Cheapest Car Insurance in Colorado (2026)

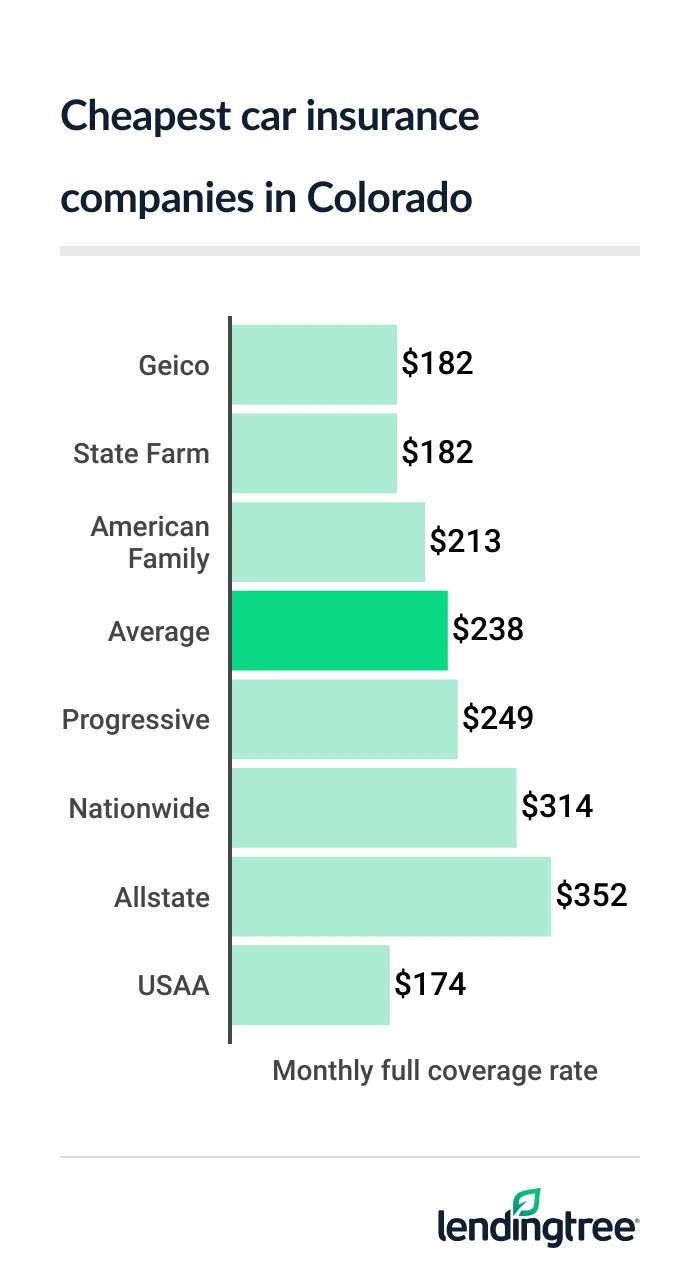

State Farm and Geico have the cheapest car insurance in Colorado for most drivers. Both companies charge $182 a month for full coverage, on average.

Cheapest car insurance companies in Colorado

Colorado’s cheapest full coverage car insurance: Geico and State Farm

State Farm and Geico are tied for the cheapest full coverage car insurance quotes for most drivers in Colorado at $182 per month. This is 24% cheaper than the state average of $238 per month.

- Both Geico and State Farm offer many discounts that could save you money. The cheapest company for you will likely be the one that gives you more of them.

- Optional coverages could make a difference, too. Although State Farm and Geico both offer emergency road service and car rental reimbursement coverage, only State Farm has rideshare insurance. Geico has mechanical breakdown insurance, though, which is similar to a car warranty.

Full coverage car insurance rates by company

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $182 | |

| Geico | $182 | |

| American Family | $213 | |

| Progressive | $249 | |

| Nationwide | $314 | |

| Allstate | $352 | |

| USAA* | $174 | |

USAA’s average rate for full coverage insurance

Cheapest liability car insurance in Colorado: State Farm

At $51 per month, State Farm has Colorado’s cheapest liability car insurance quotes. This is 34% cheaper than the state average of $78 per month.

