Cheapest Car Insurance in Georgia (2026)

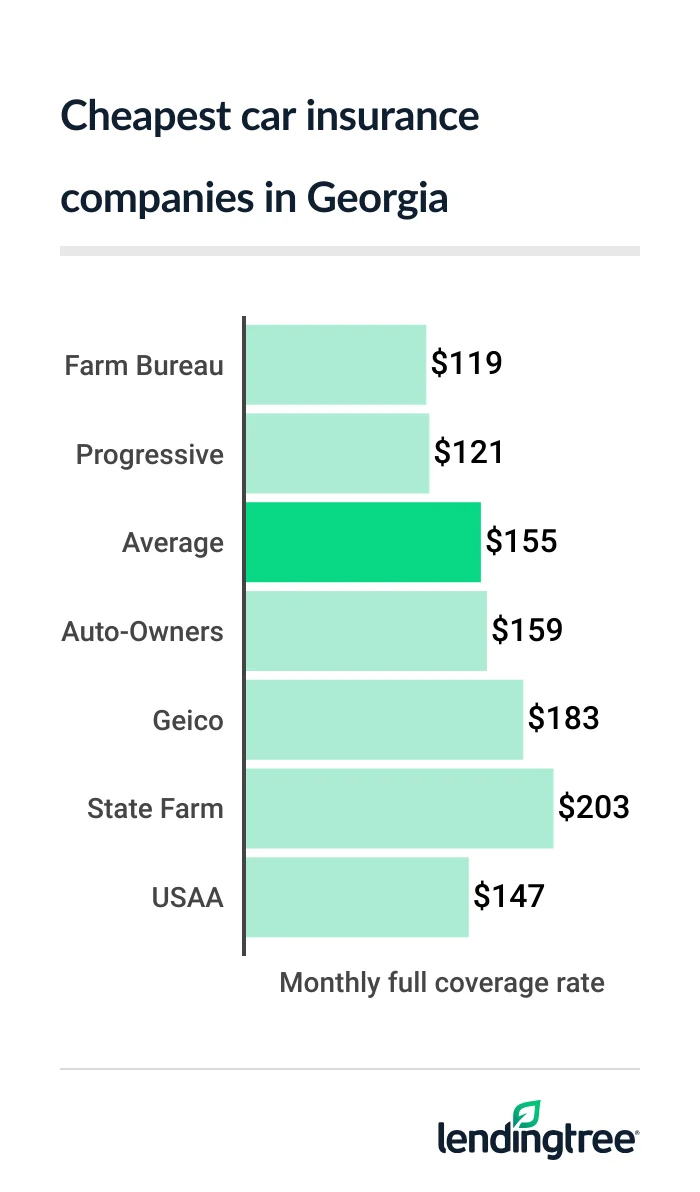

Farm Bureau has the cheapest car insurance for most Georgia drivers, at $119 a month for full coverage and $55 a month for liability coverage.

Best cheap car insurance in Georgia

Georgia’s cheapest full coverage car insurance: Farm Bureau

To get the cheapest full coverage car insurance in Georgia, start by comparing quotes from Farm Bureau and Progressive. Both companies have an average rate of around $120 per month for full coverage

Auto-Owners is the next-cheapest company for most Georgia drivers, at $159 per month.

Of the two least-expensive insurers, Farm Bureau has a slightly better customer satisfaction score from J.D. Power, while Progressive has more discounts that could make your rate cheaper.

Full coverage auto insurance rates in GA

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| Farm Bureau | $119 |  |

| Progressive | $121 |  |

| Auto-Owners | $159 |  |

| Geico | $183 |  |

| State Farm | $203 |  |

| USAA* | $147 |  |

Progressive also offers a few valuable add-on coverages that Farm Bureau doesn’t. Accident forgiveness

Cheapest liability auto insurance in Georgia: Farm Bureau

Farm Bureau also has Georgia’s cheapest liability car insurance with an average rate of $55 per month.

Auto-Owners and Progressive also have affordable car insurance for Georgia drivers who only want liability coverage

Liability auto insurance rates in GA

| Company | Monthly rate |

|---|---|

| Farm Bureau | $55 |

| Auto-Owners | $61 |

| Progressive | $64 |

| Geico | $70 |

| State Farm | $97 |

| USAA* | $58 |

Both Auto-Owners and Progressive have more car insurance discounts than Farm Bureau. Either company could give you the cheapest rate overall if you can get a few of their discounts.

Also, you have to join the Farm Bureau to get its insurance. Membership to the Georgia Farm Bureau costs $35 a year.

Cheap auto insurance in Georgia for young drivers: Farm Bureau

Most young drivers and their families get the cheapest teen car insurance rates from Farm Bureau. Farm Bureau’s liability insurance rates average $182 per month, while its full coverage rates average $379 per month.

USAA’s teen car insurance rates are even cheaper than Farm Bureau’s. For liability coverage, the company’s average rate is $146 per month. For full coverage, it’s $337 per month. However, you or a family member must be current or former military to buy from USAA.

Monthly insurance rates for teens

| Company | Liability coverage | Full coverage |

|---|---|---|

| Farm Bureau | $182 | $379 |

| Auto-Owners | $241 | $448 |

| Geico | $269 | $595 |

| Progressive | $278 | $579 |

| State Farm | $337 | $614 |

| USAA* | $146 | $337 |

In Georgia, the average cost of teen car insurance is $242 per month for liability-only coverage. That’s nearly four times what the average adult pays.

