Cheapest Car Insurance in Nevada (2026)

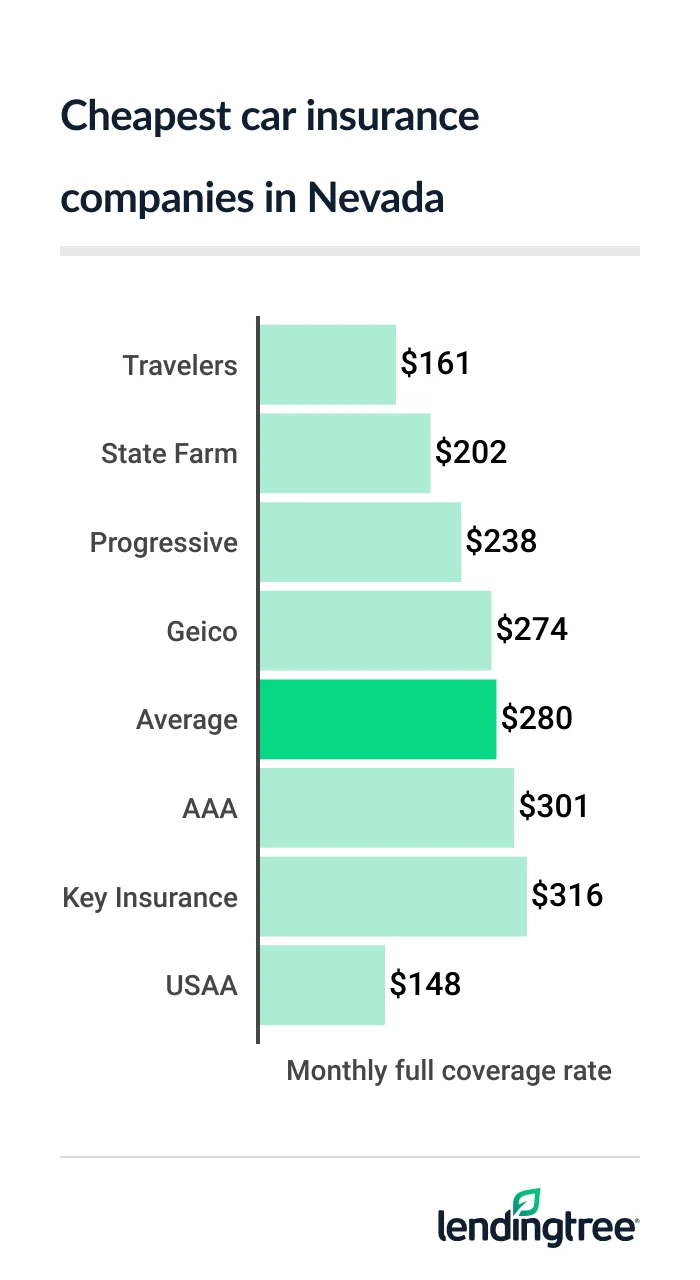

Travelers has the cheapest car insurance in Nevada, charging about $161 per month for full coverage and $79 per month for liability coverage.

Best cheap car insurance in Nevada

Cheapest full coverage car insurance in Nevada: Travelers

Travelers has the cheapest full coverage car insurance for most Nevada drivers, at an average rate of $161 per month. This is nearly $120 less than the state average of $280 per month for full coverage

State Farm, Progressive and Geico also have average rates for full coverage insurance that are cheaper than the state average. State Farm is the most affordable of these three companies, at $202 per month.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $161 | |

| State Farm | $202 | |

| Progressive | $238 | |

| Geico | $274 | |

| AAA | $301 | |

| Key Insurance | Key Insurance | $316 | Not rated |

| Allstate | $360 | |

| Mendota | Mendota | $379 | Not rated |

| Farmers | $421 | |

| USAA* | $148 | |

State Farm and Geico have better customer satisfaction scores from J.D. Power

USAA is cheaper than any of these companies, at $148 per month. It also has the best J.D. Power scores of them all. You can only get coverage from USAA if you or a family member are active or retired military, however.

Nevada’s cheapest liability car insurance: Travelers

At $79 per month, Travelers also has the cheapest liability insurance for most Nevada drivers. This is nearly half the state average rate of $147 per month.

