Cheapest Car Insurance in Utah (2026)

Auto-Owners is the best company for cheap car insurance in Utah, at $142 per month for full coverage and $67 per month for minimum coverage.

Best cheap car insurance in Utah

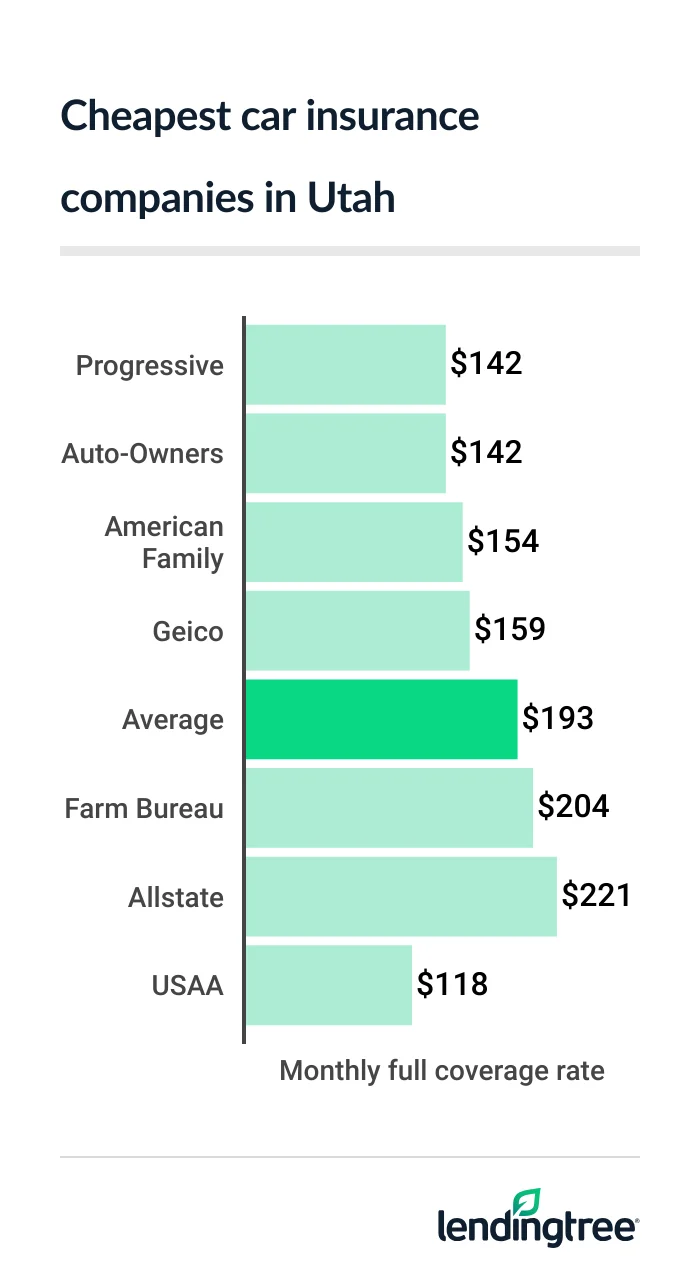

Cheapest full coverage car insurance in Utah: Auto-Owners and Progressive

Most drivers in Utah can find the cheapest full coverage car insurance with Auto-Owners and Progressive. Each of these companies offers an average rate of $142 per month for full coverage

USAA has an even cheaper average rate of $118 per month, but it’s only available to active or retired military and their families.

Cheapest companies for full coverage

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Auto-Owners | $142 | |

| Progressive | $142 | |

| American Family | $154 | |

| Geico | $159 | |

| Farm Bureau | $204 | |

| Allstate | $221 | |

| State Farm | $257 | |

| Farmers | $340 | |

| USAA* | $118 | |

Auto-Owners and USAA have better J.D. Power

Utah’s cheapest liability car insurance quotes: Auto-Owners

Although Auto-Owners has the cheapest liability insurance for most Utah drivers, at $67 per month, a few other companies are right behind it in cost.