Teen drivers and their parents can usually save money on car insurance through discounts for:

- Taking a driver’s education or training program

- Leaving their car at home while at college

- Getting good grades

Georgia’s cheapest car insurance after a speeding ticket: Farm Bureau

Farm Bureau has the cheapest car insurance in Georgia for drivers with a speeding ticket on their records, at $130 per month. That’s 27% less than the state average of $178 per month.

Progressive comes in second for Georgia drivers with a ticket. Its rates average $158 per month.

Auto insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| Farm Bureau | $130 |

| Progressive | $158 |

| Auto-Owners | $159 |

| State Farm | $217 |

| Geico | $222 |

| USAA* | $184 |

A speeding ticket usually causes car insurance rates to go up by about 15% in Georgia. However, Farm Bureau only raises its rates by 9% after a ticket.

Cheapest Georgia insurance quotes after an accident: Farm Bureau

At $130 per month, Farm Bureau also has Georgia’s cheapest car insurance for drivers with an accident on their records. This is 39% cheaper than the state average of $212 per month.

Auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| Farm Bureau | $130 |

| Progressive | $179 |

| State Farm | $203 |

| Auto-Owners | $225 |

| Geico | $324 |

| USAA* | $213 |

The average driver in Georgia sees their car insurance rate go up by 37% after an at-fault accident. If you have a policy with Farm Bureau, you should only see your car insurance premium

Cheap car insurance for Georgia teens with a bad driving record: Farm Bureau

Georgia teens with a ticket or accident on their driving records should get a quote from Farm Bureau if they want the most affordable coverage. Farm Bureau offers rates of around $200 per month for teens after both traffic incidents.

Monthly rates for teens after a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| Farm Bureau | $200 | $200 |

| Auto-Owners | $241 | $385 |

| Progressive | $288 | $309 |

| Geico | $318 | $373 |

| State Farm | $366 | $337 |

| USAA* | $237 | $262 |

The second-cheapest insurance company for teens with a bad driving record in Georgia is Auto-Owners. Although its rates are higher than Farm Bureau’s, discounts could make a difference if you get a few.

Auto-Owners also offers some coverage options Farm Bureau doesn’t, like gap insurance

Cheapest car insurance rates for Georgia drivers with a DUI: Progressive

Progressive has the cheapest DUI insurance rates in Georgia at $189 per month. Farm Bureau has the state’s next-cheapest rate of $230 per month for drivers with a DUI (driving under the influence) conviction.

Georgia insurance rates after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $189 |

| Farm Bureau | $230 |

| Auto-Owners | $296 |

| Geico | $543 |

| State Farm | $551 |

| USAA* | $301 |

The average cost of car insurance after a DUI in Georgia is $352 per month.

You should expect your car insurance rates to more than double after a DUI in Georgia. However, the average Progressive customer only sees their rates go up 56% after a DUI.

Cheap car insurance quotes in Georgia for bad credit: Farm Bureau

For the cheapest car insurance for drivers with bad credit in Georgia, make sure you get a quote from Farm Bureau. Its average rate for drivers with poor credit is $119 per month. The state average for these drivers is $341 per month.

Insurance rates for drivers with bad credit

| Company | Monthly rate |

|---|---|

| Farm Bureau | $119 |

| Progressive | $200 |

| Geico | $262 |

| Auto-Owners | $419 |

| State Farm | $775 |

| USAA* | $272 |

Progressive is the second-cheapest company for bad credit car insurance. It offers an average rate of $200 per month.

Georgia drivers with poor credit pay more than twice what drivers with good credit do for car insurance.

You can usually improve your credit by paying down debt and avoiding late payments. Once your credit score goes up, shop for car insurance again to get a lower rate.

Best car insurance in Georgia

Farm Bureau is the best car insurance company in Georgia overall. It has the most affordable car insurance rates for most of the state’s drivers. Its customers are also relatively happy with it, based on its good J.D. Power score.

Georgia car insurance company ratings

| Company | LendingTree | J.D. Power | AM Best |

|---|---|---|---|

| Auto-Owners | 638 | A+ | |

| Farm Bureau | 645 | A | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

Progressive is Georgia’s best car insurance for drivers with a DUI. It’s among the cheapest companies in the state for other drivers, too, including those with a ticket or accident on their records. Progressive also offers more discounts and add-on coverages than Farm Bureau.

USAA is one of the best car insurance companies in Georgia if you have military ties. It is especially cheap if you are a teen driver or you have one in your household. Also, USAA has the best J.D. Power customer satisfaction score of any of the companies we surveyed in Georgia.

Georgia car insurance rates by city

Kings Bay Base has the cheapest car insurance among Georgia cities, with an average rate of $129 per month. Pine Lake is the state’s most expensive city for car insurance. Rates there average $257 per month.

