in mind that in most instances you will not get any bonus points or sign-up bonus for upgrading a card. It may be better to cancel your current Southwest credit card and apply for a new one directly instead.

You can earn 2X-3X points on some travel and transit purchases depending on the card and 1 point per dollar on other purchases.

You have a few different options when you are trying to apply for a credit card. One option is to apply for a card using the links on this page. You can also apply directly on Chase’s website. No matter how you apply, make sure that you are getting the best offer currently available before you apply.

You can use your Southwest credit card anywhere Visa is accepted. However, note that the Southwest Rapid Rewards® Plus Credit Card charges foreign transaction fees of $0 — so while you could use the Southwest Rapid Rewards® Plus Credit Card when traveling internationally, you’ll incur foreign transaction fees when doing so.

All of the Southwest credit cards are issued by Chase, and Chase typically does not use only one credit bureau. Depending on your location and any number of other factors, you may have your credit pulled from any of the major credit bureaus when you apply for a Southwest credit card.

The Southwest® Rapid Rewards® Performance Business Credit Card is the only Southwest credit card that pays for Global Entry. If you have the Southwest® Rapid Rewards® Performance Business Credit Card, you’ll get a statement credit of up to $100 every four years as a reimbursement for the application fee for Global Entry, TSA PreCheck or NEXUS. The other Southwest credit cards do not offer this reimbursement for Global Entry or TSA PreCheck.

Methodology: How we chose the best Southwest credit cards

To make choosing the right card easier, we’ve looked at credit cards reviewed on LendingTree as well as cards on major issuer sites to compile a list of the best rewards credit cards available right now. Our recommendations are based on the additional value you can earn with the cards — including the rewards value, cost of ownership and value of benefits such as travel and purchase protections, lounge membership and airline companion passes. Our choices are not influenced by our advertisers. Learn more on how we calculate rewards.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Southwest Rapid Rewards® Priority Credit Card, Southwest Rapid Rewards® Plus Credit Card, Southwest Rapid Rewards® Premier Credit Card, Southwest® Rapid Rewards® Performance Business Credit Card, Southwest® Rapid Rewards® Premier Business Credit Card, Chase Sapphire Reserve®, Chase Freedom Flex® and Chase Freedom® Student credit card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.