The state’s second-cheapest company for liability insurance

Liability-only insurance rates by company

| Company | Monthly rate |

|---|---|

| State Farm | $51 |

| American Family | $61 |

| Geico | $67 |

| Progressive | $69 |

| Nationwide | $120 |

| Allstate | $139 |

| USAA* | $41 |

American Family could be your cheapest option if you can get some of its many discounts. You could save up to 23% if you bundle your auto and home insurance policies with American Family. The company also has discounts for going paperless, paying for your policy in full when you buy or enrolling in auto pay.

Liability-only insurance costs $160 per month less than full coverage car insurance in Colorado, on average. Of course, full coverage offers more protection than liability only, as it covers damage to your own car as well as to others’ vehicles and injuries.

Best cheap auto insurance rates in Colorado for teen drivers: State Farm

State Farm has the cheapest car insurance for teens in Colorado. The company charges young drivers $177 per month for liability insurance, on average.

American Family and Geico are next, charging $193 per month and $198 per month, respectively.

Geico has Colorado’s cheapest full coverage car insurance for teen drivers at around $469 per month. State Farm comes in second, with an average rate of $485 per month.

Monthly teen car insurance rates

| Company | Liability coverage | Full coverage |

|---|---|---|

| State Farm | $177 | $485 |

| American Family | $193 | $603 |

| Geico | $198 | $469 |

| Progressive | $313 | $925 |

| Allstate | $370 | $699 |

| Nationwide | $502 | $1,035 |

| USAA* | $120 | $422 |

Teen and other young drivers pay much higher car insurance rates than older drivers, mostly because they get into more accidents.

In Colorado, the average cost of teen car insurance is $268 per month for liability-only coverage. That’s more than three times what the average adult pays.

Teen drivers can usually save money on car insurance by being added to a parent’s policy rather than buying their own. They can also get car insurance discounts for:

- Getting good grades in school

- Completing a driver’s education or training program

- Leaving their car at home while at college

Cheap Colorado car insurance after a speeding ticket: State Farm

With an average rate of $193 per month, State Farm has Colorado’s cheapest car insurance for drivers with a speeding ticket on their records.

American Family and Geico are next, with rates of just over $250 per month.

Monthly auto insurance rates after a ticket

| Company | Monthly rate |

|---|---|

| State Farm | $193 |

| American Family | $251 |

| Geico | $254 |

| Progressive | $334 |

| Allstate | $388 |

| Nationwide | $452 |

| USAA* | $218 |

Discounts could make a big difference here as well, as all three companies offer several ways to lower your rates. Something else to consider is that American Family scores better with customers, based on its good J.D. Power satisfaction score

A speeding ticket raises auto insurance rates by 26% in Colorado, on average. However, State Farm only raises its rates by 6% after a ticket.

Cheapest Colorado auto insurance after an accident: State Farm

For Colorado’s cheapest car insurance for drivers with an accident on their records, make sure you get a quote from State Farm. The company’s average rate, $205 per month, is about half the state average of $368 per month.

American Family is the second-cheapest company for most Colorado drivers after an accident. Its rates average $319 per month.

Monthly car insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $205 |

| American Family | $319 |

| Geico | $349 |

| Progressive | $370 |

| Allstate | $538 |

| Nationwide | $548 |

| USAA* | $246 |

The average driver in Colorado sees their car insurance rate go up by 55% after an at-fault accident. This is where accident forgiveness can help.

With accident forgiveness, your first at-fault accident won’t make your insurance rate go up. Some companies don’t offer it. Those that do usually make you pay a little extra to add it to your policy.

American Family and Progressive are two car insurance companies that offer accident forgiveness. State Farm and Geico are among the companies that don’t.

Colorado’s cheapest insurance for teens after a ticket or accident: State Farm

Most Colorado teens with a ticket or accident on their records get the cheapest car insurance from State Farm.

State Farm’s average rate for teens with a speeding ticket is $195 per month. For teens with an accident, the company’s rates average $214 per month.

Average rates for teens with a ticket or accident

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $195 | $214 |

| American Family | $209 | $288 |

| Geico | $253 | $357 |

| Progressive | $340 | $359 |

| Allstate | $427 | $674 |

| Nationwide | $545 | $552 |

| USAA* | $194 | $212 |

American Family comes in a close second for most Colorado teens after a speeding ticket, at $209 per month. It’s also second-cheapest for teens after an accident, at $288 per month.

These average rates are for liability coverage. If you or your teen want full coverage, they will be higher.