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Abbeville | $155 | 0% |

| Acworth | $170 | 9% |

| Adairsville | $161 | 4% |

| Adel | $137 | -12% |

| Adrian | $160 | 3% |

| Ailey | $163 | 5% |

| Alamo | $160 | 3% |

| Alapaha | $146 | -6% |

| Albany | $152 | -2% |

| Aldora | $167 | 7% |

| Allenhurst | $147 | -5% |

| Allentown | $168 | 8% |

| Alma | $152 | -2% |

| Alpharetta | $163 | 5% |

| Alston | $184 | 19% |

| Alto | $154 | -1% |

| Ambrose | $147 | -6% |

| Americus | $160 | 3% |

| Andersonville | $158 | 2% |

| Appling | $158 | 2% |

| Arabi | $153 | -1% |

| Aragon | $173 | 11% |

| Argyle | $150 | -4% |

| Arlington | $160 | 3% |

| Armuchee | $159 | 2% |

| Arnoldsville | $159 | 2% |

| Ashburn | $152 | -2% |

| Athens | $157 | 1% |

| Atlanta | $205 | 32% |

| Attapulgus | $142 | -9% |

| Auburn | $180 | 16% |

| Augusta | $160 | 3% |

| Austell | $212 | 36% |

| Avera | $158 | 2% |

| Avondale Estates | $209 | 34% |

| Axson | $146 | -6% |

| Baconton | $149 | -4% |

| Bainbridge | $144 | -8% |

| Baldwin | $150 | -3% |

| Ball Ground | $159 | 2% |

| Barnesville | $167 | 7% |

| Barney | $138 | -11% |

| Bartow | $164 | 5% |

| Barwick | $145 | -6% |

| Baxley | $150 | -4% |

| Bellville | $162 | 4% |

| Belvedere Park | $227 | 46% |

| Berkeley Lake | $186 | 19% |

| Berlin | $145 | -7% |

| Bethlehem | $179 | 15% |

| Bishop | $176 | 13% |

| Blackshear | $142 | -8% |

| Blairsville | $146 | -6% |

| Blakely | $149 | -4% |

| Bloomingdale | $161 | 4% |

| Blue Ridge | $153 | -2% |

| Bluffton | $158 | 2% |

| Blythe | $159 | 2% |

| Bogart | $161 | 4% |

| Bolingbroke | $167 | 7% |

| Bonaire | $155 | 0% |

| Bonanza | $214 | 38% |

| Boneville | $153 | -1% |

| Boston | $142 | -9% |

| Bostwick | $180 | 16% |

| Bowdon | $162 | 4% |

| Bowdon Junction | $186 | 20% |

| Bowersville | $146 | -6% |

| Bowman | $150 | -3% |

| Box Springs | $172 | 11% |

| Braselton | $162 | 4% |

| Bremen | $169 | 9% |

| Brinson | $147 | -5% |

| Bristol | $146 | -6% |

| Bronwood | $163 | 5% |

| Brookfield | $166 | 7% |

| Brooklet | $162 | 4% |

| Brooks | $160 | 3% |

| Broxton | $149 | -4% |

| Brunswick | $133 | -14% |

| Buchanan | $169 | 9% |

| Buckhead | $164 | 5% |

| Buena Vista | $171 | 10% |

| Buford | $175 | 12% |

| Butler | $176 | 13% |

| Byromville | $171 | 10% |

| Byron | $158 | 2% |

| Cadwell | $153 | -1% |

| Cairo | $142 | -9% |

| Calhoun | $158 | 2% |

| Calvary | $167 | 7% |

| Camak | $161 | 4% |

| Camilla | $147 | -5% |

| Candler-McAfee | $243 | 57% |

| Canon | $145 | -7% |

| Canton | $158 | 1% |

| Carlton | $159 | 2% |

| Carnesville | $149 | -4% |

| Carrollton | $164 | 5% |

| Cartersville | $169 | 8% |

| Cassville | $167 | 7% |

| Cataula | $161 | 4% |

| Cave Spring | $165 | 6% |

| Cecil | $163 | 5% |

| Cedar Springs | $148 | -5% |

| Cedartown | $165 | 6% |

| Centerville | $158 | 2% |

| Centralhatchee | $165 | 6% |

| Chamblee | $182 | 17% |

| Chatsworth | $146 | -6% |

| Chattahoochee Hills | $195 | 26% |

| Chattanooga Valley | $141 | -9% |

| Chauncey | $154 | -1% |

| Cherry Log | $153 | -2% |

| Chester | $154 | -1% |

| Chestnut Mountain | $180 | 16% |

| Chickamauga | $142 | -9% |

| Chula | $146 | -6% |

| Cisco | $152 | -2% |

| Clarkdale | $200 | 29% |

| Clarkesville | $149 | -4% |

| Clarkston | $243 | 56% |

| Claxton | $161 | 3% |

| Clayton | $146 | -6% |

| Clermont | $157 | 1% |

| Cleveland | $154 | -1% |

| Climax | $144 | -7% |

| Clinchfield | $156 | 1% |

| Clyo | $161 | 4% |

| Cobb | $162 | 4% |

| Cobbtown | $163 | 5% |

| Cochran | $154 | -1% |

| Cohutta | $143 | -8% |

| Colbert | $160 | 3% |

| Coleman | $160 | 3% |

| College Park | $243 | 56% |

| Collins | $162 | 4% |

| Colquitt | $149 | -4% |

| Columbus | $166 | 7% |

| Comer | $156 | 0% |