American Family ($76 per month) and Farm Bureau ($78 per month) have the next-cheapest average rates for liability or minimum coverage

Cheapest companies for minimum coverage

| Company | Monthly rate |

|---|---|

| Auto-Owners | $67 |

| American Family | $76 |

| Farm Bureau | $78 |

| Progressive | $80 |

| Geico | $82 |

| Allstate | $109 |

| State Farm | $124 |

| Farmers | $147 |

| USAA* | $46 |

With all five of these companies being so close in cost for minimum coverage, discounts could make a big difference.

Geico and American Family offer many more car insurance discounts than the others do, and some are easy to get. Both companies have discounts for vehicles with anti-theft or safety features, for example. You can also save money with them if you get a quote before buying a policy or you enroll in online billing.

The average cost of minimum coverage car insurance in Utah is $90 per month.

Cheap Utah auto insurance for teens: Farm Bureau and Geico

Farm Bureau and Geico offer the cheapest teen car insurance quotes in Utah. Farm Bureau has the state’s cheapest teen liability quotes of $215 per month, while Geico has the cheapest full coverage for teens at $411 per month.

Cheapest companies for teen drivers

| Company | Minimum | Full |

|---|---|---|

| Farm Bureau | $215 | $526 |

| Geico | $223 | $411 |

| Progressive | $267 | $574 |

| Auto-Owners | $279 | $498 |

| Allstate | $382 | $785 |

| American Family | $396 | $788 |

| State Farm | $410 | $788 |

| Farmers | $592 | $1,301 |

| USAA* | $119 | $271 |

Geico comes in second for teen liability coverage, at $223 per month. Auto-Owners is the second-cheapest for teen full coverage, at $498 per month.

Farm Bureau, Geico and Auto-Owners all have discounts for young drivers that could help make your policy a lot cheaper. These include discounts for:

- Getting good grades

- Going away to school without a vehicle

- Completing a driver education or safety program

Cheapest car insurance after a speeding ticket in Utah: Auto-Owners

At $142 per month, Auto-Owners has the cheapest auto insurance for Utah drivers with a speeding ticket on their records.

American Family and Progressive are the next-cheapest companies for most of the state’s drivers after a ticket. The average quote from American Family is $183 per month, and from Progressive it’s $193 per month.

Cheapest companies after a ticket

| Company | Monthly rate |

|---|---|

| Auto-Owners | $142 |

| American Family | $183 |

| Progressive | $193 |

| Geico | $217 |

| Farm Bureau | $231 |

| Allstate | $246 |

| State Farm | $274 |

| Farmers | $473 |

| USAA* | $152 |

Even though Progressive is the most expensive of these top-three companies, you should consider it if you want to customize your policy. Progressive has more add-on coverages than either Auto-Owners or American Family.

Each of these companies offer accident forgiveness

The average cost of auto insurance for Utah drivers after a speeding ticket is $234 per month. That’s about $40 per month more than what drivers with clean records pay for the same coverage.

Cheapest car insurance quotes in Utah after an accident: Progressive

Most Utah drivers can get the cheapest car insurance after an accident from Progressive and American Family.

Progressive has the state’s lowest average rate for these drivers, at $222 per month, but American Family’s is only $2 more.

Cheapest companies after an accident

| Company | Monthly rate |

|---|---|

| Progressive | $222 |

| American Family | $224 |

| Auto-Owners | $239 |

| State Farm | $257 |

| Geico | $303 |

| Farm Bureau | $315 |

| Allstate | $353 |

| Farmers | $510 |

| USAA* | $173 |

American Family offers more discounts than Progressive and also has a better customer satisfaction score from J.D. Power. Those things could make American Family the best and cheapest company for some Utah drivers looking for coverage after an at-fault accident.

A typical driver in Utah pays $288 per month for car insurance after an accident. This is $95 per month more than what drivers without an accident on their records pay.

Best cheap Utah auto insurance rates for teens with a bad driving record: Farm Bureau

Farm Bureau and Progressive have the cheapest auto insurance for most Utah teens with bad driving records.

Farm Bureau has the most affordable rates for teens with a speeding ticket on their records, at $244 per month. Progressive has the lowest rates for teens with an accident on their records, at $313 per month.

