Cheapest Car Insurance in Oklahoma (2026)

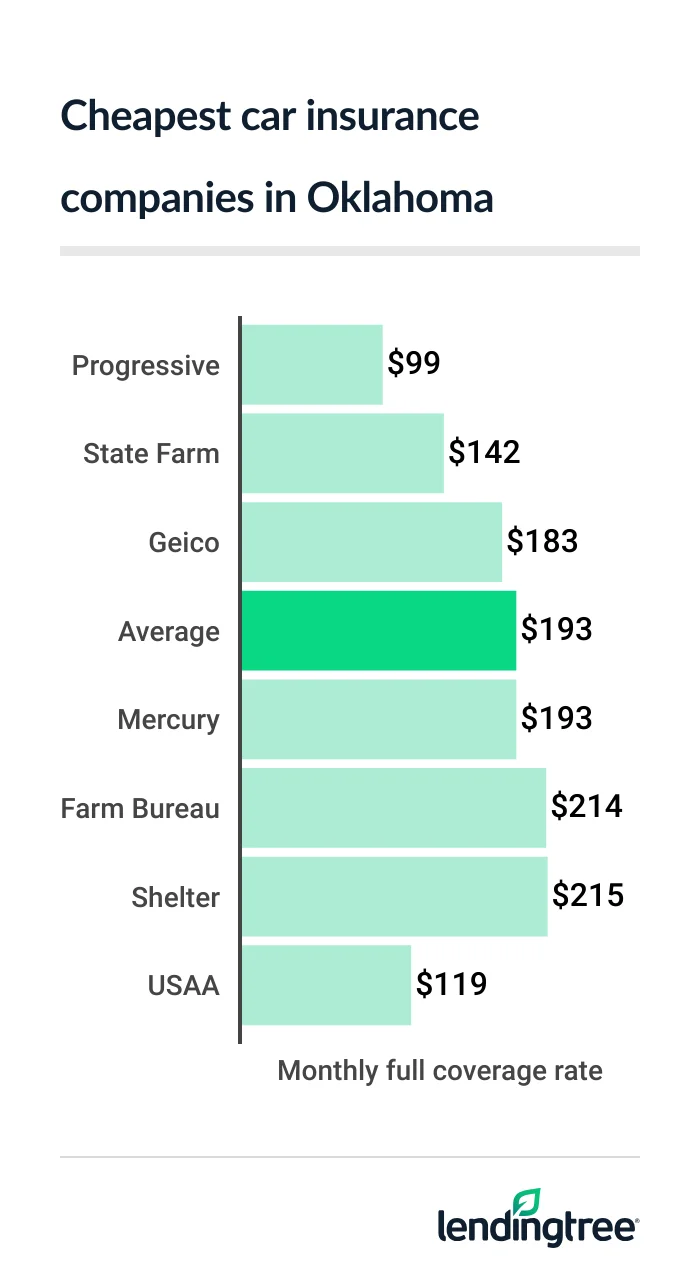

Most Oklahoma drivers can find the cheapest car insurance with Progressive, at $99 a month for full coverage. This is $94 less than the state average of $193 per month.

Best cheap car insurance in Oklahoma

Cheapest full coverage car insurance in Oklahoma: Progressive

Progressive has the cheapest full coverage car insurance for Oklahoma drivers, with an average rate of $99 per month.

USAA is the second-cheapest company in the state for full coverage

- The second-cheapest option for most drivers in Oklahoma is State Farm. Its rates average $142 per month.

- Geico comes in third, at $183 per month.

- The state average for full coverage is $193 per month.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Progressive | $99 | |

| State Farm | $142 | |

| Geico | $183 | |

| Mercury | $193 | |

| Farm Bureau | $214 | |

| Shelter | $215 | |

| Farmers | $249 | |

| Allstate | $320 | |

| USAA* | $119 | |

State Farm and USAA have the best customer satisfaction scores from J.D. Power

To find out which company is the best and cheapest for you, compare car insurance quotes from each of them before you buy or renew a policy.

Oklahoma’s cheapest car insurance for liability coverage: Progressive

At $31 per month, Progressive also has the cheapest liability insurance rates for most drivers in Oklahoma. State Farm is second, at $35 per month.

The average cost of liability car insurance in Oklahoma is $55 per month.

Liability-only auto insurance rates

| Company | Monthly rate |

|---|---|

| Progressive | $31 |

| State Farm | $35 |

| Mercury | $43 |

| Farm Bureau | $62 |

| Shelter | $62 |

| Geico | $62 |

| Farmers | $67 |

| Allstate | $104 |

| USAA* | $30 |

Both Progressive and State Farm offer several discounts that could save you money on a liability insurance policy.

