Cheapest Car Insurance in Oregon (2026)

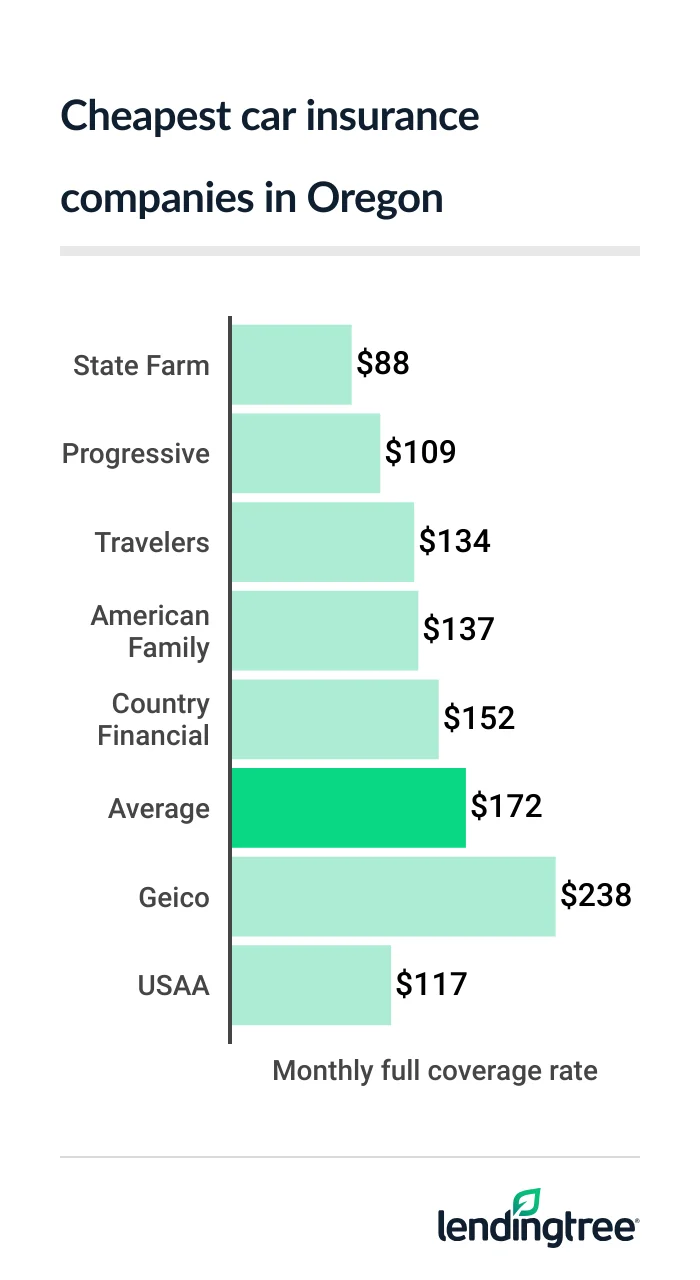

State Farm has the cheapest car insurance for most Oregon drivers. Its rates average $88 a month for full coverage. This is $84 less than the state average of $172 a month.

Oregon’s best cheap car insurance

Cheapest full coverage car insurance in Oregon: State Farm

State Farm has Oregon’s cheapest full coverage car insurance, at $88 a month. This is 20% less than the next-cheapest rate of $109 a month from Progressive.

State Farm also has a better customer satisfaction rating than Progressive from J.D. Power

Full coverage costs $172 a month on average in Oregon. The actual price you pay depends on things like your driving record, vehicle and credit.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $88 | |

| Progressive | $109 | |

| Travelers | $134 | |

| American Family | $137 | |

| Country Financial | $152 | |

| Geico | $238 | |

| Allstate | $285 | |

| Farmers | $292 | |

| USAA* | $117 | |

Companies treat these factors differently and have different car insurance discounts. This is why one company may give you a much lower rate than the others. It’s good to compare car insurance quotes from multiple to find the cheapest rate for your situation.

Cheap Oregon liability insurance: State Farm

At $43 a month, State Farm has Oregon’s cheapest liability insurance, or minimum coverage. USAA and Progressive have the next-cheapest rates at less than $55 each.