Cheapest insurance for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Farm Bureau | $244 | $334 |

| Auto-Owners | $279 | $452 |

| Geico | $285 | $404 |

| Progressive | $301 | $313 |

| American Family | $436 | $455 |

| Allstate | $437 | $546 |

| State Farm | $442 | $410 |

| Farmers | $740 | $790 |

| USAA* | $202 | $225 |

If you or your family have military ties, make sure you compare car insurance quotes from USAA as well. USAA’s quotes for teens with a ticket or accident on their records average $202 and $225 per month, respectively.

Utah’s cheapest auto insurance with a DUI: Progressive

With an average rate of $186 per month, Progressive has the cheapest DUI insurance in Utah by far.

Cheapest companies after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $186 |

| Farm Bureau | $231 |

| Geico | $279 |

| American Family | $294 |

| Allstate | $299 |

| Auto-Owners | $363 |

| Farmers | $459 |

| State Farm | $578 |

| USAA* | $226 |

Farm Bureau is the second-cheapest company for most Utah drivers with a driving under the influence (DUI) conviction, at $231 per month. Geico comes in third, at $279 per month. The state average rate is $324 per month.

If you’re convicted of DUI in Utah, you can expect your car insurance costs to go up around $130 per month.

Cheap car insurance quotes in Utah with bad credit: Progressive

The best company for cheap car insurance with bad credit in Utah is Progressive, where rates average $223 per month.

American Family is next, with an average rate of $238 per month. Geico comes in third for most Utah drivers with poor credit, at $288 per month.

Cheapest companies for drivers with poor credit

| Company | Monthly rate |

|---|---|

| Progressive | $223 |

| American Family | $238 |

| Geico | $288 |

| Farm Bureau | $383 |

| Auto-Owners | $385 |

| Allstate | $392 |

| State Farm | $520 |

| Farmers | $548 |

| USAA* | $255 |

The state average rate for auto insurance with bad credit is $359 per month. This is over $165 per month more than what Utah drivers with good credit pay.

Best car insurance in Utah

Auto-Owners and Progressive are the best car insurance companies in Utah.

Utah car insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| Auto-Owners | 638 | A+ | |

| State Farm | 650 | A++ | |

| American Family | 640 | A | |

| USAA* | 735 | A++ | |

| Farm Bureau | 645 | A | |

| Progressive | 621 | A+ | |

| Geico | 645 | A++ | |

| Allstate | 635 | A+ | |

| Farmers | 622 | A |

Auto-Owners is the state’s best car insurance company for adults with clean driving records. It has the most affordable rates for minimum and full coverage policies, outside of USAA, which is only available to members of the military and their families. Auto-Owners also offers some helpful coverage options, such as for accident forgiveness and roadside assistance.

Progressive is Utah’s best car insurance company for those with poor credit or bad driving records. Its rates for drivers with an accident or DUI are the lowest in the state for most drivers, as are its rates for drivers with bad credit. Progressive also has many discounts and coverage add-ons that let you customize a policy to your liking.

Utah insurance rates by city

Moab is the cheapest city in Utah for car insurance, with an average rate of $175 per month.

The state’s most expensive city for car insurance is Kearns, where rates average $243 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Alpine | $224 | 16% |

