Best Credit Cards for International Travel in 2025

- We thoroughly fact-check and review all content for accuracy. We aim to make corrections on any errors as soon as we are aware of them.

- Our partners do not commission or endorse our content.

- Our partners do not pay us to feature any specific product in our content, but we do feature some products and offers from companies that provide compensation to LendingTree. This may impact how and where offers appear on the site (such as the order).

- We review and interview both external and internal reputable sources for our content and disclose sourcing in our content.

Our pick for best credit card

Our pick for best credit card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is the best international travel credit card for most globetrotters, thanks to its attractive welcome bonus, reasonable annual fee and strong slate of travel perks and protections.

The best credit cards for international travel will usually come with travel perks like trip insurance or lounge access, help you avoid costly foreign transaction fees and allow you to rack up rewards on expenses like flights, meals and hotel stays.

Our picks range from no-annual-fee cards to high-priced cards with luxury perks, so you can decide what’s right for your situation.

- Chase Sapphire Preferred® Card: Winner for best credit card for international travel

- Capital One VentureOne Rewards Credit Card: Best no annual fee credit card for international travel *To see rates & fees for Capital One VentureOne Rewards Credit Card, please click here.

- American Express Platinum Card®: Best card for international travel and lounge access

- Delta SkyMiles® Reserve American Express Card: Best airline credit card for international travel

- Capital One Venture Rewards Credit Card: Best flexible rewards card for international travel

- Ink Business Preferred® Credit Card: Best business credit card for international travel

- Marriott Bonvoy Brilliant® American Express® Card: Best hotel credit card for international travel

- Bank of America® Travel Rewards Credit Card for Students: Best student credit card for international travel

- Capital One Quicksilver Secured Cash Rewards Credit Card: Best international travel card for bad credit

- American Express® Gold Card: Best international travel credit card for dining

- Capital One Venture X Rewards Credit Card: Best travel credit card for international transfer partners

Best credit card for international travel overall

Chase Sapphire Preferred® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: $0

- Can earn a nice welcome bonus

- Earns valuable transferable points

- Primary car rental coverage

- $50 Ultimate Rewards hotel credit

- $95 annual fee

- Only 2x earning on most travel purchases

- No flexible travel credit

The Chase Sapphire Preferred® Card is our pick for overall best card for international travel because of its flexibility and versatility. The Ultimate Rewards points you earn with the card can be transferred at a 1:1 ratio to Chase’s airline and hotel partners, or you can use your points to book trips directly through the Chase Travel℠ portal. The Chase Sapphire Preferred® Card is also one of the best no-foreign-transaction-fee credit cards, so you can use it abroad without worry about extra fees.

- Click APPLY NOW to apply online.

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases

- Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

- 10% anniversary points boost - each account anniversary you'll earn bonus points equal to 10% of your total purchases made the previous year.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

- Member FDIC

- Rates & Fees

Best no-annual-fee credit card for international travel

Capital One VentureOne Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- $0 annual fee

- Simple rewards structure

- Intro APR on purchases and balance transfers

- Low earning rate on everyday purchases

- Enhanced earnings for hotels and rental cars only through Capital One Travel

- Earn a relatively low welcome offer compared to other cards

- Balance transfer fee applies

If you want a no-annual-fee travel credit card you can use abroad without racking up foreign transaction fees, the Capital One VentureOne Rewards Credit Card is a good way to go. While it has a lower welcome bonus and lower earning rate than some other cards, it can be a good choice if you’re looking to lower the amount you pay in fees. The Capital One VentureOne Rewards Credit Card also comes with an introductory APR on purchases and balance transfers (a balance transfer fee applies).

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- $0 annual fee and no foreign transaction fees

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 18.49% - 28.49% variable APR after that; balance transfer fee applies

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best international travel card for lounge access

American Express Platinum Card®

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Can earn large welcome offer

- Airport lounge access and other luxury perks

- Hotel, airline and entertainment credits

- $895 annual fee

- Low earning rate for most non-travel purchases

- Travel credits less flexible than with some other cards

If you’re a frequent traveler looking for luxury perks, you’ll want to consider American Express Platinum Card®, our pick for best international travel credit card for lounge access. This premium card offers the most robust airport lounge membership program of any travel card on the market today. The American Express Global Lounge Collection comes with Priority Pass™ Select membership*, exclusive access to ultra-swanky Amex Centurion lounges and Delta Sky Club access each time you fly with Delta. Other travel benefits include a fee credit for Global Entry or TSA PreCheck membership*, as well as automatic Hilton Honors Gold status* and Marriott Bonvoy Gold status*.

