Cheap Car Insurance in Illinois (2026)

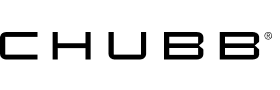

Travelers has the cheapest full coverage car insurance in Illinois at $93 a month. Erie is the cheapest company for liability-only coverage at $37 a month.

Best cheap Illinois auto insurance in Illinois

Cheapest full coverage car insurance in Illinois: Travelers

Travelers has the cheapest full coverage car insurance in Illinois at $93 a month.

Erie and Progressive are the next-cheapest companies, charging about $125 a month each. Of the three, Erie has the best satisfaction rating from J.D. Power, or the happiest customers.

Cheap full coverage auto insurance

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Travelers | $93 | |

| Erie | $125 | |

| Progressive | $126 | |

| Country Financial | $133 | |

| State Farm | $134 | |

| Auto-Owners | $140 | |

| Geico | $227 | |

| Allstate | $242 | |

| USAA* | $167 | |

Full coverage

Each insurance company’s rates vary by customer. It’s good to compare car insurance quotes from a few companies to find the cheapest rate.

Cheap Illinois liability insurance: Erie

At $37 a month, Erie has Illinois’ cheapest liability insurance, or minimum coverage, but not by much. Travelers and State Farm only charge $5 to $6 more per month. Minimum coverage in Illinois includes liability

Liability auto insurance rates

| Company | Monthly rate |

|---|---|

| Erie | $37 |

| Travelers | $42 |

| State Farm | $43 |

| Auto-Owners | $48 |

| Country Financial | $56 |

| Progressive | $66 |

| Geico | $96 |

| Allstate | $98 |

| USAA* | $60 |

Travelers offers a few car insurance discounts that Erie and State Farm don’t have. These include discounts for owning your home and driving a hybrid or electric vehicle. If you qualify, Travelers could be your cheapest option.

Best car insurance rates for Illinois teens: Erie

Erie has Illinois’ cheapest car insurance for teens who only need liability coverage. The company’s minimum coverage rates for young drivers average $81 a month. This is 28% less than the next-cheapest rate of $112 a month from Country Financial.

However, Country Financial and Travelers have the cheapest full coverage for teens. Both companies charge young drivers $255 a month for full coverage. Erie’s rate is 9% higher at $277 a month.

Teen auto insurance rates

| Company | Minimum coverage | Full coverage |

|---|---|---|

| Erie | $81 | $277 |

| Country Financial | $112 | $255 |

| Travelers | $121 | $255 |

| State Farm | $143 | $379 |

| Auto-Owners | $152 | $322 |

| Progressive | $153 | $350 |

| Geico | $214 | $512 |

| Allstate | $242 | $534 |

| USAA* | $148 | $413 |

Teens have higher crash rates than older drivers, and this translates into higher insurance rates. A teen usually gets lower rates on a parent’s policy than they do on their own.

Discounts can also make car insurance more affordable for young drivers.

- Unmarried teens living with their parents can get a Youthful Driver discount from Erie.

- Travelers and Country Financial give young drivers a discount for getting good grades.

- Driver training gets teens a discount from Erie and Travelers.

- Country Financial gives teens a discount for completing its Simply Drive course.

Other companies offer similar discounts. It’s good to ask about these and other young driver discounts when you get car insurance quotes.

Cheap Illinois auto insurance with a speeding ticket: Travelers

Illinois drivers with a speeding ticket can get cheap auto insurance quotes from Travelers. The company’s rates average $117 a month after a ticket. This is 16% less than the next-cheapest rate of $139 a month from Erie.

Insurance rates with a speeding ticket

| Company | Monthly rate |

|---|---|

| Travelers | $117 |

| Erie | $139 |

| Auto-Owners | $140 |

| State Farm | $141 |

| Country Financial | $167 |

| Progressive | $173 |

| Geico | $291 |

| Allstate | $319 |

| USAA* | $215 |

A speeding ticket raises the price of full coverage by an average of 23% to $189 a month. However, some companies raise their rates by lower amounts. Shopping around can help you find cheap car insurance with a bad driving record.

Illinois’ cheapest car insurance after an accident: Travelers

At $129 a month, Travelers has cheap car insurance for drivers with an at-fault accident. This is 45% less than the state average of $232 a month after an accident. State Farm has the next-cheapest rate at $151 a month.

Cheap car insurance after an accident

| Company | Monthly rate |

|---|---|

| Travelers | $129 |

| State Farm | $151 |

| Auto-Owners | $170 |

| Country Financial | $179 |

| Erie | $184 |

| Progressive | $200 |

| Geico | $390 |

| Allstate | $445 |

| USAA* | $244 |

An at-fault accident raises the cost of full coverage in Illinois by 51%. Adding accident forgiveness to your policy before an accident can protect you from a rate hike like this.

Travelers, Auto-Owners, Erie and Progressive have accident forgiveness. It usually costs extra, but Progressive and Erie have free options. You also usually have to have a few years of incident-free driving to get it.

Best insurance for Illinois teens with a ticket or accident: Erie

Erie has the best car insurance rates for Illinois teens with a ticket or accident. Its liability rates average $94 a month for young drivers with a speeding ticket. Teens with an at-fault accident pay $114 a month.

Country Financial is the next-cheapest company. Its young driver rates average $145 a month after a ticket and $166 a month after an accident.

Insurance rates for bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| Erie | $94 | $114 |

| Country Financial | $145 | $166 |

| Travelers | $152 | $179 |

| Auto-Owners | $152 | $209 |

| State Farm | $155 | $171 |

| Progressive | $173 | $181 |

| Geico | $277 | $359 |

| Allstate | $337 | $506 |

| USAA* | $244 | $264 |

Cheapest Illinois car insurance after a DUI: Travelers

Travelers has the cheapest car insurance for Illinois drivers with a DUI. Its rate of $134 a month is 52% less than the average of $278 a month. Progressive has the next-cheapest DUI insurance at $163 a month.

Cheapest car insurance with a DUI

| Company | Monthly rate |

|---|---|

| Travelers | $134 |

| Progressive | $163 |

| Erie | $229 |

| Auto-Owners | $238 |

| State Farm | $310 |

| Country Financial | $335 |

| Geico | $383 |

| Allstate | $384 |

| USAA* | $326 |

Best auto insurance for drivers with bad credit: Travelers

Travelers has the best rates for bad credit car insurance in Illinois at $140 a month. This is 23% less than the next-cheapest rate of $183 a month from Country Financial.

| Company | Monthly rate |

|---|---|

| Travelers | $140 |

| Country Financial | $183 |

| Progressive | $220 |

| Erie | $284 |

| Allstate | $369 |

| Auto-Owners | $418 |

| Geico | $435 |

| State Farm | $578 |

| USAA* | $301 |

Insurance companies check your credit for things like your payment history and debts. Avoiding late payments and paying down debts can help you get cheaper insurance rates.

Best car insurance in Illinois

Low rates and excellent ratings make Erie the best car insurance company in Illinois. It has a better satisfaction score than most other companies. This means Erie has more customers who like its rates, coverage and customer service.

Erie’s free accident forgiveness kicks in after you’ve been insured by the company for three years. Most other companies charge extra for accident forgiveness. Erie also offers new car replacement

State Farm and Travelers are also good to contact for car insurance quotes. Travelers has cheaper rates than State Farm for many drivers. It also has more coverage options, including gap insurance

State Farm doesn’t offer as many optional coverage options as Travelers. However, it has a higher satisfaction rating.