Liability auto insurance rates

| Company | Monthly rate |

|---|---|

| Travelers | $79 |

| State Farm | $91 |

| Progressive | $100 |

| Geico | $104 |

| AAA | $152 |

| Mendota | $165 |

| Farmers | $177 |

| Allstate | $191 |

| Key Insurance | $353 |

| USAA* | $61 |

State Farm, Progressive and Geico also offer liability insurance

If you like to customize your policy, make sure you include Progressive when you compare car insurance quotes in Nevada. Progressive offers several nice add-ons, including roadside assistance

Best cheap car insurance in Nevada for young drivers: Travelers

Most drivers in Nevada get the cheapest teen car insurance from Travelers. The company’s teen liability rates are the state’s lowest (besides USAA), at $242 per month. It also has the lowest full coverage rates for most teen drivers, at $436 per month.

Monthly car insurance rates for teens

| Company | Liability | Full |

|---|---|---|

| Travelers | $242 | $436 |

| Geico | $246 | $526 |

| State Farm | $313 | $601 |

| Progressive | $349 | $813 |

| AAA | $386 | $791 |

| Mendota | $414 | $845 |

| Farmers | $683 | $1,569 |

| Allstate | $854 | $1,452 |

| Key Insurance | $1,280 | $1,062 |

| USAA* | $169 | $371 |

You should also consider Geico for cheap teen car insurance in Nevada, especially if you only want liability coverage. Its teen liability rate is only $4 per month more than Travelers.

Also, Geico offers many more car insurance discounts than Travelers. If you can get a few of them, Geico could be your cheapest option.

With both Travelers and Geico, you may earn teen car insurance discounts for:

- Getting good grades

- Going away to school without a vehicle

- Completing a driver’s education program

You can also earn discounts from Geico if you get a quote before buying a policy, enroll in online billing or drive a vehicle with certain anti-theft or safety features.

Cheap car insurance in Nevada after a speeding ticket: Travelers

Travelers is the cheapest car insurance company in Nevada for most drivers with a speeding ticket on their records. Its average rate for these drivers is $199 per month.

Car insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| Travelers | $199 |

| State Farm | $220 |

| Progressive | $308 |

| Key Insurance | $316 |

| AAA | $384 |

| Allstate | $401 |

| Mendota | $409 |

| Geico | $418 |

| Farmers | $531 |

| USAA* | $183 |

The state average cost of car insurance after a speeding ticket is $337 per month in Nevada. State Farm also comes in well below that amount, with an average rate of $220 per month.

If you get a speeding ticket in Nevada, you can expect your car insurance premium to go up about $60 per month. Travelers customers may see a lower increase, however. We found that Travelers only raises its rates by $38 per month after a ticket, on average.

Cheapest Nevada auto insurance after an accident: State Farm

With an average rate of $202 per month, State Farm has Nevada’s cheapest car insurance after an accident. Travelers also has an affordable average rate of $222 per month for drivers with an accident on their records.

Auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $202 |

| Travelers | $222 |

| Key Insurance | $356 |

| Progressive | $369 |

| Mendota | $468 |

| Geico | $479 |

| Allstate | $502 |

| AAA | $504 |

| Farmers | $637 |

| USAA* | $210 |

Both State Farm and Travelers are much cheaper than the state average of $395 per month for car insurance after an accident.

In Nevada, the average driver sees their car insurance premium go up around $115 per month after an at-fault accident.

Best cheap car insurance for Nevada teens with bad driving records: Travelers and State Farm

Travelers and State Farm have the cheapest car insurance for most Nevada teens with a ticket or accident on their driving records.

Travelers has the most affordable rates for teens with a speeding ticket on their records, at $306 per month. State Farm has the lowest rates for teens with an accident on their records, at $313 per month.

Monthly teen insurance rates after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Travelers | $306 | $362 |

| Geico | $346 | $412 |

| State Farm | $348 | $313 |

| Progressive | $375 | $404 |

| Mendota | $412 | $517 |

| AAA | $511 | $705 |

| Farmers | $783 | $931 |

| Allstate | $985 | $1,076 |

| Key Insurance | $1,280 | $1,409 |

| USAA* | $243 | $293 |

If you or your family have military ties, make sure you compare car insurance quotes from USAA as well. USAA’s quotes for teens with a ticket or accident on their records average $243 and $293 per month, respectively.

Cheapest DUI car insurance in Nevada: Travelers

At $232 per month, Travelers has the cheapest DUI insurance in Nevada by a good margin.

In fact, the second-cheapest option for most drivers with a driving under the influence (DUI) conviction, Progressive, has an average rate of $337 per month. That’s $105 per month more than Travelers.

DUI car insurance rates

| Company | Monthly rate |

|---|---|

| Travelers | $232 |

| Progressive | $337 |

| Key Insurance | $387 |

| AAA | $409 |

| Mendota | $417 |

| Allstate | $490 |

| Geico | $498 |

| State Farm | $523 |

| Farmers | $646 |

| USAA* | $299 |

The average driver in Nevada pays $424 per month for auto insurance after a DUI. This is about $145 per month more than what drivers with clean records pay for the same coverage.

