Cheap Full Coverage Car Insurance Companies (2025)

Cheap full coverage car insurance companies

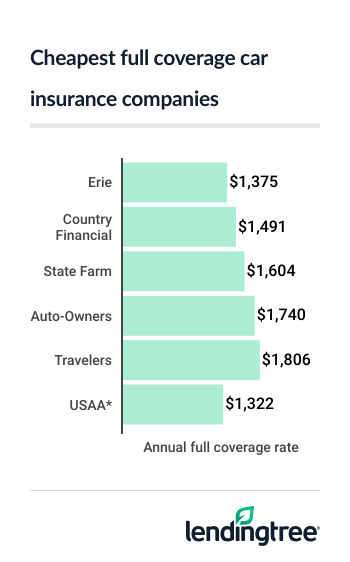

Cheapest companies for full coverage car insurance

State Farm has the cheapest full coverage car insurance for most drivers at $1,604 a year, on average.

Regional companies Erie Insurance and Country Financial are even cheaper, with average rates that are under $1,400 annually. However, Erie is only available in 12 states

| Company | Average annual rate | LendingTree score |

|---|---|---|

| Erie | $1,375 | |

| Country Financial | $1,491 | |

| State Farm | $1,604 | |

| Auto-Owners | $1,740 | |

| Travelers | $1,806 | |

| Farm Bureau | $1,911 | |

| American Family | $2,019 | |

| Progressive | $2,078 | |

| Geico | $2,109 | |

| Nationwide | $2,402 | |

| Allstate | $2,960 | |

| Farmers | $3,462 | |

| USAA* | $1,322 |

USAA offers the cheapest full coverage car insurance rates nationally, at just $1,322 a year, but it only sells to military personnel, veterans and their families.

Best full coverage car insurance companies

- Best for most drivers: State Farm, $1,604

- Best mid-size company: Erie, $1,375

- Best for coverages: Amica, $2,784

- Best for military members and veterans: USAA, $1,322

Best full coverage car insurance for most drivers: State Farm

Annual rate: $1,604

State Farm is a great option for a full coverage policy if you’re looking for affordable rates and a reliable insurer. Full coverage policies with State Farm cost $1,604 a year on average, which is 24% less than other major companies. State Farm also offers several car insurance discounts that can help you save money, such as savings of up to $1,356 if you bundle your car and home insurance policies.

Customers are generally happy with State Farm, too, based on the company’s J.D. Power satisfaction and National Association of Insurance Commissioners (NAIC) complaint ratings.

Company highlights:

- State Farm’s Drive Safe & Save program can earn you a discount of up to 30% if you follow safe driving habits

Pros

- Many car insurance discounts

- Good customer service

- Great app and website experience

-

Strong financial strength rating

which shows an excellent ability to pay claims

Cons

- Expensive car insurance rates with bad credit

- No gap insurance or accident forgiveness

Best mid-size company for full coverage car insurance: Erie Insurance

Annual rate: $1,375

Erie Insurance is an excellent option for drivers in certain states because of its cheap rates and great customer service.

Full coverage car insurance from Erie Insurance costs $1,375 a year, on average. Also, compared to its competitors, Erie has one of the best customer satisfaction ratings from J.D. Power’s 2024 Auto Insurance Study.

However, Erie’s website experience is lacking compared to competitors. With Erie, you can’t buy a policy online, but need to go through an agent instead.

Company highlights:

- Offers a rate lock feature, which protects you from future rate increases until you make major changes to your policy, like moving

Pros

- Offers unique coverage

- Good customer satisfaction ratings

- Cheap car insurance rates

Cons

- Only available in 12 states and the District of Columbia

Best coverage options: Amica

Annual rate: $2,784

Although Amica’s full coverage car insurance rates are higher than average at $2,784 a year, it offers a wide range of optional coverages. Amica offers a Platinum Choice Auto package, which includes new car replacement if your car is less than a year old or has fewer than 1,500 miles, and prestige rental car coverage that has no daily limit.

Amica also has excellent customer satisfaction reviews. J.D. Power gave Amica a score of 746 out of 1,000 in its 2024 U.S. Auto Claim Satisfaction Study, which is the second-best score in the study.