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Allstate | 3.2 | 635 | A+ |

| Auto-Owners | 4.8 | 638 | A+ |

| Country Financial | 4.8 | 659 | A+ |

| Erie | 4.1 | 703 | A |

| Geico | 3.7 | 645 | A++ |

| Progressive | 3.8 | 621 | A+ |

| State Farm | 4.5 | 650 | A++ |

| Travelers | 4.4 | 613 | A++ |

| USAA* | 4.1 | 735 | A++ |

Illinois car insurance rates by city

At $244 a month, Dolton has the most expensive car insurance among Illinois’ cities and towns. This is only slightly more than the rate of $236 a month in the Cook County village of Phoenix.

At $139 a month, Chenoa drivers have the state’s cheapest car insurance. Drivers in both Twin Grove and Rock Falls only pay slightly more at $140 a month.

Car insurance costs an average of $214 a month in the city of Chicago. This is 39% higher than the state average.

Auto insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Abingdon | $163 | 6% |

| Adair | $163 | 6% |

| Addieville | $167 | 8% |

| Addison | $167 | 9% |

| Albany | $150 | -3% |

| Albers | $160 | 4% |

| Albion | $166 | 7% |

| Aledo | $162 | 5% |

| Alexander | $165 | 7% |

| Alexis | $159 | 3% |

| Algonquin | $152 | -1% |

| Allendale | $160 | 4% |

| Allerton | $152 | -1% |

| Alorton | $200 | 30% |

| Alpha | $160 | 4% |

| Alsey | $170 | 10% |

| Alsip | $205 | 33% |

| Altamont | $153 | -1% |

| Alto Pass | $179 | 16% |

| Alton | $178 | 16% |

| Altona | $160 | 4% |

| Alvin | $156 | 1% |

| Amboy | $149 | -4% |

| Anchor | $145 | -6% |

| Ancona | $148 | -4% |

| Andalusia | $161 | 4% |

| Andover | $159 | 3% |

| Anna | $177 | 15% |

| Annapolis | $165 | 7% |

| Annawan | $151 | -2% |

| Antioch | $156 | 1% |

| Apple River | $156 | 1% |

| Arcola | $148 | -4% |

| Argenta | $152 | -2% |

| Arlington | $150 | -3% |

| Arlington Heights | $156 | 1% |

| Armington | $161 | 4% |

| Armstrong | $154 | 0% |

| Aroma Park | $165 | 7% |

| Arrowsmith | $149 | -4% |

| Arthur | $148 | -4% |

| Ashland | $173 | 12% |

| Ashley | $164 | 6% |

| Ashmore | $154 | 0% |

| Ashton | $148 | -4% |

| Assumption | $163 | 6% |

| Athens | $175 | 14% |

| Atkinson | $151 | -2% |

| Atlanta | $155 | 1% |

| Atwood | $151 | -2% |

| Auburn | $155 | 1% |

| Augusta | $171 | 11% |

| Aurora | $158 | 2% |

| Ava | $185 | 20% |

| Aviston | $157 | 2% |

| Avon | $168 | 9% |

| Baileyville | $151 | -2% |

| Bannockburn | $167 | 9% |

| Bardolph | $155 | 1% |

| Barnhill | $170 | 10% |

| Barrington | $159 | 3% |

| Barrington Hills | $158 | 2% |

| Barry | $179 | 16% |

| Barstow | $151 | -2% |

| Bartelso | $164 | 6% |

| Bartlett | $167 | 9% |

| Bartonville | $162 | 5% |

| Basco | $169 | 9% |

| Batavia | $152 | -1% |

| Batchtown | $177 | 15% |

| Bay View Gardens | $152 | -1% |

| Baylis | $178 | 16% |

| Beach Park | $165 | 7% |

| Beardstown | $169 | 10% |

| Beason | $154 | 0% |

| Beckemeyer | $164 | 6% |

| Bedford Park | $203 | 32% |

| Beecher | $165 | 7% |

| Beecher City | $157 | 2% |

| Belknap | $184 | 19% |

| Belle Rive | $174 | 13% |

| Belleville | $171 | 11% |

| Bellevue | $160 | 3% |

| Bellmont | $162 | 5% |

| Bellwood | $217 | 41% |

| Belvidere | $155 | 1% |

| Bement | $146 | -5% |

| Benld | $164 | 6% |

| Bensenville | $168 | 9% |

| Benson | $149 | -3% |

| Benton | $176 | 14% |

| Berkeley | $189 | 23% |

| Berwick | $157 | 2% |

| Berwyn | $205 | 33% |

| Bethalto | $164 | 7% |

| Bethany | $152 | -1% |

| Bingham | $160 | 4% |

| Bishop Hill | $156 | 1% |

| Bismarck | $158 | 3% |

| Blackstone | $148 | -4% |

| Blandinsville | $165 | 7% |

| Bloomingdale | $164 | 7% |

| Bloomington | $141 | -8% |

| Blue Island | $223 | 44% |

| Blue Mound | $151 | -2% |

| Bluff Springs | $176 | 14% |

| Bluffs | $172 | 12% |

| Bluford | $175 | 13% |

| Boles | $188 | 22% |

| Bolingbrook | $168 | 9% |

| Bolivia | $171 | 11% |

| Bondville | $144 | -7% |

| Bone Gap | $162 | 5% |

| Bonfield | $163 | 6% |

| Bonnie | $169 | 10% |

| Boody | $152 | -1% |

| Boulder Hill | $162 | 5% |

| Bourbonnais | $159 | 3% |

| Bowen | $169 | 9% |

| Braceville | $157 | 2% |

| Bradford | $160 | 4% |

| Bradley | $160 | 4% |

| Braidwood | $160 | 4% |

| Breese | $164 | 6% |

| Bridgeport | $163 | 6% |

| Bridgeview | $198 | 29% |

| Brighton | $169 | 10% |

| Brimfield | $169 | 9% |

| Bristol | $159 | 3% |

| Broadlands | $149 | -3% |

| Broadview | $213 | 38% |

| Brocton | $159 | 3% |

| Brookfield | $171 | 11% |

| Brooklyn | $206 | 33% |

| Brookport | $186 | 21% |

| Broughton | $180 | 17% |

| Browns | $161 | 5% |

| Brownstown | $155 | 1% |

| Brussels | $178 | 15% |

| Bryant | $165 | 7% |

| Buckingham | $156 | 1% |

| Buckley | $152 | -1% |

| Buckner | $179 | 16% |

| Buda | $153 | -1% |

| Buffalo | $173 | 12% |

| Buffalo Grove | $168 | 9% |

| Buffalo Prairie | $160 | 4% |

| Bulpitt | $169 | 9% |

| Buncombe | $179 | 16% |

| Bunker Hill | $170 | 11% |

| Burbank | $195 | 26% |

| Bureau | $151 | -2% |

| Burlington | $149 | -3% |

| Burnham | $228 | 48% |

| Burnt Prairie | $170 | 10% |

| Burr Ridge | $170 | 10% |

| Bushnell | $163 | 6% |

| Butler | $160 | 4% |

| Byron | $155 | 1% |

| Cabery | $150 | -3% |

| Cahokia | $197 | 28% |

| Cairo | $185 | 20% |

| Calhoun | $164 | 6% |

| Calumet City | $234 | 52% |

| Calumet Park | $224 | 45% |

| Camargo | $155 | 0% |

| Cambria | $172 | 12% |

| Cambridge | $150 | -2% |

| Camden | $172 | 11% |

| Cameron | $158 | 3% |

| Camp Grove | $158 | 3% |

| Camp Point | $175 | 13% |

| Campbell Hill | $183 | 19% |

| Campton Hills | $155 | 1% |

| Campus | $149 | -4% |

| Canton | $164 | 7% |

| Cantrall | $164 | 7% |

| Capron | $157 | 2% |

| Carbon Cliff | $148 | -4% |

| Carbondale | $169 | 10% |

| Carlinville | $164 | 6% |

