Cheapest Car Insurance in Washington State (2026)

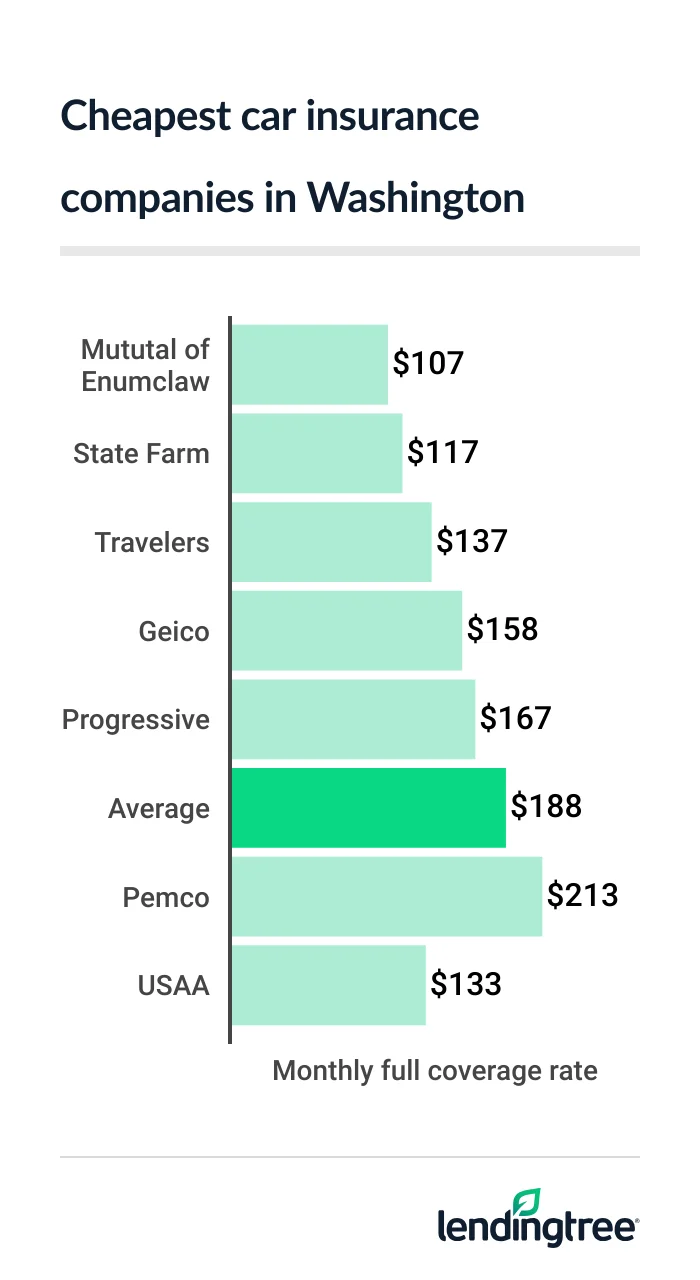

Mutual of Enumclaw has the cheapest car insurance in Washington state, at $107 per month for full coverage. This is $81 less than the state average of $188 per month.

Best cheap car insurance in Washington State

Cheapest full coverage car insurance in Washington state: Mutual of Enumclaw

Mutual of Enumclaw has Washington’s cheapest full coverage car insurance, with an average rate of $107 per month.

- State Farm is the second-cheapest company for full coverage, at $117 per month. Travelers is third, at $137 per month.

- All three companies come in well below the state average of $188 per month for full coverage insurance.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Mutual of Enumclaw | $107 | Not rated |

| State Farm | $117 | |

| Travelers | $137 | |

| Geico | $158 | |

| Progressive | $167 | |

| Pemco | $213 | |

| Allstate | $221 | |

| Farmers | $240 | |

| Sentry | Sentry | $392 | Not rated |

| USAA* | $133 | |

Although State Farm’s average rate for full coverage

State Farm offers many more discounts than Mutual of Enumclaw does, including ones for having vehicle safety features, going three years or more without a moving violation or accident, and paying for your entire policy period upfront.

Cheap Washington state liability insurance: Mutual of Enumclaw

At $40 per month, Mutual of Enumclaw also has the cheapest liability insurance quotes in Washington state. State Farm is only a few dollars more, though, at $43 per month.

The average cost of liability

Liability auto insurance rates

| Company | Monthly rate |

|---|---|

| Mutual of Enumclaw | $40 |

| State Farm | $43 |

| Travelers | $61 |

| Pemco | $64 |

| Progressive | $64 |

| Geico | $64 |

| Farmers | $99 |

| Allstate | $115 |

| Sentry | $119 |

| USAA* | $37 |

Besides discounts, another reason to consider State Farm is that it scores well with customers. This is based on its above-average J.D. Power

USAA has an even better J.D. Power rating, and it’s also cheaper than both Mutual of Enumclaw and State Farm. But only active or retired military and their families can buy a policy from USAA.

To find out which of these companies is the cheapest for you, compare car insurance quotes from each of them before you renew or buy a policy.

Washington state’s cheapest car insurance quotes for teen drivers: Mutual of Enumclaw

To get the cheapest teen car insurance in Washington, make sure you include Mutual of Enumclaw when you compare quotes. It has the state’s lowest teen liability rates of $120 per month. Its teen rates for full coverage are also the state’s best, at $264 per month.