USAA has the best satisfaction rating out of these three companies. However, USAA is only available to the military community and their families.

Cheapest liability insurance

| Company | Monthly rate |

|---|---|

| State Farm | $43 |

| Progressive | $54 |

| American Family | $57 |

| Travelers | $68 |

| Country Financial | $76 |

| Geico | $113 |

| Farmers | $147 |

| Allstate | $161 |

| USAA* | $53 |

Minimum coverage includes liability

Cheapest car insurance for Oregon teens: Country Financial and State Farm

You can usually get Oregon’s cheapest car insurance for teens from Country Financial or State Farm. At $135 a month, Country Financial has the cheapest teen liability rate for young drivers. This is barely cheaper than State Farm’s rate of $137 a month.

State Farm has the cheapest full coverage for young drivers, at $266 a month. This only beats Country Financial’s rate of $274 a month by 3%.

Cheap car insurance for teens

| Company | Minimum | Full |

|---|---|---|

| Country Financial | $135 | $274 |

| State Farm | $137 | $266 |

| Travelers | $183 | $369 |

| Progressive | $211 | $432 |

| American Family | $228 | $548 |

| Geico | $238 | $499 |

| Farmers | $547 | $987 |

| Allstate | $554 | $1,104 |

| USAA* | $141 | $301 |

A lack of driving experience makes teens more likely to get into accidents than older drivers. This is the main reason why insurance companies charge young drivers so much. Teens usually get cheaper rates on a parent’s policy than they do on their own.

Discounts can also make car insurance more affordable for young drivers. Several companies, including State Farm and Country Financial, give teens a discount for getting good grades.

- State Farm also gives teens a discount for completing an approved driver education course. Parents get a discount when a teen on your policy goes off to college without a car.

- Country Financial has a discount for teens who complete its Simply Drive safety course. This discount is not available for other driver education or training programs.

Most other companies have discounts like these for young drivers. It’s important to ask about them with your quotes so they don’t get overlooked.

Best Oregon car insurance rates after a speeding ticket: State Farm

Oregon drivers with a speeding ticket get the cheapest car insurance quotes from State Farm. The company’s rates only go up to $93 a month after a speeding ticket. This is 32% less than the next-cheapest rate of $137 a month from Progressive.

However, Progressive is a better choice if you need gap insurance

Cheap auto insurance with a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $93 |

| Progressive | $137 |

| American Family | $162 |

| Travelers | $170 |

| Country Financial | $197 |

| Allstate | $339 |

| Geico | $346 |

| Farmers | $405 |

| USAA* | $150 |

A speeding ticket raises the average cost of car insurance in Oregon by 29% to $222 a month. Shopping around can help you find cheaper car insurance with a bad driving record.

Oregon’s cheapest car insurance after an accident: State Farm

State Farm has Oregon’s cheapest car insurance after an accident, at $88 a month. This is 67% less than the state average of $268 a month after an accident. Progressive is the next-cheapest company, at $152 a month.

Auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $88 |

| Progressive | $152 |

| Travelers | $189 |

| Country Financial | $214 |

| American Family | $237 |

| Farmers | $406 |

| Geico | $472 |

| Allstate | $476 |

| USAA* | $175 |

An at-fault accident makes car insurance rates go up by an average of 55% across Oregon. You can protect yourself from a potential rate increase like this with accident forgiveness

Travelers and Progressive are among the companies with accident forgiveness. State Farm and Geico don’t have it. It usually costs extra, but Progressive has paid and free options.

Best OR car insurance for teens with bad driving records: State Farm

Oregon teens with bad driving records can get the cheapest auto insurance quotes from State Farm. The company’s liability rates for young drivers average $149 a month after a speeding ticket. Young drivers with an at-fault accident pay an average of $137 a month.

Country Financial is the next-cheapest company. Its young driver rates average $177 a month after a ticket and $197 a month after an accident.

Best teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $149 | $137 |

| Country Financial | $177 | $197 |

| Progressive | $215 | $222 |

| Travelers | $226 | $264 |

| American Family | $255 | $355 |

| Geico | $337 | $441 |

| Allstate | $690 | $770 |

| Farmers | $700 | $685 |

| USAA* | $231 | $262 |

Cheapest Oregon car insurance after a DUII: Progressive

At $126 a month, Progressive has Oregon’s cheapest car insurance after a DUII (driving under the influence of intoxicants). State Farm has the next-cheapest DUII insurance, at $172 a month. A DUII increases the average cost of Oregon car insurance by 86% to $321 a month.