| Carlock | $153 | -1% |

| Carlyle | $163 | 6% |

| Carmi | $170 | 11% |

| Carol Stream | $160 | 4% |

| Carpentersville | $163 | 6% |

| Carrier Mills | $185 | 20% |

| Carterville | $172 | 11% |

| Carthage | $168 | 9% |

| Cary | $152 | -1% |

| Casey | $162 | 5% |

| Caseyville | $185 | 20% |

| Castleton | $162 | 5% |

| Catlin | $153 | -1% |

| Cedar Point | $148 | -4% |

| Cedarville | $150 | -2% |

| Central City | $167 | 8% |

| Centralia | $166 | 8% |

| Centreville | $201 | 30% |

| Cerro Gordo | $152 | -1% |

| Chadwick | $154 | 0% |

| Chambersburg | $174 | 13% |

| Champaign | $146 | -5% |

| Chana | $154 | 0% |

| Channahon | $156 | 2% |

| Channel Lake | $157 | 2% |

| Charleston | $151 | -2% |

| Chatham | $155 | 0% |

| Chenoa | $139 | -10% |

| Cherry | $149 | -3% |

| Cherry Valley | $158 | 2% |

| Chester | $176 | 14% |

| Chesterfield | $169 | 10% |

| Chestnut | $156 | 1% |

| Chicago | $214 | 39% |

| Chicago Heights | $203 | 32% |

| Chicago Ridge | $190 | 23% |

| Chillicothe | $161 | 4% |

| Chrisman | $161 | 4% |

| Christopher | $179 | 16% |

| Cicero | $220 | 43% |

| Cisco | $148 | -4% |

| Cisne | $172 | 12% |

| Cissna Park | $156 | 1% |

| Clare | $151 | -2% |

| Claremont | $163 | 6% |

| Clarendon Hills | $160 | 4% |

| Clayton | $176 | 14% |

| Claytonville | $153 | -1% |

| Clifton | $154 | 0% |

| Clinton | $150 | -3% |

| Coal City | $156 | 1% |

| Coal Valley | $152 | -1% |

| Coatsburg | $169 | 10% |

| Cobden | $178 | 15% |

| Coello | $179 | 16% |

| Coffeen | $160 | 4% |

| Colchester | $163 | 6% |

| Colfax | $146 | -5% |

| Collinsville | $166 | 7% |

| Collison | $154 | 0% |

| Colona | $152 | -1% |

| Colp | $174 | 13% |

| Columbia | $166 | 7% |

| Colusa | $174 | 13% |

| Compton | $148 | -4% |

| Congerville | $155 | 1% |

| Cooksville | $146 | -5% |

| Cornell | $147 | -5% |

| Cornland | $160 | 4% |

| Cortland | $144 | -7% |

| Cottage Hills | $169 | 10% |

| Coulterville | $182 | 18% |

| Country Club Hills | $203 | 32% |

| Countryside | $171 | 11% |

| Cowden | $161 | 4% |

| Crainville | $172 | 11% |

| Crescent City | $152 | -1% |

| Crest Hill | $170 | 10% |

| Creston | $150 | -3% |

| Crestwood | $188 | 22% |

| Crete | $172 | 12% |

| Creve Coeur | $157 | 2% |

| Cropsey | $145 | -6% |

| Crossville | $170 | 10% |

| Crystal Lake | $150 | -3% |

| Crystal Lawns | $169 | 10% |

| Cuba | $168 | 9% |

| Cullom | $146 | -5% |

| Cutler | $180 | 17% |

| Cypress | $182 | 18% |

| Dahinda | $167 | 9% |

| Dakota | $154 | 0% |

| Dalton City | $151 | -2% |

| Dalzell | $148 | -4% |

| Dana | $151 | -2% |

| Danvers | $151 | -2% |

| Danville | $154 | 0% |

| Darien | $164 | 6% |

| Davis | $159 | 3% |

| Davis Junction | $154 | 0% |

| Dawson | $171 | 11% |

| De Land | $149 | -3% |

| De Pue | $151 | -2% |

| De Soto | $175 | 14% |

| De Witt | $150 | -3% |

| DeKalb | $145 | -6% |

| Decatur | $156 | 1% |

| Deer Grove | $150 | -3% |

| Deer Park | $156 | 1% |

| Deerfield | $167 | 8% |

| Delavan | $161 | 4% |

| Dennison | $161 | 4% |

| Des Plaines | $179 | 16% |

| Dewey | $146 | -5% |

| Diamond | $156 | 1% |

| Dieterich | $154 | 0% |

| Dix | $171 | 11% |

| Dixmoor | $228 | 48% |

| Dixon | $148 | -4% |

| Dolton | $244 | 58% |

| Dongola | $181 | 17% |

| Donnellson | $162 | 5% |

| Donovan | $159 | 3% |

| Dorsey | $164 | 6% |

| Dover | $149 | -3% |

| Dow | $180 | 17% |

| Dowell | $178 | 16% |

| Downers Grove | $158 | 3% |

| Downs | $148 | -4% |

| Du Quoin | $176 | 14% |

| Dundas | $162 | 5% |

| Dunfermline | $165 | 7% |

| Dunlap | $163 | 6% |

| Dupo | $177 | 15% |

| Durand | $159 | 3% |

| Dwight | $146 | -5% |

| Eagarville | $168 | 9% |

| Earlville | $152 | -1% |

| East Alton | $171 | 11% |

| East Carondelet | $170 | 11% |

| East Dubuque | $154 | 0% |

| East Dundee | $162 | 5% |

| East Galesburg | $150 | -3% |

| East Hazel Crest | $221 | 43% |

| East Lynn | $152 | -1% |

| East Moline | $150 | -3% |

| East Peoria | $149 | -3% |

| East St. Louis | $204 | 32% |

| Easton | $169 | 10% |

| Eddyville | $183 | 19% |

| Edelstein | $163 | 6% |

| Edgewood | $154 | 0% |

| Edinburg | $174 | 13% |

| Edwards | $163 | 6% |

| Edwardsville | $165 | 7% |

| Effingham | $148 | -4% |

| Elburn | $145 | -6% |

| Eldena | $146 | -5% |

| Eldorado | $183 | 19% |

| Eldred | $174 | 13% |

| Eleroy | $160 | 4% |

| Elgin | $162 | 5% |

| Elizabeth | $161 | 4% |

| Elizabethtown | $192 | 24% |

| Elk Grove Village | $158 | 2% |

| Elkville | $178 | 16% |

| Ellery | $163 | 5% |

| Elliott | $148 | -4% |

| Ellisville | $167 | 8% |

| Ellsworth | $147 | -4% |

| Elmhurst | $160 | 3% |

| Elmwood | $168 | 9% |

| Elmwood Park | $208 | 35% |

| Elvaston | $167 | 8% |

| Elwin | $156 | 1% |

| Elwood | $165 | 7% |

| Emden | $156 | 1% |

| Emington | $148 | -4% |

| Emma | $174 | 13% |

| Energy | $173 | 12% |

| Eola | $156 | 1% |

| Esmond | $149 | -3% |

| Essex | $158 | 3% |

| Eureka | $151 | -2% |

| Evanston | $179 | 16% |

| Evansville | $178 | 15% |

| Evergreen Park | $199 | 29% |

| Ewing | $180 | 17% |

| Fairbury | $141 | -8% |

| Fairfield | $172 | 11% |

| Fairmont | $165 | 7% |

| Fairmont City | $197 | 28% |

| Fairmount | $155 | 1% |

| Fairview Heights | $171 | 11% |

| Farina | $158 | 2% |

| Farmer City | $148 | -4% |

| Farmersville | $163 | 5% |

| Farmington | $165 | 7% |

| Fenton | $152 | -2% |

| Ferris | $168 | 9% |

| Fiatt | $165 | 7% |

| Fidelity | $173 | 12% |

| Fieldon | $173 | 12% |

| Findlay | $154 | 0% |

| Fisher | $147 | -5% |

| Fithian | $156 | 1% |

| Flanagan | $146 | -5% |

| Flat Rock | $165 | 7% |

| Flora | $160 | 4% |

| Flossmoor | $193 | 25% |

| Foosland | $148 | -4% |

| Ford Heights | $206 | 33% |

