Car Buyers Could Save $2,346, on Average, by Shopping Around for Best Auto Loan Rate

You can knock thousands of dollars off the cost of an auto loan simply by shopping around for the best rates.

“Shop around” is perhaps the oldest financial advice. However, an analysis of more than 400,000 auto loan terms offered to users on our platform is proof that comparison shopping is effective. That’s great news for those in the market for a new or used car.

Here’s more of what we found.

Key findings

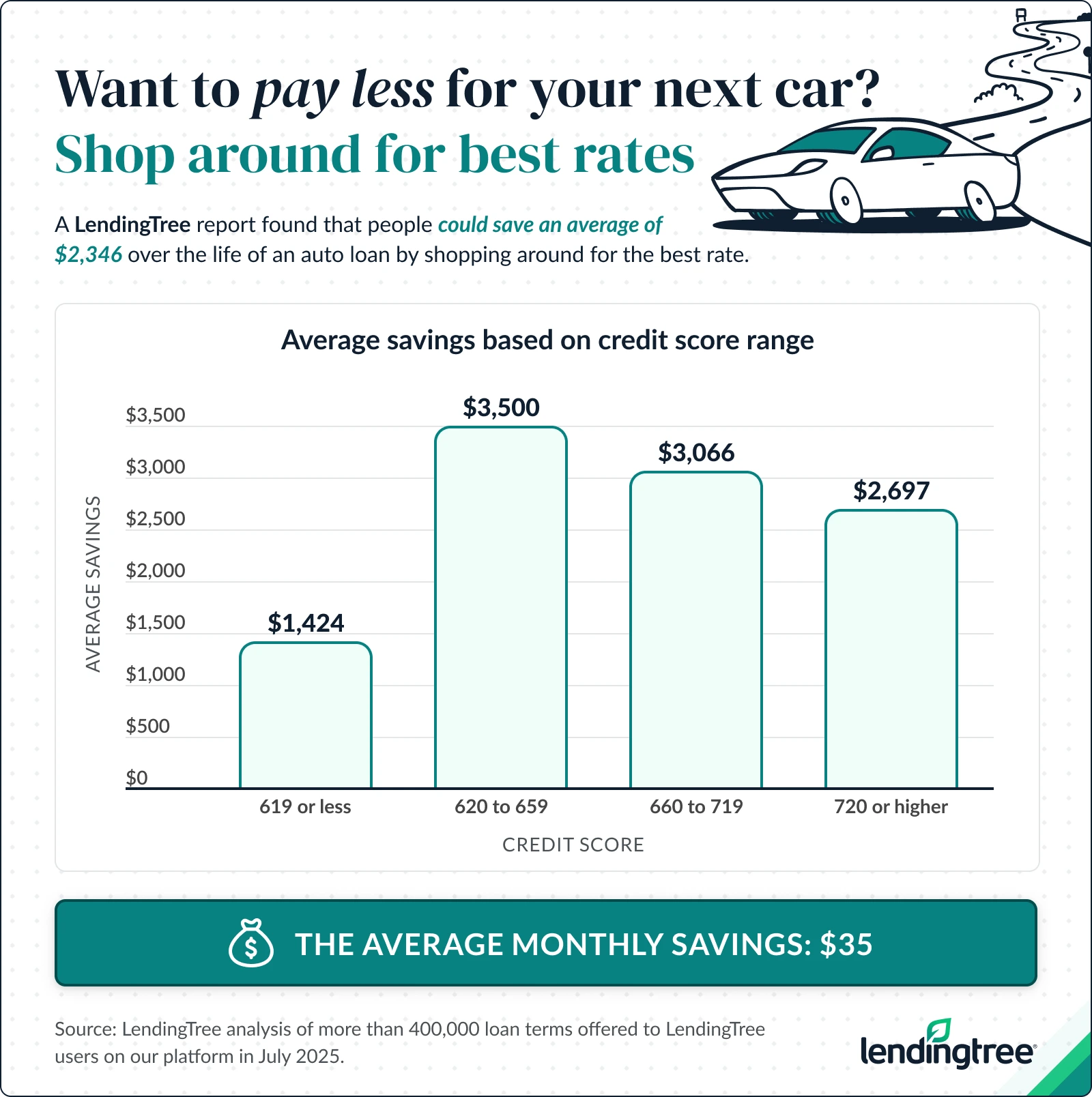

- People who shopped for auto loans on the LendingTree platform in July 2025 could save an average of $2,346 by choosing the offer with the lowest APR. The average highest APR offered was 15.90%, while the lowest was 2.45 percentage points less at 13.45%. The average loan amount offered was $26,566 over an average term of 67.5 months. That breaks down to $598 versus $563 monthly.

- Potential savings are still big, but they’ve shrunk since 2023. That analysis found average savings of $5,198 — more than double this year. That’s because the average loan amount offered was bigger ($32,012) and the gap between the average lowest APR and average highest APR was 4.84 percentage points, nearly twice as big as this year’s.