Cheap DUII insurance

| Company | Monthly rate |

|---|---|

| Progressive | $126 |

| State Farm | $172 |

| Travelers | $199 |

| American Family | $252 |

| Allstate | $381 |

| Farmers | $391 |

| Geico | $415 |

| Country Financial | $707 |

| USAA* | $247 |

Oregon’s best car insurance for bad credit: Progressive

Oregon drivers with bad credit often get the cheapest car insurance quotes from Progressive. The company’s bad-credit car insurance rates average $169 a month. This is 27% less than the next-cheapest rate of $231 a month from American Family.

Cheap bad-credit car insurance

| Company | Monthly rate |

|---|---|

| Progressive | $169 |

| American Family | $231 |

| Travelers | $236 |

| Country Financial | $243 |

| Geico | $350 |

| Allstate | $473 |

| Farmers | $482 |

| State Farm | $484 |

| USAA* | $256 |

Insurance companies check your credit for things like your payment history and the amounts you borrow. They believe these factors show how likely you are to have an accident or claim. Paying down debts and avoiding late payments can help you get cheaper car insurance.

Discounts can help lower your insurance rate with any credit rating. Some easy ways to lower your rate with Progressive include:

- Getting your quote online

- Signing policy documents online

- Setting up automatic payments

- Paying in full for your policy up front

It’s good to check about payment discounts like these with other companies, too.

Best car insurance in Oregon

State Farm and Progressive are Oregon’s best car insurance companies for different reasons.

State Farm is the best choice if you want basic car insurance at a low rate. The company has the state’s cheapest rates for most drivers. Its good satisfaction rating means customers like its prices and customer service. However, it doesn’t offer as many coverage options as Progressive.

Progressive has Oregon’s best combination of price and coverage options. Its rates are lower than state averages for most drivers. It also offers extras like gap insurance, accident forgiveness

- Gap insurance can be useful if you finance your car with a low down payment.

- Accident forgiveness prevents your rates from spiking after your first at-fault accident.

- CPE protects your investment in custom features for your vehicle.

Insurance company ratings

| Company | LendingTree score | Satisfaction rating | AM Best |

|---|---|---|---|

| Country Financial | 4.8 | 659 | A+ |

| State Farm | 4.5 | 650 | A++ |

| Travelers | 4.4 | 613 | A++ |

| American Family | 4.1 | 640 | A |

| USAA* | 4.1 | 735 | A++ |

| Progressive | 3.8 | 621 | A+ |

| Geico | 3.7 | 645 | A++ |

| Allstate | 3.2 | 635 | A+ |

| Farmers | 3.1 | 622 | A |

Oregon car insurance rates by city

With rates averaging $257 a month, Maywood Park is Oregon’s most expensive city for car insurance. This barely beats No. 2 Gresham’s rate of $253 a month.

Car insurance tends to cost more in areas with high accident and car-theft rates. High medical and car-repair costs can also drive up an area’s auto insurance rates.

Millersburg has Oregon’s cheapest car insurance, at $174 a month.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Adams | $184 | 7% |