| Forest City | $166 | 8% |

| Forest Lake | $162 | 5% |

| Forest Park | $199 | 29% |

| Forest View | $202 | 31% |

| Forrest | $144 | -7% |

| Forreston | $153 | -1% |

| Forsyth | $149 | -3% |

| Fort Sheridan | $166 | 8% |

| Fowler | $167 | 9% |

| Fox Lake | $161 | 4% |

| Fox Lake Hills | $158 | 3% |

| Fox River Grove | $153 | -1% |

| Fox Valley | $167 | 8% |

| Frankfort | $162 | 5% |

| Frankfort Heights | $180 | 16% |

| Frankfort Square | $163 | 6% |

| Franklin Grove | $151 | -2% |

| Franklin Park | $196 | 27% |

| Frederick | $171 | 11% |

| Freeburg | $165 | 7% |

| Freeman Spur | $183 | 19% |

| Freeport | $148 | -4% |

| Fulton | $150 | -3% |

| Fults | $167 | 8% |

| Gages Lake | $158 | 2% |

| Galatia | $188 | 22% |

| Galena | $153 | -1% |

| Galesburg | $147 | -4% |

| Galt | $146 | -5% |

| Galva | $150 | -3% |

| Garden Prairie | $154 | 0% |

| Gardner | $153 | 0% |

| Gays | $152 | -2% |

| Geff | $170 | 11% |

| Geneseo | $153 | -1% |

| Geneva | $150 | -3% |

| Genoa | $144 | -7% |

| Georgetown | $153 | -1% |

| Gerlaw | $156 | 1% |

| German Valley | $154 | 0% |

| Germantown | $163 | 6% |

| Germantown Hills | $155 | 1% |

| Gibson City | $148 | -4% |

| Gifford | $150 | -3% |

| Gilberts | $155 | 1% |

| Gillespie | $164 | 6% |

| Gilman | $152 | -1% |

| Gilson | $166 | 8% |

| Girard | $166 | 8% |

| Glasford | $171 | 11% |

| Glen Carbon | $163 | 6% |

| Glen Ellyn | $159 | 3% |

| Glenarm | $159 | 3% |

| Glencoe | $171 | 11% |

| Glendale Heights | $169 | 9% |

| Glenview | $178 | 15% |

| Glenwood | $205 | 33% |

| Godfrey | $173 | 12% |

| Golconda | $191 | 24% |

| Golden | $174 | 13% |

| Golden Eagle | $175 | 13% |

| Golden Gate | $168 | 9% |

| Golf | $180 | 17% |

| Good Hope | $164 | 6% |

| Goodfield | $152 | -2% |

| Goodwine | $158 | 3% |

| Goreville | $180 | 17% |

| Gorham | $180 | 17% |

| Grafton | $180 | 17% |

| Grand Ridge | $150 | -3% |

| Grandview | $162 | 5% |

| Grandwood Park | $158 | 2% |

| Granite City | $180 | 17% |

| Grant Park | $162 | 5% |

| Grantsburg | $183 | 19% |

| Granville | $158 | 3% |

| Graymont | $146 | -5% |

| Grayslake | $158 | 2% |

| Grayville | $164 | 6% |

| Great Lakes | $166 | 8% |

| Green Oaks | $160 | 4% |

| Green Valley | $161 | 5% |

| Greenfield | $172 | 12% |

| Greenup | $159 | 3% |

| Greenview | $175 | 14% |

| Greenville | $161 | 4% |

| Greenwood | $151 | -2% |

| Griggsville | $177 | 15% |

| Gurnee | $159 | 3% |

| Hagaman | $169 | 10% |

| Hagarstown | $166 | 7% |

| Hainesville | $159 | 3% |

| Hamburg | $173 | 12% |

| Hamel | $165 | 7% |

| Hamilton | $166 | 7% |

| Hammond | $153 | -1% |

| Hampshire | $150 | -3% |

| Hampton | $148 | -4% |

| Hanna City | $168 | 9% |

| Hanover Park | $168 | 9% |

| Hardin | $176 | 14% |

| Harrisburg | $186 | 20% |

| Harrison | $177 | 15% |

| Harristown | $154 | 0% |

| Hartford | $169 | 10% |

| Hartsburg | $155 | 0% |

| Harvard | $155 | 1% |

| Harvey | $233 | 51% |

| Harwood Heights | $198 | 29% |

| Havana | $167 | 8% |

| Hawthorn Woods | $162 | 5% |

| Hazel Crest | $216 | 40% |

| Hebron | $156 | 1% |

| Hecker | $170 | 10% |

| Hennepin | $162 | 5% |

| Henning | $153 | -1% |

| Henry | $161 | 5% |

| Heritage Lake | $160 | 4% |

| Herod | $187 | 21% |

| Herrin | $171 | 11% |

| Herscher | $158 | 3% |

| Hettick | $171 | 11% |

| Heyworth | $148 | -4% |

| Hickory Hills | $189 | 23% |

| Hidalgo | $162 | 5% |

| Highland | $163 | 6% |

| Highland Park | $167 | 8% |

| Highwood | $164 | 7% |

| Hillsboro | $161 | 4% |

| Hillsdale | $156 | 1% |

| Hillside | $177 | 15% |

| Hillview | $174 | 13% |

| Hinckley | $148 | -4% |

| Hindsboro | $152 | -1% |

| Hines | $195 | 26% |

| Hinsdale | $161 | 4% |

| Hodgkins | $173 | 12% |

| Hoffman | $164 | 6% |

| Hoffman Estates | $165 | 7% |

| Holcomb | $159 | 3% |

| Holiday Shores | $163 | 5% |

| Homer | $154 | 0% |

| Homer Glen | $163 | 6% |

| Hometown | $198 | 28% |

| Homewood | $197 | 27% |

| Hoopeston | $153 | -1% |

| Hooppole | $154 | 0% |

| Hopkins Park | $163 | 6% |

| Hoyleton | $161 | 4% |

| Hudson | $144 | -7% |

| Huey | $169 | 10% |

| Hull | $180 | 17% |

| Humboldt | $152 | -1% |

| Hume | $160 | 4% |

| Huntley | $149 | -4% |

| Hurst | $176 | 14% |

| Hutsonville | $165 | 7% |

| Illinois City | $165 | 7% |

| Illiopolis | $169 | 10% |

| Ina | $171 | 11% |

| Indian Head Park | $170 | 11% |

| Indianola | $155 | 0% |

| Ingalls Park | $174 | 13% |

| Ingleside | $156 | 1% |

| Ingraham | $162 | 5% |

| Inverness | $159 | 3% |

| Ipava | $166 | 7% |

| Iroquois | $156 | 1% |

| Irvington | $163 | 5% |

| Island Lake | $155 | 1% |

| Itasca | $164 | 7% |

| Ivesdale | $149 | -3% |

| Jacksonville | $153 | -1% |

| Jacob | $183 | 19% |

| Janesville | $162 | 5% |

| Jerome | $158 | 3% |

| Jerseyville | $169 | 10% |

| Jewett | $155 | 1% |

| Johnsburg | $155 | 0% |

| Johnsonville | $169 | 10% |

| Johnston City | $175 | 14% |

| Joliet | $168 | 9% |

| Jonesboro | $180 | 17% |

| Joppa | $182 | 18% |

| Joy | $162 | 5% |

| Junction | $182 | 18% |

| Justice | $201 | 31% |

| Kampsville | $175 | 13% |

| Kane | $173 | 12% |

| Kaneville | $157 | 2% |

| Kankakee | $164 | 6% |

| Kansas | $159 | 3% |

| Karbers Ridge | $183 | 19% |

| Kasbeer | $152 | -2% |

| Keenes | $176 | 14% |

| Keensburg | $161 | 4% |

| Keithsburg | $164 | 6% |

| Kell | $169 | 10% |

| Kempton | $149 | -4% |

| Kenilworth | $172 | 11% |

| Kenney | $151 | -2% |

| Kent | $154 | 0% |

| Kewanee | $148 | -4% |

| Keyesport | $160 | 4% |

| Kildeer | $161 | 5% |

| Kincaid | $171 | 11% |

| Kinderhook | $178 | 15% |

| Kingston Mines | $163 | 6% |

| Kinmundy | $168 | 9% |

| Kinsman | $151 | -2% |

| Kirkland | $147 | -5% |