| Commerce | $161 | 4% |

| Concord | $168 | 8% |

| Conley | $235 | 51% |

| Conyers | $208 | 34% |

| Coolidge | $146 | -6% |

| Coosa | $183 | 17% |

| Cordele | $157 | 1% |

| Cornelia | $148 | -5% |

| Cotton | $171 | 10% |

| Country Club Estates | $134 | -14% |

| Covington | $197 | 26% |

| Crandall | $148 | -5% |

| Crawford | $160 | 3% |

| Crawfordville | $157 | 1% |

| Crescent | $141 | -9% |

| Culloden | $172 | 10% |

| Cumming | $159 | 3% |

| Cusseta | $163 | 5% |

| Cuthbert | $160 | 3% |

| Dacula | $180 | 16% |

| Dahlonega | $158 | 1% |

| Daisy | $184 | 19% |

| Dallas | $179 | 15% |

| Dalton | $145 | -7% |

| Damascus | $149 | -4% |

| Danielsville | $157 | 1% |

| Danville | $169 | 9% |

| Darien | $136 | -13% |

| Dasher | $132 | -15% |

| Davisboro | $162 | 4% |

| Dawson | $161 | 4% |

| Dawsonville | $160 | 3% |

| De Soto | $159 | 2% |

| Dearing | $150 | -4% |

| Decatur | $202 | 30% |

| Deenwood | $138 | -11% |

| Deepstep | $163 | 5% |

| Demorest | $150 | -4% |

| Denton | $160 | 3% |

| Dewy Rose | $152 | -2% |

| Dexter | $155 | 0% |

| Dillard | $152 | -3% |

| Dixie | $143 | -8% |

| Dock Junction | $133 | -14% |

| Doerun | $150 | -4% |

| Donalsonville | $147 | -6% |

| Doraville | $187 | 20% |

| Douglas | $148 | -5% |

| Douglasville | $197 | 27% |

| Dover | $187 | 21% |

| Druid Hills | $178 | 14% |

| Dry Branch | $175 | 12% |

| Du Pont | $147 | -6% |

| Dublin | $155 | -1% |

| Dudley | $158 | 1% |

| Duluth | $187 | 20% |

| Dunwoody | $178 | 14% |

| Dutch Island | $169 | 9% |

| East Dublin | $154 | -1% |

| East Ellijay | $154 | -1% |

| East Griffin | $170 | 9% |

| East Point | $239 | 54% |

| Eastanollee | $144 | -7% |

| Eastman | $153 | -2% |

| Eatonton | $163 | 5% |

| Eden | $159 | 2% |

| Edison | $162 | 4% |

| Elberton | $150 | -3% |

| Elko | $159 | 2% |

| Ellabell | $160 | 3% |

| Ellaville | $176 | 13% |

| Ellenton | $146 | -6% |

| Ellenwood | $236 | 52% |

| Ellerslie | $161 | 3% |

| Ellijay | $154 | -1% |

| Emerson | $167 | 7% |

| Enigma | $149 | -4% |

| Epworth | $154 | -1% |

| Esom Hill | $188 | 21% |

| Eton | $150 | -4% |

| Euharlee | $171 | 10% |

| Evans | $154 | -1% |

| Experiment | $169 | 9% |

| Fair Oaks | $196 | 26% |

| Fairburn | $220 | 41% |

| Fairmount | $156 | 0% |

| Fairview | $141 | -9% |

| Fargo | $140 | -10% |

| Farmington | $161 | 3% |

| Fayetteville | $188 | 21% |

| Felton | $193 | 24% |

| Fitzgerald | $142 | -8% |

| Fleming | $147 | -6% |

| Flemington | $154 | -1% |

| Flintstone | $141 | -9% |

| Flovilla | $172 | 11% |

| Flowery Branch | $160 | 3% |

| Folkston | $133 | -14% |

| Forest Park | $232 | 49% |

| Forsyth | $169 | 8% |

| Fort Gaines | $158 | 2% |

| Fort Moore | $163 | 5% |

| Fort Oglethorpe | $141 | -9% |

| Fort Stewart | $153 | -2% |

| Fort Valley | $165 | 6% |

| Fortson | $162 | 4% |

| Fowlstown | $168 | 8% |

| Franklin | $166 | 7% |

| Franklin Springs | $179 | 15% |

| Funston | $147 | -5% |

| Gainesville | $160 | 3% |

| Garden City | $170 | 9% |

| Garfield | $166 | 7% |

| Gay | $174 | 12% |

| Geneva | $170 | 9% |

| Georgetown | $163 | 5% |

| Gibson | $157 | 1% |

| Gillsville | $158 | 2% |

| Girard | $169 | 9% |

| Glenn | $189 | 21% |

| Glennville | $159 | 2% |

| Glenwood | $159 | 2% |

| Good Hope | $189 | 22% |

| Gordon | $168 | 8% |

| Gough | $182 | 17% |

| Gracewood | $185 | 19% |

| Grantville | $170 | 9% |

| Gray | $174 | 12% |

| Grayson | $190 | 22% |

| Graysville | $143 | -8% |

| Greensboro | $159 | 2% |

| Greenville | $171 | 10% |

| Gresham Park | $232 | 49% |

| Griffin | $168 | 8% |

| Grovetown | $153 | -2% |

| Gumlog | $145 | -7% |

| Guyton | $157 | 1% |

| Haddock | $170 | 10% |

| Hagan | $162 | 4% |

| Hahira | $133 | -14% |

| Hamilton | $171 | 10% |