Between them, only State Farm has discounts for vehicles with anti-theft or safety features. It also offers a low-mileage discount that Progressive does not. But only Progressive gives a discount to homeowners or customers who sign their documents online.

Best cheap auto insurance in Oklahoma for teen drivers: State Farm

Most Oklahoma drivers get the cheapest teen car insurance from State Farm. The company’s teen liability rates are the state’s most affordable, at $121 per month. It also has the lowest full coverage rates for most teen drivers, at $363 per month.

Monthly car insurance rates for teens

| Company | Liability | Full |

|---|---|---|

| State Farm | $121 | $363 |

| Shelter | $163 | $533 |

| Geico | $167 | $435 |

| Progressive | $179 | $466 |

| Farm Bureau | $240 | $602 |

| Farmers | $243 | $766 |

| Mercury | $270 | $1,077 |

| Allstate | $328 | $872 |

| USAA* | $76 | $250 |

If you or a family member are active or retired military, make sure you get a quote from USAA for teen car insurance in Oklahoma. Its rates are even cheaper than State Farm’s, at $76 per month for liability and $250 per month for full coverage.

State Farm and USAA each offer the most common car insurance discounts for teen drivers.

- Both companies have a discount for students who get good grades.

- State Farm also has a discount for teens who complete an approved driver education course.

- Students who go away to school without a vehicle can get another discount from State Farm.

Cheap Oklahoma car insurance rates after a speeding ticket: Progressive

To get the cheapest auto insurance in Oklahoma after a speeding ticket, compare quotes with Progressive. Its average rate for drivers after a ticket is $136 per month, the state’s cheapest.

State Farm is the next-cheapest company for most drivers after a ticket, with an average rate of $148 per month.

Car insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| Progressive | $136 |

| State Farm | $148 |

| Farm Bureau | $214 |

| Geico | $250 |

| Shelter | $250 |

| Mercury | $267 |

| Farmers | $328 |

| Allstate | $371 |

| USAA* | $147 |

Although State Farm is more expensive than Progressive for drivers with a ticket on their records, you might want to go with it anyway because of its good customer satisfaction rating. Progressive lets you customize your policy more, however, with add-ons for accident forgiveness, trip interruption and custom parts and equipment.

An average driver in Oklahoma pays $235 per month for car insurance after getting a speeding ticket. That’s around $40 per month more than what drivers with clean records pay.

Cheapest car insurance after an accident in Oklahoma: State Farm

Oklahoma drivers with an at-fault accident on their records can get the cheapest car insurance quotes from State Farm, at $142 per month.

Progressive is the state’s second-cheapest company for car insurance after an accident, at $165 per month.

Car insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $142 |

| Progressive | $165 |

| Farm Bureau | $231 |

| Shelter | $272 |

| Farmers | $331 |

| Mercury | $333 |

| Geico | $338 |

| Allstate | $453 |

| USAA* | $173 |

The average cost of auto insurance in Oklahoma after an accident is $271 per month. That’s almost $80 more than what drivers with a clean record pay for the same coverage.

Cheap Oklahoma car insurance for teens with bad driving records: State Farm

State Farm has the cheapest auto insurance for most Oklahoma teens with bad driving records. The company’s average rate for teens with a speeding ticket on their records is $131 per month. Teens with an accident on their records pay $121 per month with State Farm.

Monthly insurance rates for teens with a ticket or an accident

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $131 | $121 |

| Progressive | $192 | $203 |

| Shelter | $198 | $235 |

| Geico | $210 | $291 |

| Farm Bureau | $240 | $274 |

| Mercury | $275 | $296 |

| Farmers | $303 | $313 |

| Allstate | $419 | $542 |

| USAA* | $110 | $123 |

Progressive comes in second for these teens. Its rates average $192 per month for teens after a ticket and $203 per month for teens after an accident.

Oklahoma’s cheapest DUI insurance: Progressive

With an average rate of $124 per month, Progressive has the cheapest DUI insurance in Oklahoma by far.

Car insurance rates after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $124 |

| Mercury | $253 |

| State Farm | $283 |

| Geico | $300 |

| Shelter | $311 |

| Farm Bureau | $319 |

| Farmers | $364 |

| Allstate | $406 |

| USAA* | $217 |

Mercury is the next-cheapest company for drivers with a DUI (driving under the influence) conviction, at $253 per month. State Farm comes in third, at $283 per month. The state average rate is $286 per month.

If you’re convicted of DUI in Oklahoma, you can expect your car insurance premium to go up by around $90 per month.