Just like adult drivers, teens pay higher car insurance rates after a ticket or accident. In Colorado, getting a speeding ticket makes the cost of teen car insurance go up 15%, on average.

Cheap car insurance rates after a DUI in Colorado: Progressive

Progressive has the cheapest DUI insurance rates in Colorado of $301 per month. Geico has the next-cheapest rate of $318 per month.

Average car insurance rates after a DUI

| Company | Monthly rate |

|---|---|

| Progressive | $301 |

| Geico | $318 |

| State Farm | $364 |

| American Family | $372 |

| Allstate | $463 |

| Nationwide | $736 |

| USAA* | $363 |

Geico offers many more discounts than Progressive, and several are easy to get. Its discounts for going paperless and signing up for autopay are two examples. Considering how close the two companies are in price, Geico could be the cheapest for you if you qualify for a few of its best discounts.

If you’re convicted of DUI (driving under the influence) in Colorado, you can expect your car insurance rates to go up by around 75%. However, Progressive customers only see their rates go up 21% after a DUI, on average.

Best auto insurance for Colorado drivers with bad credit: Geico

At $267 per month, Geico has the cheapest car insurance for drivers with bad credit in Colorado. This is 26% less than the second-cheapest rate of $361 per month from American Family.

Insurance companies view your credit history as a sign of how risky you may be to insure. The average cost of bad-credit car insurance in Colorado is $470 a month. This is nearly double what drivers with good credit pay.

Average car insurance rates with poor credit

| Company | Monthly rate |

|---|---|

| Geico | $267 |

| American Family | $361 |

| Progressive | $421 |

| Nationwide | $479 |

| Allstate | $594 |

| State Farm | $817 |

| USAA* | $354 |

You can usually improve your credit by paying down debt and avoiding late payments. Once your credit score goes up, shop for car insurance again. You are likely to get a cheaper rate.

Best car insurance companies in Colorado

State Farm is the best car insurance company for most Colorado drivers because of its low rates, which are often the state’s cheapest, and great customer ratings.

State Farm has the best customer satisfaction score from J.D. Power other than USAA, which is only available to members of the military and their families.

Colorado car insurance company ratings

| Company | J.D. Power | AM Best | LendingTree |

|---|---|---|---|

| Allstate | 635 | A+ | |

| American Family | 640 | A | |

| Geico | 645 | A++ | |

| Nationwide | 645 | A | |

| Progressive | 621 | A+ | |

| State Farm | 650 | A++ | |

| USAA* | 735 | A++ |

If you or a close relative has military ties, though, don’t ignore USAA. USAA’s car insurance rates often compete with State Farm’s in Colorado, and sometimes they’re cheaper.

American Family is also worth a look. The company’s rates are usually among the cheapest in Colorado, and it also has many discounts that could make it cheaper still. It scores well with customers, too.

Colorado auto insurance rates by city

Clifton is Colorado’s cheapest city for car insurance, with an average rate of $174 per month. Blende is the state’s most expensive city for car insurance. Rates there average $264 per month.

Colorado’s biggest cities have average car insurance rates between those extremes.