| Hampton | $205 | 32% |

| Hannahs Mill | $165 | 6% |

| Hapeville | $245 | 57% |

| Haralson | $162 | 4% |

| Hardwick | $175 | 12% |

| Harlem | $151 | -3% |

| Harrison | $163 | 5% |

| Hartsfield | $147 | -5% |

| Hartwell | $146 | -6% |

| Hawkinsville | $157 | 1% |

| Hazlehurst | $155 | 0% |

| Helen | $152 | -2% |

| Helena | $155 | 0% |

| Hephzibah | $163 | 5% |

| Hiawassee | $144 | -7% |

| High Shoals | $202 | 30% |

| Hillsboro | $172 | 11% |

| Hinesville | $153 | -1% |

| Hiram | $192 | 23% |

| Hoboken | $137 | -12% |

| Hogansville | $169 | 9% |

| Holly Springs | $158 | 2% |

| Homer | $155 | -1% |

| Homerville | $142 | -9% |

| Hortense | $140 | -10% |

| Hoschton | $165 | 6% |

| Howard | $174 | 12% |

| Hull | $160 | 3% |

| Ideal | $174 | 12% |

| Ila | $161 | 4% |

| Indian Springs | $140 | -10% |

| Iron City | $146 | -6% |

| Irondale | $233 | 50% |

| Irwinton | $165 | 6% |

| Isle of Hope | $170 | 10% |

| Ivey | $168 | 8% |

| Jackson | $170 | 9% |

| Jacksonville | $160 | 3% |

| Jakin | $148 | -5% |

| Jasper | $154 | -1% |

| Jefferson | $164 | 6% |

| Jeffersonville | $172 | 11% |

| Jekyll Island | $132 | -15% |

| Jenkinsburg | $174 | 12% |

| Jersey | $202 | 30% |

| Jesup | $145 | -7% |

| Jewell | $163 | 5% |

| Johns Creek | $172 | 11% |

| Jonesboro | $226 | 45% |

| Juliette | $171 | 10% |

| Junction City | $178 | 14% |

| Kathleen | $155 | 0% |

| Kennesaw | $172 | 10% |

| Keysville | $159 | 2% |

| Kings Bay | $129 | -17% |

| Kings Bay Base | $129 | -17% |

| Kingsland | $130 | -17% |

| Kingston | $167 | 7% |

| Kite | $162 | 4% |

| Knoxville | $172 | 10% |

| LaFayette | $144 | -8% |

| Lagrange | $165 | 6% |

| Lake City | $228 | 47% |

| Lake Park | $133 | -15% |

| Lakeland | $140 | -10% |

| Lakemont | $148 | -5% |

| Lakeview | $139 | -11% |

| Lakeview Estates | $209 | 34% |

| Lavonia | $144 | -7% |

| Lawrenceville | $195 | 25% |

| Leary | $164 | 5% |

| Lebanon | $182 | 17% |

| Leesburg | $150 | -4% |

| Lenox | $142 | -9% |

| Leslie | $164 | 5% |

| Lexington | $159 | 2% |

| Lilburn | $198 | 28% |

| Lilly | $190 | 22% |

| Lincoln Park | $165 | 6% |

| Lincolnton | $158 | 2% |

| Lindale | $165 | 6% |

| Lithia Springs | $210 | 35% |

| Lithonia | $253 | 63% |

| Lizella | $170 | 9% |

| Locust Grove | $196 | 26% |

| Loganville | $200 | 29% |

| Lookout Mountain | $141 | -9% |

| Louisville | $161 | 3% |

| Louvale | $159 | 2% |

| Lovejoy | $211 | 36% |

| Ludowici | $152 | -2% |

| Lula | $157 | 1% |

| Lumber City | $159 | 2% |

| Lumpkin | $164 | 6% |

| Luthersville | $172 | 11% |

| Lyerly | $156 | 0% |

| Lyons | $162 | 4% |

| Mableton | $209 | 35% |

| Macon | $177 | 14% |

| Madison | $165 | 6% |

| Manassas | $162 | 4% |

| Manchester | $171 | 10% |

| Manor | $138 | -11% |

| Mansfield | $189 | 21% |

| Marble Hill | $157 | 1% |

| Marietta | $185 | 19% |

| Marshallville | $165 | 6% |

| Martin | $146 | -6% |

| Martinez | $155 | -1% |

| Matthews | $156 | 0% |

| Mauk | $176 | 13% |

| Maxeys | $185 | 19% |

| Maysville | $160 | 3% |

| Mc Intyre | $174 | 12% |

| McCaysville | $150 | -3% |

| McRae | $153 | -2% |

| Mcdonough | $200 | 29% |

| Meansville | $168 | 8% |

| Meigs | $147 | -6% |

| Meldrim | $159 | 2% |

| Menlo | $152 | -3% |

| Meridian | $141 | -9% |

| Mershon | $146 | -6% |

| Mesena | $180 | 16% |

| Metter | $163 | 5% |

| Midland | $163 | 5% |

| Midville | $164 | 6% |

| Midway | $154 | -1% |

| Milan | $159 | 2% |

| Milledgeville | $176 | 13% |

| Millen | $171 | 10% |

| Millwood | $140 | -10% |

| Milner | $165 | 6% |

| Milton | $159 | 2% |

| Mineral Bluff | $148 | -5% |

| Mitchell | $160 | 3% |

| Molena | $168 | 8% |

| Monroe | $187 | 20% |

| Montezuma | $172 | 11% |

| Montgomery | $171 | 10% |

| Monticello | $174 | 12% |