Best cheap car insurance rates in Oklahoma for bad credit: Progressive

The best company for cheap car insurance with bad credit in Oklahoma is Progressive, where rates average $158 per month.

Bad credit car insurance rates

| Company | Monthly rate |

|---|---|

| Progressive | $158 |

| Farm Bureau | $215 |

| Geico | $266 |

| Mercury | $323 |

| Farmers | $398 |

| Shelter | $427 |

| Allstate | $480 |

| State Farm | $723 |

| USAA* | $218 |

Farm Bureau is next, with an average rate of $215 per month. Geico comes in third for most of the state’s drivers with poor credit, at $266 per month.

Both Farm Bureau and Geico score a bit better with customers than Progressive does. If service is important to you, you might want to consider them instead.

The state average rate for car insurance with poor credit is $356 per month. This is over $160 per month more than what Oklahoma drivers with good credit pay for a policy.

Oklahoma’s best car insurance companies

State Farm and Progressive are the best car insurance companies in Oklahoma for most drivers.

State Farm has the state’s cheapest auto insurance for young drivers and adults with an accident on their records. It’s also among the most affordable for other driver and coverage types. On top of that, State Farm has a great J.D. Power customer satisfaction score.

Progressive has the lowest car insurance rates for most Oklahomans. It offers the state’s cheapest liability and full coverage insurance. And it also has the cheapest rates for adult drivers with a speeding ticket or DUI on their records. The main issue with Progressive is that its customer satisfaction score is slightly worse than average.

Oklahoma car insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ | |

| Farm Bureau | 645 | A | |

| Progressive | 621 | A+ | |

| Geico | 645 | A++ | |

| Shelter | 669 | A | |

| Mercury | 594 | A | |

| Allstate | 635 | A+ | |

| Farmers | 622 | A |

Beyond rates and ratings, State Farm and Progressive offer many discounts that can help make your policy cheaper.

Both companies offer the most common discounts, such as for bundling policies, insuring more than one vehicle and buying more than one type of policy from them. They also give discounts to good drivers, loyal customers and those who pay their premiums in full.

Progressive may be a better choice if you like to customize your policy, however. It offers many more add-on coverages than State Farm does, including coverage for loan/lease payoff and pet injuries.

Oklahoma car insurance rates by city

Dewey is the cheapest city for car insurance in Oklahoma, with rates of around $180 per month.

The state’s most expensive city for insurance is Forest Park, where rates average $228 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Achille | $197 | 2% |