Monthly car insurance rates for teen drivers

| Company | Liability-only | Full |

|---|---|---|

| Mutual of Enumclaw | $120 | $264 |

| State Farm | $134 | $322 |

| Travelers | $172 | $334 |

| Pemco | $186 | $562 |

| Geico | $198 | $454 |

| Progressive | $246 | $768 |

| Sentry | $298 | $673 |

| Allstate | $344 | $665 |

| Farmers | $362 | $622 |

| USAA* | $137 | $423 |

You should also get a quote from State Farm if you want cheap car insurance for a teen in Washington. The company’s average liability rate for teens is only $14 per month more than Mutual of Enumclaw’s, at $134 per month. For full coverage, State Farm’s average rate is $322 per month.

State Farm and Mutual of Enumclaw each offer the most common car insurance discounts for teen drivers. Both companies:

- Have a discount for teens who complete an approved driver education course

- Offer a discount to students who get good grades

- Give discounts to students who go away to school and don’t take a vehicle with them

Cheapest auto insurance with a speeding ticket in Washington state: State Farm

State Farm and Mutual of Enumclaw have Washington state’s cheapest auto insurance for drivers with a speeding ticket on their records.

State Farm’s average rate for these drivers is $127 per month, while Mutual of Enumclaw’s is just $2 per month more.

Car insurance quotes after a speeding ticket

| Company | Monthly rate |

|---|---|

| State Farm | $127 |

| Mutual of Enumclaw | $129 |

| Travelers | $168 |

| Progressive | $224 |

| Geico | $238 |

| Pemco | $246 |

| Allstate | $282 |

| Farmers | $304 |

| Sentry | $633 |

| USAA* | $157 |

A typical driver in Washington pays $251 per month for car insurance after getting a speeding ticket. That’s $63 per month more than what drivers with clean records pay.

If you have a policy with State Farm, however, you may see a much smaller increase. We found that State Farm only raises its customers’ rates by $10 per month after a ticket, on average.

Best cheap car insurance in Washington state after an accident: State Farm

Drivers in Washington with an at-fault accident on their records can get the cheapest car insurance quotes from State Farm, at $136 per month.

Mutual of Enumclaw is the state’s second-cheapest company for car insurance after an accident, at $143 per month.

Insurance quotes after an at-fault accident

| Company | Monthly rate |

|---|---|

| State Farm | $136 |

| Mutual of Enumclaw | $143 |

| Travelers | $187 |

| Geico | $260 |

| Pemco | $260 |

| Progressive | $279 |

| Farmers | $320 |

| Allstate | $337 |

| Sentry | $684 |

| USAA* | $183 |

The average Washington driver pays $91 per month more for car insurance after an accident. That’s almost 50% higher than what drivers with a clean record pay.

Accident forgiveness

Washington state’s best insurance for teens with a bad driving record: State Farm

State Farm has the cheapest car insurance for teens with a speeding ticket or accident on their records in Washington. The company’s average rate for teens with a ticket is $149 per month. For teens with an accident, the average rate is $164 per month.

Monthly insurance rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $149 | $164 |

| Mutual of Enumclaw | $157 | $181 |

| Pemco | $195 | $204 |

| Travelers | $214 | $253 |

| Progressive | $265 | $294 |

| Geico | $273 | $306 |

| Sentry | $398 | $409 |

| Farmers | $424 | $401 |

| Allstate | $465 | $586 |

| USAA* | $187 | $236 |

Mutual of Enumclaw is the state’s second-cheapest company for these teen drivers. For teens with a ticket, it charges about $157 per month. Teens with an accident pay around $181 per month with Mutual of Enumclaw.

Cheap car insurance in Washington state after a DUI: Mutual of Enumclaw

At $183 per month, Mutual of Enumclaw has Washington’s cheapest DUI insurance rates.

Travelers and Progressive are nearly as cheap, however. Travelers’ average rate for drivers with a DUI (driving under the influence) conviction is $194 per month. With Progressive, the average rate is $198 per month.

Car insurance rates with a DUI

| Company | Monthly rate |

|---|---|

| Mutual of Enumclaw | $183 |

| Travelers | $194 |

| Progressive | $198 |

| Geico | $243 |

| State Farm | $255 |

| Allstate | $294 |

| Pemco | $296 |

| Farmers | $369 |

| Sentry | $519 |

| USAA* | $245 |

Both Travelers and Progressive have more car insurance discounts than Mutual of Enumclaw does. If you can get a few, either of these companies could have the cheapest quotes for you.

If you’re convicted of DUI in Washington state, you can expect your car insurance rates to go up by around $92 per month.

Best Washington state car insurance quotes for bad credit: Mutual of Enumclaw

The best company for cheap car insurance with bad credit in Washington state is Mutual of Enumclaw, where rates average $185 per month.

Geico is next, with an average rate of $194 per month. Travelers comes in third for most of the state’s drivers with poor credit, at $217 per month.

Bad credit car insurance rates

| Company | Monthly rate |

|---|---|

| Mutual of Enumclaw | $185 |

| Geico | $194 |

| Travelers | $217 |

| Farmers | $240 |

| State Farm | $240 |

| Progressive | $260 |

| Pemco | $342 |

| Allstate | $350 |

| Sentry | $392 |

| USAA* | $204 |

You can get more discounts from Geico than you can from any other car insurance company we surveyed in Washington.