| Adel | $194 | 13% |

| Adrian | $189 | 10% |

| Agness | $179 | 4% |

| Albany | $175 | 2% |

| Allegany | $191 | 11% |

| Aloha | $214 | 24% |

| Alsea | $190 | 10% |

| Altamont | $192 | 12% |

| Alvadore | $193 | 12% |

| Amity | $210 | 22% |

| Antelope | $203 | 18% |

| Arch Cape | $196 | 14% |

| Arlington | $187 | 8% |

| Arock | $207 | 20% |

| Ashland | $184 | 7% |

| Ashwood | $192 | 11% |

| Astoria | $191 | 11% |

| Aumsville | $202 | 17% |

| Aurora | $210 | 22% |

| Azalea | $186 | 8% |

| Baker City | $175 | 1% |

| Bandon | $177 | 3% |

| Banks | $205 | 19% |

| Barview | $181 | 5% |

| Bates | $183 | 6% |

| Bay City | $198 | 15% |

| Bayside Gardens | $195 | 13% |

| Beatty | $198 | 15% |

| Beaver | $200 | 16% |

| Beavercreek | $224 | 30% |

| Beaverton | $214 | 24% |

| Bend | $183 | 6% |

| Bethany | $211 | 22% |

| Blachly | $184 | 7% |

| Black Butte Ranch | $193 | 12% |

| Blodgett | $188 | 9% |

| Blue River | $194 | 12% |

| Bly | $198 | 15% |

| Boardman | $182 | 6% |

| Bonanza | $197 | 14% |

| Boring | $237 | 38% |

| Bridal Veil | $240 | 39% |

| Bridgeport | $181 | 5% |

| Brightwood | $227 | 31% |

| Broadbent | $181 | 5% |

| Brogan | $181 | 5% |

| Brookings | $179 | 4% |

| Brothers | $187 | 8% |

| Brownsville | $181 | 5% |

| Bunker Hill | $181 | 5% |

| Burns | $181 | 5% |

| Butte Falls | $191 | 11% |

| Buxton | $207 | 20% |

| Camas Valley | $182 | 6% |

| Camp Sherman | $193 | 12% |

| Canby | $212 | 23% |

| Cannon Beach | $194 | 12% |

| Canyon City | $183 | 6% |

| Canyonville | $183 | 6% |

| Carlton | $209 | 21% |

| Cascade Locks | $197 | 14% |

| Cascadia | $188 | 9% |

| Cave Junction | $189 | 10% |

| Cedar Hills | $215 | 25% |

| Cedar Mill | $210 | 22% |

| Central Point | $176 | 2% |

| Chemult | $196 | 14% |

| Chenoweth | $189 | 10% |

| Cheshire | $188 | 9% |

| Christmas Valley | $199 | 16% |

| Clackamas | $232 | 35% |

| Cloverdale | $200 | 16% |

| Coburg | $176 | 2% |

| Columbia City | $203 | 18% |

| Coos Bay | $182 | 5% |

| Coquille | $178 | 3% |

| Cornelius | $212 | 23% |

| Corvallis | $176 | 2% |

| Cottage Grove | $181 | 5% |

| Cove | $181 | 5% |

| Crabtree | $198 | 15% |

| Crane | $185 | 7% |

| Crater Lake | $197 | 14% |

| Crawfordsville | $195 | 13% |

| Crescent | $193 | 12% |

| Creswell | $180 | 4% |

| Dairy | $197 | 14% |

| Dale | $186 | 8% |

| Dallas | $196 | 13% |

| Damascus | $236 | 37% |

| Days Creek | $184 | 7% |

| Dayton | $209 | 21% |

| Dayville | $187 | 8% |

| Deadwood | $182 | 6% |

| Deer Island | $201 | 16% |

| Depoe Bay | $191 | 11% |

| Deschutes River Woods | $181 | 5% |

| Detroit | $203 | 18% |

| Dexter | $185 | 7% |

| Diamond Lake | $196 | 14% |

| Dillard | $193 | 12% |

| Donald | $217 | 26% |

| Dorena | $187 | 8% |

| Drain | $182 | 6% |

| Drewsey | $186 | 8% |

| Dundee | $207 | 20% |

| Dunes City | $175 | 1% |

| Durkee | $181 | 5% |

| Eagle Creek | $233 | 35% |

| Eagle Crest | $182 | 5% |

| Eagle Point | $182 | 6% |

| Echo | $182 | 5% |

| Elgin | $184 | 7% |

| Elkton | $184 | 7% |

| Elmira | $187 | 9% |

| Enterprise | $182 | 6% |

| Estacada | $233 | 35% |

| Eugene | $181 | 5% |

| Fairview | $251 | 45% |

| Fall Creek | $189 | 10% |

| Falls City | $202 | 17% |

| Fields | $199 | 15% |

| Florence | $175 | 1% |

| Forest Grove | $208 | 21% |