| Ada | $192 | 0% |

| Adair | $188 | -2% |

| Adams | $190 | -2% |

| Addington | $191 | -1% |

| Afton | $190 | -1% |

| Agra | $201 | 4% |

| Akins | $191 | -1% |

| Albany | $195 | 1% |

| Albert | $189 | -2% |

| Albion | $193 | 0% |

| Alderson | $192 | 0% |

| Alex | $195 | 1% |

| Aline | $192 | 0% |

| Allen | $196 | 2% |

| Altus | $188 | -2% |

| Altus Afb | $191 | -1% |

| Alva | $194 | 1% |

| Amber | $194 | 0% |

| Ames | $190 | -1% |

| Amorita | $194 | 1% |

| Anadarko | $191 | -1% |

| Antlers | $207 | 8% |

| Apache | $191 | -1% |

| Arapaho | $183 | -5% |

| Arcadia | $209 | 8% |

| Ardmore | $193 | 0% |

| Arkoma | $194 | 1% |

| Arnett | $197 | 2% |

| Asher | $197 | 2% |

| Atoka | $205 | 6% |

| Atwood | $194 | 1% |

| Avant | $195 | 1% |

| Balko | $190 | -1% |

| Barnsdall | $195 | 1% |

| Bartlesville | $184 | -4% |

| Battiest | $199 | 3% |

| Beaver | $192 | 0% |

| Beggs | $194 | 1% |

| Bell | $196 | 2% |

| Bennington | $204 | 6% |

| Bessie | $186 | -3% |

| Bethany | $219 | 13% |

| Bethel | $197 | 2% |

| Bethel Acres | $202 | 5% |

| Big Cabin | $194 | 0% |

| Billings | $187 | -3% |

| Binger | $197 | 2% |

| Bison | $186 | -3% |

| Bixby | $206 | 7% |

| Blackwell | $194 | 1% |

| Blair | $193 | 0% |

| Blanchard | $199 | 3% |

| Blanco | $193 | 0% |

| Blocker | $194 | 1% |

| Bluejacket | $192 | 0% |

| Boise City | $193 | 0% |

| Bokchito | $197 | 2% |

| Bokoshe | $190 | -2% |

| Boley | $193 | 0% |

| Boswell | $203 | 5% |

| Bowlegs | $191 | -1% |

| Boynton | $192 | -1% |

| Bradley | $196 | 2% |

| Braggs | $190 | -1% |

| Braman | $196 | 2% |

| Bristow | $194 | 1% |

| Broken Arrow | $203 | 6% |

| Broken Bow | $207 | 8% |

| Bromide | $193 | 0% |

| Brushy | $192 | -1% |

| Buffalo | $197 | 2% |

| Bunch | $192 | -1% |

| Burbank | $196 | 2% |

| Burlington | $192 | 0% |

| Burneyville | $186 | -3% |

| Burns Flat | $196 | 2% |

| Bushyhead | $187 | -3% |

| Butler | $191 | -1% |

| Byars | $198 | 3% |

| Byng | $192 | 0% |

| Cache | $186 | -4% |

| Caddo | $198 | 3% |

| Calera | $195 | 1% |

| Calumet | $197 | 2% |

| Calvin | $194 | 1% |

| Camargo | $197 | 2% |

| Cameron | $192 | -1% |

| Canadian | $190 | -1% |

| Caney | $201 | 4% |

| Canton | $194 | 1% |

| Canute | $192 | -1% |

| Cardin | $193 | 0% |

| Carlisle | $192 | 0% |

| Carmen | $191 | -1% |

| Carnegie | $194 | 1% |

| Carney | $198 | 3% |

| Carrier | $187 | -3% |

| Carter | $194 | 1% |

| Cartwright | $195 | 1% |

| Cashion | $202 | 5% |

| Castle | $192 | -1% |

| Catoosa | $195 | 1% |

| Cedar Crest | $195 | 1% |

| Cement | $193 | 0% |

| Centrahoma | $199 | 3% |

| Central High | $192 | 0% |

| Chandler | $197 | 2% |

| Chattanooga | $185 | -4% |

| Checotah | $192 | 0% |

| Chelsea | $191 | -1% |

| Cherokee | $195 | 1% |

| Chester | $193 | 0% |

| Chewey | $193 | 0% |

| Cheyenne | $200 | 4% |

| Chickasha | $192 | 0% |

| Choctaw | $210 | 9% |

| Chouteau | $193 | 0% |

| Claremore | $186 | -3% |

| Clarita | $198 | 3% |

| Clayton | $204 | 6% |

| Cleo Springs | $191 | -1% |

| Cleora | $190 | -1% |

| Cleveland | $199 | 4% |

| Clinton | $187 | -3% |

| Coalgate | $204 | 6% |

| Colbert | $192 | 0% |

| Colcord | $191 | -1% |

| Coleman | $196 | 2% |

| Collinsville | $189 | -2% |

| Colony | $191 | -1% |

| Comanche | $191 | -1% |

| Commerce | $189 | -2% |

| Concho | $203 | 5% |

| Connerville | $197 | 2% |

| Cookson | $196 | 2% |

| Copan | $183 | -5% |

| Copeland | $188 | -2% |

| Cordell | $190 | -2% |

| Corn | $187 | -3% |