- Click APPLY NOW to apply online.

- You may be eligible for as high as 175,000 Membership Rewards® points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings. You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

- More Value! With over 1,550 airport lounges - more than any other credit card company on the market* - enjoy the benefits of the Global Lounge Collection®, over $850 of annual value, with access to Centurion Lounges, 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations), Priority Pass Select membership (enrollment required), and other select partner lounges. * As of 07/2025.

- More Value! $200 Uber Cash + $120 Uber One Credit: With the Platinum Card® you can receive $15 in Uber Cash each month plus a bonus $20 in December when you add your Platinum Card® to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction. Plus, when you use the Platinum Card® to pay for an auto-renewing Uber One membership, you can get up to $120 in statement credits each calendar year. Terms apply.

- More Value! $300 Digital Entertainment Credit: Get up to $25 in statement credits each month after you pay for eligible purchases with the Platinum Card® at participating partners. Enrollment required.

- More Value! $600 Hotel Credit: Get up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using the Platinum Card®. *The Hotel Collection requires a minimum two-night stay.

- New! $400 Resy Credit + Platinum Nights by Resy: When you use the Platinum Card® to pay at U.S. Resy restaurants and to make other eligible purchases through Resy, you can get up to $100 in statement credits each quarter with the $400 Resy Credit benefit. Plus, with Platinum Nights by Resy, you can get special access to reservations on select nights at participating in demand Resy restaurants with the Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you, enrollment required.

- More Value! $209 CLEAR® Plus Credit: CLEAR® Plus helps get you to your gate faster by using unique facial attributes to verify you are you at 50+ airports nationwide. You can cover the cost of a CLEAR Plus Membership* with up to $209 in statement credits per calendar year after you pay for CLEAR Plus with the Platinum Card®. *Excluding any applicable taxes and fees. Subject to auto-renewal.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to the Platinum Card® Account*. American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details.

- Start your vacation sooner, and keep it going longer. When you book Fine Hotels + Resorts® through American Express Travel®, enjoy noon check-in upon arrival, when available, and guaranteed 4PM check-out.

- New! $300 lululemon Credit: Enjoy up to $75 in statement credits each quarter when you use the Platinum Card® for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That’s up to $300 in statement credits each calendar year. Enrollment required.

- $155 Walmart+ Credit: Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with the Platinum Card®.*Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

- $100 Saks Credit: Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on the Platinum Card®. That’s up to $50 in statement credits from January through June and up to $50 in statement credits from July through December. No minimum purchase required. Enrollment required.

- Whenever you need us, we're here. Our Member Services team will ensure you are taken care of. From lost Card replacement to statement questions, we are available to help 24/7.

- $895 annual fee.

- Terms Apply.

- Rates & Fees

Best airline credit card for international travel

Delta SkyMiles® Reserve American Express Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Can earn attractive welcome offer

- Airport lounge access and other travel perks

- Yearly companion certificate

- Travel statement credits, including Delta 20% in-flight purchase statement credit

- High $650 annual fee

- Bonus rewards earning only on Delta purchases

- Hotel credit limited to Delta Stays bookings

The Delta SkyMiles® Reserve American Express Card is our choice for best airline card for international travel due to its array of luxe travel perks. The card offers some of the best benefits on the market, including generous dining and hotel statement credits, an annual companion pass after your cardmember anniversary and complimentary airport lounge access to Delta Sky Club, Escape and ritzy Amex Centurion lounges. You should know that the annual fee also is one of the highest on the market, so this card is best for frequent travelers who will get enough value from the perks to make that cost worthwhile.

- Click APPLY NOW to apply online.

- Earn 70,000 Bonus Miles after you spend $5,000 in eligible purchases on your new Card in your first 6 months of Card Membership.

