How to Do a Citi Balance Transfer

Citi is an advertising partner.

If you’re looking to pay down credit card debt by transferring a balance from a high-interest card to one with a 0% introductory APR, know that Citi offers balance transfer cards boasting some of the longest intro 0% APRs available. As long as the debt you want to transfer is on a non-Citi credit card, a balance transfer with Citi could give up to almost two years of no interest.

What you need to initiate a Citi balance transfer

You’ll need a few pieces of information to get your balance transfer started:

- A Citi credit card. Perhaps you opened a new Citi card for the purpose of doing a balance transfer — or maybe you have an existing Citi card with an active balance transfer offer.

- The amount of debt you wish to transfer. Citi allows cardholders to transfer balances up to the credit limit to their Citi card minus the amount of any applicable balance transfer fee.

- Your old account information. Be ready to enter the account numbers of the credit card(s) you want to move debt from so Citi can send payment.

How to do a balance transfer to a new Citi card

When opening a new Citi credit card online, you should be able to request a balance transfer toward the end of the online application form. You’ll have to enter account details for the card(s) you want to pay off and the amount(s) to be paid.

Be aware that your balance transfer request won’t start to process until your new Citi card has been open for at least 14 days. If there’s a payment due on your old account in the interim, you’re responsible for making it.

You can also call the number on the back of your new card once it comes in the mail and let a Citi customer service representative know you’d like to initiate a balance transfer request. But make sure to check if there’s a deadline for requesting your balance transfer so you don’t miss out on the 0% intro APR as some cards have 60- to 90-day transfer limits.

How to do a balance transfer for existing Citi cardholders

If you already have a Citi credit card, you can check for balance transfer offers by logging into your online account, hovering over the “rewards and offers” tab and selecting “Offers for you” from the menu that appears.

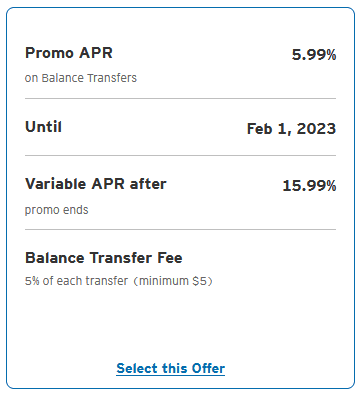

If you have a balance transfer offer, the next screen should present you with a button saying “transfer now.” Clicking that button will show you the details of your balance transfer offer in a format like this:

Note that your offer might be merely a reduced balance transfer APR, not an intro 0% APR. If so, you’ll have to decide if the lower rate offers enough savings to make it worth the balance transfer fee, or if you’d apply for a new Citi card offering an introductory 0% APR.

How long does a balance transfer take with Citi?

If you take advantage of a balance transfer offer on an existing Citi card and initiate a request to pay off another credit card electronically, that process will go through in as quickly as two to four business days, according to a Citi customer service representative.

Meanwhile, if you have an offer on an existing Citi card and ask Citi to send a check to your other lender, that might take up to 10 days.

Finally, if you open a new Citi card and request a balance transfer, that won’t begin processing until your account has been open for at least 14 days.

What types of debt can you transfer?

One of the most common uses for a balance transfer is to pay off debt you’re carrying on a credit card with a high APR. While you can’t transfer balances between two Citi cards, you can transfer debt from pretty much any other credit card issuer to a Citi card, such as American Express, Capital One, Chase, Discover and more.

In addition, you can also use a Citi balance transfer to pay off other types of debt — at least as long as the other lender accepts balance transfer payments either electronically or by check.

Best Citi balance transfer credit cards

Based on our research of cards available through LendingTree, as well as other Citi cards, we gathered some of the most generous balance transfer cards currently available that offer a long intro 0% APR.

Citi Simplicity® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro Balance Transfer APR: 0% intro APR for 21 months on Balance Transfers

Followed by an ongoing balance transfer rate of 17.49% - 28.24% (variable).

- Lengthy intro APR on purchases, even longer for balance transfers

- No late fee or penalty rate

- $0 annual fee

- No rewards program

- No sign-up bonus

The Citi Simplicity® Card comes with an exceptional intro APR period on transferred debt: 0% intro APR for 21 months on Balance Transfers, after which a 17.49% - 28.24% (variable) APR applies.