| Montrose | $156 | 0% |

| Moody AFB | $130 | -17% |

| Moreland | $165 | 6% |

| Morgan | $163 | 5% |

| Morganton | $149 | -4% |

| Morris | $158 | 2% |

| Morrow | $229 | 47% |

| Morven | $140 | -10% |

| Moultrie | $147 | -6% |

| Mount Airy | $147 | -6% |

| Mount Berry | $159 | 2% |

| Mount Vernon | $160 | 3% |

| Mount Zion | $161 | 3% |

| Mountain City | $151 | -3% |

| Mountain Park | $194 | 25% |

| Murrayville | $157 | 1% |

| Musella | $172 | 11% |

| Mystic | $142 | -8% |

| Nahunta | $140 | -10% |

| Nashville | $143 | -8% |

| Naylor | $136 | -12% |

| Nelson | $183 | 18% |

| Newborn | $178 | 14% |

| Newington | $176 | 13% |

| Newnan | $165 | 6% |

| Newton | $159 | 2% |

| Nicholls | $151 | -3% |

| Nicholson | $160 | 3% |

| Norcross | $191 | 23% |

| Norman Park | $146 | -6% |

| Norristown | $186 | 19% |

| North Atlanta | $179 | 15% |

| North Decatur | $184 | 19% |

| North Druid Hills | $181 | 16% |

| North Metro | $211 | 36% |

| Norwood | $157 | 1% |

| Nunez | $187 | 20% |

| Oakfield | $160 | 3% |

| Oakman | $155 | 0% |

| Oakwood | $160 | 3% |

| Ochlocknee | $146 | -6% |

| Ocilla | $142 | -8% |

| Oconee | $185 | 19% |

| Odum | $148 | -5% |

| Offerman | $167 | 8% |

| Oglethorpe | $176 | 13% |

| Oliver | $169 | 9% |

| Omaha | $159 | 2% |

| Omega | $145 | -7% |

| Orchard Hill | $166 | 7% |

| Oxford | $196 | 26% |

| Palmetto | $187 | 20% |

| Panthersville | $250 | 61% |

| Parrott | $161 | 4% |

| Patterson | $141 | -9% |

| Pavo | $144 | -7% |

| Peachtree City | $157 | 1% |

| Peachtree Corners | $179 | 15% |

| Pearson | $146 | -6% |

| Pelham | $145 | -7% |

| Pembroke | $161 | 3% |

| Pendergrass | $162 | 4% |

| Perkins | $171 | 10% |

| Perry | $156 | 0% |

| Phillipsburg | $142 | -9% |

| Pine Lake | $257 | 65% |

| Pine Mountain | $167 | 8% |

| Pine Mountain Valley | $170 | 10% |

| Pinehurst | $167 | 7% |

| Pineview | $161 | 3% |

| Pitts | $158 | 2% |

| Plains | $166 | 7% |

| Plainville | $159 | 2% |

| Pooler | $162 | 4% |

| Port Wentworth | $164 | 5% |

| Portal | $160 | 3% |

| Porterdale | $207 | 33% |

| Poulan | $149 | -4% |

| Powder Springs | $199 | 28% |

| Pulaski | $164 | 5% |

| Putney | $153 | -2% |

| Quitman | $139 | -11% |

| Rabun Gap | $146 | -6% |

| Ranger | $153 | -2% |

| Raoul | $154 | -1% |

| Ray City | $137 | -12% |

| Rayle | $155 | 0% |

| Rebecca | $155 | 0% |

| Red Oak | $238 | 53% |

| Redan | $252 | 62% |

| Reed Creek | $145 | -6% |

| Register | $160 | 3% |

| Reidsville | $160 | 3% |

| Remerton | $132 | -15% |

| Rentz | $154 | -1% |

| Resaca | $154 | -1% |

| Rex | $219 | 41% |

| Reynolds | $177 | 14% |

| Rhine | $157 | 1% |

| Riceboro | $153 | -2% |

| Richland | $165 | 6% |

| Richmond Hill | $155 | -1% |

| Rincon | $157 | 1% |

| Ringgold | $140 | -10% |

| Rising Fawn | $145 | -7% |

| Riverdale | $240 | 55% |

| Roberta | $174 | 12% |

| Robins AFB | $157 | 1% |

| Rochelle | $159 | 2% |

| Rock Spring | $140 | -10% |

| Rockledge | $156 | 0% |

| Rockmart | $173 | 11% |

| Rocky Face | $145 | -7% |

| Rocky Ford | $173 | 11% |

| Rome | $159 | 3% |

| Roopville | $163 | 5% |

| Rossville | $140 | -10% |

| Roswell | $164 | 6% |

| Royston | $149 | -4% |

| Rupert | $173 | 11% |

| Russell | $179 | 15% |

| Rutledge | $173 | 11% |

| Rydal | $161 | 4% |

| Sale City | $148 | -5% |

| Sandersville | $162 | 4% |

| Sandy Springs | $172 | 11% |

| Sapelo Island | $141 | -9% |

| Sardis | $171 | 10% |

| Sargent | $187 | 20% |

| Sasser | $156 | 0% |

| Satilla | $156 | 0% |

| Sautee Nacoochee | $151 | -3% |

| Savannah | $174 | 12% |

| Scotland | $162 | 4% |

| Scottdale | $219 | 41% |

| Screven | $148 | -5% |

| Sea Island | $131 | -15% |

| Senoia | $157 | 1% |

| Seville | $159 | 2% |

| Shady Dale | $175 | 13% |