- Delta SkyMiles® Reserve American Express Card Members receive 15 Visits per Medallion® Year to the Delta Sky Club® when flying Delta and can unlock an unlimited number of Visits after spending $75,000 in purchases on your Card in a calendar year. Plus, you'll receive four One-Time Guest Passes each Medallion Year so you can share the experience with family and friends when traveling Delta together.

- Enjoy complimentary access to The Centurion® Lounge when you book a Delta flight with your Reserve Card.

- Receive $2,500 Medallion® Qualification Dollars with MQD Headstart each Medallion Qualification Year and earn $1 MQD for each $10 in purchases on your Delta SkyMiles® Reserve American Express Card with MQD Boost to get closer to Status next Medallion Year.

- Enjoy a Companion Certificate on a Delta First, Delta Comfort, or Delta Main round-trip flight to select destinations each year after renewal of your Card. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply. Delta Basic experiences are not eligible for this benefit.

- $240 Resy Credit: When you use your Delta SkyMiles® Reserve American Express Card for eligible purchases with U.S. Resy restaurants, you can earn up to $20 each month in statement credits. Enrollment required.

- $120 Rideshare Credit: Earn up to $10 back in statement credits each month after you use your Delta SkyMiles® Reserve American Express Card to pay for U.S. rideshare purchases with select providers. Enrollment required.

- Delta SkyMiles® Reserve American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

- With your Delta SkyMiles® Reserve American Express Card, receive upgrade priority over others with the same Medallion tier, product and fare experience purchased, and Million Miler milestone when you fly with Delta.

- Earn 3X Miles on Delta purchases and earn 1X Miles on all other eligible purchases.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- $650 Annual Fee.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- Rates & Fees

Best flexible rewards credit card for international travel

Capital One Venture Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Earn an excellent welcome bonus

- Great flexibility with miles

- Global Entry or TSA PreCheck credit

- $95 annual fee

- Enhanced earnings for hotels and rental cars only through Capital One Travel

For a simple travel card with rewards that are as easy to redeem as they are to earn, the Capital One Venture Rewards Credit Card is hard to beat. You earn 2 Miles per dollar on every purchase, every day; 5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. And one of the Capital One Venture Rewards Credit Card‘s best features is the flexibility of the rewards you earn — you can redeem them as a statement credit for any type of travel or transfer them to any of Capital One’s airline and hotel partners.

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best business credit card for international travel

Ink Business Preferred® Credit Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: $0

- Can earn generous welcome offer

- Earns flexible Ultimate Rewards points

- Earns extra rewards in popular business spending categories

- $95 annual fee

- Requires you to have a business to apply

- Yearly spending cap on bonus earnings

The Ink Business Preferred® Credit Card is one of the most flexible and valuable business credit cards for travel. This card’s generous sign-up bonus and high earning rate on travel and business purchases can help you pile up rewards quickly. Like other Chase cards, it offers primary car rental protection and trip cancellation/interruption insurance when you use your card. These protections, along with $0 foreign transaction fees, make the Ink Business Preferred® Credit Card a great option for international business travel.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Member FDIC

Best hotel credit card for international travel

Marriott Bonvoy Brilliant® American Express® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Excellent welcome offer

- Marriott Bonvoy® Platinum Elite status (enrollment required)

- Priority Pass™ Select lounge access (registration required)

- Travel and purchase protection

- $650 annual fee

- Highest bonus earning category limited to Marriott hotel purchases

- Transfer partners generally offer poor redemption value

The Marriott Bonvoy Brilliant® American Express® Card is our top pick for hotels due to its welcome offer, earning rate on paid Marriott hotel stays and excellent travel perks. Although a $650 annual fee applies, cardholders get: up to $300 a year back as a dining credit (up to $25 per month), a free night award after card renewal each year (up to 85,000 points) and a $100 Marriott Bonvoy property credit. Additional perks include a Priority Pass™ Select membership (enrollment required), a fee credit for Global Entry or TSA PreCheck membership (enrollment required) and no foreign transaction fees.

- Click APPLY NOW to apply online.

- Earn 100,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

- Earn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy.