| Kirkwood | $159 | 3% |

| Knollwood | $159 | 3% |

| Knoxville | $152 | -1% |

| La Fayette | $161 | 4% |

| La Grange | $168 | 9% |

| La Grange Park | $168 | 9% |

| La Place | $150 | -3% |

| La Prairie | $169 | 10% |

| La Rose | $151 | -2% |

| LaSalle | $145 | -6% |

| Laclede | $154 | 0% |

| Lacon | $159 | 3% |

| Ladd | $149 | -4% |

| Lafox | $157 | 2% |

| Lake Barrington | $158 | 3% |

| Lake Bluff | $159 | 3% |

| Lake Forest | $160 | 4% |

| Lake Fork | $160 | 4% |

| Lake Holiday | $152 | -2% |

| Lake Petersburg | $176 | 14% |

| Lake Villa | $157 | 2% |

| Lake Zurich | $160 | 4% |

| Lake in the Hills | $153 | -1% |

| Lake of the Woods | $148 | -4% |

| Lakemoor | $154 | 0% |

| Lakewood | $149 | -4% |

| Lakewood Shores | $164 | 6% |

| Lanark | $155 | 1% |

| Lane | $150 | -3% |

| Lansing | $196 | 27% |

| Latham | $158 | 3% |

| Laura | $165 | 7% |

| Lawndale | $162 | 5% |

| Lawrenceville | $163 | 6% |

| Le Roy | $146 | -5% |

| Lebanon | $164 | 6% |

| Lee | $151 | -2% |

| Lee Center | $147 | -4% |

| Leland | $154 | 0% |

| Leland Grove | $158 | 2% |

| Lemont | $169 | 10% |

| Lena | $153 | 0% |

| Lenzburg | $162 | 5% |

| Leonore | $150 | -3% |

| Lerna | $155 | 0% |

| Lewistown | $167 | 8% |

| Lexington | $145 | -6% |

| Libertyville | $159 | 3% |

| Lima | $170 | 10% |

| Lincoln | $153 | -1% |

| Lincoln’s New Salem | $168 | 9% |

| Lincolnshire | $164 | 7% |

| Lincolnwood | $203 | 31% |

| Lindenhurst | $157 | 2% |

| Lindenwood | $151 | -2% |

| Lisle | $154 | 0% |

| Litchfield | $158 | 2% |

| Literberry | $166 | 8% |

| Little York | $161 | 4% |

| Littleton | $171 | 11% |

| Liverpool | $166 | 8% |

| Livingston | $160 | 4% |

| Loami | $160 | 4% |

| Lockport | $161 | 5% |

| Loda | $154 | 0% |

| Logan | $183 | 19% |

| Lomax | $158 | 2% |

| Lombard | $157 | 2% |

| London Mills | $171 | 11% |

| Long Grove | $163 | 6% |

| Long Lake | $162 | 5% |

| Long Point | $148 | -4% |

| Longview | $151 | -2% |

| Loraine | $172 | 12% |

| Lostant | $149 | -3% |

| Louisville | $162 | 5% |

| Lovejoy | $202 | 31% |

| Loves Park | $154 | 0% |

| Lowder | $167 | 8% |

| Lowpoint | $153 | -1% |

| Lynn Center | $156 | 1% |

| Lynwood | $205 | 33% |

| Lyons | $182 | 18% |

| Macedonia | $177 | 15% |

| Machesney Park | $156 | 1% |

| Mackinaw | $160 | 4% |

| Macomb | $156 | 1% |

| Macon | $152 | -2% |

| Madison | $202 | 31% |

| Maeystown | $169 | 10% |

| Magnolia | $162 | 5% |

| Mahomet | $147 | -5% |

| Malden | $150 | -3% |

| Malta | $147 | -5% |

| Manchester | $169 | 10% |

| Manhattan | $162 | 5% |

| Manito | $169 | 10% |

| Manlius | $151 | -2% |

| Mansfield | $147 | -4% |

| Manteno | $159 | 3% |

| Maple Park | $146 | -5% |

| Mapleton | $163 | 5% |

| Marengo | $154 | 0% |

| Marietta | $165 | 7% |

| Marine | $163 | 6% |

| Marion | $174 | 13% |

| Marissa | $166 | 8% |

| Mark | $158 | 2% |

| Markham | $234 | 52% |

| Maroa | $150 | -3% |

| Marquette Heights | $151 | -2% |

| Marseilles | $151 | -2% |

| Marshall | $161 | 4% |

| Martinsville | $164 | 7% |

| Maryville | $164 | 6% |

| Mascoutah | $162 | 5% |

| Mason | $154 | 0% |

| Mason City | $166 | 8% |

| Matherville | $161 | 4% |

| Matteson | $203 | 31% |

| Mattoon | $149 | -4% |

| Maunie | $169 | 10% |

| Maywood | $218 | 41% |

| Mazon | $152 | -1% |

| Mc Connell | $155 | 1% |

| McHenry | $153 | -1% |

| McLean | $149 | -3% |

| McLeansboro | $180 | 17% |

| McNabb | $162 | 5% |

| Mechanicsburg | $171 | 11% |

| Medinah | $165 | 7% |

| Medora | $169 | 10% |

| Melrose Park | $204 | 32% |

| Melvin | $147 | -4% |

| Menard | $181 | 18% |

| Mendon | $171 | 11% |

| Mendota | $148 | -4% |

| Meredosia | $173 | 12% |

| Merna | $152 | -1% |

| Merrionette Park | $195 | 26% |

| Metamora | $155 | 0% |

| Metcalf | $160 | 4% |

| Metropolis | $183 | 18% |

| Mettawa | $159 | 3% |

| Michael | $171 | 11% |

| Middletown | $159 | 3% |

| Midlothian | $190 | 23% |

| Milan | $154 | 0% |

| Milford | $157 | 2% |

| Mill Shoals | $170 | 10% |

| Millbrook | $153 | -1% |

| Milledgeville | $153 | -1% |

| Miller City | $184 | 20% |

| Millington | $153 | -1% |

| Millstadt | $165 | 7% |

| Milmine | $149 | -3% |

| Mineral | $150 | -3% |

| Minier | $163 | 6% |

| Minonk | $146 | -5% |

| Minooka | $161 | 4% |

| Mitchell | $178 | 15% |

| Mode | $155 | 1% |

| Modesto | $166 | 7% |

| Modoc | $179 | 16% |

| Mokena | $160 | 3% |

| Moline | $146 | -5% |

| Momence | $164 | 6% |

| Monee | $167 | 9% |

| Monmouth | $157 | 2% |

| Monroe Center | $154 | 0% |

| Montgomery | $163 | 6% |

| Monticello | $147 | -5% |

| Montrose | $159 | 3% |

| Mooseheart | $155 | 1% |

| Morris | $151 | -2% |

| Morrison | $152 | -1% |

| Morrisonville | $168 | 9% |

| Morton | $148 | -4% |

| Morton Grove | $187 | 21% |

| Mossville | $163 | 6% |

| Mound City | $185 | 20% |

| Mounds | $184 | 19% |

| Mount Auburn | $174 | 13% |

| Mount Carmel | $157 | 2% |

| Mount Carroll | $159 | 3% |

| Mount Erie | $172 | 11% |

| Mount Morris | $155 | 0% |

| Mount Olive | $162 | 5% |

| Mount Prospect | $171 | 11% |

| Mount Pulaski | $160 | 4% |

| Mount Sterling | $174 | 13% |

| Mount Vernon | $167 | 8% |

| Mount Zion | $149 | -3% |

| Moweaqua | $156 | 1% |

| Mozier | $172 | 12% |

| Muddy | $186 | 21% |

| Mulberry Grove | $160 | 3% |

| Mulkeytown | $181 | 17% |

| Muncie | $153 | -1% |

| Mundelein | $158 | 2% |

| Murdock | $153 | -1% |

| Murphysboro | $177 | 15% |

| Nachusa | $146 | -5% |

| Naperville | $156 | 1% |

| Nashville | $167 | 8% |

| Nason | $173 | 12% |

| National Stock Yards | $200 | 30% |

| Nauvoo | $169 | 10% |

| Nebo | $180 | 17% |

| Neoga | $153 | -1% |

| Neponset | $151 | -2% |