| Shannon | $159 | 2% |

| Sharon | $185 | 19% |

| Sharpsburg | $161 | 4% |

| Shellman | $163 | 5% |

| Shiloh | $172 | 11% |

| Siloam | $159 | 2% |

| Silver Creek | $168 | 8% |

| Skidaway Island | $160 | 3% |

| Sky Valley | $146 | -6% |

| Smarr | $190 | 22% |

| Smithville | $160 | 3% |

| Smyrna | $183 | 17% |

| Snellville | $205 | 32% |

| Social Circle | $191 | 23% |

| Soperton | $162 | 4% |

| Sparks | $138 | -11% |

| Sparta | $171 | 10% |

| Springfield | $160 | 3% |

| St. George | $137 | -12% |

| St. Marys | $129 | -17% |

| St. Simons | $132 | -15% |

| St. Simons Island | $136 | -12% |

| Stapleton | $155 | 0% |

| Statenville | $147 | -5% |

| Statesboro | $165 | 6% |

| Statham | $169 | 9% |

| Stephens | $158 | 2% |

| Stillmore | $165 | 6% |

| Stockbridge | $208 | 34% |

| Stockton | $140 | -10% |

| Stone Mountain | $238 | 53% |

| Suches | $149 | -4% |

| Sugar Hill | $177 | 14% |

| Sugar Valley | $152 | -2% |

| Summerville | $154 | -1% |

| Sumner | $155 | 0% |

| Sunny Side | $190 | 22% |

| Sunnyside | $136 | -12% |

| Surrency | $153 | -2% |

| Suwanee | $177 | 14% |

| Swainsboro | $164 | 5% |

| Sycamore | $153 | -1% |

| Sylvania | $174 | 12% |

| Sylvester | $151 | -3% |

| Talahi Island | $162 | 4% |

| Talbotton | $173 | 12% |

| Talking Rock | $153 | -2% |

| Tallapoosa | $162 | 4% |

| Tallulah Falls | $152 | -3% |

| Talmo | $162 | 4% |

| Tarrytown | $162 | 4% |

| Tate | $158 | 1% |

| Taylorsville | $168 | 8% |

| Temple | $173 | 11% |

| Tennga | $150 | -3% |

| Tennille | $161 | 3% |

| The Rock | $166 | 7% |

| Thomaston | $165 | 6% |

| Thomasville | $142 | -8% |

| Thomson | $151 | -3% |

| Thunderbolt | $179 | 15% |

| Tifton | $143 | -8% |

| Tiger | $146 | -6% |

| Tignall | $155 | 0% |

| Toccoa | $145 | -7% |

| Toccoa Falls | $155 | -1% |

| Toomsboro | $163 | 5% |

| Townsend | $142 | -8% |

| Trenton | $144 | -7% |

| Trion | $149 | -4% |

| Tucker | $200 | 28% |

| Tunnel Hill | $143 | -8% |

| Turin | $160 | 3% |

| Turnerville | $175 | 13% |

| Twin City | $165 | 6% |

| Ty Ty | $148 | -5% |

| Tybee Island | $159 | 2% |

| Tyrone | $167 | 7% |

| Unadilla | $168 | 8% |

| Union City | $242 | 56% |

| Union Point | $159 | 2% |

| Unionville | $141 | -9% |

| Upatoi | $164 | 5% |

| Uvalda | $161 | 3% |

| Valdosta | $131 | -16% |

| Varnell | $167 | 8% |

| Vidalia | $162 | 4% |

| Vienna | $165 | 6% |

| Villa Rica | $178 | 14% |

| Vinings | $175 | 12% |

| Waco | $165 | 6% |

| Wadley | $164 | 5% |

| Waleska | $159 | 3% |

| Walnut Grove | $199 | 28% |

| Walthourville | $154 | -1% |

| Waresboro | $161 | 4% |

| Warm Springs | $166 | 7% |

| Warner Robins | $158 | 2% |

| Warrenton | $158 | 2% |

| Warthen | $164 | 6% |

| Warwick | $162 | 4% |

| Washington | $155 | 0% |

| Watkinsville | $156 | 0% |

| Waverly | $134 | -14% |

| Waverly Hall | $169 | 9% |

| Waycross | $138 | -11% |

| Waynesboro | $162 | 4% |

| Waynesville | $142 | -9% |

| Webster County | $166 | 7% |

| West Green | $148 | -5% |

| West Point | $165 | 6% |

| Weston | $162 | 4% |

| Whigham | $144 | -7% |

| White | $164 | 6% |

| White Oak | $133 | -14% |

| White Plains | $160 | 3% |

| Whitemarsh Island | $163 | 5% |

| Whitesburg | $174 | 12% |

| Wildwood | $141 | -9% |

| Wiley | $152 | -2% |

| Willacoochee | $145 | -6% |

| Williamson | $166 | 7% |

| Wilmington Island | $162 | 4% |

| Winder | $179 | 15% |

| Winston | $188 | 21% |

| Winterville | $159 | 2% |

| Woodbine | $129 | -17% |

| Woodbury | $167 | 8% |

| Woodland | $172 | 10% |

| Woodstock | $163 | 5% |

| Wray | $142 | -8% |

| Wrens | $156 | 0% |

| Wrightsville | $161 | 4% |

| Yatesville | $171 | 10% |

| Young Harris | $145 | -7% |

| Zebulon | $167 | 8% |

The average monthly cost of car insurance in Georgia’s biggest cities:

- Athens, $157

- Atlanta, $205

- Augusta, $160

- Columbus, $166

- Macon, $177

- Savannah, $174

Best and worst drivers in Georgia

Drivers in Valdosta get into the fewest traffic incidents in Georgia, making them the state’s best drivers. Sandy Springs’ high incident rate means it is home to Georgia’s worst drivers. Incidents include speeding tickets, car accidents and similar events.

Drivers from the Silent Generation tend to be the safest in Georgia among different age groups. Mercury drivers have the lowest incident rate among vehicle brands.

Best drivers in Georgia

Valdosta drivers are the safest drivers in Georgia, with an average of 8.4 auto-related incidents per 1,000 drivers. At 8.8 incidents per 1,000 drivers, Macon has the state’s second-best drivers. Augusta is third at 9.9 incidents.

Best drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Valdosta | 8.4 |

| Macon | 8.8 |

| Augusta | 9.9 |

| Athens | 10.7 |

| Peachtree Corners | 11.1 |

Worst drivers in Georgia

With 26.1 traffic incidents per 1,000 drivers, Sandy Springs has the worst drivers in Georgia. Brookhaven is next, with 25.1 incidents per 1,000 drivers.

Worst drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Sandy Springs | 26.1 |

| Brookhaven | 25.1 |

| Stonecrest | 21.4 |

| Newnan | 19.3 |

| Smyrna | 18.2 |

Best and worst drivers in Georgia by age group

Older drivers in Georgia have the lowest number of incidents among the various age groups. The Silent Generation has the best incident rate overall of 15.56 incidents per 1,000 drivers. Baby boomers have the next-best rate of 18.3.

Gen Z has the state’s highest number of traffic-related incidents by age group, at 58.1 per 1,000 drivers. Millennials have the second-highest rate of 28.9.

Driving incidents by generation

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 58.1 |

| Millennial | 28.9 |

| Gen X | 22.7 |

| Baby boomer | 18.3 |

| Silent Generation | 15.6 |

Best Georgia drivers by car make

Mercury drivers are Georgia’s best when it comes to car make or brand, with an average of 14.7 incidents per 1,000 drivers. Pontiac drivers are next, with an incident rate of 15.6. Lincoln and Chrysler drivers are close behind at 17.3 and 17.5 incidents per 1,000 drivers, respectively.

Best drivers by car brand

| Make | Incidents per 1,000 drivers |

|---|---|

| Mercury | 14.7 |

| Pontiac | 15.6 |

| Lincoln | 17.3 |

| Chrysler | 17.5 |

| Cadillac | 19.9 |

Worst Georgia drivers by car make

The worst drivers in Georgia drive Teslas, based on our data, with 34.7 incidents per 1,000 drivers. Ram drivers come in at a close second, at 32.0 incidents per 1,000 drivers. At 31.1 incidents per 1,000 drivers, Subaru is third among car brands.

Worst drivers by car brand

| Make | Incidents per 1,000 drivers |

|---|---|

| Tesla | 34.7 |

| Ram | 32.0 |

| Subaru | 31.1 |

| Audi | 30.9 |

| Volkswagen | 30.6 |

Minimum coverage for car insurance in Georgia

You need to have 25/50/25 car insurance to meet Georgia’s car insurance requirements. This means you must get at least:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $25,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

State law doesn’t require full coverage car insurance, which usually includes collision

If you need a car loan, though, your lender will require you to get both to protect its financial interest in your car. Leasing companies also usually make you get these coverages.

Frequently asked questions

The average cost of car insurance in Georgia is $155 per month if you get full coverage. For liability-only coverage, the average cost is $68 per month.

Farm Bureau has the cheapest car insurance in Georgia for most drivers. Its rates are especially cheap for adults with clean driving records. These drivers pay about $55 per month for liability coverage and $119 per month for full coverage with Farm Bureau.

To get cheap car insurance in Georgia, look for discounts and compare quotes from several companies before you buy or renew a policy. You can also raise your deductible, which will lower the premium to pay to the insurance company. Just make sure you can afford the higher deductible. You’ll need to pay it if you file a claim.

USAA, which serves the military and their families, has the best customer satisfaction score (from J.D. Power) of the car insurance companies we surveyed in Georgia. State Farm has the state’s second-best score, followed by Farm Bureau and Geico.

Yes, Georgia drivers must buy enough car insurance to meet the state’s minimum coverage limits. To meet these limits, you need $25,000 of bodily injury liability coverage per person and $50,000 per accident. You also need $25,000 of property damage liability coverage.

How we selected the cheapest car insurance companies in Georgia

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full-coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full-coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Georgia

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.