There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5)There’s an intro APR on purchases, though it’s relatively short: 0% intro apr for 12 months on purchases, after which a 17.49% - 28.24% (variable) APR applies.

The annual fee is $0, but there’s a foreign transaction fee of 3%.

You won’t earn rewards with this card, but when it comes to a long 0% intro APR on balance transfers, the Citi Simplicity® Card is hard to beat.

Who’s this card best for?

If you need almost two years of 0% intro APR on balance transfers, the Citi Simplicity® Card might just be the card for you. However, know that in exchange for the long intro period, the Citi Simplicity® Card charges a balance transfer fee that’s on the high side. But if you need to maximize the time you have to work on getting out of debt, this card is a powerful tool.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR on balance transfers for 21 months and on purchases for 12 months from date of account opening. After that the variable APR will be 17.49% - 28.24%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Stay protected with Citi® Quick Lock

Citi® Diamond Preferred® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro Balance Transfer APR: 0% intro APR for 21 months on Balance Transfers

Followed by an ongoing balance transfer rate of 16.49% - 27.24% (variable).

- $0 annual fee

- Lengthy intro APR on purchases, even longer for balance transfers

- No rewards program

- No sign-up bonus

- Balance transfer fee

The Citi® Diamond Preferred® Card comes with an exceptional intro APR of 0% intro apr for 21 months on balance transfers. After the intro period ends, a 16.49% - 27.24% (variable) APR applies.

A balance transfer fee applies with this offer; 5% of each balance transfer; $5 minimum.

The card’s intro APR on purchases is short: 0% intro apr for 12 months on purchases — after, a 16.49% - 27.24% (variable) APR applies.

And while you’ll pay a $0 annual fee to carry the card, beware the 3% foreign transaction fee.

Who’s this card best for?

Like the Citi Simplicity® Card mentioned above, the Citi® Diamond Preferred® Card offers almost two years of no interest on transferred balances. That deal is hard to beat if you’re playing the long game, even though the flip side is a balance transfer fee that’s a bit on the high side.

- 0% Intro APR on balance transfers for 21 months and on purchases for 12 months from date of account opening. After that the variable APR will be 16.49% - 27.24%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

Citi Double Cash® Card

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro Balance Transfer APR: 0% intro APR for 18 months on Balance Transfers

Followed by an ongoing balance transfer rate of 17.49% - 27.49% (variable).

- Long intro APR on balance transfers

- Solid cash back rate on every purchase

- $0 annual fee

- Valuable sign-up bonus

- Balance transfer fee

- Cash back isn’t issued all at once

The Citi Double Cash® Card comes with an intro APR of 0% intro APR for 18 months on Balance Transfers, after which a 17.49% - 27.49% (Variable) APR applies. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5)

The Citi Double Cash® Card does come with a rewards program: Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel.

The annual fee is $0. But if you’re traveling, beware the 3% foreign transaction fee.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, earn 5% total cash back on hotel, car rentals and attractions booked with Citi Travel.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 17.49% - 27.49%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

Citi Custom Cash® Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro Balance Transfer APR: 0% intro APR for 18 months on Balance Transfers

Followed by an ongoing balance transfer rate of 17.49% - 27.49% (variable).

- Flexible rewards rate

- Long intro APR on purchases and balance transfers

- Valuable sign-up bonus

- $0 annual fee

- Balance transfer fee

- Highest rewards rate has spending cap

The Citi Custom Cash® Card offers a 0% intro APR for 18 months on Balance Transfers, after which a 17.49% - 27.49% (variable) APR applies. This card has a high balance transfer fee: 5% of each balance transfer; $5 minimum. However, cardholders also get a N/A; after, a 17.49% - 27.49% (variable) APR applies.

You can also earn a sign-up bonus: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

The card offers excellent ongoing value with a cash back program: Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.

Finally, the annual fee is $0 and the foreign transaction fee is 3%.

Who’s this card best for?

The Citi Custom Cash® Card provides ongoing value in the form of a unique cash back program. If you max out the $500 monthly spend cap on the 5% cash back rate, that’s $25 in cash back. Your top spending category from the following list will automatically receive 5% cash back each month:

- Restaurants

- Gas stations

- Grocery stores

- Select travel

- Select transit

- Select streaming services

- Drugstores

- Home improvement stores

- Fitness clubs

- Live entertainment

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 17.99% - 27.99%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2026.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- No Annual Fee

- Citi will only issue one Citi Custom Cash® Card account per person.