| New Athens | $165 | 7% |

| New Baden | $159 | 3% |

| New Bedford | $151 | -2% |

| New Berlin | $153 | 0% |

| New Burnside | $187 | 22% |

| New Canton | $179 | 16% |

| New Douglas | $164 | 7% |

| New Haven | $181 | 18% |

| New Holland | $158 | 2% |

| New Lenox | $154 | 0% |

| New Memphis | $160 | 4% |

| New Milford | $160 | 4% |

| New Salem | $174 | 13% |

| New Windsor | $162 | 5% |

| Newark | $152 | -1% |

| Newman | $156 | 1% |

| Newton | $161 | 5% |

| Niantic | $155 | 0% |

| Niles | $187 | 21% |

| Nilwood | $167 | 8% |

| Niota | $169 | 10% |

| Noble | $163 | 6% |

| Nokomis | $162 | 5% |

| Nora | $155 | 0% |

| Normal | $142 | -8% |

| Norridge | $199 | 29% |

| Norris | $170 | 10% |

| Norris City | $177 | 15% |

| North Aurora | $154 | 0% |

| North Barrington | $158 | 2% |

| North Chicago | $167 | 9% |

| North City | $178 | 16% |

| North Pekin | $151 | -2% |

| North Riverside | $177 | 15% |

| North Utica | $148 | -4% |

| Northbrook | $174 | 13% |

| Northfield | $169 | 10% |

| Northlake | $195 | 27% |

| O’Fallon | $165 | 7% |

| Oak Brook | $163 | 6% |

| Oak Forest | $180 | 16% |

| Oak Lawn | $188 | 22% |

| Oak Park | $195 | 27% |

| Oakbrook Terrace | $161 | 5% |

| Oakdale | $166 | 8% |

| Oakford | $178 | 16% |

| Oakland | $156 | 1% |

| Oakwood | $157 | 2% |

| Oakwood Hills | $154 | 0% |

| Odell | $144 | -6% |

| Odin | $166 | 8% |

| Oglesby | $146 | -5% |

| Ohlman | $174 | 13% |

| Okawville | $160 | 4% |

| Olive Branch | $184 | 20% |

| Olivet | $157 | 2% |

| Olmsted | $185 | 20% |

| Olney | $161 | 4% |

| Olympia Fields | $198 | 28% |

| Onarga | $151 | -2% |

| Oneida | $162 | 5% |

| Opdyke | $169 | 10% |

| Ophiem | $157 | 2% |

| Oquawka | $162 | 5% |

| Orangeville | $155 | 0% |

| Oraville | $186 | 21% |

| Oreana | $151 | -2% |

| Oregon | $157 | 2% |

| Orient | $175 | 14% |

| Orion | $158 | 2% |

| Orland Hills | $172 | 11% |

| Orland Park | $170 | 10% |

| Oswego | $153 | -1% |

| Ottawa | $146 | -5% |

| Owaneco | $166 | 8% |

| Palatine | $159 | 3% |

| Palestine | $163 | 6% |

| Palmer | $168 | 9% |

| Palmyra | $172 | 11% |

| Paloma | $169 | 10% |

| Palos Heights | $179 | 16% |

| Palos Hills | $186 | 21% |

| Palos Park | $185 | 20% |

| Pana | $163 | 5% |

| Panama | $161 | 4% |

| Papineau | $162 | 5% |

| Paris | $159 | 3% |

| Park City | $166 | 8% |

| Park Forest | $190 | 23% |

| Park Ridge | $180 | 17% |

| Parkersburg | $165 | 7% |

| Patoka | $166 | 8% |

| Patterson | $174 | 13% |

| Paw Paw | $151 | -2% |

| Pawnee | $159 | 3% |

| Paxton | $148 | -4% |

| Payson | $174 | 13% |

| Pearl | $179 | 16% |

| Pearl City | $155 | 0% |

| Pecatonica | $155 | 1% |

| Pekin | $151 | -2% |

| Pembroke Township | $165 | 7% |

| Penfield | $150 | -3% |

| Peoria | $162 | 5% |

| Peoria Heights | $157 | 2% |

| Peotone | $163 | 6% |

| Percy | $183 | 19% |

| Perks | $191 | 24% |

| Perry | $174 | 13% |

| Peru | $143 | -7% |

| Petersburg | $176 | 14% |

| Philo | $145 | -6% |

| Phoenix | $236 | 53% |

| Piasa | $171 | 11% |

| Pierron | $165 | 7% |

| Pinckneyville | $178 | 16% |

| Piper City | $146 | -5% |

| Pistakee Highlands | $156 | 1% |

| Pittsburg | $178 | 15% |

| Pittsfield | $175 | 14% |

| Plainfield | $164 | 7% |

| Plainville | $177 | 15% |

| Plano | $152 | -1% |

| Plato Center | $166 | 7% |

| Pleasant Hill | $177 | 15% |

| Pleasant Plains | $169 | 10% |

| Plymouth | $167 | 8% |

| Pocahontas | $164 | 7% |

| Polo | $153 | -1% |

| Pomona | $180 | 17% |

| Pontiac | $143 | -7% |

| Pontoon Beach | $179 | 16% |

| Poplar Grove | $154 | 0% |

| Port Barrington | $158 | 2% |

| Port Byron | $157 | 2% |

| Posen | $225 | 46% |

| Potomac | $159 | 3% |

| Prairie Grove | $151 | -2% |

| Prairie du Rocher | $179 | 16% |

| Preemption | $159 | 3% |

| Prestbury | $151 | -2% |

| Preston Heights | $175 | 14% |

| Princeton | $150 | -3% |

| Prophetstown | $152 | -1% |

| Prospect Heights | $174 | 13% |

| Putnam | $165 | 7% |

| Quincy | $148 | -4% |

| Radom | $164 | 7% |

| Raleigh | $186 | 21% |

| Rankin | $155 | 0% |

| Ransom | $152 | -2% |

| Rantoul | $146 | -5% |

| Rapids City | $166 | 7% |

| Raritan | $156 | 1% |

| Raymond | $161 | 4% |

| Red Bud | $175 | 14% |

| Reddick | $154 | 0% |

| Redmon | $159 | 3% |

| Renault | $172 | 11% |

| Reynolds | $160 | 4% |

| Richmond | $154 | 0% |

| Richton Park | $198 | 28% |

| Ridge Farm | $158 | 2% |

| Rinard | $169 | 10% |

| Ringwood | $154 | 0% |

| River Forest | $190 | 23% |

| River Grove | $201 | 31% |

| Riverdale | $230 | 49% |

| Riverside | $173 | 13% |

| Riverton | $166 | 8% |

| Riverwoods | $170 | 10% |

| Robbins | $218 | 42% |

| Roberts | $148 | -4% |

| Robinson | $163 | 5% |

| Roby | $171 | 11% |

| Rochelle | $148 | -4% |

| Rochester | $158 | 2% |

| Rock City | $156 | 1% |

| Rock Falls | $140 | -9% |

| Rock Island | $150 | -3% |

| Rockbridge | $173 | 12% |

| Rockdale | $172 | 12% |

| Rockford | $164 | 6% |

| Rockport | $178 | 15% |

| Rockton | $151 | -2% |

| Rockwood | $181 | 17% |

| Rolling Meadows | $159 | 3% |

| Rome | $160 | 4% |

| Romeoville | $166 | 8% |

| Roodhouse | $169 | 10% |

| Rosamond | $167 | 8% |

| Roscoe | $149 | -3% |

| Roselle | $163 | 5% |

| Rosemont | $182 | 18% |

| Roseville | $161 | 4% |

| Rosewood Heights | $171 | 11% |

| Rosiclare | $189 | 23% |

| Rossville | $159 | 3% |

| Round Lake | $161 | 5% |

| Round Lake Beach | $162 | 5% |

| Round Lake Heights | $162 | 5% |

| Round Lake Park | $162 | 5% |

| Roxana | $173 | 12% |

| Royal | $150 | -3% |

| Royalton | $175 | 14% |

| Rushville | $172 | 11% |

| Russell | $164 | 6% |

| Rutland | $149 | -3% |

| Sailor Springs | $164 | 6% |

| Salem | $164 | 6% |