- Earn 3X points at restaurants worldwide and on flights booked directly with airlines.

- Earn 2X points on all other eligible purchases.

- Earn up to 21X Marriott Bonvoy® points for every $1 spent on eligible purchases at hotels participating in Marriott Bonvoy. Earn 6X points with the Marriott Bonvoy Brilliant® American Express® Card. Earn up to 10X points from Marriott Bonvoy for being a Marriott Bonvoy member. Earn up to 5X points from Marriott Bonvoy with the 50% Bonus Points on Stays, a benefit available with your complimentary Platinum Elite status.

- $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant® American Express® Card at restaurants worldwide.

- A Marriott Bonvoy® Platinum Elite member will earn 50% more points on eligible purchases at hotels participating in Marriott Bonvoy for each U.S. dollar or the currency equivalent that is incurred and paid for by the member.

- Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy® points) at hotels participating in Marriott Bonvoy®, such as Le Metropolitan, a Tribute Portfolio Hotel in Paris. Certain hotels have resort fees.

- Each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant® American Express® Card, you will be eligible to select a Brilliant Earned Choice Award benefit. You can only earn one Brilliant Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

- $100 Marriott Bonvoy® Property Credit: Enjoy your stay. Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton® or St. Regis® when you book direct using a special rate for a two-night minimum stay using your Card.

- Fee Credit for Global Entry or TSA PreCheck®: Receive either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant® American Express® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Each calendar year with your Marriott Bonvoy Brilliant® American Express® Card you can receive 25 Elite Night Credits toward the next level of Marriott Bonvoy® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express.

- With your Marriott Bonvoy Brilliant® American Express® Card, you can enroll in Priority Pass™ Select, with an unlimited number of visits to over 1,200 airport lounges in over 130 countries, regardless of which carrier or class you are flying. This allows you to relax before or between flights. You can enjoy snacks, drinks and internet access in a quiet, comfortable location.

- Trip Cancelled or Interrupted? If you purchase a round-trip entirely with your Eligible Card and a covered reason cancels or interrupts your trip, we may be able to help. Terms, conditions and limitations apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- No Foreign Transaction Fees on international purchases.

- $650 Annual Fee.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- Rates & Fees

Best student credit card for international travel

Bank of America® Travel Rewards Credit Card for Students*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: $0

- $0 annual fee

- Nice welcome offer

- Intro APR offer for purchases and balance transfers

- No bonus categories

- Rewards aren’t transferable

The Bank of America® Travel Rewards Credit Card for Students is the best international travel card for students due to its lack of foreign transaction fees and $0 annual fee. It has a simple rewards structure: Cardholders earn 1.5 points per $1 spent on all purchases. This card may work well for students who want to keep their options open as they figure out their travel style.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a 17.49% to 27.49% Variable APR will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Access your FICO® Score for free within Online Banking or your Mobile Banking app.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Best international travel credit card for bad credit

Capital One Quicksilver Secured Cash Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- $0 annual fee

- Solid cash back earnings on every purchase

- Earn enhanced cash back rate on hotels and rental cars booked through Capital One Travel

- Requires a minimum $200 refundable security deposit

- High purchase APR

- Lacks travel perks

The Capital One Quicksilver Secured Cash Rewards Credit Card is the best option for international travel among credit cards for bad credit. It doesn’t charge an annual fee or foreign transaction fees. This card is marketed to those with limited / poor credit, while travel credit cards generally target consumers with good to excellent credit. You’ll need to put down a security deposit of at least $200, which means your credit limit starts at $200.

You can earn a solid flat rate of cash back on everyday purchases, with a bonus earning rate on hotels and rental cars booked through Capital One Travel.

- No annual or hidden fees, and you can earn unlimited 1.5% cash back on every purchase, every day. See if you're approved in seconds

- Put down a refundable $200 security deposit to get at least a $200 initial credit line

- Building your credit? Using a card like this responsibly could help

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

Best for dining and international travel

American Express® Gold Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- High earning rate on dining and U.S. supermarkets

- Generous dining and Uber benefits (enrollment required)

- Travel and purchase protection

- $325 annual fee

- Low earning rate for travel aside from flights and dining

- Redeeming your points for non-travel options isn’t a good value

The American Express® Gold Card is an attractive option if you spend the most on dining and groceries. The American Express® Gold Card lets you earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. Terms apply. This makes it a great option to use while dining abroad, since you earn extra rewards and won’t pay foreign transaction fees.