| Council Hill | $190 | -1% |

| Countyline | $189 | -2% |

| Covington | $184 | -4% |

| Coweta | $200 | 4% |

| Coyle | $202 | 5% |

| Crawford | $196 | 2% |

| Crescent | $202 | 5% |

| Cromwell | $193 | 0% |

| Crowder | $195 | 1% |

| Cushing | $195 | 1% |

| Custer City | $193 | 0% |

| Cyril | $193 | 0% |

| Dacoma | $193 | 0% |

| Daisy | $199 | 3% |

| Davenport | $198 | 3% |

| Davidson | $192 | 0% |

| Davis | $193 | 0% |

| Deer Creek | $195 | 1% |

| Del City | $221 | 15% |

| Delaware | $195 | 1% |

| Depew | $192 | 0% |

| Devol | $192 | 0% |

| Dewar | $200 | 4% |

| Dewey | $180 | -7% |

| Dibble | $198 | 3% |

| Dickson | $194 | 1% |

| Dill City | $193 | 0% |

| Disney | $196 | 2% |

| Dougherty | $194 | 1% |

| Douglas | $187 | -3% |

| Dover | $192 | 0% |

| Drummond | $185 | -4% |

| Drumright | $195 | 1% |

| Dry Creek | $197 | 2% |

| Duke | $197 | 2% |

| Duncan | $188 | -2% |

| Durant | $192 | 0% |

| Durham | $197 | 2% |

| Dustin | $192 | 0% |

| Eagletown | $203 | 6% |

| Eakly | $193 | 0% |

| Earlsboro | $197 | 2% |

| Edmond | $209 | 8% |

| El Reno | $204 | 6% |

| Eldorado | $189 | -2% |

| Elgin | $183 | -5% |

| Elk City | $196 | 1% |

| Elmer | $191 | -1% |

| Elmore City | $189 | -2% |

| Enid | $182 | -6% |

| Erick | $202 | 5% |

| Eucha | $192 | 0% |

| Eufaula | $189 | -2% |

| Fair Oaks | $190 | -1% |

| Fairfax | $196 | 2% |

| Fairland | $188 | -2% |

| Fairmont | $185 | -4% |

| Fairview | $190 | -1% |

| Fanshawe | $193 | 0% |

| Fargo | $194 | 0% |

| Faxon | $186 | -4% |

| Fay | $195 | 1% |

| Felt | $193 | 0% |

| Finley | $206 | 7% |

| Fittstown | $195 | 1% |

| Fitzhugh | $192 | 0% |

| Fletcher | $186 | -4% |

| Forest Park | $228 | 18% |

| Forgan | $192 | -1% |

| Fort Cobb | $192 | 0% |

| Fort Gibson | $192 | 0% |

| Fort Supply | $191 | -1% |

| Fort Towson | $207 | 7% |

| Foss | $192 | 0% |

| Foster | $187 | -3% |

| Fox | $191 | -1% |

| Foyil | $191 | -1% |

| Francis | $193 | 0% |

| Frederick | $189 | -2% |

| Freedom | $194 | 1% |

| Gage | $194 | 1% |

| Gans | $190 | -1% |

| Garber | $185 | -4% |

| Garvin | $205 | 6% |

| Gate | $194 | 1% |

| Geary | $199 | 3% |

| Gene Autry | $190 | -2% |

| Geronimo | $188 | -2% |

| Glencoe | $192 | -1% |

| Glenpool | $202 | 5% |

| Golden | $200 | 4% |

| Goldsby | $199 | 3% |

| Goltry | $189 | -2% |

| Goodwell | $185 | -4% |

| Gore | $192 | 0% |

| Gotebo | $192 | 0% |

| Gould | $198 | 3% |

| Gowen | $194 | 0% |

| Gracemont | $191 | -1% |

| Graham | $188 | -2% |

| Grandfield | $189 | -2% |

| Grandview | $196 | 2% |

| Granite | $196 | 1% |

| Grant | $197 | 2% |

| Greenfield | $193 | 0% |

| Grove | $188 | -2% |

| Guthrie | $205 | 7% |

| Guymon | $185 | -4% |

| Haileyville | $196 | 2% |

| Hallett | $198 | 3% |

| Hammon | $196 | 2% |

| Hanna | $195 | 1% |

| Hardesty | $190 | -1% |

| Harrah | $207 | 8% |

| Hartshorne | $190 | -2% |

| Haskell | $195 | 1% |

| Hastings | $194 | 1% |

| Haworth | $203 | 6% |

| Headrick | $191 | -1% |

| Healdton | $189 | -2% |

| Heavener | $196 | 1% |

| Helena | $192 | 0% |

| Hendrix | $197 | 2% |

| Hennepin | $192 | -1% |

| Hennessey | $190 | -2% |

| Henryetta | $194 | 1% |

| Hillsdale | $190 | -2% |

| Hinton | $197 | 2% |

| Hitchcock | $188 | -2% |

| Hitchita | $193 | 0% |

| Hobart | $195 | 1% |

| Hodgen | $200 | 4% |

| Holdenville | $193 | 0% |

| Hollis | $200 | 4% |

| Hollister | $188 | -2% |

| Hominy | $201 | 4% |

| Honobia | $197 | 2% |

| Hooker | $185 | -4% |

| Hopeton | $191 | -1% |