- Denver, $260 per month

- Colorado Springs, $246 per month

- Aurora, $264 per month

- Fort Collins, $203 per month

- Lakewood, $243 per month

Car insurance rates near you

| City | Monthly rate | % from average |

|---|---|---|

| Acres Green | $240 | 1% |

| Agate | $255 | 7% |

| Aguilar | $232 | -2% |

| Air Force Academy | $238 | 0% |

| Akron | $238 | 0% |

| Alamosa | $219 | -8% |

| Alamosa East | $209 | -12% |

| Allenspark | $218 | -8% |

| Alma | $226 | -5% |

| Almont | $205 | -14% |

| Amherst | $238 | 0% |

| Anton | $246 | 3% |

| Antonito | $206 | -13% |

| Applewood | $231 | -3% |

| Arapahoe | $243 | 2% |

| Arlington | $242 | 2% |

| Arriba | $241 | 1% |

| Arvada | $226 | -5% |

| Aspen | $212 | -11% |

| Atwood | $236 | -1% |

| Ault | $211 | -12% |

| Aurora | $264 | 11% |

| Austin | $184 | -23% |

| Avon | $214 | -10% |

| Avondale | $260 | 9% |

| Bailey | $237 | -1% |

| Basalt | $213 | -11% |

| Battlement Mesa | $190 | -20% |

| Bayfield | $214 | -10% |

| Bedrock | $196 | -18% |

| Bellvue | $206 | -13% |

| Bennett | $240 | 1% |

| Berkley | $241 | 1% |

| Berthoud | $205 | -14% |

| Bethune | $246 | 3% |

| Beulah | $252 | 6% |

| Black Forest | $245 | 3% |

| Black Hawk | $228 | -4% |

| Blanca | $211 | -12% |

| Blende | $264 | 11% |

| Blue River | $215 | -10% |

| Boncarbo | $232 | -3% |

| Bond | $216 | -9% |

| Boone | $261 | 10% |

| Boulder | $212 | -11% |

| Bow Mar | $235 | -1% |

| Branson | $233 | -2% |

| Breckenridge | $215 | -10% |

| Briggsdale | $223 | -6% |

| Brighton | $230 | -4% |

| Brookside | $212 | -11% |

| Broomfield | $219 | -8% |

| Brush | $241 | 1% |

| Buena Vista | $204 | -15% |

| Buffalo Creek | $239 | 0% |

| Burlington | $245 | 3% |

| Burns | $219 | -8% |

| Byers | $241 | 1% |

| Cahone | $206 | -14% |

| Calhan | $244 | 2% |

| Campo | $237 | -1% |

| Canon City | $212 | -11% |

| Capulin | $211 | -12% |

| Carbondale | $202 | -15% |

| Carr | $211 | -11% |

| Cascade | $237 | 0% |

| Castle Pines | $240 | 1% |

| Castle Pines North | $240 | 1% |

| Castle Rock | $241 | 1% |

| Cedaredge | $188 | -21% |

| Centennial | $242 | 2% |

| Center | $202 | -15% |

| Central City | $229 | -4% |

| Chama | $211 | -12% |

| Cherry Creek | $243 | 2% |

| Cherry Hills Village | $243 | 2% |

| Cheyenne Wells | $245 | 3% |

| Chromo | $218 | -8% |

| Cimarron | $195 | -18% |

| Cimarron Hills | $250 | 5% |

| Clark | $214 | -10% |

| Clifton | $174 | -27% |

| Climax | $220 | -8% |

| Coal Creek | $223 | -7% |

| Coaldale | $216 | -9% |

| Coalmont | $217 | -9% |

| Collbran | $185 | -22% |

| Colorado City | $251 | 6% |

| Colorado Springs | $246 | 3% |

| Columbine | $232 | -3% |

| Columbine Valley | $235 | -1% |

| Commerce City | $248 | 4% |

| Como | $224 | -6% |

| Conejos | $211 | -11% |

| Conifer | $248 | 4% |

| Cope | $245 | 3% |

| Copper Mountain | $215 | -10% |

| Cortez | $202 | -15% |

| Cory | $185 | -22% |

| Cotopaxi | $213 | -11% |

| Cowdrey | $218 | -9% |

| Craig | $206 | -14% |

| Crawford | $189 | -21% |

| Creede | $204 | -14% |

| Crested Butte | $202 | -15% |

| Crestone | $204 | -14% |

| Cripple Creek | $235 | -2% |

| Crook | $237 | 0% |

| Crowley | $238 | 0% |

| Dacono | $223 | -7% |

| Dakota Ridge | $245 | 3% |

| De Beque | $180 | -25% |

| Deer Trail | $250 | 5% |