Pros

- Many discount options

-

Upgrade package offers better coverage

Amica offers Platinum Choice® Auto package, which includes full glass coverage, identity fraud monitoring and prestige rental coverage

- Excellent customer satisfaction

Cons

- Above-average car insurance rates

Best full coverage auto insurance for military families: USAA

Annual rate: $1,322

USAA offers cheap car insurance rates along with excellent customer satisfaction. However, it’s only available for military members and veterans, as well as their spouses and children.

USAA had the best customer satisfaction scores in all U.S. regions, according to J.D. Power’s 2024 car insurance study.

USAA also offers military-specific discounts. If you’re deployed and just storing your insured car, for example, you could get up to 60% off of your policy.

Company highlights:

- Offers car replacement assistance, which will give you 20% more then the current value of your vehicle if it gets totaled or stolen

Pros

- Excellent customer satisfaction

- Discounts aimed at military members

- Easy online quotes

Cons

- Only available for military members, veterans and their families

- No local agents

Cheap full coverage car insurance near me

Full coverage car insurance rates can vary by state. Crime rates, accident rates, population density and severe weather in your area affect how much you pay for car insurance.

State Farm offers the cheapest full coverage rates in 21 states. You may find cheaper rates from local or mid-size car insurance companies depending on where you live.

| State | Cheapest company | Cheapest rate |

|---|---|---|

| Alabama | State Farm | $1,231 |

| Alaska | State Farm | $1,383 |

| Arizona | State Farm | $1,652 |

| Arkansas | State Farm | $1,359 |

| California | Geico | $1,486 |

| Colorado | State Farm | $1,948 |

| Connecticut | Travelers | $1,183 |

| Delaware | State Farm | $1,787 |

| Florida | State Farm | $1,957 |

| Georgia | Farm Bureau | $1,334 |

| Hawaii | Geico | $829 |

| Idaho | State Farm | $658 |

| Illinois | Country Financial | $1,232 |

| Indiana | Travelers | $1,272 |

| Iowa | State Farm | $1,050 |

| Kansas | Travelers | $1,405 |

| Kentucky | Farm Bureau | $1,689 |

| Louisiana | Farm Bureau | $1,746 |

| Maine | Travelers | $938 |

| Maryland | State Farm | $1,408 |

| Massachusetts | Geico | $1,320 |

| Michigan | Progressive | $1,906 |

| Minnesota | Travelers | $1,269 |

| Mississippi | State Farm | $1,144 |

| Missouri | American Family | $1,645 |

| Montana | State Farm | $912 |

| Nebraska | State Farm | $1,391 |

| Nevada | Travelers | $2,005 |

| New Hampshire | Hanover | $681 |

| New Jersey | Geico | $1,163 |

| New Mexico | State Farm | $1,464 |

| New York | Progressive | $1,201 |

| North Carolina | Erie | $789 |

| North Dakota | State Farm | $1,333 |

| Ohio | Geico | $690 |

| Oklahoma | State Farm | $1,541 |

| Oregon | State Farm | $1,302 |

| Pennsylvania | Travelers | $1,216 |

| Rhode Island | Travelers | $1,894 |

| South Carolina | Auto-Owners | $1,460 |

| South Dakota | State Farm | $1,289 |

| Tennessee | Erie | $1,379 |

| Texas | Texas Farm Bureau | $1,036 |

| Utah | Progressive | $1,665 |

| Vermont | State Farm | $714 |

| Virginia | Farm Bureau | $1,256 |

| Washington | State Farm | $1,180 |

| Washington DC | Geico | $2,095 |

| West Virginia | Erie | $1,361 |

| Wisconsin | Erie | $1,236 |

| Wyoming | State Farm | $1,196 |

Cheapest full coverage car insurance with a ticket

Erie Insurance, USAA and State Farm are the cheapest companies for full coverage car insurance after a speeding ticket, with all three offering average rates under $2,000 a year.

Insurance companies raise your rates by 22% after a ticket, on average. Auto-Owners raises full coverage rates by just 8%.

| Company | Annual rate after a ticket | % increase from a clean record |

|---|---|---|

| Erie | $1,551 | 13% |

| State Farm | $1,755 | 9% |

| Auto-Owners | $1,883 | 8% |

| Country Financial | $1,952 | 31% |

| Farm Bureau | $2,156 | 13% |

| Travelers | $2,319 | 28% |

| American Family | $2,414 | 20% |

| Progressive | $2,728 | 31% |

| Geico | $2,763 | 31% |

| Amica | $2,987 | 7% |

| Nationwide | $3,178 | 32% |

| Allstate | $3,513 | 19% |

| AAA | $3,954 | 32% |

| Farmers | $4,589 | 33% |

| USAA* | $1,603 | 21% |

Cheap rates for full coverage car insurance with an accident

At around $1,806 a year, Erie Insurance has the cheapest full coverage car insurance rates if you’ve been in an accident.