| Howe | $194 | 1% |

| Hoyt | $196 | 2% |

| Hugo | $200 | 4% |

| Hulbert | $197 | 2% |

| Hunter | $186 | -4% |

| Hydro | $193 | 0% |

| Idabel | $204 | 6% |

| Indiahoma | $184 | -4% |

| Indianola | $192 | 0% |

| Inola | $188 | -2% |

| Isabella | $191 | -1% |

| Jay | $191 | -1% |

| Jenks | $203 | 5% |

| Jennings | $201 | 4% |

| Jet | $192 | 0% |

| Jones | $209 | 9% |

| Justice | $186 | -4% |

| Kansas | $191 | -1% |

| Katie | $189 | -2% |

| Kaw City | $193 | 0% |

| Kellyville | $194 | 1% |

| Kemp | $196 | 2% |

| Kenefic | $194 | 1% |

| Kenton | $192 | 0% |

| Kenwood | $190 | -1% |

| Keota | $189 | -2% |

| Ketchum | $195 | 1% |

| Keyes | $191 | -1% |

| Kiefer | $194 | 1% |

| Kingfisher | $196 | 2% |

| Kingston | $190 | -1% |

| Kinta | $196 | 2% |

| Kiowa | $195 | 1% |

| Konawa | $190 | -1% |

| Krebs | $191 | -1% |

| Kremlin | $188 | -3% |

| Lahoma | $186 | -3% |

| Lamar | $192 | 0% |

| Lamont | $196 | 2% |

| Lane | $205 | 6% |

| Langley | $195 | 1% |

| Langston | $202 | 5% |

| Laverne | $194 | 1% |

| Lawton | $185 | -4% |

| Lebanon | $189 | -2% |

| Leedey | $201 | 4% |

| Leflore | $192 | 0% |

| Lehigh | $198 | 3% |

| Lenapah | $192 | -1% |

| Leon | $189 | -2% |

| Leonard | $196 | 2% |

| Lequire | $194 | 1% |

| Lexington | $201 | 4% |

| Limestone | $186 | -3% |

| Lindsay | $190 | -2% |

| Loco | $191 | -1% |

| Locust Grove | $194 | 1% |

| Lone Grove | $192 | 0% |

| Lone Wolf | $195 | 1% |

| Long | $191 | -1% |

| Longdale | $191 | -1% |

| Longtown | $189 | -2% |

| Lookeba | $193 | 0% |

| Loveland | $190 | -2% |

| Loyal | $194 | 0% |

| Lucien | $191 | -1% |

| Luther | $210 | 9% |

| Macomb | $203 | 5% |

| Madill | $189 | -2% |

| Manchester | $192 | 0% |

| Mangum | $201 | 4% |

| Manitou | $187 | -3% |

| Mannford | $199 | 3% |

| Mannsville | $190 | -1% |

| Maramec | $187 | -3% |

| Marble City | $196 | 2% |

| Marietta | $188 | -3% |

| Marland | $188 | -2% |

| Marlow | $192 | 0% |

| Marshall | $196 | 2% |

| Martha | $192 | -1% |

| Maud | $197 | 2% |

| May | $193 | 0% |

| Maysville | $192 | -1% |

| McAlester | $189 | -2% |

| McCord | $194 | 1% |

| McCurtain | $195 | 1% |

| McLoud | $205 | 7% |

| Mead | $193 | 0% |

| Medford | $194 | 1% |

| Medicine Park | $184 | -5% |

| Meeker | $197 | 2% |

| Meers | $187 | -3% |

| Meno | $189 | -2% |

| Meridian | $197 | 2% |

| Miami | $193 | 0% |

| Midwest City | $217 | 13% |

| Milburn | $195 | 1% |

| Milfay | $191 | -1% |

| Mill Creek | $192 | 0% |

| Millerton | $198 | 3% |

| Minco | $200 | 4% |

| Moffett | $200 | 4% |

| Monroe | $197 | 2% |

| Moodys | $193 | 0% |

| Moore | $211 | 9% |

| Mooreland | $195 | 1% |

| Morris | $194 | 1% |

| Morrison | $196 | 2% |

| Mounds | $194 | 1% |

| Mountain Park | $193 | 0% |

| Mountain View | $194 | 1% |

| Moyers | $198 | 3% |

| Muldrow | $190 | -1% |

| Mulhall | $197 | 2% |

| Muse | $197 | 2% |

| Muskogee | $190 | -1% |

| Mustang | $203 | 6% |

| Mutual | $195 | 1% |

| Nardin | $195 | 1% |

| Nash | $189 | -2% |

| Nashoba | $197 | 2% |

| New Cordell | $189 | -2% |

| Newalla | $208 | 8% |

| Newcastle | $205 | 6% |

| Newkirk | $195 | 1% |

| Nichols Hills | $226 | 17% |

| Nicoma Park | $214 | 11% |

| Ninnekah | $196 | 2% |

| Noble | $201 | 4% |

| Norman | $203 | 5% |

| North Enid | $182 | -5% |

| North Miami | $189 | -2% |

| Nowata | $195 | 1% |

| Oakhurst | $213 | 11% |

| Oakland | $189 | -2% |

| Oaks | $196 | 1% |

| Oakwood | $194 | 1% |

| Ochelata | $183 | -5% |