| Fort Klamath | $199 | 15% |

| Fort Rock | $193 | 12% |

| Foster | $186 | 8% |

| Four Corners | $215 | 25% |

| Fox | $189 | 10% |

| Frenchglen | $193 | 12% |

| Gales Creek | $209 | 21% |

| Garden Home-Whitford | $212 | 23% |

| Gardiner | $177 | 3% |

| Garibaldi | $199 | 15% |

| Gaston | $215 | 25% |

| Gates | $205 | 19% |

| Gearhart | $192 | 12% |

| Gervais | $217 | 26% |

| Gilchrist | $185 | 7% |

| Gladstone | $221 | 28% |

| Glasgow | $175 | 2% |

| Glendale | $183 | 6% |

| Gleneden Beach | $203 | 18% |

| Glide | $187 | 8% |

| Gold Beach | $176 | 2% |

| Gold Hill | $183 | 6% |

| Government Camp | $218 | 26% |

| Grand Ronde | $199 | 15% |

| Granite | $182 | 6% |

| Grants Pass | $184 | 7% |

| Grass Valley | $200 | 16% |

| Green | $180 | 4% |

| Greenhorn | $182 | 6% |

| Greenleaf | $182 | 6% |

| Gresham | $253 | 47% |

| Haines | $180 | 4% |

| Halsey | $180 | 4% |

| Hammond | $191 | 11% |

| Happy Valley | $239 | 39% |

| Harbor | $179 | 4% |

| Harper | $188 | 9% |

| Harrisburg | $182 | 5% |

| Hayesville | $215 | 25% |

| Hebo | $203 | 17% |

| Helix | $181 | 5% |

| Hereford | $182 | 6% |

| Hermiston | $182 | 6% |

| Hillsboro | $208 | 21% |

| Hines | $184 | 7% |

| Hood River | $187 | 8% |

| Hubbard | $214 | 24% |

| Idanha | $204 | 18% |

| Idleyld Park | $192 | 12% |

| Imbler | $182 | 5% |

| Imnaha | $189 | 10% |

| Independence | $202 | 17% |

| Ione | $188 | 9% |

| Ironside | $181 | 5% |

| Irrigon | $183 | 6% |

| Jacksonville | $188 | 9% |

| Jamieson | $182 | 5% |

| Jeffers Gardens | $191 | 11% |

| Jefferson | $194 | 12% |

| John Day | $180 | 4% |

| Junction City | $185 | 7% |

| Juntura | $186 | 8% |

| Keizer | $208 | 21% |

| Keno | $195 | 13% |

| Kent | $202 | 17% |

| Kerby | $188 | 9% |

| Kimberly | $189 | 10% |

| King City | $209 | 21% |

| Klamath Falls | $195 | 13% |

| La Grande | $176 | 2% |

| La Pine | $186 | 8% |

| Lafayette | $209 | 21% |

| Lake Oswego | $210 | 22% |

| Lakeside | $178 | 3% |

| Lakeview | $193 | 12% |

| Langlois | $179 | 4% |

| Lebanon | $181 | 5% |

| Lexington | $188 | 9% |

| Lincoln Beach | $191 | 11% |

| Lincoln City | $192 | 11% |

| Logsden | $192 | 12% |

| Long Creek | $189 | 10% |

| Lookingglass | $180 | 5% |

| Lorane | $189 | 10% |

| Lostine | $184 | 7% |

| Lowell | $186 | 8% |

| Lyons | $200 | 16% |

| Madras | $194 | 12% |

| Manning | $203 | 18% |

| Manzanita | $196 | 14% |

| Mapleton | $183 | 6% |

| Marion | $203 | 18% |

| Marylhurst | $224 | 30% |

| Maupin | $202 | 17% |

| Maywood Park | $257 | 49% |

| McMinnville | $206 | 19% |

| Meacham | $182 | 6% |

| Medford | $179 | 4% |

| Mehama | $213 | 23% |

| Melrose | $180 | 5% |

| Merlin | $184 | 7% |

| Metolius | $194 | 12% |

| Midland | $194 | 13% |

| Mikkalo | $187 | 8% |

| Mill City | $203 | 18% |

| Millersburg | $174 | 1% |

| Milton-Freewater | $184 | 7% |

| Milwaukie | $226 | 31% |

| Mission | $179 | 4% |

| Mitchell | $194 | 13% |

| Molalla | $233 | 35% |

| Monmouth | $194 | 12% |

| Monroe | $180 | 4% |

| Monument | $196 | 14% |

| Moro | $190 | 10% |

| Mosier | $189 | 9% |

| Mount Angel | $216 | 25% |

| Mount Hood Parkdale | $192 | 11% |

| Mount Vernon | $183 | 6% |

| Mulino | $223 | 29% |

| Murphy | $195 | 13% |

| Myrtle Creek | $184 | 7% |