Many are easy to get, too, including discounts for airbags, anti-lock brakes, anti-theft systems and daytime running lights. You may also earn a discount from Geico for getting a quote before you buy your policy and signing up for paperless billing.

The state average rate for car insurance with poor credit is $262 per month. This is $74 per month more than what Washington drivers with good credit pay for the same coverage.

Find out your credit score for free with LendingTree Spring before you shop for car insurance.

Best auto insurance in Washington state

Mutual of Enumclaw and State Farm are Washington state’s best car insurance companies.

Mutual of Enumclaw has the cheapest auto insurance rates for most of the state’s drivers. It doesn’t offer many discounts or coverage options, however, which some Washingtonians might consider a dealbreaker. It also doesn’t have a J.D. Power score.

Car insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| Allstate | 635 | A+ | |

| Farmers | 622 | A | |

| Geico | 645 | A++ | |

| Mutual of Enumclaw | Not rated | Not rated | A- |

| Pemco | 619 | B++ | |

| Progressive | 621 | A+ | |

| Sentry | Not rated | Not rated | A+ |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA | 735 | A++ |

State Farm’s rates are often higher than Mutual of Enumclaw’s, but usually only by a few dollars per month. Also, State Farm has many more discounts than Mutual of Enumclaw, which means it could be cheaper for you if you get even a couple.

State Farm has the second-best J.D. Power score of the companies we surveyed as well.

Washington car insurance rates by city

Washington’s cheapest city for car insurance is Anacortes, where rates average $148 per month.

Bryn Mawr-Skyway, part of the Seattle metro area, has the state’s most expensive car insurance rates of $247 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $163 | -14% |