There is a $325 annual fee, but you can wipe out a large part of the fee if you take advantage of benefits, such as up to $120 in credits toward select dining purchases ($10 monthly, enrollment required).

- Click APPLY NOW to apply online.

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

- Rates & Fees

Best for international transfer partners

Capital One Venture X Rewards Credit Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Foreign transaction fee: None

- Earn an outstanding welcome bonus

- Solid earning rate on all purchases

- Global Entry/TSA PreCheck credit

- Attractive anniversary bonus

- $395 annual fee

- Doesn’t offer hotel or airline elite status

- Enhanced miles earnings only on Capital One Travel bookings

- Annual travel credit restricted to Capital One Travel bookings

If you’re in the market for points that can easily be transferred to partners, consider the Capital One Venture X Rewards Credit Card. Capital One has more than 15 hotel and airline transfer partners, allowing you to maximize your points no matter where you’re going. You’ll earn 2 Miles per dollar on every purchase, every day; 10 Miles per dollar on hotels and rental cars booked through Capital One Travel; 5 Miles per dollar on flights and vacation rentals booked through Capital One Travel. And with no foreign transaction fees, the Capital One Venture X Rewards Credit Card is a great card to have in your wallet when traveling abroad.

The card charges a $395 annual fee, but it’s more than worth it if you’ll take advantage of the card perks. It awards you 10,000 Venture miles (equal to $100 towards travel) on your account anniversary and gives you an annual $300 travel credit that applies to bookings made with Capital One Travel.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights and vacation rentals booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Top rated mobile app

- For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

| Credit Cards | Our Ratings | Foreign Exchange Fee | Annual Fee | Welcome Offer | |

|---|---|---|---|---|---|

Chase Sapphire Preferred® Card

on Chase's secure site Rates & Fees |

$0 | $95 | Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. |

on Chase's secure site Rates & Fees |

|

Capital One VentureOne Rewards Credit Card

|

None | $0 | Earn 20,000 Miles once you spend $500 on purchases within 3 months from account opening | ||

American Express Platinum Card®

|

None | $895 | You may be eligible for as high as 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. | ||

Delta SkyMiles® Reserve American Express Card

|

None | $650 | Earn 70,000 Bonus Miles after you spend $5,000 in eligible purchases on your new Card in your first 6 months of Card Membership. | ||

Capital One Venture Rewards Credit Card

|

None | $95 | Earn up to $1,000 towards travel once you spend $4,000 on purchases within the first 3 months of account opening | ||

Ink Business Preferred® Credit Card*

|

$0 | $95 | Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. | ||

Marriott Bonvoy Brilliant® American Express® Card

|

None | $650 | Earn 100,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. | ||

Bank of America® Travel Rewards Credit Card for Students*

|

$0 | $0 | 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases | ||

Capital One Quicksilver Secured Cash Rewards Credit Card

|

None | $0 | N/A | ||

American Express® Gold Card

|

None | $325 | You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. | ||

Capital One Venture X Rewards Credit Card

|

None | $395 | Earn 75,000 Miles when you spend $4,000 on purchases in the first 3 months from account opening |

Types of international travel credit cards

Airline credit cards

Airline credit cards are usually co-branded between a specific airline and a credit card issuer. They usually earn miles of one particular airline, and they typically come with airline-specific benefits such as priority boarding, free checked bags or help qualifying for airline elite status. They’re best for people who typically travel with one particular airline.

Hotel credit cards

Hotel credit cards are usually co-branded between a credit card issuer and a particular hotel chain. These cards usually earn hotel points that can be used for stays and also offer hotel-specific benefits such as complimentary night certificates, elite status or bonus rewards earning rates. They’re best for hotel brand loyalists.