| Myrtle Point | $182 | 6% |

| Neotsu | $191 | 11% |

| Netarts | $198 | 15% |

| New Hope | $183 | 6% |

| New Pine Creek | $195 | 13% |

| Newberg | $204 | 18% |

| Newport | $187 | 8% |

| North Bend | $176 | 2% |

| North Plains | $212 | 23% |

| North Powder | $179 | 4% |

| Noti | $191 | 11% |

| Nyssa | $184 | 7% |

| O’Brien | $192 | 11% |

| Oak Grove | $222 | 29% |

| Oak Hills | $212 | 23% |

| Oakland | $181 | 5% |

| Oakridge | $187 | 8% |

| Oceanside | $200 | 16% |

| Odell | $187 | 8% |

| Ontario | $182 | 5% |

| Ophir | $198 | 15% |

| Oregon City | $221 | 28% |

| Otis | $196 | 14% |

| Otter Rock | $188 | 9% |

| Oxbow | $183 | 6% |

| Pacific City | $200 | 16% |

| Paisley | $196 | 14% |

| Paulina | $186 | 8% |

| Pendleton | $179 | 4% |

| Philomath | $180 | 5% |

| Phoenix | $181 | 5% |

| Plush | $197 | 14% |

| Port Orford | $175 | 2% |

| Portland | $234 | 36% |

| Post | $187 | 8% |

| Princeton | $194 | 12% |

| Prineville | $184 | 7% |

| Prospect | $196 | 14% |

| Rainier | $200 | 16% |

| Raleigh Hills | $216 | 26% |

| Redmond | $182 | 6% |

| Redwood | $183 | 6% |

| Reedsport | $177 | 3% |

| Rhododendron | $228 | 32% |

| Richland | $181 | 5% |

| Rickreall | $204 | 18% |

| Riddle | $184 | 7% |

| Riley | $186 | 8% |

| Ritter | $189 | 10% |

| Riverside | $185 | 7% |

| Rockaway Beach | $197 | 14% |

| Rockcreek | $210 | 22% |

| Rogue River | $182 | 6% |

| Roseburg | $181 | 5% |

| Roseburg North | $182 | 5% |

| Rufus | $188 | 9% |

| Salem | $209 | 21% |

| Sandy | $233 | 35% |

| Scappoose | $200 | 16% |

| Scio | $194 | 13% |

| Scotts Mills | $216 | 25% |

| Scottsburg | $182 | 5% |

| Seal Rock | $184 | 7% |

| Seaside | $193 | 12% |

| Selma | $188 | 9% |

| Seneca | $183 | 6% |

| Shady Cove | $190 | 10% |

| Shaniko | $211 | 22% |

| Shedd | $178 | 3% |

| Sheridan | $204 | 19% |

| Sherwood | $198 | 15% |

| Silver Lake | $194 | 13% |

| Silverton | $206 | 19% |

| Sisters | $193 | 12% |

| Sixes | $179 | 4% |

| South Beach | $187 | 8% |

| Sprague River | $198 | 15% |

| Spray | $195 | 13% |

| Springfield | $180 | 4% |

| St. Benedict | $222 | 29% |

| St. Helens | $200 | 16% |

| St. Paul | $212 | 23% |

| Stafford | $208 | 20% |

| Stanfield | $182 | 5% |

| Stayton | $199 | 15% |

| Sublimity | $199 | 16% |

| Summer Lake | $197 | 14% |

| Summerville | $184 | 7% |

| Sumpter | $182 | 6% |

| Sunriver | $187 | 9% |

| Sutherlin | $180 | 4% |

| Sweet Home | $186 | 8% |

| Swisshome | $183 | 6% |

| Talent | $184 | 7% |

| Tangent | $177 | 3% |

| Tenmile | $182 | 5% |

| Terrebonne | $189 | 10% |

| The Dalles | $189 | 10% |

| Tidewater | $189 | 10% |

| Tigard | $212 | 23% |

| Tillamook | $198 | 15% |

| Tiller | $190 | 10% |

| Timber | $204 | 18% |

| Timberline Lodge | $218 | 26% |

| Toledo | $189 | 10% |

| Tolovana Park | $195 | 13% |

| Trail | $191 | 10% |

| Tri-City | $184 | 7% |

| Troutdale | $243 | 41% |

| Tualatin | $204 | 18% |

| Turner | $202 | 17% |

| Tygh Valley | $198 | 15% |

| Ukiah | $186 | 8% |

| Umatilla | $182 | 6% |

| Umpqua | $185 | 8% |

| Union | $180 | 4% |

| Unity | $182 | 5% |

| Vale | $181 | 5% |

| Veneta | $189 | 9% |

| Vernonia | $201 | 17% |

| Vida | $193 | 12% |

| Waldport | $185 | 8% |

| Walterville | $191 | 11% |

| Walton | $181 | 5% |

| Warm Springs | $201 | 17% |