Best car insurance in Nevada for bad credit: Travelers

The best company in Nevada for cheap car insurance with bad credit is Travelers, where rates average $261 per month.

Key Insurance also offers a fairly low rate for the state’s drivers who have bad credit, at $316 per month.

Auto insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $261 |

| Key Insurance | $316 |

| Mendota | $379 |

| Progressive | $388 |

| Geico | $427 |

| AAA | $430 |

| Allstate | $661 |

| Farmers | $666 |

| State Farm | $897 |

| USAA* | $261 |

Travelers and Key Insurance are both much cheaper than the state average of $469 per month for drivers with poor credit.

In Nevada, drivers with poor credit pay around $190 per month more for car insurance than they would if they had good credit.

To improve your credit, focus on paying down debts and avoiding late payments. Once your credit score goes up, shop for car insurance again. You’ll likely get much better quotes.

Nevada’s best car insurance companies

Travelers is the best car insurance company in Nevada overall.

It has the lowest rates for most of the state’s drivers and also offers many discounts that can make it even cheaper. Customers can pay extra for some helpful coverage add-ons, too, such as for roadside assistance, accident forgiveness and rental car reimbursement

Nevada auto insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| Key Insurance | NR | NR | NR |

| Mendota | NR | NR | NR |

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| USAA | 735 | A++ | |

| Progressive | 621 | A+ | |

| Geico | 645 | A++ | |

| Allstate | 635 | A+ | |

| Farmers | 622 | A | |

| AAA | 652 | A+ |

State Farm and Geico are also good options for Nevada drivers looking for the best cheap car insurance. These companies are often among the cheapest in the state for most drivers, and their many discounts could make them the most affordable for you. Both have better J.D. Power customer satisfaction scores than Travelers as well.

Don’t ignore USAA if you or a family member are active duty or retired military. USAA’s rates are the cheapest for many Nevada drivers, and its reputation for customer service is unmatched by other insurance companies.

Nevada car insurance rates by city

Winnemucca is the cheapest city in Nevada for car insurance, with an average rate of $179 per month.

The state’s most expensive city for car insurance is Sunrise Manor, where rates average $405 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Alamo | $216 | -23% |