| Acme | $166 | -12% |

| Addy | $170 | -10% |

| Adna | $174 | -8% |

| Ahtanum | $161 | -15% |

| Airway Heights | $171 | -9% |

| Albion | $158 | -16% |

| Alderton | $212 | 12% |

| Alderwood Manor | $221 | 17% |

| Algona | $223 | 19% |

| Allyn | $174 | -8% |

| Almira | $155 | -18% |

| Amanda Park | $160 | -15% |

| Amboy | $177 | -6% |

| Ames Lake | $209 | 11% |

| Anacortes | $148 | -21% |

| Anatone | $160 | -15% |

| Anderson Island | $197 | 5% |

| Appleton | $169 | -10% |

| Ardenvoir | $169 | -10% |

| Ariel | $172 | -9% |

| Arlington | $186 | -2% |

| Arlington Heights | $186 | -2% |

| Artondale | $186 | -1% |

| Ashford | $183 | -3% |

| Asotin | $158 | -16% |

| Auburn | $221 | 17% |

| Bainbridge Island | $172 | -9% |

| Bangor Base | $170 | -10% |

| Barberton | $190 | 1% |

| Baring | $203 | 8% |

| Battle Ground | $187 | -1% |

| Bay Center | $158 | -16% |

| Bay View | $159 | -16% |

| Beaver | $149 | -21% |

| Belfair | $171 | -9% |

| Bellevue | $214 | 14% |

| Bellingham | $159 | -15% |

| Belmont | $156 | -17% |

| Benge | $156 | -17% |

| Benton City | $153 | -19% |

| Bethel | $173 | -8% |

| Beverly | $163 | -14% |

| Bickleton | $158 | -16% |

| Bingen | $160 | -15% |

| Birch Bay | $156 | -17% |

| Black Diamond | $202 | 7% |

| Blaine | $156 | -17% |

| Blakely Island | $153 | -19% |

| Bonney Lake | $207 | 10% |

| Bothell | $207 | 10% |

| Bothell East | $206 | 9% |

| Bothell West | $211 | 12% |

| Boulevard Park | $247 | 31% |

| Bow | $158 | -16% |

| Boyds | $170 | -10% |

| Bremerton | $174 | -7% |

| Brewster | $162 | -14% |

| Bridgeport | $156 | -17% |

| Brier | $221 | 17% |

| Brinnon | $159 | -15% |

| Browns Point | $229 | 21% |

| Brownstown | $174 | -8% |

| Brush Prairie | $193 | 2% |

| Bryn Mawr-Skyway | $247 | 31% |

| Buckley | $195 | 3% |

| Bucoda | $179 | -5% |

| Buena | $159 | -16% |

| Bunk Foss | $204 | 8% |

| Burbank | $158 | -16% |

| Burien | $229 | 22% |

| Burley | $173 | -8% |

| Burlington | $159 | -15% |

| Burton | $212 | 12% |

| Camano Island | $160 | -15% |

| Camas | $184 | -2% |

| Canterwood | $188 | 0% |

| Canyon Creek | $186 | -2% |

| Carbonado | $199 | 5% |

| Carlsborg | $149 | -21% |

| Carlton | $164 | -13% |

| Carnation | $199 | 5% |

| Carrolls | $167 | -11% |

| Carson | $174 | -8% |

| Cascade Valley | $149 | -21% |

| Cashmere | $158 | -16% |

| Castle Rock | $165 | -12% |

| Cathcart | $203 | 8% |

| Cathlamet | $166 | -12% |

| Cavalero | $201 | 7% |

| Centerville | $161 | -15% |

| Central Park | $163 | -14% |

| Centralia | $166 | -12% |

| Chain Lake | $192 | 2% |

| Chattaroy | $174 | -8% |

| Chehalis | $161 | -14% |

| Chelan | $156 | -17% |

| Chelan Falls | $158 | -16% |

| Cheney | $164 | -13% |

| Cherry Grove | $187 | -1% |

| Chewelah | $166 | -12% |

| Chico | $164 | -13% |

| Chimacum | $155 | -18% |

| Chinook | $172 | -9% |

| Cinebar | $169 | -11% |

| Clallam Bay | $151 | -20% |

| Clarkston | $153 | -19% |

| Clarkston Heights-Vineland | $153 | -19% |

| Clayton | $175 | -7% |

| Cle Elum | $158 | -16% |

| Clear Lake | $160 | -15% |

| Clearlake | $161 | -15% |

| Clearview | $203 | 8% |

| Clinton | $170 | -10% |

| Clover Creek | $223 | 18% |

| Clyde Hill | $211 | 12% |

| Colbert | $180 | -5% |

| Colfax | $150 | -21% |

| College Place | $163 | -13% |

| Colton | $159 | -15% |

| Colville | $163 | -13% |

| Conconully | $162 | -14% |

| Concrete | $164 | -13% |

| Connell | $153 | -19% |

| Copalis Beach | $158 | -16% |

| Copalis Crossing | $160 | -15% |

| Cosmopolis | $161 | -14% |

| Cottage Lake | $203 | 8% |

| Cougar | $179 | -5% |

| Coulee City | $156 | -17% |

| Coulee Dam | $159 | -16% |

| Country Homes | $179 | -5% |

| Coupeville | $156 | -17% |

| Covington | $219 | 16% |

| Cowiche | $164 | -13% |

| Creston | $158 | -16% |

| Crocker | $202 | 7% |

| Curlew | $167 | -12% |

| Curtis | $171 | -9% |

| Cusick | $171 | -9% |

| Custer | $161 | -15% |

| Dallesport | $160 | -15% |

| Danville | $169 | -10% |

| Darrington | $173 | -8% |

| Davenport | $159 | -16% |

| Dayton | $156 | -17% |

| Deer Harbor | $154 | -18% |

| Deer Park | $171 | -9% |

| Deming | $166 | -12% |

| Des Moines | $222 | 18% |

| Dixie | $155 | -17% |

| Doty | $169 | -10% |

| Dryden | $158 | -16% |

| DuPont | $194 | 3% |

| Duluth | $182 | -3% |

| Duvall | $203 | 8% |

| East Cathlamet | $166 | -12% |

| East Hill-Meridian | $223 | 19% |

| East Olympia | $190 | 1% |

| East Port Orchard | $171 | -9% |

| East Renton Highlands | $222 | 18% |

| East Wenatchee | $157 | -17% |

| Eastgate | $214 | 14% |

| Eastmont | $205 | 9% |

| Easton | $168 | -11% |

| Eastsound | $149 | -21% |