| Altamont | $200 | 3% |

| Alton | $188 | -3% |

| Altonah | $201 | 4% |

| American Fork | $215 | 12% |

| Aneth | $188 | -3% |

| Annabella | $189 | -2% |

| Antimony | $192 | -1% |

| Aurora | $187 | -3% |

| Axtell | $188 | -3% |

| Ballard | $196 | 2% |

| Bear River City | $197 | 2% |

| Beaver | $186 | -3% |

| Benjamin | $207 | 7% |

| Benson | $187 | -3% |

| Beryl | $187 | -3% |

| Bicknell | $190 | -1% |

| Bingham Canyon | $216 | 12% |

| Blanding | $187 | -3% |

| Bluebell | $199 | 3% |

| Bluff | $195 | 1% |

| Bluffdale | $212 | 10% |

| Bonanza | $200 | 4% |

| Boulder | $188 | -3% |

| Bountiful | $202 | 5% |

| Brian Head | $182 | -6% |

| Brigham City | $190 | -2% |

| Bryce | $190 | -1% |

| Cache Junction | $191 | -1% |

| Cannonville | $191 | -1% |

| Carbonville | $184 | -5% |

| Castle Dale | $185 | -4% |

| Cedar City | $182 | -6% |

| Cedar Hills | $217 | 12% |

| Cedar Valley | $209 | 8% |

| Centerfield | $187 | -3% |

| Centerville | $198 | 3% |

| Central | $189 | -2% |

| Chester | $193 | 0% |

| Circleville | $194 | 0% |

| Cisco | $180 | -7% |

| Clarkston | $196 | 1% |

| Clawson | $188 | -2% |

| Clearfield | $206 | 7% |

| Cleveland | $187 | -3% |

| Clinton | $205 | 6% |

| Coalville | $205 | 6% |

| Collinston | $194 | 0% |

| Copperton | $212 | 10% |

| Corinne | $196 | 2% |

| Cornish | $192 | 0% |

| Cottonwood Heights | $217 | 13% |

| Croydon | $202 | 5% |

| Dammeron Valley | $189 | -2% |

| Delta | $181 | -6% |

| Deweyville | $197 | 2% |

| Draper | $215 | 12% |

| Duchesne | $203 | 5% |

| Duck Creek Village | $188 | -2% |

| Dugway | $200 | 4% |

| Dutch John | $200 | 4% |

| Eagle Mountain | $214 | 11% |

| East Carbon | $188 | -3% |

| Echo | $202 | 5% |

| Eden | $208 | 8% |

| Elberta | $207 | 7% |

| Elk Ridge | $207 | 7% |

| Elmo | $188 | -2% |

| Elsinore | $183 | -5% |

| Emery | $187 | -3% |

| Emigration Canyon | $214 | 11% |

| Enoch | $181 | -6% |

| Enterprise | $197 | 2% |

| Ephraim | $195 | 1% |

| Erda | $201 | 4% |

| Escalante | $202 | 5% |

| Eureka | $195 | 1% |

| Fairview | $207 | 7% |

| Farmington | $198 | 2% |

| Farr West | $209 | 8% |

| Fayette | $188 | -3% |

| Ferron | $189 | -2% |

| Fielding | $196 | 1% |

| Fillmore | $185 | -4% |

| Fort Duchesne | $198 | 2% |

| Fountain Green | $195 | 1% |

| Fruit Heights | $203 | 5% |

| Fruitland | $203 | 5% |

| Garden | $196 | 1% |

| Garden City | $194 | 1% |

| Garland | $195 | 1% |

| Garrison | $188 | -3% |

| Genola | $200 | 4% |

| Glendale | $188 | -3% |

| Glenwood | $184 | -5% |

| Goshen | $198 | 3% |

| Grantsville | $198 | 3% |

| Green River | $182 | -6% |

| Greenville | $192 | -1% |

| Greenwich | $191 | -1% |

| Grouse Creek | $200 | 3% |

| Gunlock | $193 | 0% |

| Gunnison | $188 | -2% |

| Hanksville | $188 | -2% |

| Hanna | $202 | 5% |

| Harrisville | $208 | 8% |

| Hatch | $192 | 0% |

| Heber | $207 | 7% |

| Heber City | $207 | 7% |

| Helper | $185 | -4% |

| Henefer | $204 | 6% |

| Henrieville | $189 | -2% |

| Herriman | $217 | 13% |

| Highland | $217 | 12% |

| Hildale | $190 | -2% |

| Hill Air Force Base | $206 | 7% |

| Hinckley | $183 | -5% |

| Holden | $184 | -5% |

| Holladay | $220 | 14% |

| Honeyville | $193 | 0% |

| Hooper | $202 | 5% |

| Howell | $199 | 3% |

| Huntington | $185 | -4% |

| Huntsville | $210 | 9% |

| Hurricane | $183 | -5% |

| Hyde Park | $186 | -3% |

| Hyrum | $192 | 0% |