| San Jose | $166 | 8% |

| Sandoval | $165 | 7% |

| Sandwich | $151 | -2% |

| Sauk Village | $206 | 34% |

| Savanna | $159 | 3% |

| Savoy | $146 | -5% |

| Sawyerville | $164 | 6% |

| Saybrook | $147 | -5% |

| Scales Mound | $155 | 1% |

| Schaumburg | $165 | 7% |

| Scheller | $176 | 14% |

| Schiller Park | $201 | 30% |

| Schram City | $161 | 4% |

| Sciota | $164 | 6% |

| Scott AFB | $160 | 4% |

| Seaton | $163 | 5% |

| Seatonville | $148 | -4% |

| Secor | $153 | -1% |

| Seneca | $152 | -1% |

| Sesser | $183 | 19% |

| Seward | $154 | 0% |

| Seymour | $145 | -6% |

| Shannon | $153 | -1% |

| Shawneetown | $183 | 19% |

| Sheffield | $152 | -1% |

| Shelbyville | $155 | 1% |

| Sheldon | $156 | 1% |

| Sheridan | $155 | 0% |

| Sherman | $164 | 6% |

| Sherrard | $161 | 4% |

| Shiloh | $167 | 9% |

| Shirland | $160 | 4% |

| Shirley | $146 | -6% |

| Shobonier | $159 | 3% |

| Shorewood | $167 | 8% |

| Shumway | $152 | -2% |

| Sibley | $148 | -4% |

| Sidell | $153 | -1% |

| Sidney | $151 | -2% |

| Silvis | $146 | -6% |

| Sims | $173 | 13% |

| Skokie | $198 | 28% |

| Sleepy Hollow | $160 | 4% |

| Smithboro | $160 | 4% |

| Smithfield | $167 | 9% |

| Smithshire | $158 | 2% |

| Smithton | $167 | 8% |

| Somonauk | $152 | -2% |

| Sorento | $161 | 4% |

| South Barrington | $162 | 5% |

| South Beloit | $151 | -2% |

| South Chicago Heights | $204 | 32% |

| South Elgin | $158 | 2% |

| South Holland | $208 | 35% |

| South Jacksonville | $153 | -1% |

| South Pekin | $152 | -1% |

| South Roxana | $166 | 8% |

| South Suburban | $207 | 35% |

| South Wilmington | $152 | -1% |

| Southern View | $164 | 7% |

| Sparland | $161 | 4% |

| Sparta | $185 | 20% |

| Speer | $161 | 4% |

| Spring Grove | $151 | -2% |

| Spring Valley | $148 | -4% |

| Springerton | $174 | 13% |

| Springfield | $161 | 5% |

| St. Anne | $163 | 6% |

| St. Augustine | $163 | 6% |

| St. Charles | $152 | -2% |

| St. David | $164 | 6% |

| St. Elmo | $156 | 1% |

| St. Francisville | $160 | 4% |

| St. Joseph | $146 | -5% |

| St. Libory | $163 | 6% |

| St. Peter | $158 | 2% |

| Standard | $156 | 1% |

| Stanford | $151 | -2% |

| Staunton | $161 | 5% |

| Ste. Marie | $159 | 3% |

| Steeleville | $181 | 18% |

| Steger | $191 | 24% |

| Sterling | $143 | -7% |

| Steward | $148 | -4% |

| Stewardson | $152 | -2% |

| Stickney | $209 | 36% |

| Stillman Valley | $155 | 1% |

| Stockland | $154 | 0% |

| Stockton | $157 | 2% |

| Stone Park | $213 | 38% |

| Stonington | $167 | 9% |

| Stoy | $166 | 7% |

| Strasburg | $152 | -2% |

| Strawn | $148 | -4% |

| Streamwood | $169 | 9% |

| Streator | $147 | -5% |

| Stronghurst | $158 | 2% |

| Sugar Grove | $151 | -2% |

| Sullivan | $151 | -2% |

| Summerfield | $162 | 5% |

| Summit | $203 | 32% |

| Summit Argo | $204 | 32% |

| Sumner | $166 | 8% |

| Sun River Terrace | $161 | 5% |

| Sutter | $169 | 9% |

| Swansea | $169 | 9% |

| Sycamore | $141 | -8% |

| Table Grove | $165 | 7% |

| Tallula | $176 | 14% |

| Tamaroa | $179 | 16% |

| Tampico | $149 | -3% |

| Taylor Ridge | $160 | 4% |

| Taylor Springs | $160 | 4% |

| Taylorville | $166 | 8% |

| Techny | $173 | 12% |

| Teutopolis | $150 | -3% |

| Texico | $171 | 11% |

| Thawville | $152 | -1% |

| Thayer | $155 | 1% |

| The Galena Territory | $153 | -1% |

| Thebes | $184 | 19% |

| Thomasboro | $149 | -3% |

| Thompsonville | $178 | 16% |

| Thomson | $152 | -1% |

| Thornton | $201 | 30% |

| Tilden | $177 | 15% |

| Tilton | $152 | -1% |

| Timewell | $173 | 12% |

| Tinley Park | $171 | 11% |

| Tiskilwa | $155 | 0% |

| Toledo | $161 | 5% |

| Tolono | $144 | -6% |

| Toluca | $150 | -3% |

| Tonica | $149 | -3% |

| Topeka | $166 | 8% |

| Toulon | $156 | 1% |

| Tovey | $161 | 4% |

| Tower Hill | $157 | 2% |

| Tower Lakes | $157 | 2% |

| Tremont | $158 | 2% |

| Trenton | $160 | 4% |

| Trilla | $154 | 0% |

| Triumph | $156 | 1% |

| Troy | $164 | 6% |

| Troy Grove | $147 | -4% |

| Tuscola | $152 | -1% |

| Twin Grove | $140 | -9% |

| Ullin | $185 | 20% |

| Union | $153 | -1% |

| Union Hill | $158 | 2% |

| Unity | $182 | 18% |

| University Park | $185 | 20% |

| Urbana | $148 | -4% |

| Valier | $176 | 14% |

| Valmeyer | $168 | 9% |

| Van Orin | $150 | -3% |

| Vandalia | $154 | 0% |

| Varna | $155 | 1% |

| Venetian Village | $157 | 2% |

| Venice | $202 | 31% |

| Vermilion | $165 | 7% |

| Vermont | $166 | 8% |

| Vernon | $167 | 8% |

| Vernon Hills | $159 | 3% |

| Verona | $152 | -1% |

| Vienna | $184 | 20% |

| Villa Grove | $150 | -3% |

| Villa Park | $161 | 4% |

| Viola | $161 | 5% |

| Virden | $163 | 6% |

| Virginia | $174 | 13% |

| Wadsworth | $163 | 6% |

| Waggoner | $161 | 4% |

| Walnut Hill | $170 | 10% |

| Walsh | $180 | 17% |

| Walshville | $163 | 6% |

| Waltonville | $172 | 11% |

| Wamac | $167 | 8% |

| Warren | $157 | 2% |

| Warrensburg | $151 | -2% |

| Warrenville | $157 | 2% |

| Warsaw | $169 | 10% |

| Wasco | $163 | 6% |

| Washburn | $154 | 0% |

| Washington | $148 | -4% |

| Washington Park | $213 | 38% |

| Wataga | $159 | 3% |

| Waterloo | $163 | 6% |

| Waterman | $148 | -4% |

| Watseka | $153 | -1% |

| Watson | $151 | -2% |

| Wauconda | $152 | -1% |

| Waukegan | $166 | 8% |

| Waverly | $165 | 7% |

| Wayne | $162 | 5% |

| Wayne City | $175 | 13% |

| Wedron | $152 | -1% |

| Weldon | $150 | -3% |

| Wellington | $155 | 0% |

| Wenona | $150 | -3% |

| West Brooklyn | $147 | -4% |

| West Chicago | $159 | 3% |

| West City | $176 | 14% |

| West Dundee | $160 | 4% |

| West Frankfort | $175 | 13% |

| West Liberty | $161 | 4% |

| West Peoria | $162 | 5% |

| West Point | $169 | 10% |

| West Salem | $169 | 10% |

| West Union | $164 | 6% |