| Eatonville | $188 | 0% |

| Edgewood | $215 | 14% |

| Edmonds | $217 | 15% |

| Edwall | $163 | -13% |

| Elbe | $193 | 2% |

| Electric City | $153 | -19% |

| Elk | $178 | -6% |

| Elk Plain | $217 | 15% |

| Ellensburg | $152 | -19% |

| Elma | $164 | -13% |

| Elmer City | $161 | -14% |

| Eltopia | $157 | -17% |

| Endicott | $151 | -20% |

| Entiat | $163 | -13% |

| Enumclaw | $195 | 3% |

| Ephrata | $152 | -19% |

| Erlands Point-Kitsap Lake | $169 | -10% |

| Esperance | $220 | 17% |

| Ethel | $176 | -7% |

| Evans | $169 | -10% |

| Everett | $215 | 14% |

| Everson | $161 | -15% |

| Fairchild AFB | $175 | -7% |

| Fairfield | $170 | -10% |

| Fairwood | $206 | 10% |

| Fall City | $201 | 7% |

| Farmington | $158 | -16% |

| Federal Way | $231 | 23% |

| Felida | $189 | 0% |

| Fern Prairie | $184 | -2% |

| Ferndale | $157 | -17% |

| Fife | $222 | 18% |

| Fife Heights | $225 | 19% |

| Finley | $158 | -16% |

| Fircrest | $220 | 17% |

| Five Corners | $198 | 5% |

| Fobes Hill | $192 | 2% |

| Ford | $170 | -10% |

| Fords Prairie | $166 | -12% |

| Forks | $151 | -20% |

| Fort Lewis | $223 | 18% |

| Four Lakes | $164 | -13% |

| Fox Island | $190 | 1% |

| Frederickson | $221 | 17% |

| Freeland | $162 | -14% |

| Friday Harbor | $148 | -21% |

| Fruitland | $167 | -11% |

| Galvin | $177 | -6% |

| Garfield | $153 | -19% |

| Garrett | $157 | -17% |

| Geneva | $159 | -15% |

| George | $151 | -20% |

| Gifford | $166 | -12% |

| Gig Harbor | $187 | -1% |

| Gleed | $164 | -13% |

| Glenoma | $168 | -11% |

| Glenwood | $160 | -15% |

| Gold Bar | $192 | 2% |

| Goldendale | $156 | -17% |

| Graham | $216 | 15% |

| Grand Coulee | $156 | -17% |

| Grand Mound | $169 | -10% |

| Grandview | $157 | -17% |

| Granger | $156 | -17% |

| Granite Falls | $193 | 2% |

| Grapeview | $173 | -8% |

| Grayland | $158 | -16% |

| Grays River | $169 | -10% |

| Greenacres | $161 | -15% |

| Greenbank | $160 | -15% |

| Hamilton | $169 | -10% |

| Hansville | $167 | -11% |

| Harrah | $163 | -14% |

| Harrington | $161 | -14% |

| Hartline | $157 | -17% |

| Hay | $149 | -21% |

| Hazel Dell | $193 | 3% |

| Heisson | $182 | -3% |

| High Bridge | $199 | 6% |

| Hobart | $209 | 11% |

| Hockinson | $190 | 1% |

| Home | $194 | 3% |

| Hoodsport | $168 | -11% |

| Hooper | $156 | -17% |

| Hoquiam | $159 | -16% |

| Humptulips | $162 | -14% |

| Hunters | $164 | -13% |

| Hunts Point | $211 | 12% |

| Husum | $165 | -12% |

| Ilwaco | $167 | -11% |

| Inchelium | $168 | -11% |

| Index | $189 | 0% |

| Indianola | $169 | -10% |

| Inglewood-Finn Hill | $211 | 12% |

| Ione | $166 | -12% |

| Issaquah | $204 | 8% |

| Joyce | $161 | -15% |

| Kahlotus | $161 | -15% |

| Kalama | $168 | -11% |

| Kapowsin | $210 | 11% |

| Keller | $165 | -13% |

| Kelso | $165 | -12% |

| Kenmore | $219 | 16% |

| Kennewick | $160 | -15% |

| Kent | $230 | 22% |

| Kettle Falls | $165 | -12% |

| Key Center | $187 | -1% |

| Keyport | $167 | -11% |

| Kingsgate | $211 | 12% |

| Kingston | $170 | -10% |

| Kirkland | $207 | 10% |

| Klahanie | $202 | 7% |

| Klickitat | $161 | -14% |

| La Center | $183 | -3% |

| La Conner | $156 | -17% |

| La Grande | $206 | 9% |

| La Push | $153 | -19% |

| LaCrosse | $152 | -20% |

| Lacey | $184 | -2% |

| Lake Cassidy | $194 | 3% |

| Lake Forest Park | $227 | 21% |

| Lake Holm | $218 | 16% |

| Lake Ketchum | $169 | -10% |

| Lake Marcel-Stillwater | $199 | 6% |

| Lake Morton-Berrydale | $219 | 16% |

| Lake Shore | $191 | 2% |

| Lake Stevens | $200 | 6% |

| Lake Stickney | $226 | 20% |

| Lake Tapps | $207 | 10% |

| Lakebay | $194 | 3% |

| Lakeland North | $223 | 19% |

| Lakeland South | $230 | 22% |

| Lakewood | $227 | 20% |

| Lamona | $156 | -17% |

| Lamont | $159 | -15% |

| Langley | $165 | -12% |

| Larch Way | $220 | 17% |

| Latah | $168 | -11% |

| Laurier | $166 | -12% |

| Leavenworth | $157 | -17% |

| Lebam | $171 | -9% |

| Lewisville | $187 | -1% |

| Liberty Lake | $161 | -15% |

| Lilliwaup | $171 | -9% |

| Lincoln | $158 | -16% |

| Lind | $158 | -16% |

| Littlerock | $187 | -1% |

| Lochsloy | $198 | 5% |

| Lofall | $162 | -14% |

| Long Beach | $172 | -9% |

| Longbranch | $193 | 3% |

| Longmire | $201 | 7% |

| Longview | $166 | -12% |

| Longview Heights | $166 | -12% |

| Loomis | $168 | -11% |

| Loon Lake | $175 | -7% |

| Lopez Island | $148 | -21% |

| Lummi Island | $161 | -15% |

| Lyle | $159 | -15% |

| Lyman | $171 | -9% |

| Lynden | $159 | -16% |

| Lynnwood | $222 | 18% |

| Mabton | $159 | -16% |

| Machias | $198 | 5% |

| Malaga | $159 | -16% |

| Malden | $163 | -13% |

| Malo | $169 | -10% |

| Malone | $164 | -13% |