| Ibapah | $201 | 4% |

| Ivins | $188 | -2% |

| Jensen | $201 | 4% |

| Joseph | $184 | -5% |

| Junction | $192 | -1% |

| Kamas | $204 | 6% |

| Kanab | $180 | -7% |

| Kanarraville | $182 | -5% |

| Kanosh | $187 | -3% |

| Kaysville | $201 | 4% |

| Kearns | $243 | 26% |

| Kenilworth | $190 | -2% |

| Kingston | $191 | -1% |

| Koosharem | $190 | -2% |

| La Sal | $187 | -3% |

| La Verkin | $186 | -3% |

| Lake Powell | $186 | -4% |

| Lake Shore | $208 | 8% |

| Laketown | $196 | 1% |

| Lapoint | $198 | 2% |

| Layton | $202 | 5% |

| Leamington | $187 | -3% |

| Leeds | $185 | -4% |

| Lehi | $210 | 9% |

| Levan | $194 | 1% |

| Lewiston | $197 | 2% |

| Lindon | $219 | 14% |

| Loa | $196 | 2% |

| Logan | $186 | -3% |

| Lyman | $191 | -1% |

| Lynndyl | $187 | -3% |

| Maeser | $193 | 0% |

| Magna | $238 | 23% |

| Manila | $200 | 4% |

| Manti | $196 | 2% |

| Mantua | $193 | 0% |

| Mapleton | $215 | 11% |

| Marion | $204 | 6% |

| Marriott-Slaterville | $212 | 10% |

| Marysvale | $192 | -1% |

| Mayfield | $189 | -2% |

| Meadow | $187 | -3% |

| Mendon | $191 | -1% |

| Mexican Hat | $190 | -1% |

| Midvale | $218 | 13% |

| Midway | $206 | 7% |

| Milford | $193 | 0% |

| Millcreek | $223 | 16% |

| Millville | $187 | -3% |

| Minersville | $192 | 0% |

| Moab | $175 | -9% |

| Modena | $187 | -3% |

| Mona | $189 | -2% |

| Monroe | $183 | -5% |

| Montezuma Creek | $193 | 0% |

| Monticello | $192 | 0% |

| Monument Valley | $195 | 1% |

| Morgan | $204 | 6% |

| Moroni | $200 | 4% |

| Mount Carmel | $188 | -3% |

| Mount Pleasant | $199 | 3% |

| Mountain Green | $204 | 6% |

| Mountain Home | $202 | 5% |

| Murray | $226 | 17% |

| Myton | $202 | 5% |

| Naples | $194 | 1% |

| Neola | $201 | 4% |

| Nephi | $188 | -3% |

| New Harmony | $185 | -4% |

| Newcastle | $192 | -1% |

| Newton | $197 | 2% |

| Nibley | $188 | -2% |

| North Logan | $183 | -5% |

| North Ogden | $204 | 6% |

| North Salt Lake | $206 | 7% |

| Oak City | $183 | -5% |

| Oakley | $208 | 8% |

| Ogden | $210 | 9% |

| Orangeville | $188 | -3% |

| Orderville | $194 | 1% |

| Orem | $220 | 14% |

| Palmyra | $211 | 9% |

| Panguitch | $201 | 4% |

| Paradise | $194 | 0% |

| Paragonah | $186 | -3% |

| Park City | $200 | 4% |

| Park Valley | $197 | 2% |

| Parowan | $182 | -6% |

| Payson | $206 | 7% |

| Peoa | $203 | 5% |

| Perry | $189 | -2% |

| Pine Valley | $190 | -2% |

| Plain City | $210 | 9% |

| Pleasant Grove | $219 | 13% |

| Pleasant View | $206 | 7% |

| Plymouth | $197 | 2% |

| Portage | $196 | 2% |

| Price | $183 | -5% |

| Providence | $184 | -4% |

| Provo | $215 | 12% |

| Randlett | $199 | 3% |

| Randolph | $204 | 6% |

| Redmond | $187 | -3% |

| Richfield | $183 | -5% |

| Richmond | $193 | 0% |

| River Heights | $187 | -3% |

| Riverdale | $206 | 7% |

| Riverside | $197 | 2% |

| Riverton | $214 | 11% |

| Rockville | $188 | -3% |

| Roosevelt | $197 | 2% |

| Roy | $205 | 6% |

| Rush Valley | $199 | 3% |

| Salem | $205 | 6% |

| Salina | $185 | -4% |

| Salt Lake City | $224 | 16% |

| Sandy | $217 | 13% |

| Santa Clara | $186 | -4% |

| Santaquin | $200 | 4% |

| Saratoga Springs | $212 | 10% |

| Scipio | $190 | -2% |

| Sevier | $188 | -2% |

| Sigurd | $190 | -2% |

| Silver Summit | $202 | 5% |

| Smithfield | $192 | -1% |

| Snowville | $196 | 2% |

| Snyderville | $200 | 4% |

| South Jordan | $218 | 13% |