| West York | $164 | 6% |

| Westchester | $173 | 12% |

| Western Springs | $167 | 8% |

| Westfield | $161 | 4% |

| Westmont | $161 | 5% |

| Westville | $154 | 0% |

| Wheaton | $154 | 0% |

| Wheeler | $157 | 2% |

| Wheeling | $176 | 14% |

| White Hall | $171 | 11% |

| White Heath | $148 | -4% |

| Whittington | $178 | 16% |

| Williamsfield | $167 | 8% |

| Williamsville | $161 | 5% |

| Willisville | $179 | 16% |

| Willow Springs | $177 | 15% |

| Willowbrook | $168 | 9% |

| Wilmette | $173 | 12% |

| Wilmington | $164 | 7% |

| Wilsonville | $167 | 8% |

| Winchester | $171 | 11% |

| Winfield | $152 | -1% |

| Winnebago | $155 | 1% |

| Winnetka | $167 | 8% |

| Winthrop Harbor | $162 | 5% |

| Witt | $162 | 5% |

| Wolf Lake | $180 | 16% |

| Wonder Lake | $150 | -2% |

| Wood Dale | $166 | 8% |

| Wood River | $168 | 9% |

| Woodhull | $158 | 2% |

| Woodland | $153 | 0% |

| Woodlawn | $166 | 8% |

| Woodridge | $159 | 3% |

| Woodson | $158 | 2% |

| Woodstock | $154 | 0% |

| Woosung | $149 | -3% |

| Worden | $163 | 6% |

| Worth | $188 | 22% |

| Wrights | $179 | 16% |

| Wyanet | $153 | -1% |

| Wyoming | $161 | 4% |

| Yale | $162 | 5% |

| Yates City | $165 | 7% |

| Yorkville | $156 | 2% |

| Zeigler | $178 | 15% |

| Zion | $165 | 7% |

Best and worst drivers in Illinois

Schaumburg has the best drivers in Illinois, according to LendingTree research. Decatur has the state’s worst drivers.

Of all age groups, Generation Z is involved in the most traffic incidents by a wide margin. Boomers are Illinois’ best drivers by age group.

Illinois metros with the best and worst drivers

Of the largest metro areas in Illinois, Schaumburg has the fewest traffic incidents, at 9.2 per 1,000 drivers. Cicero and Mount Prospect are tied for second, with 10.2 incidents per 1,000 drivers. Arlington Heights comes in third with 10.8.

Best drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Schaumburg | 9.2 |

| Cicero | 10.2 |

| Mount Prospect | 10.2 |

| Arlington Heights | 10.8 |

| Tinley Park | 11.3 |

Decatur has the most traffic incidents in Illinois, at 26.7 per 1,000 drivers. Bloomington is next, with 24.6 incidents per 1,000 drivers.

Worst drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Decatur | 26.7 |

| Bloomington | 24.6 |

| Peoria | 18.8 |

| Naperville | 16.0 |

| Rockford | 15.8 |

Best and worst drivers by age group

Illinois’ best drivers by age group are Boomers. They get into just 16.2 incidents per 1,000 drivers. The Silent Generation comes in a close second, with a rate of 16.7.

The worst drivers by age group in Illinois come from Gen Z. Their incident rate is by far the highest of the generations we surveyed, at 42.0 per 1,000 drivers. Millennials are next, with a rate of 21.4.

Worst drivers by generation

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 42.0 |

| Millenial | 21.4 |

| Gen X | 17.7 |

| Boomer | 16.2 |

| Silent Generation | 16.7 |

Best and worst drivers by car make

Mercury drivers are the best in Illinois, with a traffic incident rate of 12.9 per 1,000 drivers. Cadillac drivers come in second, with an incident rate of 13.6.

Best drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Mercury | 12.9 |

| Cadillac | 13.6 |

| Chrysler | 16.8 |

| Buick | 17.1 |

| Land Rover | 17.6 |

Ram is the car brand involved in the most traffic-related incidents in Illinois. Ram owners get into 27.6 incidents per 1,000 drivers, which is the state’s highest rate. Subaru owners are next, at 25.9 incidents per 1,000 drivers.

Worst drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Ram | 27.6 |

| Subaru | 25.9 |

| Audi | 24.1 |

| Pontiac | 22.9 |

| Mazda | 22.8 |

Illinois car insurance requirements

Car insurance is required by law in Illinois. The state’s minimum car insurance requirements include:

-

Bodily injury liability

: $25,000 per person, $50,000 per accidentBodily injury liability helps cover the medical bills of other people you injure in a car accident.

-

Property damage liability

: $20,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

-

Uninsured motorist

: $25,000 per person, $50,000 per accidentUninsured motorist covers you and your passengers for injuries caused by a driver with no insurance. It’s required in about 20 states and optional everywhere else.

You usually have to add collision

Car insurance laws in Illinois

Illinois enforces its car insurance laws with an electronic verification system. The system checks the insurance status of registered vehicles twice a year. You also have to show proof of insurance to law enforcement after a traffic stop or accident.

The penalties for driving without insurance include fines and a suspension of your registration.

SR-22 car insurance in Illinois

You may need SR-22 insurance to reinstate your driving privileges after certain violations. An SR-22 is a form that certifies you have car insurance. Your insurance company files it for you when you buy your policy.

The cost of SR-22 insurance depends on the offense that leads to the filing requirement. The average cost of SR-22 insurance after a DUI is about $280 a month. The average rate for lesser offenses like an insurance violation is about $190 a month.

You can often find a cheaper rate in SR-22 insurance by shopping around.

Some companies don’t offer SR-22 insurance. Those that do may add a filing fee of about $25 to your rate. It’s good to be upfront about your SR-22 requirement when you shop for your policy. This helps you get accurate quotes.

How we selected the cheapest car insurance companies in Illinois

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Illinois

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.