| Malott | $162 | -14% |

| Maltby | $203 | 8% |

| Manchester | $171 | -9% |

| Mansfield | $156 | -17% |

| Manson | $154 | -18% |

| Maple Falls | $167 | -11% |

| Maple Heights-Lake Desire | $220 | 17% |

| Maple Valley | $208 | 11% |

| Maplewood | $188 | 0% |

| Marblemount | $165 | -13% |

| Marcus | $167 | -11% |

| Marietta-Alderwood | $159 | -15% |

| Marlin | $152 | -19% |

| Marrowstone | $156 | -17% |

| Marshall | $165 | -12% |

| Martha Lake | $214 | 13% |

| Marysville | $197 | 4% |

| Matlock | $172 | -9% |

| Mattawa | $154 | -18% |

| Mazama | $178 | -5% |

| McChord AFB | $221 | 17% |

| McCleary | $162 | -14% |

| McMillin | $202 | 7% |

| Mckenna | $206 | 9% |

| Mead | $177 | -6% |

| Meadow Glade | $187 | -1% |

| Meadowdale | $220 | 17% |

| Medical Lake | $168 | -11% |

| Medina | $205 | 9% |

| Menlo | $172 | -9% |

| Mercer Island | $213 | 13% |

| Mesa | $153 | -19% |

| Metaline | $167 | -12% |

| Metaline Falls | $168 | -11% |

| Methow | $166 | -12% |

| Mica | $168 | -11% |

| Midland | $233 | 24% |

| Mill Creek | $207 | 10% |

| Mill Creek East | $206 | 9% |

| Millwood | $174 | -8% |

| Milton | $218 | 16% |

| Mineral | $182 | -3% |

| Minnehaha | $197 | 4% |

| Mirrormont | $205 | 9% |

| Moclips | $168 | -11% |

| Mohler | $157 | -17% |

| Monitor | $157 | -17% |

| Monroe | $195 | 4% |

| Monroe North | $192 | 2% |

| Montesano | $156 | -17% |

| Morton | $165 | -13% |

| Moses Lake | $149 | -21% |

| Moses Lake North | $149 | -21% |

| Mossyrock | $161 | -15% |

| Mount Vernon | $159 | -16% |

| Mount Vista | $186 | -1% |

| Mountlake Terrace | $222 | 18% |

| Moxee | $160 | -15% |

| Mukilteo | $206 | 9% |

| Naches | $165 | -13% |

| Nahcotta | $178 | -5% |

| Napavine | $161 | -14% |

| Naselle | $170 | -10% |

| Navy Yard City | $169 | -10% |

| Neah Bay | $150 | -20% |

| Nespelem | $164 | -13% |

| Newcastle | $225 | 19% |

| Newman Lake | $164 | -13% |

| Newport | $173 | -8% |

| Nine Mile Falls | $175 | -7% |

| Nisqually Indian Community | $182 | -3% |

| Nooksack | $166 | -12% |

| Nordland | $156 | -17% |

| Normandy Park | $223 | 19% |

| North Bend | $198 | 5% |

| North Bonneville | $174 | -8% |

| North Fort Lewis | $225 | 19% |

| North Lakewood | $216 | 14% |

| North Lynnwood | $222 | 18% |

| North Puyallup | $215 | 14% |

| North Yelm | $187 | -1% |

| Northport | $169 | -11% |

| Oak Harbor | $157 | -16% |

| Oakesdale | $153 | -19% |

| Oakville | $168 | -11% |

| Ocean Park | $171 | -9% |

| Ocean Shores | $155 | -18% |

| Odessa | $158 | -16% |

| Okanogan | $162 | -14% |

| Olalla | $175 | -7% |

| Olga | $154 | -18% |

| Olympia | $178 | -6% |

| Omak | $162 | -14% |

| Onalaska | $164 | -13% |

| Orchards | $200 | 6% |

| Orient | $167 | -11% |

| Orondo | $159 | -16% |

| Oroville | $162 | -14% |

| Orting | $201 | 7% |

| Othello | $154 | -18% |

| Otis Orchards | $163 | -14% |

| Otis Orchards-East Farms | $163 | -13% |

| Outlook | $162 | -14% |

| Oysterville | $172 | -9% |

| Pacific | $229 | 21% |

| Pacific Beach | $160 | -15% |

| Packwood | $174 | -8% |

| Palisades | $158 | -16% |

| Palouse | $152 | -20% |

| Paradise Inn | $203 | 7% |

| Parker | $169 | -10% |

| Parkland | $235 | 25% |

| Parkwood | $171 | -9% |

| Pasco | $159 | -15% |

| Pateros | $163 | -14% |

| Paterson | $160 | -15% |

| Pe Ell | $167 | -11% |

| Peaceful Valley | $167 | -11% |

| Peshastin | $158 | -16% |

| Picnic Point | $223 | 18% |

| Plymouth | $161 | -15% |

| Point Roberts | $165 | -13% |

| Pomeroy | $159 | -16% |

| Port Angeles | $150 | -20% |

| Port Angeles East | $150 | -21% |

| Port Gamble | $174 | -7% |

| Port Gamble Tribal Comunity | $170 | -10% |

| Port Hadlock | $155 | -18% |

| Port Hadlock-Irondale | $155 | -18% |

| Port Ludlow | $156 | -17% |

| Port Orchard | $172 | -9% |

| Port Townsend | $151 | -20% |

| Poulsbo | $162 | -14% |

| Prairie Heights | $195 | 3% |

| Prairie Ridge | $207 | 10% |

| Prescott | $159 | -16% |

| Preston | $207 | 10% |

| Prosser | $152 | -19% |

| Puget Island | $166 | -12% |

| Pullman | $166 | -12% |

| Purdy | $188 | 0% |

| Puyallup | $214 | 14% |

| Quilcene | $161 | -14% |

| Quinault | $159 | -15% |

| Quincy | $151 | -20% |

| Rainier | $183 | -3% |

| Randle | $169 | -10% |

| Ravensdale | $209 | 11% |

| Raymond | $163 | -13% |

| Reardan | $167 | -11% |

| Redmond | $205 | 9% |

| Renton | $228 | 21% |

| Republic | $166 | -12% |

| Retsil | $186 | -1% |

| Rice | $169 | -10% |

| Richland | $155 | -18% |

| Ridgefield | $182 | -3% |

| Ritzville | $152 | -20% |

| Riverbend | $197 | 5% |

| Riverside | $164 | -13% |

| Riverton | $243 | 29% |

| Rochester | $170 | -10% |