| Del Norte | $201 | -16% |

| Delta | $182 | -23% |

| Denver | $260 | 9% |

| Derby | $243 | 2% |

| Dillon | $212 | -11% |

| Dinosaur | $203 | -15% |

| Divide | $236 | -1% |

| Dolores | $206 | -14% |

| Dove Creek | $208 | -13% |

| Dove Valley | $243 | 2% |

| Drake | $201 | -16% |

| Dumont | $233 | -2% |

| Dupont | $248 | 4% |

| Durango | $209 | -12% |

| Eads | $242 | 2% |

| Eagle | $212 | -11% |

| East Pleasant View | $231 | -3% |

| Eastlake | $231 | -3% |

| Eaton | $214 | -10% |

| Eckert | $183 | -23% |

| Eckley | $243 | 2% |

| Edgewater | $248 | 4% |

| Edwards | $213 | -10% |

| Egnar | $207 | -13% |

| El Jebel | $209 | -12% |

| El Moro | $231 | -3% |

| Elbert | $244 | 2% |

| Eldorado Springs | $209 | -12% |

| Elizabeth | $244 | 2% |

| Empire | $234 | -2% |

| Englewood | $245 | 3% |

| Erie | $215 | -10% |

| Estes Park | $204 | -14% |

| Evans | $213 | -10% |

| Evergreen | $245 | 3% |

| Fairmount | $226 | -5% |

| Fairplay | $224 | -6% |

| Federal Heights | $241 | 1% |

| Firestone | $211 | -11% |

| Flagler | $243 | 2% |

| Fleming | $237 | -1% |

| Florence | $212 | -11% |

| Florissant | $230 | -3% |

| Fort Carson | $245 | 3% |

| Fort Collins | $203 | -15% |

| Fort Garland | $217 | -9% |

| Fort Lupton | $222 | -7% |

| Fort Lyon | $260 | 9% |

| Fort Morgan | $242 | 2% |

| Fountain | $242 | 2% |

| Fowler | $231 | -3% |

| Foxfield | $245 | 3% |

| Franktown | $242 | 2% |

| Fraser | $216 | -9% |

| Frederick | $216 | -9% |

| Frisco | $215 | -10% |

| Fruita | $175 | -26% |

| Fruitvale | $175 | -27% |

| Galeton | $211 | -12% |

| Garden City | $210 | -12% |

| Gardner | $229 | -4% |

| Gateway | $178 | -25% |

| Genesee | $232 | -3% |

| Genoa | $246 | 3% |

| Georgetown | $234 | -2% |

| Gilcrest | $217 | -9% |

| Gill | $214 | -10% |

| Glade Park | $177 | -25% |

| Glen Haven | $200 | -16% |

| Glendale | $259 | 9% |

| Gleneagle | $238 | 0% |

| Glenwood Springs | $194 | -19% |

| Golden | $230 | -3% |

| Granada | $243 | 2% |

| Granby | $214 | -10% |

| Grand Junction | $175 | -26% |

| Grand Lake | $213 | -10% |

| Grand View Estates | $236 | -1% |

| Granite | $210 | -12% |

| Grant | $226 | -5% |

| Greeley | $209 | -12% |

| Green Mountain Falls | $240 | 1% |

| Greenwood Village | $239 | 0% |

| Grover | $218 | -9% |

| Guffey | $226 | -5% |

| Gunbarrel | $207 | -13% |

| Gunnison | $208 | -13% |

| Gypsum | $209 | -12% |

| Hamilton | $208 | -13% |

| Hartman | $241 | 1% |

| Hartsel | $222 | -7% |

| Hasty | $243 | 2% |

| Haswell | $244 | 3% |

| Haxtun | $236 | -1% |

| Hayden | $208 | -13% |

| Henderson | $237 | -1% |

| Hereford | $219 | -8% |

| Hesperus | $212 | -11% |

| Highlands Ranch | $234 | -2% |

| Hillrose | $239 | 1% |

| Hillside | $214 | -10% |

| Hoehne | $235 | -2% |

| Holly | $245 | 3% |

| Holly Hills | $258 | 8% |

| Holyoke | $241 | 1% |

| Homelake | $204 | -14% |

| Hooper | $210 | -12% |

| Hot Sulphur Springs | $214 | -10% |

| Hotchkiss | $191 | -20% |

| Howard | $209 | -12% |

| Hudson | $226 | -5% |

| Hugo | $245 | 3% |

| Hygiene | $213 | -10% |

| Idaho Springs | $234 | -2% |

| Idalia | $245 | 3% |

| Idledale | $241 | 1% |

| Ignacio | $210 | -12% |

| Iliff | $236 | -1% |

| Indian Hills | $243 | 2% |

| Inverness | $243 | 2% |

| Jamestown | $223 | -7% |

| Jaroso | $210 | -12% |