- Near-prime (credit scores of 620 to 659) and prime borrowers (660 to 719) could save the most by shopping around. On a $26,566 loan over 67.5 months, that could mean $3,500 in savings for near-prime and $3,066 for prime borrowers, making it vital to choose the lowest rate. Those with scores of 720 or higher could save $2,697 — still substantial, but not quite as high as those with lower scores.

- Shopping around isn’t the only way to save money on a car purchase — raising your credit score is key. Someone with a subprime credit score below 620 would pay $12,559 more than a super-prime borrower (720 or higher) to borrow $26,566 for an auto purchase, even after securing the lowest possible rate available to them.

Shopping around for an auto loan can save you thousands

It’s a rough time to shop for a car. Prices for both new and used cars are still high, and so are interest rates on car loans, despite the Federal Reserve’s recent rate cuts. It’s easy to feel powerless in times like these, but you have more control over the situation than you think.

One of the best ways to wield that power is to compare offers from multiple lenders before you choose an auto loan. Helping people shop for the best loan rate is our bread and butter at LendingTree. To demonstrate the effectiveness of rate shopping, we analyzed more than 400,000 loan offers made on our platform. What we found was eye-opening.

Our analysis revealed that individuals who shopped for auto loans on the LendingTree platform in July 2025 could save an average of $2,346 by choosing the offer with the lowest APR over the one with the highest.

Average auto loan offers, 2025

| Avg. minimum offer (APR) | 13.45% |

| Avg. maximum offer (APR) | 15.90% |

| Avg. amount offered | $26,566 |

| Avg. term length offered (months) | 67.5 |

The average amount offered was $26,566 over an average term of 67.5 months. Those taking the maximum offer would pay an average of $598 per month, while those taking the minimum offer would pay an average of $563 per month. That’s a monthly savings of $35.

Average monthly payment, 2025

| Avg. monthly payment on avg. minimum offer | $563 |

| Avg. monthly payment on avg. maximum offer | $598 |

| Monthly difference | $35 |

| Difference over avg. term length offered | $2,346 |

An extra $35 a month may not be life-changing, but given how tight many Americans’ budgets are and how expensive life is in 2025, every dollar saved helps. That’s money that can go each month toward building an emergency fund or saving for retirement, a car down payment or other major financial goals. It matters.

Potential savings are still big, but they’ve shrunk since 2023

While you can still save a lot of money by shopping around for an auto loan, our analysis revealed that the potential savings are substantially smaller than they were just two years ago.

When we last did this report in 2023, the average savings were $5,198. That’s more than double the average from this year’s report. The savings were bigger in 2023 because the average loan amount offered was bigger ($32,012 versus $26,566) and the gap between the average minimum APR and average maximum APR was nearly double this year’s (4.84 percentage points versus 2.45).

Average auto loan offers, 2023 vs. 2025

| 2023 | 2025 | Change | |

|---|---|---|---|

| Avg. minimum offer (APR) | 8.98% | 13.45% | 4.47 points |

| Avg. maximum offer (APR) | 13.92% | 15.90% | 1.98 points |

| Difference between avg. minimum, maximum offer | 4.84 points | 2.45 points | -2.39 points |

| Avg. amount offered | $32,012 | $26,566 | -$5,446 |

| Difference over avg. term length offered | $5,198 | $2,346 | -$2,852 |

Here’s who can save the most by shopping around

Some consumers may be able to save even more than others. So-called near-prime borrowers with a credit score from 620 to 659 could save an average of $3,500 over a typical loan.

That’s because they see the biggest average difference between the highest and lowest APRs offered to them for the same loan. The average highest APR offered to near-prime borrowers on the LendingTree platform was 17.33%, while the average lowest APR offered was 13.53% — a difference of 3.80 percentage points.

Given that the average loan amount offered to near-prime borrowers was $24,813 and the average loan length was 68.7 months, the total savings on the cost of purchasing a vehicle amounts to $3,500 if they opt for the lowest offered APR rather than the highest.

Here’s how those with other credit scores compare:

Average auto loan offers by credit score, 2025

| Subprime (below 620) | Near-prime (620 to 659) | Prime (660 to 719) | Super-prime (720 or higher) | |

|---|---|---|---|---|

| Avg. minimum offer (APR) | 20.16% | 13.53% | 9.61% | 6.89% |

| Avg. maximum offer (APR) | 21.82% | 17.33% | 12.99% | 9.40% |

| Difference between avg. minimum, maximum offer | 1.66 points | 3.80 points | 3.38 points | 2.51 points |

| Avg. amount offered | $21,985 | $24,813 | $26,508 | $33,083 |

| Avg. term length offered (months) | 67.6 | 68.7 | 67.2 | 67.0 |

| Avg. monthly payment, minimum offer | $547 | $521 | $512 | $596 |

| Avg. monthly payment, maximum offer | $568 | $572 | $557 | $636 |

| Monthly difference | $21 | $51 | $46 | $40 |

| Difference over avg. term length offered | $1,424 | $3,500 | $3,066 | $2,697 |

Prime borrowers (those with credit scores from 660 to 719) could find the next biggest savings. They could knock nearly $3,100 off the cost of purchasing a vehicle if they choose the lowest offered APR. While the average loan amount offered was larger than the average offered to near-prime borrowers, the spread between the highest and lowest APR offers was smaller, resulting in lower savings overall.