| Oilton | $201 | 4% |

| Okarche | $193 | 0% |

| Okay | $199 | 3% |

| Okeene | $193 | 0% |

| Okemah | $196 | 2% |

| Oklahoma City | $218 | 13% |

| Okmulgee | $192 | 0% |

| Oktaha | $188 | -2% |

| Olustee | $195 | 1% |

| Omega | $199 | 3% |

| Oologah | $186 | -3% |

| Orlando | $197 | 2% |

| Osage | $193 | 0% |

| Oscar | $193 | 0% |

| Overbrook | $190 | -1% |

| Owasso | $190 | -1% |

| Paden | $194 | 1% |

| Panama | $195 | 1% |

| Panola | $190 | -1% |

| Paoli | $191 | -1% |

| Park Hill | $196 | 2% |

| Pauls Valley | $191 | -1% |

| Pawhuska | $197 | 2% |

| Pawnee | $202 | 5% |

| Peggs | $197 | 2% |

| Perkins | $191 | -1% |

| Perry | $190 | -2% |

| Pettit | $198 | 3% |

| Picher | $195 | 1% |

| Pickens | $201 | 4% |

| Piedmont | $205 | 6% |

| Pink | $200 | 4% |

| Pittsburg | $196 | 2% |

| Platter | $193 | 0% |

| Pocasset | $200 | 4% |

| Pocola | $192 | 0% |

| Ponca City | $196 | 2% |

| Pond Creek | $193 | 0% |

| Porter | $199 | 3% |

| Porum | $188 | -3% |

| Poteau | $194 | 1% |

| Prague | $198 | 3% |

| Preston | $197 | 2% |

| Proctor | $193 | 0% |

| Prue | $193 | 0% |

| Pryor | $188 | -3% |

| Pryor Creek | $187 | -3% |

| Purcell | $198 | 3% |

| Putnam | $195 | 1% |

| Quapaw | $195 | 1% |

| Quinton | $191 | -1% |

| Ralston | $191 | -1% |

| Ramona | $183 | -5% |

| Randlett | $193 | 0% |

| Ratliff City | $188 | -2% |

| Rattan | $208 | 8% |

| Ravia | $192 | 0% |

| Red Oak | $196 | 1% |

| Red Rock | $191 | -1% |

| Redbird | $196 | 2% |

| Rentiesville | $194 | 1% |

| Reydon | $195 | 1% |

| Ringling | $189 | -2% |

| Ringold | $198 | 3% |

| Ringwood | $186 | -3% |

| Ripley | $192 | 0% |

| Rocky | $194 | 1% |

| Rocky Mountain | $195 | 1% |

| Roff | $192 | -1% |

| Roland | $194 | 0% |

| Roosevelt | $193 | 0% |

| Rose | $188 | -2% |

| Rosston | $194 | 1% |

| Rufe | $196 | 2% |

| Rush Springs | $196 | 2% |

| Ryan | $196 | 2% |

| Salina | $194 | 1% |

| Sallisaw | $191 | -1% |

| Sams Corner | $194 | 0% |

| Sand Hill | $191 | -1% |

| Sand Springs | $199 | 3% |

| Sapulpa | $197 | 2% |

| Sasakwa | $190 | -2% |

| Savanna | $195 | 1% |

| Sawyer | $203 | 5% |

| Sayre | $197 | 2% |

| Schulter | $195 | 1% |

| Seiling | $197 | 2% |

| Seminole | $191 | -1% |

| Sentinel | $198 | 3% |

| Sequoyah | $186 | -4% |

| Shady Grove | $194 | 1% |

| Shady Point | $192 | 0% |

| Shamrock | $199 | 3% |

| Sharon | $193 | 0% |

| Shattuck | $195 | 1% |

| Shawnee | $200 | 4% |

| Shidler | $194 | 1% |

| Simms | $188 | -3% |

| Skiatook | $192 | 0% |

| Slaughterville | $200 | 4% |

| Slick | $198 | 3% |

| Smithville | $204 | 6% |

| Snake Creek | $195 | 1% |

| Snow | $200 | 4% |

| Snyder | $192 | 0% |

| Soper | $204 | 6% |

| South Coffeyville | $190 | -1% |

| Southard | $191 | -1% |

| Sparks | $193 | 0% |

| Spavinaw | $191 | -1% |

| Spencer | $216 | 12% |

| Spencerville | $195 | 1% |

| Sperry | $195 | 1% |

| Spiro | $195 | 1% |

| Springer | $190 | -2% |

| St. Louis | $196 | 2% |

| Sterling | $184 | -5% |

| Stidham | $194 | 1% |

| Stigler | $194 | 1% |

| Stillwater | $191 | -1% |

| Stilwell | $196 | 2% |

| Stonewall | $194 | 1% |

| Strang | $190 | -1% |

| Stratford | $192 | 0% |

| Stringtown | $207 | 7% |

| Stroud | $195 | 1% |

| Stuart | $196 | 2% |

| Sulphur | $195 | 1% |

| Sweetwater | $196 | 2% |

| Swink | $199 | 3% |

| Taft | $191 | -1% |

| Tahlequah | $196 | 2% |

| Talala | $190 | -2% |

| Talihina | $203 | 5% |

| Taloga | $200 | 4% |

| Tatums | $191 | -1% |

| Tecumseh | $197 | 2% |