| Rock Island | $162 | -14% |

| Rockford | $167 | -11% |

| Rockport | $171 | -9% |

| Rocky Point | $169 | -10% |

| Rollingbay | $182 | -3% |

| Ronald | $156 | -17% |

| Roosevelt | $156 | -17% |

| Rosalia | $155 | -18% |

| Rosburg | $164 | -13% |

| Rosedale | $188 | 0% |

| Roslyn | $156 | -17% |

| Roy | $197 | 5% |

| Royal City | $151 | -20% |

| Ryderwood | $176 | -7% |

| SEATAC | $233 | 24% |

| Salkum | $167 | -12% |

| Salmon Creek | $189 | 0% |

| Sammamish | $201 | 7% |

| Satsop | $165 | -12% |

| Seabeck | $166 | -12% |

| Seahurst | $238 | 26% |

| Seattle | $230 | 22% |

| Seaview | $172 | -9% |

| Sedro-Woolley | $160 | -15% |

| Sekiu | $150 | -20% |

| Selah | $160 | -15% |

| Sequim | $149 | -21% |

| Shadow Lake | $213 | 13% |

| Shaw Island | $156 | -17% |

| Shelton | $169 | -10% |

| Shoreline | $229 | 21% |

| Silvana | $206 | 9% |

| Silver Creek | $155 | -18% |

| Silver Firs | $205 | 9% |

| Silverdale | $166 | -12% |

| Silverlake | $167 | -11% |

| Sisco Heights | $186 | -2% |

| Skamokawa Valley | $170 | -10% |

| Skokomish | $169 | -10% |

| Skykomish | $194 | 3% |

| Snohomish | $195 | 4% |

| Snoqualmie | $193 | 2% |

| Snoqualmie Pass | $182 | -4% |

| Soap Lake | $151 | -20% |

| South Bend | $162 | -14% |

| South Cle Elum | $156 | -17% |

| South Colby | $185 | -2% |

| South Creek | $204 | 9% |

| South Hill | $217 | 15% |

| South Prairie | $202 | 7% |

| South Wenatchee | $158 | -16% |

| Southworth | $171 | -9% |

| Spanaway | $222 | 18% |

| Spangle | $166 | -12% |

| Spokane | $181 | -4% |

| Spokane Valley | $170 | -10% |

| Sprague | $163 | -13% |

| Springdale | $174 | -7% |

| St. John | $155 | -18% |

| Stansberry Lake | $187 | -1% |

| Stanwood | $169 | -10% |

| Startup | $191 | 1% |

| Stehekin | $169 | -10% |

| Steilacoom | $210 | 12% |

| Steptoe | $167 | -12% |

| Stevenson | $169 | -10% |

| Stratford | $150 | -21% |

| Sudden Valley | $159 | -16% |

| Sultan | $191 | 1% |

| Sumas | $163 | -13% |

| Summit | $216 | 15% |

| Summit View | $218 | 16% |

| Sumner | $206 | 10% |

| Sunnyside | $156 | -17% |

| Sunnyslope | $158 | -16% |

| Suquamish | $167 | -12% |

| Tacoma | $230 | 22% |

| Taholah | $162 | -14% |

| Tahuya | $169 | -10% |

| Tanglewilde | $183 | -3% |

| Tanner | $198 | 5% |

| Tekoa | $155 | -18% |

| Tenino | $171 | -9% |

| Terrace Heights | $163 | -14% |

| Thornton | $152 | -19% |

| Thorp | $161 | -14% |

| Three Lakes | $192 | 2% |

| Tieton | $166 | -12% |

| Tokeland | $166 | -12% |

| Toledo | $162 | -14% |

| Tonasket | $162 | -14% |

| Toppenish | $161 | -15% |

| Touchet | $157 | -17% |

| Toutle | $168 | -11% |

| Town and Country | $177 | -6% |

| Tracyton | $171 | -9% |

| Trout Lake | $160 | -15% |

| Tukwila | $239 | 27% |

| Tumtum | $173 | -8% |

| Tumwater | $174 | -8% |

| Twisp | $159 | -15% |

| Underwood | $170 | -10% |

| Union | $172 | -9% |

| Union Gap | $161 | -15% |

| Union Hill-Novelty Hill | $209 | 11% |

| Uniontown | $156 | -17% |

| University Place | $220 | 17% |

| Usk | $169 | -10% |

| Vader | $166 | -12% |

| Valley | $175 | -7% |

| Valleyford | $167 | -11% |

| Vancouver | $196 | 4% |

| Vantage | $152 | -19% |

| Vashon | $186 | -1% |

| Vaughn | $187 | -1% |

| Venersborg | $187 | -1% |

| Veradale | $173 | -8% |

| Wahkiacus | $168 | -11% |

| Waitsburg | $156 | -17% |

| Waldron | $156 | -17% |

| Walla Walla | $157 | -17% |

| Walla Walla East | $157 | -17% |

| Waller | $217 | 15% |

| Wallula | $159 | -16% |

| Walnut Grove | $196 | 4% |

| Wapato | $160 | -15% |

| Warden | $148 | -21% |

| Warm Beach | $169 | -10% |

| Washougal | $183 | -3% |

| Washtucna | $154 | -18% |

| Waterville | $157 | -17% |

| Wauconda | $168 | -11% |

| Wauna | $187 | -1% |

| Waverly | $170 | -10% |

| Wellpinit | $176 | -7% |

| Wenatchee | $158 | -16% |

| West Clarkston-Highland | $153 | -19% |

| West Pasco | $159 | -15% |

| West Richland | $155 | -18% |

| West Side Highway | $166 | -12% |

| Westport | $159 | -16% |

| Whidbey Island Station | $165 | -12% |

| White Center | $237 | 26% |

| White Salmon | $158 | -16% |

| White Swan | $161 | -14% |

| Wilbur | $158 | -16% |

| Wilderness Rim | $197 | 5% |

| Wilkeson | $201 | 7% |

| Winlock | $164 | -13% |

| Winthrop | $167 | -12% |

| Wishram | $161 | -15% |

| Wollochet | $186 | -1% |

| Woodinville | $203 | 8% |

| Woodland | $175 | -7% |

| Woods Creek | $195 | 4% |

| Woodway | $215 | 14% |

| Yacolt | $187 | -1% |

| Yakima | $164 | -13% |

| Yarrow Point | $211 | 12% |

| Yelm | $187 | -1% |

| Zillah | $159 | -16% |

The average cost of car insurance in Washington’s largest cities:

- Seattle, $230 per month

- Spokane, $181 per month