| Jefferson | $231 | -3% |

| Joes | $246 | 3% |

| Johnstown | $211 | -12% |

| Julesburg | $240 | 1% |

| Karval | $241 | 1% |

| Keenesburg | $223 | -7% |

| Ken Caryl | $236 | -1% |

| Kersey | $213 | -11% |

| Keystone | $212 | -11% |

| Kim | $233 | -2% |

| Kiowa | $254 | 7% |

| Kirk | $247 | 4% |

| Kit Carson | $241 | 1% |

| Kittredge | $244 | 3% |

| Kremmling | $212 | -11% |

| La Jara | $207 | -13% |

| La Junta | $233 | -2% |

| La Salle | $218 | -9% |

| La Veta | $230 | -3% |

| Lafayette | $211 | -12% |

| Lake City | $202 | -15% |

| Lake George | $235 | -1% |

| Lakewood | $243 | 2% |

| Lamar | $242 | 2% |

| Laporte | $202 | -15% |

| Larkspur | $245 | 3% |

| Las Animas | $242 | 1% |

| Lazear | $196 | -18% |

| Leadville | $218 | -8% |

| Leadville North | $218 | -8% |

| Lewis | $204 | -14% |

| Limon | $245 | 3% |

| Lincoln Park | $212 | -11% |

| Lindon | $237 | -1% |

| Littleton | $233 | -2% |

| Livermore | $208 | -13% |

| Lochbuie | $229 | -4% |

| Log Lane Village | $242 | 2% |

| Loma | $178 | -25% |

| Lone Tree | $240 | 1% |

| Longmont | $210 | -12% |

| Louisville | $210 | -12% |

| Louviers | $237 | 0% |

| Loveland | $201 | -16% |

| Lucerne | $209 | -12% |

| Lyons | $217 | -9% |

| Mack | $175 | -26% |

| Manassa | $207 | -13% |

| Mancos | $205 | -14% |

| Manitou Springs | $239 | 0% |

| Manzanola | $235 | -1% |

| Marvel | $220 | -8% |

| Masonville | $199 | -17% |

| Matheson | $259 | 9% |

| Maybell | $206 | -14% |

| Mc Clave | $244 | 3% |

| Mc Coy | $215 | -10% |

| Mead | $216 | -9% |

| Meeker | $195 | -18% |

| Meredith | $211 | -11% |

| Meridian | $238 | 0% |

| Merino | $239 | 0% |

| Mesa | $185 | -22% |

| Mesa Verde National Park | $210 | -12% |

| Milliken | $210 | -12% |

| Minturn | $216 | -9% |

| Model | $232 | -3% |

| Moffat | $208 | -13% |

| Molina | $189 | -21% |

| Monarch | $202 | -15% |

| Monte Vista | $202 | -15% |

| Montrose | $186 | -22% |

| Monument | $243 | 2% |

| Morrison | $244 | 2% |

| Mosca | $209 | -12% |

| Mount Crested Butte | $201 | -16% |

| Mountain View | $246 | 3% |

| Mountain Village | $209 | -12% |

| Nathrop | $205 | -14% |

| Naturita | $197 | -17% |

| Nederland | $225 | -6% |

| New Castle | $195 | -18% |

| New Raymer | $226 | -5% |

| Niwot | $206 | -13% |

| North Washington | $237 | 0% |

| Northglenn | $233 | -2% |

| Norwood | $206 | -13% |

| Nucla | $197 | -17% |

| Nunn | $213 | -11% |

| Oak Creek | $217 | -9% |

| Ohio City | $202 | -15% |

| Olathe | $185 | -22% |

| Olney Springs | $242 | 2% |

| Ophir | $208 | -13% |

| Orchard | $234 | -2% |

| Orchard Mesa | $176 | -26% |

| Ordway | $247 | 4% |

| Otis | $237 | -1% |

| Ouray | $203 | -15% |

| Ovid | $240 | 1% |

| Padroni | $233 | -2% |

| Pagosa Springs | $213 | -11% |

| Palisade | $176 | -26% |

| Palmer Lake | $236 | -1% |

| Paoli | $238 | 0% |

| Paonia | $192 | -19% |

| Parachute | $190 | -20% |

| Paradox | $202 | -15% |

| Paragon Estates | $208 | -13% |

| Parker | $241 | 1% |

| Parlin | $201 | -16% |

| Parshall | $212 | -11% |

| Peetz | $235 | -1% |

| Penrose | $217 | -9% |

| Perry Park | $245 | 3% |

| Peyton | $244 | 2% |

| Phippsburg | $218 | -9% |

| Pierce | $209 | -12% |

| Pine | $250 | 5% |

| Pine Brook Hill | $215 | -10% |

| Pinecliffe | $222 | -7% |

| Pitkin | $202 | -15% |