State Farm offers the next-cheapest average annual rates of $1,846 after an accident. Also, State Farm’s full coverage rates go up by just 15% after an accident, on average. Overall, car insurance rates go up around 49% after an accident.

| Company | Annual rate after an accident | % increase from a clean record |

|---|---|---|

| Erie | $1,806 | 31.35% |

| State Farm | $1,846 | 15.09% |

| Country Financial | $2,162 | 45.00% |

| Auto-Owners | $2,400 | 37.93% |

| Travelers | $2,524 | 39.76% |

| Farm Bureau | $2,586 | 35.32% |

| Progressive | $3,102 | 49.28% |

| American Family | $3,191 | 58.05% |

| Geico | $3,634 | 72.31% |

| Nationwide | $3,853 | 60.41% |

| Amica | $4,313 | 54.92% |

| Allstate | $4,709 | 59.09% |

| AAA | $5,205 | 74.20% |

| Farmers | $5,535 | 59.88% |

| USAA | $1,809 | 36.84% |

If you’re at fault for an accident, it will usually affect your car insurance rates for three to five years.

Cheapest full coverage car insurance for young drivers

Country Financial offers the cheapest full coverage policies to teen drivers, with rates that average $3,050 a year. Young drivers pay about 3 times more for car insurance than older drivers do.

To save money on car insurance as a young driver, see if your insurance company offers a good-student discount or an away-at-school discount.

Some insurance companies also offer a discount to drivers if they’ve completed an approved driver education course.

| Company | Annual rate |

|---|---|

| Country Financial | $3,050 |

| Erie | $3,108 |

| Farm Bureau | $4,371 |

| State Farm | $4,577 |

| Auto-Owners | $4,839 |

| Geico | $5,590 |

| Travelers | $5,978 |

| American Family | $6,385 |

| AAA | $7,472 |

| Nationwide | $8,214 |

| Progressive | $8,434 |

| Allstate | $8,547 |

| Amica | $9,943 |

| Farmers | $11,931 |

| USAA | $3,188 |

Affordable full coverage car insurance with bad credit

Country Financial, USAA and Erie Insurance are the cheapest companies for a full coverage policy if you have bad credit. On average, these drivers with a Country Financial policy pay $2,318 a year.

Drivers with bad credit pay twice as much for car insurance than drivers with good credit.

If you live in California, Hawaii, Massachusetts or Michigan, your credit score won’t impact your car insurance rate.

| Company | Annual rate |

|---|---|

| Country Financial | $2,318 |

| Erie | $3,174 |

| Farm Bureau | $3,202 |

| American Family | $3,313 |

| Geico | $3,409 |

| Travelers | $3,419 |

| Nationwide | $3,533 |

| Progressive | $3,621 |

| Auto-Owners | $4,718 |

| Allstate | $4,855 |

| Farmers | $6,003 |

| Amica | $6,247 |

| State Farm | $6,484 |

| AAA | $7,710 |

| USAA | $2,418 |

If you’re looking for ways to improve your credit, you can pay your bills on time, pay down debt or improve your credit utilization.

How do I get affordable full coverage insurance?

To get the cheapest full coverage car insurance, it’s a good idea to compare quotes from multiple companies. Raising your deductible and asking about discounts you might qualify for can also help keep your rates affordable.

- Compare quotes from many car insurance companies. Start by getting full coverage insurance quotes from several different insurance companies. Use the same limits and deductible amounts for each insurer to make the best comparison. Check each company’s customer satisfaction ratings from J.D. Power and the NAIC Complaint Index as well.

- Increase your deductible. The higher your deductible, the lower your car insurance rate. This can be a good step if you have a clean driving record. Don’t choose a deductible amount you can’t afford to pay if you need to file a claim, though.

- Look for discounts. Most auto insurance companies offer a range of discounts to stay competitive. Ask an agent which discounts could drive your rate down.

Methodology

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Minimum-liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $25,000

- Uninsured / underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: minimum limits, where required by law

- Collision: $500 deductible

- Comprehensive: $500 deductible

–

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

*USAA is only available to current and former members of the military as well as certain family members.

Recommended Articles