General travel credit cards

General travel cards are great for international travel due to their flexibility and perks. These cards may earn flexible, transferable points such as Chase Ultimate Rewards points or Amex Membership Rewards points, which can be transferred to airline and hotel transfer partners to maximize their value. General travel credit cards also typically come with travel perks and insurance, and usually don’t charge foreign transaction fees.

Business travel credit cards

Business travel credit cards allow cardholders to maximize earnings, enjoy travel perks and take advantage of travel protections while traveling for business. Some of these cards are general business credit cards that offer travel perks, such as airport lounge access or travel credits, while others are co-branded airline or hotel credit cards with brand-specific perks such as free checked bags or complimentary elite status.

How to choose an international travel credit card

The best credit card for international travel for you will depend on your travel style and needs, but you’ll want to consider the following factors when shopping for an international travel credit card.

Whenever you use a debit or credit card outside of the U.S., your issuer may charge you a fee of about 3% of each purchase. While it may not seem like a huge deal, the charges can quickly add up to hundreds of dollars — or more. So look for a credit card without foreign transaction fees if you’re planning a trip abroad.

One of the most frustrating experiences you can encounter during international travel: having your card declined. While Mastercard and Visa are widely accepted around the world, you might have a harder time paying with American Express or Discover. You’ll want to make sure the card you’re interested in is usually accepted in your planned travel destination(s).

Some travel credit cards offer robust travel coverage that can give you peace of mind and protection on your next trip, while other cards have minimal coverage or none at all. The best credit cards for travel insurance typically include a full slate of travel protection such as: trip cancellation and delay insurance, travel accident insurance, lost or delayed luggage coverage and car rental insurance that works abroad.

Travel Tip:

Always check with your card issuer to make sure the countries where you plan to rent a car are included in your coverage.

The rewards earning rate is an important consideration when choosing a credit card for international travel. Look for a credit card that has higher earning rates on airline purchases, general travel and dining so you can maximize your trip earnings. If you travel infrequently, you might want to look for a card that also has a more generous earning rate on everyday purchases.

If a card only has high earning rates for travel booked through the issuer’s travel portal, make sure you’ll actually use the travel portal before getting the card.

Many of the best credit card sign-up bonuses happen to be offered on cards that work well for international travel. In some cases, the bonus may be worth $1,000 when used for travel, which could be enough to cover plane tickets or a hotel for your next trip. With some cards, you may even get an increased redemption rate if you use the card issuer’s travel portal, stretching your sign-up bonus even further.

The best credit cards for international travel tend to offer rewards redemption flexibility. Having redemption options allows you to maximize the value of the rewards you earn, especially when redeeming your points or miles for free travel. Many issuers offer a travel portal where you can book hotels, rental cars, vacation packages and more. But the best cards also let you transfer your rewards to airline and hotel partners at a 1:1 (or more advantageous) ratio.

Many of the best international travel cards offer travel perks to make your trips a little nicer. Premium travel cards, which tend to charge higher annual fees, may offer airport lounge access, Global Entry or TSA PreCheck application fee credits and other travel credits to offset the cost of your trips. Even cards with lower annual fees may offer perks such as free checked bags, priority boarding or complimentary elite status.