| Temple | $194 | 1% |

| Tenkiller | $194 | 1% |

| Terlton | $197 | 2% |

| Terral | $193 | 0% |

| Texanna | $188 | -2% |

| Texhoma | $185 | -4% |

| Texola | $194 | 1% |

| Thackerville | $187 | -3% |

| The Village | $227 | 18% |

| Thomas | $190 | -1% |

| Tipton | $191 | -1% |

| Tishomingo | $194 | 1% |

| Titanic | $196 | 2% |

| Tonkawa | $197 | 2% |

| Tryon | $200 | 4% |

| Tulsa | $214 | 11% |

| Tupelo | $196 | 2% |

| Turley | $212 | 10% |

| Turpin | $190 | -1% |

| Tuskahoma | $193 | 0% |

| Tussy | $191 | -1% |

| Tuttle | $202 | 5% |

| Twin Oaks | $188 | -3% |

| Tyrone | $189 | -2% |

| Union City | $202 | 5% |

| Valley Brook | $220 | 14% |

| Valliant | $205 | 7% |

| Velma | $190 | -2% |

| Vera | $182 | -6% |

| Verden | $194 | 1% |

| Verdigris | $186 | -3% |

| Vian | $192 | 0% |

| Vici | $197 | 2% |

| Vinita | $195 | 1% |

| Vinson | $199 | 3% |

| Wagoner | $192 | 0% |

| Wainwright | $192 | 0% |

| Wakita | $197 | 2% |

| Walters | $188 | -2% |

| Wanette | $198 | 3% |

| Wann | $191 | -1% |

| Wapanucka | $198 | 3% |

| Wardville | $199 | 3% |

| Warner | $193 | 0% |

| Warr Acres | $223 | 16% |

| Washington | $200 | 4% |

| Watonga | $191 | -1% |

| Watson | $208 | 8% |

| Watts | $193 | 0% |

| Waukomis | $185 | -4% |

| Waurika | $193 | 0% |

| Wayne | $199 | 3% |

| Waynoka | $197 | 2% |

| Weatherford | $186 | -3% |

| Webbers Falls | $190 | -1% |

| Welch | $193 | 0% |

| Weleetka | $194 | 1% |

| Welling | $194 | 1% |

| Wellston | $205 | 6% |

| Westville | $190 | -1% |

| Wetumka | $193 | 0% |

| Wewoka | $190 | -1% |

| Wheatland | $209 | 8% |

| Whitefield | $193 | 0% |

| Whitesboro | $198 | 3% |

| Wilburton | $195 | 1% |

| Willow | $196 | 2% |

| Wilson | $189 | -2% |

| Wister | $194 | 1% |

| Woodall | $194 | 1% |

| Woodward | $194 | 1% |

| Wright City | $206 | 7% |

| Wyandotte | $191 | -1% |

| Wynnewood | $194 | 1% |

| Wynona | $194 | 1% |

| Yale | $195 | 1% |

| Yukon | $202 | 5% |

| Zeb | $194 | 1% |

The average cost of car insurance in Oklahoma’s largest cities:

- Oklahoma City, $218 per month

- Tulsa, $214 per month

- Norman, $203 per month

- Broken Arrow, $203 per month

- Edmond, $209 per month

Minimum coverage for car insurance in Oklahoma

You need car insurance to register your vehicle in Oklahoma. The state’s minimum car insurance requirements are:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property, including their vehicles.

Oklahoma state law doesn’t require full coverage car insurance, which typically includes collision

If you have a car loan, though, your lender will probably make you get full coverage. The same is true for leased vehicles.

Frequently asked questions

Car insurance in Oklahoma costs $193 a month, on average, if you buy a full coverage policy. For a minimum coverage policy, the average cost is $55 a month.

You’ll usually pay more than these average rates if you have any traffic incidents on your driving record, like accidents or DUIs.

Most Oklahoma drivers can find the cheapest car insurance with Progressive. It has the state’s most affordable liability insurance rates, at $31 a month. It also has the lowest full coverage rates of $99 a month.

Driving without insurance is a misdemeanor offense in Oklahoma. The penalties include a fine, license suspension and possible jail time.

How we selected the cheapest car insurance companies in Oklahoma

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Oklahoma

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.