| South Ogden | $205 | 6% |

| South Salt Lake | $235 | 22% |

| South Weber | $206 | 7% |

| Spanish Fork | $208 | 8% |

| Spring City | $198 | 2% |

| Springdale | $187 | -3% |

| Springville | $216 | 12% |

| St. George | $189 | -2% |

| Stansbury Park | $201 | 4% |

| Sterling | $195 | 1% |

| Stockton | $203 | 5% |

| Summit | $183 | -5% |

| Summit Park | $201 | 4% |

| Sunnyside | $189 | -2% |

| Sunset | $205 | 6% |

| Syracuse | $202 | 5% |

| Tabiona | $203 | 5% |

| Talmage | $201 | 4% |

| Taylorsville | $234 | 21% |

| Teasdale | $189 | -2% |

| Thompson | $177 | -9% |

| Tooele | $204 | 6% |

| Toquerville | $186 | -4% |

| Torrey | $193 | 0% |

| Tremonton | $197 | 2% |

| Trenton | $192 | -1% |

| Tridell | $199 | 3% |

| Tropic | $188 | -3% |

| Uintah | $208 | 8% |

| Vernal | $194 | 0% |

| Vernon | $201 | 4% |

| Veyo | $190 | -2% |

| Vineyard | $219 | 14% |

| Virgin | $188 | -3% |

| Wales | $196 | 1% |

| Wallsburg | $209 | 9% |

| Washington | $186 | -3% |

| Washington Terrace | $203 | 5% |

| Wellington | $184 | -5% |

| Wellsville | $193 | 0% |

| Wendover | $200 | 3% |

| West Bountiful | $200 | 4% |

| West Haven | $205 | 6% |

| West Jordan | $227 | 18% |

| West Point | $206 | 7% |

| West Valley City | $239 | 24% |

| White City | $218 | 13% |

| Whiterocks | $202 | 5% |

| Willard | $193 | 0% |

| Woodruff | $200 | 3% |

| Woods Cross | $202 | 5% |

The average cost of car insurance in Utah’s largest cities:

- Salt Lake City, $224 per month

- West Valley City, $239 per month

- West Jordan, $227 per month

- Provo, $215 per month

- St. George, $189 per month

Minimum coverage for car insurance in Utah

You need these coverages and amounts to meet Utah’s minimum car insurance requirements:

- $30,000 of bodily injury liability coverage per person

- $65,000 of bodily injury liability coverage per accident

- $25,000 of property damage coverage

- $3,000 of personal injury protection

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Personal injury protection, or PIP, covers injuries to you and your passengers, no matter who causes the accident. It also covers lost wages and other expenses tied to your recovery.

Utah state law doesn’t require full coverage car insurance, which typically includes collision

Frequently asked questions

Car insurance in Utah costs about $90 a month if you only buy minimum coverage. If you get full coverage, the average cost is around $193 a month.

You’ll usually pay more than these average rates if you have any traffic incidents on your driving record, like accidents or DUIs.

Auto-Owners and Progressive have the cheapest car insurance in Utah for most drivers.

Auto-Owners’ average rate for minimum coverage is $67 a month. That’s the lowest in the state outside of USAA, which only sells to members of the military and their families.

Auto-Owners and Progressive each charge about $142 a month for full coverage. This is cheaper than any other company we surveyed, except USAA.

Utah is a no-fault state for car insurance. This means you file a claim with your own car insurance company for medical expenses after an accident, no matter who caused it.

How we selected the cheapest car insurance companies in Utah

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection (PIP): $3,000 per person

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Utah

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.