| Warren | $201 | 16% |

| Warrenton | $189 | 10% |

| Waterloo | $182 | 5% |

| Wedderburn | $194 | 12% |

| Welches | $229 | 33% |

| West Haven-Sylvan | $213 | 23% |

| West Linn | $208 | 21% |

| West Slope | $215 | 25% |

| Westfall | $182 | 6% |

| Westfir | $188 | 9% |

| Westlake | $181 | 5% |

| Wheeler | $197 | 14% |

| White City | $184 | 7% |

| Wilbur | $193 | 12% |

| Wilderville | $187 | 9% |

| Willamina | $203 | 18% |

| Williams | $194 | 13% |

| Wilsonville | $205 | 19% |

| Winchester | $182 | 6% |

| Winston | $180 | 5% |

| Wolf Creek | $187 | 8% |

| Wood Village | $244 | 42% |

| Woodburn | $220 | 28% |

| Yachats | $184 | 7% |

| Yamhill | $207 | 20% |

| Yoncalla | $181 | 5% |

Portland drivers pay an average of $234 a month for car insurance. This is 36% higher than the state average. Car insurance costs $209 a month, or 21% more than the average, in Salem.

Minimum coverage for car insurance in Oregon

Car insurance is required by law in Oregon. The minimum amounts of coverage you need to drive legally include:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $20,000

- Uninsured motorist: $25,000 per person, $50,000 per accident

- Personal injury protection (PIP): $15,000

Bodily injury liability kicks in if the medical expenses of someone you hurt goes over their PIP limit. It also covers injuries that are especially severe.

Physical damage liability covers damage you cause to other people’s vehicles or property.

Uninsured motorist covers you and your passengers for injuries caused by a driver with no car insurance. It kicks in for expenses that go over your own PIP limits.

Personal injury protection, or PIP, covers injuries to you and your passengers, no matter who causes the accident. It also covers lost wages and other expenses tied to your recovery.

Collision

How does SR-22 insurance work in Oregon?

A court can order you to get SR-22 car insurance after certain violations. These range from DUII to driving without insurance. An SR-22 is a certificate that your insurance company files with the state for you.

Start by seeing how an SR-22 affects your current insurance company’s rate. You can compare this to SR-22 quotes from other companies to find the cheapest price.

Most companies add a filing fee of about $25 to your rate. The actual price you pay for SR-22 insurance depends largely on your driving record.

SR-22 insurance costs an average of $325 a month in Oregon after a major violation like DUII. The average is closer to $225 a month after an offense like driving without insurance. You’ll pay less if you only need liability insurance without collision or comprehensive coverage.

Frequently asked questions

Car insurance costs an average of $172 a month in Oregon for full coverage. Minimum coverage policies cost $86 a month, on average.

Yes. You need to provide a valid car insurance policy number when you register your vehicle. The requirement applies to personal passenger vehicles. There are exceptions for antiques and collectible cars, farm trailers and certain other vehicles.

How we selected the cheapest car insurance companies in Oregon

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $15,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Oregon

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.