| Placerville | $206 | -13% |

| Platteville | $219 | -8% |

| Pleasant View | $203 | -15% |

| Poncha Springs | $204 | -14% |

| Ponderosa Park | $244 | 2% |

| Powderhorn | $202 | -15% |

| Pritchett | $236 | -1% |

| Pueblo | $259 | 9% |

| Pueblo West | $246 | 3% |

| Ramah | $252 | 6% |

| Rand | $215 | -10% |

| Rangely | $193 | -19% |

| Red Cliff | $214 | -10% |

| Red Feather Lakes | $208 | -13% |

| Redlands | $177 | -26% |

| Redvale | $196 | -18% |

| Ridgway | $200 | -16% |

| Rifle | $193 | -19% |

| Rockvale | $212 | -11% |

| Rocky Ford | $233 | -2% |

| Roggen | $221 | -7% |

| Rollinsville | $227 | -5% |

| Romeo | $210 | -12% |

| Roxborough Park | $232 | -2% |

| Rush | $260 | 9% |

| Rye | $247 | 4% |

| Saguache | $201 | -16% |

| Salida | $204 | -14% |

| Salt Creek | $264 | 11% |

| San Luis | $204 | -14% |

| Sanford | $207 | -13% |

| Sargents | $206 | -13% |

| Security-Widefield | $240 | 1% |

| Sedalia | $244 | 2% |

| Sedgwick | $239 | 0% |

| Seibert | $251 | 5% |

| Severance | $211 | -11% |

| Shaw Heights | $229 | -4% |

| Shawnee | $235 | -1% |

| Sheridan | $250 | 5% |

| Sheridan Lake | $244 | 2% |

| Sherrelwood | $243 | 2% |

| Silt | $194 | -18% |

| Silver Plume | $233 | -2% |

| Silverthorne | $215 | -10% |

| Silverton | $212 | -11% |

| Simla | $253 | 6% |

| Slater | $204 | -14% |

| Snowmass | $212 | -11% |

| Snowmass Village | $215 | -10% |

| Snyder | $239 | 1% |

| Somerset | $200 | -16% |

| South Fork | $201 | -16% |

| Springfield | $242 | 2% |

| Steamboat Springs | $210 | -12% |

| Sterling | $236 | -1% |

| Stonegate | $236 | -1% |

| Stoneham | $235 | -1% |

| Strasburg | $242 | 2% |

| Stratmoor | $243 | 2% |

| Stratton | $244 | 2% |

| Sugar City | $243 | 2% |

| Sugarloaf | $218 | -9% |

| Superior | $210 | -12% |

| Swink | $235 | -1% |

| Tabernash | $215 | -10% |

| Telluride | $209 | -12% |

| The Pinery | $238 | 0% |

| Thornton | $236 | -1% |

| Timnath | $211 | -12% |

| Todd Creek | $227 | -5% |

| Toponas | $212 | -11% |

| Towaoc | $202 | -15% |

| Trinchera | $231 | -3% |

| Trinidad | $231 | -3% |

| Twin Lakes | $239 | 0% |

| Two Buttes | $242 | 2% |

| Upper Bear Creek | $239 | 0% |

| Usaf Academy | $238 | 0% |

| Vail | $215 | -10% |

| Vernon | $241 | 1% |

| Victor | $234 | -2% |

| Vilas | $240 | 1% |

| Villa Grove | $203 | -15% |

| Vona | $241 | 1% |

| Walden | $213 | -11% |

| Walsenburg | $236 | -1% |

| Walsh | $242 | 2% |

| Ward | $225 | -6% |

| Watkins | $239 | 0% |

| Welby | $237 | 0% |

| Weldona | $236 | -1% |

| Wellington | $201 | -16% |

| West Pleasant View | $231 | -3% |

| Westcliffe | $226 | -5% |

| Westminster | $228 | -4% |

| Weston | $231 | -3% |

| Wetmore | $228 | -4% |

| Wheat Ridge | $239 | 0% |

| Whitewater | $175 | -27% |

| Wiggins | $239 | 0% |

| Wild Horse | $244 | 3% |

| Wiley | $242 | 2% |

| Windsor | $211 | -11% |

| Winter Park | $217 | -9% |

| Wolcott | $213 | -11% |

| Woodland Park | $240 | 1% |

| Woodmoor | $243 | 2% |

| Woodrow | $243 | 2% |

| Woody Creek | $211 | -11% |

| Wray | $241 | 1% |

| Yampa | $217 | -9% |

| Yellow Jacket | $203 | -15% |

| Yoder | $249 | 4% |

| Yuma | $243 | 2% |

Where you live impacts what you pay for car insurance, but it’s only one factor companies look at to come up with your rate. They also consider your:

- Age

- Marital status

- Vehicle make and model

- Annual mileage

- Driving history

- Insurance history

This is one of the reasons why it’s a great idea to compare car insurance quotes from several companies before you renew or buy a policy.

Best and worst drivers in Colorado

The best drivers in Colorado live in Centennial, according to LendingTree research. Windsor is home to the state’s worst drivers.

Of all age groups, Generation Z is involved in the most accidents in Colorado by a wide margin. Gen X is involved in the fewest.

Colorado cities with the best and worst drivers

Among the largest metros in Colorado, Centennial has the fewest car-related incidents

Best drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Centennial | 4.6 |

| Highland Ranch | 5.8 |

| Lakewood | 6.2 |

| Boulder | 9.5 |

| Arvada | 10.3 |

The Colorado metro with the most car-related incidents is Windsor, at 23.0 per 1,000 drivers. Greeley has the next-highest rate of driving incidents in the state, at 20.2.

Worst drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Windsor | 23.0 |

| Greeley | 20.2 |

| Brighton | 19.8 |

| Thornton | 18.1 |

| Erie | 17.8 |

Worst drivers by age group

Gen Z is the age group with the highest number of traffic-related incidents in Colorado, at 61.4 incidents per 1,000 drivers. Millennials have the state’s second-highest rate of 23.2.

Worst drivers by generation

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z (circa 1997-2012) | 61.4 |

| Millennial (circa 1981-1996) | 23.2 |

| Gen X (circa 1965-1980) | 16.2 |

| Boomer (circa 1946-1964) | 18.7 |

| Silent Generation (circa 1928-1945) | 18.1 |

Best drivers by car make

Pontiac and Buick drivers are tied for best in Colorado, with an incident rate of 13.0 per 1,000 drivers. Cadillac drivers are next, at 15.2.

Best drivers by car brand

| Make | Incidents per 1,000 drivers |

|---|---|

| Pontiac | 13.0 |

| Buick | 13.0 |

| Cadillac | 15.2 |

| Dodge | 17.6 |

| Saturn | 17.7 |

Worst drivers by car make

Ram is the automobile brand most often involved in a traffic-related incident in Colorado, at 29.1 incidents per 1,000 drivers. Tesla comes in second, at 27.7.

Worst drivers by car brand

| Make | Incidents per 1,000 drivers |

|---|---|

| Ram | 29.1 |

| Tesla | 27.7 |

| Mazda | 27.6 |

| Acura | 27.3 |

| Lexus | 26.5 |

Colorado car insurance requirements

Colorado law requires you to have car insurance at all times. You must show proof of insurance to register your car and renew its registration each year.

The penalties for driving without insurance in Colorado include a fine and possible driver’s license suspension. You may also have to perform 40 hours of community service.

Minimum coverage for car insurance in Colorado

You need a car insurance policy with at least 25/50/15 liability coverage limits in Colorado. This means you must have:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $15,000

Bodily injury and property damage liability cover injuries and damage you cause to other people and their property.

Your insurance agent also must offer uninsured motorist

State law does not require collision

Frequently asked questions

The average cost of car insurance in Colorado is $238 a month for full coverage. For liability-only insurance, the average cost is $78 a month. You’ll pay more if you have a prior incident on your record or bad credit.

Geico and State Farm have the cheapest car insurance for most Colorado drivers. Both companies charge a typical adult driver $182 a month for full coverage. Geico is the cheapest company for drivers with bad credit, while Progressive is cheapest after a DUI.

Yes, you can get SR-22 insurance in Colorado if you don’t have a car. Several companies offer non-owner car insurance. A non-owner’s policy lets you legally drive cars you borrow or rent while your SR-22 requirement is in place.

How we selected the cheapest car insurance companies in Colorado

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Colorado

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.