| Amargosa Valley | $239 | -15% |

| Austin | $191 | -32% |

| Baker | $198 | -29% |

| Battle Mountain | $181 | -35% |

| Beatty | $223 | -21% |

| Blue Diamond | $308 | 10% |

| Boulder City | $275 | -2% |

| Bunkerville | $224 | -20% |

| Cal Nev Ari | $237 | -16% |

| Caliente | $223 | -21% |

| Carlin | $189 | -33% |

| Carson City | $192 | -31% |

| Cold Springs | $214 | -24% |

| Coyote Springs | $279 | -1% |

| Crescent Valley | $191 | -32% |

| Crystal Bay | $213 | -24% |

| Dayton | $190 | -32% |

| Deeth | $196 | -30% |

| Denio | $192 | -31% |

| Duckwater | $196 | -30% |

| Dyer | $204 | -27% |

| East Valley | $194 | -31% |

| Elko | $193 | -31% |

| Ely | $191 | -32% |

| Empire | $201 | -28% |

| Enterprise | $355 | 27% |

| Eureka | $193 | -31% |

| Fallon | $200 | -28% |

| Fallon Station | $184 | -34% |

| Fernley | $200 | -29% |

| Fish Springs | $194 | -31% |

| Gabbs | $193 | -31% |

| Gardnerville | $195 | -30% |

| Gardnerville Ranchos | $195 | -30% |

| Genoa | $202 | -28% |

| Gerlach | $197 | -30% |

| Glenbrook | $218 | -22% |

| Golconda | $185 | -34% |

| Golden Valley | $217 | -23% |

| Goldfield | $210 | -25% |

| Hawthorne | $191 | -32% |

| Henderson | $317 | 13% |

| Hiko | $217 | -23% |

| Imlay | $188 | -33% |

| Incline Village | $214 | -23% |

| Indian Hills | $197 | -30% |

| Indian Springs | $269 | -4% |

| Jackpot | $194 | -31% |

| Jean | $285 | 2% |

| Johnson Lane | $191 | -32% |

| Kingsbury | $213 | -24% |

| Lakeridge | $217 | -22% |

| Lamoille | $192 | -32% |

| Las Vegas | $370 | 32% |

| Laughlin | $234 | -16% |

| Lemmon Valley | $215 | -23% |

| Logandale | $249 | -11% |

| Lovelock | $186 | -34% |

| Lund | $194 | -31% |

| Luning | $196 | -30% |

| Manhattan | $201 | -28% |

| Mc Dermitt | $191 | -32% |

| McGill | $192 | -32% |

| Mercury | $248 | -11% |

| Mesquite | $232 | -17% |

| Mina | $197 | -30% |

| Minden | $191 | -32% |

| Moapa | $251 | -10% |

| Moapa Valley | $253 | -10% |

| Mogul | $213 | -24% |

| Montello | $191 | -32% |

| Mountain City | $199 | -29% |

| Nellis AFB | $376 | 34% |

| Nixon | $205 | -27% |

| North Las Vegas | $374 | 34% |

| Orovada | $192 | -31% |

| Overton | $255 | -9% |

| Owyhee | $197 | -30% |

| Pahrump | $275 | -2% |

| Panaca | $218 | -22% |

| Paradise | $373 | 33% |

| Paradise Valley | $189 | -32% |

| Pioche | $212 | -24% |

| Reno | $218 | -22% |

| Round Hill Village | $215 | -23% |

| Round Mountain | $193 | -31% |

| Ruby Valley | $194 | -31% |

| Ruhenstroth | $194 | -31% |

| Ruth | $193 | -31% |

| Sandy Valley | $287 | 3% |

| Schurz | $191 | -32% |

| Searchlight | $238 | -15% |

| Silver City | $197 | -30% |

| Silver Springs | $193 | -31% |

| Silverpeak | $202 | -28% |

| Sloan | $323 | 15% |

| Smith | $192 | -32% |

| Spanish Springs | $214 | -23% |

| Sparks | $218 | -22% |

| Spring Creek | $189 | -33% |

| Spring Valley | $375 | 34% |

| Stagecoach | $193 | -31% |

| Stateline | $213 | -24% |

| Summerlin South | $340 | 21% |

| Sun Valley | $219 | -22% |

| Sunrise Manor | $405 | 45% |

| Tonopah | $199 | -29% |

| Topaz Ranch Estates | $193 | -31% |

| Tuscarora | $195 | -30% |

| Valmy | $191 | -32% |

| Verdi | $216 | -23% |

| Virginia City | $197 | -30% |

| Wadsworth | $200 | -29% |

| Washoe Valley | $201 | -28% |

| Wellington | $191 | -32% |

| Wells | $189 | -33% |

| West Wendover | $189 | -32% |

| Whitney | $380 | 36% |

| Winchester | $399 | 42% |

| Winnemucca | $179 | -36% |

| Yerington | $187 | -33% |

| Zephyr Cove | $215 | -23% |

The average cost of car insurance in Nevada’s largest cities:

- Las Vegas, $370

- Henderson, $317

- North Las Vegas, $374

- Reno, $218

- Enterprise, $355

- Spring Valley, $375

Minimum coverage for car insurance in Nevada

You need to get these coverages to meet Nevada’s minimum car insurance requirements:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $20,000

Bodily injury liability coverage helps pay the medical bills of anyone you injure in a car accident. Property damage liability coverage pays for damage you cause to property like fences, toll booths and light posts.

You can’t register your vehicle in Nevada without proof of insurance. The state also uses an online system to verify the insurance status of registered vehicles.

The penalties for driving without insurance in Nevada include a fine and reinstatement fee. You also have to get SR-22 car insurance to reinstate your license if you are uninsured for more than 90 days.

Frequently asked questions

Car insurance in Nevada costs about $147 a month if you only buy liability coverage. If you buy full coverage, the average cost is around $280 a month.

You’ll usually pay more than these average rates if you have traffic incidents on your driving record, like accidents or DUIs.

The main reasons Nevada has the most expensive car insurance rates in the U.S. are the state’s densely populated urban areas and high number of accidents. Its many uninsured drivers and increasing medical and vehicle repair costs also likely play a role.

Most Nevada drivers can find the cheapest car insurance with Travelers. It has the state’s most affordable liability insurance rates, at $79 a month. It also has the lowest full coverage rates of $161 a month.

Members of the military and certain relatives can get even cheaper car insurance in Nevada from USAA. Its average rate for liability coverage is $61 a month, while its average full coverage rate is $148 a month.

No. Nevada has traditional at-fault driving laws. You are financially responsible for injuries and property damage you cause in a car accident. However, the amounts you owe may be reduced if the other driver is partially at fault for the crash.

How we selected the cheapest car insurance companies in Nevada

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Nevada

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.