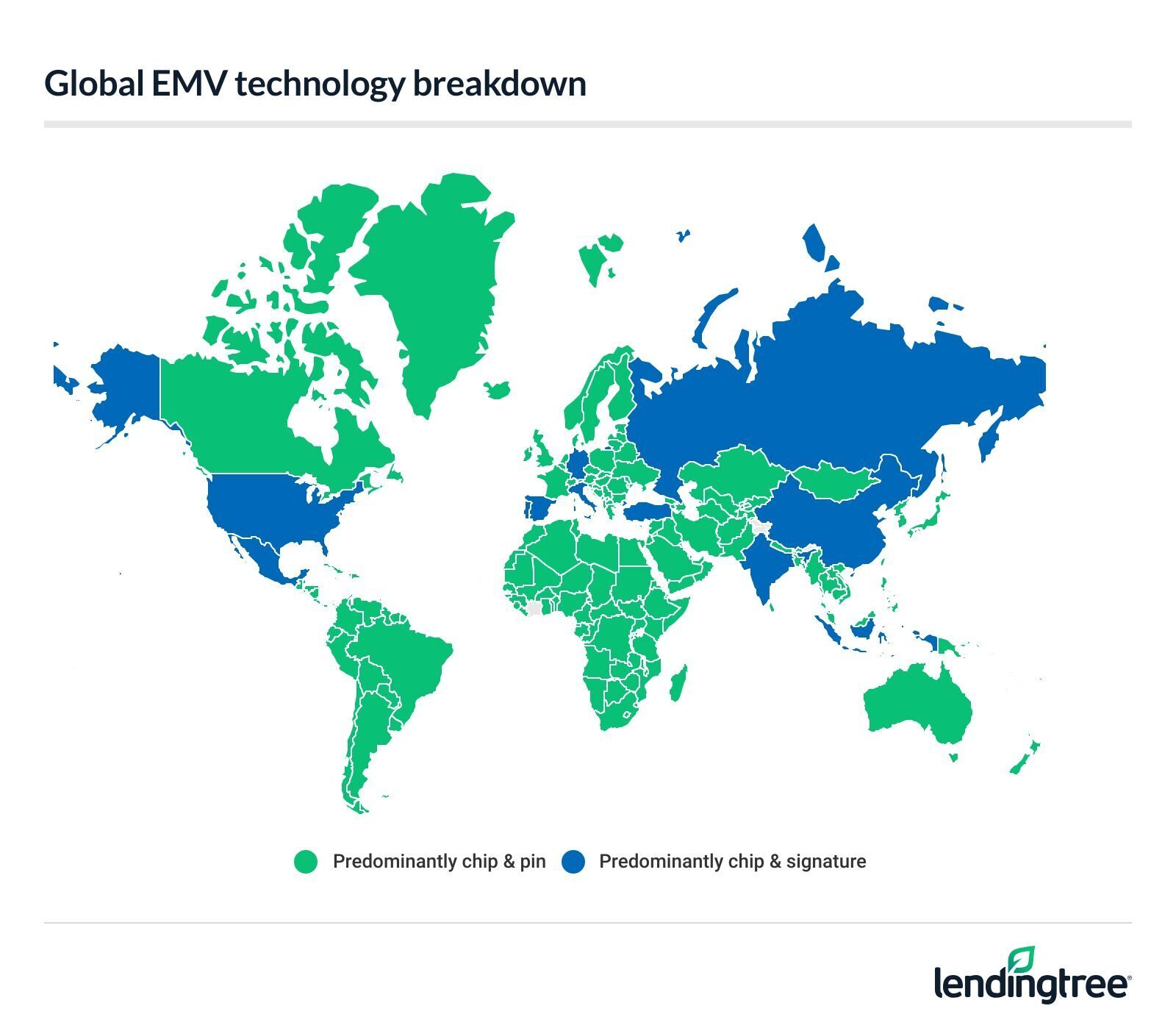

While contactless credit card payments are becoming more popular in Europe, some transactions, such buying tickets at an unattended terminal at a train station in France or Germany, may still require a card with both an EMV chip and a PIN. While most credit cards issued within the U.S. include an EMV chip, credit cards with PINs are rare. However, some issuers (such as Bank of America) allow you to add a PIN to your travel credit card. You should check with your issuer to see if they offer this option.

Best lounge access credit cards while traveling internationally

Another factor you should consider is whether you want airport lounge access, which can significantly improve your travel experience by giving you a quiet place to unwind, recharge and refuel with complimentary food and beverages. Many premium credit cards come with lounge membership or passes.

ADMIRALS CLUB

AMEX CENTURION LOUNGE

DELTA SKY CLUBS

- Delta SkyMiles® Reserve American Express Card

- American Express Platinum Card®

PRIORITY PASS™ SELECT

UNITED CLUB

International travel tips: how to use your credit card

Getting the best credit card for international travel is a step in the right direction, but you also need to know how to use it. Here are a few tips and tricks — and pitfalls to avoid — when using your credit card internationally.

Dynamic Currency Conversion (DCC) is when you pay in your own currency, rather than the local currency, while traveling internationally. When you use a credit card abroad, you may get a choice on whether to use DCC when paying. While it might seem like a good idea, since you’ll see the final cost in your own currency, you should generally avoid DCC due to less favorable exchange rates.