- Tacoma, $230 per month

- Vancouver, $196 per month

- Bellevue, $214 per month

- Kent, $230 per month

- Everett, $215 per month

Best and worst drivers in Washington

Seattle has the best drivers in Washington, according to LendingTree research from 2025. Olympia has the state’s worst drivers.

Generation Z is involved in more traffic incidents than any other age group in Washington by a wide margin.

Washington metros with the best and worst drivers

Of the largest metros in Washington, Seattle has the fewest car-related incidents. Seattle’s incident rate is 21.5 per 1,000 drivers. Shoreline is tied with Renton for second with 22.3 incidents per 1,000 drivers.

Best drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Seattle | 21.5 |

| Shoreline | 22.3 |

| Renton | 22.3 |

| Pasco | 23.3 |

| Everett | 23.6 |

The Washington metro with the most car-related incidents is Olympia, at 34.1 per 1,000 drivers. Kirkland has the next-highest rate of driving incidents in Washington at 33.1.

Worst drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Olympia | 34.1 |

| Kirkland | 33.1 |

| Spokane | 31.7 |

| Lacey | 30.6 |

| Redmond | 30.0 |

Best and worst drivers by age group

Gen Z is the age group with the highest number of traffic-related incidents in Washington, at 63.7 per 1,000 drivers. Millennials are next, with a 41.1 rate.

Worst drivers by generation

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 63.7 |

| Millenial | 41.1 |

| Gen X | 31.8 |

| Boomer | 34.3 |

| Silent Generation | 32.3 |

Best and worst drivers by car make

Volvo drivers are the best in Washington, with an incident rate of 27.4 per 1,000 drivers. Chrysler drivers come in second and have an incident rate of 30.0.

Best drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Volvo | 27.4 |

| Chrysler | 30.0 |

| Pontiac | 31.7 |

| Mercedes-Benz | 31.8 |

| Land Rover | 32.7 |

Subaru is the automobile brand most often involved in a traffic-related incident in Washington. The company’s rate is 45.7 incidents per 1,000 drivers. Mazda is next, at 45.0.

Worst drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Subaru | 45.7 |

| Mazda | 45.0 |

| Ram | 43.6 |

| Volkswagen | 43.0 |

| Jeep | 42.8 |

Minimum coverage for car insurance in Washington State

You are required to have liability car insurance to drive in Washington unless you get a bond or certificate of deposit. The state’s minimum coverage requirements include:

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $10,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Car insurance companies are also required to offer personal injury protection (PIP) and uninsured motorist coverage to Washington drivers. Both are good to have, but you can reject them.

PIP covers injuries to you and your passengers after an accident, no matter who caused it. It also covers lost wages, essential services during your recovery and funeral expenses for fatal accidents. Uninsured motorist covers you and your passengers for injuries caused by a driver with no car insurance.

How to get SR-22 insurance in Washington

Most Washington insurance companies offer SR-22 insurance. An SR-22 is a form that proves you have insurance. Your insurance company sends it to the Department of Licensing for you.

You usually need an SR-22 to reinstate your license after offenses like DUI, reckless driving or certain insurance violations.

Many companies add a small SR-22 filing fee to your rate. Your overall insurance rate depends largely on the incident that led to the filing requirement. You generally pay more for SR-22 car insurance after a DUI than you do after a lesser offense.

Frequently asked questions

Car insurance in Washington costs $188 per month, on average, if you buy full coverage. If you only buy liability coverage, the state’s average cost is $71 per month.

The cheapest car insurance in Washington state comes from Mutual of Enumclaw. It has the lowest average rate for liability coverage, at $40 per month. It also has the lowest full coverage rate of $107 per month.

Getting car insurance is the easiest way to meet Washington’s proof of financial responsibility requirement. You can get a bond or certificate of deposit instead, however.

The penalties for driving without insurance include a $550 fine. Your license can be suspended if you injure someone or cause more than $1,000 in damage while driving without insurance.

How we selected the cheapest car insurance companies in Washington

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Washington

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighed these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.