The savings for those at the top and bottom of the credit scoring spectrum were smaller than for those in the middle, but they’re significant nonetheless. Super-prime borrowers with credit scores of 720 or higher could save $2,697 off the cost of purchasing a vehicle by picking the lowest offered APR, while subprime borrowers with scores below 620 could save $1,424 by doing the same.

Again, that’s money that can be saved simply by shopping around for the best rates; money that could go toward other goals rather than being spent unnecessarily on an auto loan.

Shopping around isn’t the only way to save money on a car purchase

Given the difference in offers between those with good credit scores and those with poor credit scores, it’s worth emphasizing that shopping around isn’t the only way to save some cash on a car purchase. Raising your credit score is also crucial.

On an average loan size of $26,566, someone with a subprime credit score below 620 would pay $12,559 more than a super-prime borrower (720 or higher) for an auto purchase, even when accepting the lowest possible rate available to them.

When comparing super-prime borrowers to other credit tiers, the savings are smaller but still substantial. A near-prime borrower would pay $6,228 more than a super-prime borrower and a prime borrower would pay $2,374 more if they all chose the lowest rate available to them.

Total cost of a $26,556 auto loan by credit score

| Subprime (below 620) | Near-prime (620 to 659) | Prime (660 to 719) | Super-prime (720 or higher) | |

|---|---|---|---|---|

| Avg. monthly payment on minimum offer | $661 | $558 | $513 | $479 |

| Avg. monthly payment on maximum offer | $686 | $613 | $558 | $511 |

| Monthly difference | $25 | $55 | $46 | $32 |

| Difference over term of loan | $1,717 | $3,682 | $3,084 | $2,180 |

| Total cost using minimum offer | $44,640 | $38,309 | $34,455 | $32,081 |

| Difference from super-prime offer | $12,559 | $6,228 | $2,374 | N/A |

Broken down monthly, a subprime borrower would have to pay $661 per month when using the lowest available offer, while the super-prime borrowers would have to pay just $479 — a difference of $182 per month. That’s a big deal.

Looking for an auto loan? Here’s what to keep in mind

If you’re looking to finance a new car, our report makes it clear that shopping around is about the best thing you could do to try to get low rates. Here are a few tips to help:

- Get preapproved for financing. Chances are that the financing deals offered by the car dealership aren’t going to be nearly as good as what you could get from an outside lender. Take the time to rate shop. It can make a big difference.

- Don’t be afraid to wait. Auto loan rates are high right now and haven’t changed much lately. That could change, however, thanks to recent Federal Reserve rate cuts. While there’s no guarantee that rates will fall further, it may be worth waiting a little while to see what happens. In the meantime, you can use that extra time to save money for a down payment, which can have a significant impact on your overall costs.

In addition, for those who aren’t super-prime borrowers, taking steps to improve your credit score is a wise move. While you typically don’t go from awful to awesome credit overnight, the following tips can help you get moving in the right direction:

- Knock down your credit card debt. It’s a good thing to do for many reasons, but it could also send your credit score higher because it could improve your credit utilization, which is the second-most important factor in FICO credit-scoring formulas. Of course, paying down that debt is easier said than done, but it should be every credit cardholder’s goal.

- Increase the credit limits on your current credit cards. It’s vital that you don’t just see the higher credit limit as an excuse to spend. If you do, you’ll make things worse for yourself. However, if you can avoid the lure of spending that new credit, it could lower your utilization rate and bump up your score.

- Removing mistakes from your credit report can significantly boost your credit score. These errors are more common than people realize and can do damage to your score. It’s difficult enough to have a good credit score. The last thing you want is for someone else’s mistakes or fraudulent activity to weigh down your score. Review your reports from the three major bureaus at AnnualCreditReport.com and report any mistakes to them when you find them. Just know that the process of removing errors can take time.

- Ultimately, remember that nothing matters more to your score than your payment history. If you’re planning to apply for a loan soon, take steps to make sure you’re always paying on time. Autopay can be a great way to do so. However, technology is imperfect, so be sure to check in regularly to ensure everything is working as it should.

Methodology

LendingTree researchers analyzed a random sample of more than 400,000 loan terms offered to LendingTree users on our platform in July 2025.

The average lowest and highest APRs offered to each customer were calculated, along with the average loan size and term length offered across the offers they received.

These results were then aggregated by credit band category before being used to calculate the average monthly payments and total amount paid over the loan’s duration under the highest and lowest offered APRs.

The credit band categories are defined as:

- Subprime (credit scores below 620)

- Near-prime (620 to 659)

- Prime (660 to 719)

- Super-prime (720 and higher)

Get auto loan offers from up to 5 lenders in minutes

Recommended Articles