An example to illustrate how dynamic currency conversion works:

Say you’re traveling in France and you decide to buy a shirt that costs €100, at a time when the conversion rate is €1 to $1.07 (USD). That means the shirt would be worth $107. If you’re given the option to pay in USD and you accept, the merchant may charge $109 to your card — which means you’d be paying extra for no reason. It’s usually better to pay in the local currency, with a credit card that doesn’t charge foreign transaction fees.

This will help you rack up plenty of travel rewards points or miles, especially if you’re getting bonus points for everyday categories. You can use your rewards to get flight upgrades, free hotel nights or other perks on your next trip.

Paying for your expenses with a credit card can also give you additional security because credit cards typically come with a $0 fraud liability benefit.

Many premium travel credit cards come with benefits that can make your trip more affordable and comfortable. Check to see if your card offers these benefits and learn how to take advantage of them ahead of your next international trip.

- Room or seat upgrades: Some airline or hotel credit cards offer upgrades to cardholders. An international trip can be a great time to redeem some of these card benefits.

- Free checked baggage: Many airline credit cards offer free checked bags. If you need to fly with a lot of luggage, consider signing up for an airline credit card as an alternative to paying baggage fees.

- Free lounge access: If your international trip involves spending a lot of time in airports, look for cards that offer airport lounge access as a perk. An airport lounge can be a great way to make your trip more relaxing and less stressful, so you should look for a card that will give you lounge access in the airports you’re traveling through.

- Companion passes: Some airline credit cards offer a companion pass or certificate after you meet certain criteria, like earning enough points, or taking a certain number of flights. A companion pass allows a travel companion to fly with you for free, or for a reduced cost. A companion pass on an expensive international trip can be very valuable.

Global Entry and TSA PreCheck are two very popular trusted traveler programs. These programs can make your travel much nicer and less stressful by shortening your wait times, helping you avoid crowds and allowing you to skip some security steps. Many cards offer credits that cover the cost of Global Entry or TSA PreCheck.

If you’re looking at Global Entry vs. TSA PreCheck, Global Entry is the clear winner for international travel and includes TSA PreCheck benefits. Global Entry gives you expedited re-entry into the United States when you return from an international trip, while TSA PreCheck helps you speed through security for domestic travel.

Frequently asked questions

Most U.S. credit cards can be used internationally, though acceptance varies by country and merchant. Visa and Mastercard are more accepted worldwide than American Express and Discover.

Many travel credit cards offer some kind of travel insurance, but the coverage varies greatly from card to card. Some cards offer only very basic coverage, such as travel accident insurance. Other cards offer a robust slate of coverage that may include: trip cancellation and delay insurance, lost or delayed baggage coverage and car rental insurance. Some premium cards even offer emergency evacuation and transportation, which could help you get home if you got sick or injured on a trip abroad.

It’s a good idea to let your credit card company know about any international travel to make sure your purchases aren’t flagged as fraudulent. You can typically let your card issuer know about your travel plans through your online account or by calling the number on the back of your card.

Both Visa and Mastercard are widely accepted around the world in over 200 countries, but Visa generally offers significantly better travel benefits and insurance than Mastercard. Benefits do vary by card so it’s important to read the fine print on any card you’re considering for international travel.

Methodology

To make choosing the right card easier, we’ve looked at credit cards reviewed on LendingTree as well as cards on major issuer sites to compile a list of the best rewards credit cards for international travel.

Our recommendations are based on the additional value you can earn with the cards — including the rewards value, cost of ownership and value of benefits such as travel and purchase protections, lounge membership and airline companion passes. No cards on this page charge foreign transaction fees. Our choices are not influenced by our advertisers. Learn more about our credit card methodology.

To see rates & fees for American Express cards mentioned on this page, visit the links provided below:

- American Express Platinum Card®

- Delta SkyMiles® Reserve American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express® Gold Card

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

The information related to the Ink Business Preferred® Credit Card, Bank of America® Travel Rewards Credit Card for Students, Citi® / AAdvantage® Executive World Elite Mastercard®, Chase Sapphire Reserve® and The New United Club℠ Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.