Citi Rewards+® Card*

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.

How LendingTree Rates Credit Cards?

Our experts rate credit cards based on several factors including card benefits, bonus offers and independent research. Credit card issuers do not influence or have a say in our card ratings. Read our credit card methodology here.Intro Balance Transfer APR: 0% intro APR for 15 months on Balance Transfers

Followed by an ongoing balance transfer rate of 17.74% - 27.74% (variable).

- Long intro APR on purchases and balance transfers

- Elevated rewards on supermarkets and gas stations

- Flexible point redemptions

- $0 annual fee

- Balance transfer fee

- 3% foreign transaction fee

The Citi Rewards+® Card also offers an intro APR on balance transfers of 0% intro APR for 15 months on Balance Transfers, after which a 17.74% - 27.74% (variable) APR applies.

However, it has a lower balance transfer fee: There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5)

Cardholders also get an intro APR on purchases of 0% intro APR for 15 months on Purchases. After, a 17.74% - 27.74% (variable) APR applies.

You can also earn a sign-up bonus: Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com

As for ongoing rewards: Earn 2X ThankYou® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points thereafter. Plus, earn 1X ThankYou® Points on All Other Purchases. Plus, as a special offer, earn a total of 5 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025.

The annual fee is $0, and there’s a foreign transaction fee of 3%.

Who’s this card best for?

Though the Citi Rewards+® Card doesn’t come with as long an intro APR offer as some of the other Citi cards listed here, it still offers more than a year of no interest on transferred debt.

It also offers rewards on every purchase, and a unique benefit where your rewards are rounded up to the nearest 10 points on every purchase. For example, Citi gives the example of $2 spent at a parking meter being rounded up to 10 points and a $12 spent on drugstore purchases being rounded up to 20 points. If you make lots of small purchases when you’re out and about, that benefit could net you a nice chunk of extra rewards.

- Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com

- Plus, as a special offer, earn a total of 5 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025.

- 0% Intro APR on balance transfers for 15 months on purchases; after that, the variable APR will be 17.74% - 27.74%, based on your creditworthiness. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Earn 2X ThankYou® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points thereafter. Plus, earn 1X ThankYou® Points on All Other Purchases.

- The Citi Rewards+® Card - the only credit card that automatically rounds up to the nearest 10 points on every purchase - with no cap.

- No Annual Fee

Comparison of Citi balance transfer cards

| Credit Cards | Our Ratings | Intro Balance Transfer APR | Regular Balance Transfer Rate | Balance Transfer Fee | |

|---|---|---|---|---|---|

Citi Simplicity® Card

|

0% intro APR for 21 months on Balance Transfers | 17.49% - 28.24% (Variable) | There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5) | ||

Citi® Diamond Preferred® Card

|

0% intro APR for 21 months on Balance Transfers | 16.49% - 27.24% (Variable) | Balance transfer fee applies with this offer; 5% of each balance transfer; $5 minimum. | ||

Citi Double Cash® Card

|

0% intro APR for 18 months on Balance Transfers | 17.49% - 27.49% (Variable) | There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5) | ||

Citi Custom Cash® Card*

|

0% intro APR for 18 months on Balance Transfers | 17.49% - 27.49% (Variable) | 5% of each balance transfer; $5 minimum. | ||

Citi Rewards+® Card*

|

0% intro APR for 15 months on Balance Transfers | 17.74% - 27.74% (Variable) | There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5) |

Citi balance transfer: Frequently asked questions

No, it’s a rule across the board that you can’t transfer balances between cards from the same issuer. If you are carrying debt on a Citi credit card and wish to transfer it, consider a balance transfer card from a different issuer.

You’ll be able to transfer up to your credit limit on your Citi card, minus the amount of any balance transfer fees.

Yes, if you have a Citi balance transfer offer available, you should be able to transfer a balance from an American Express card to your Citi card. You’ll be able to transfer a balance from virtually any issuer other than Citi itself.

The information related to the Citi Custom Cash® Card and Citi Rewards+® Card has been independently collected by LendingTree and has not been reviewed or provided by the issuer of this card prior to publication. Terms apply.

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.