How To Refinance a Car Loan With Bad Credit

- It’s possible to refinance your car with bad credit, or a FICO Score below 580.

- If a lower rate isn’t an option, a longer loan term can still cut your monthly payment.

- You can check your rates without hurting your credit by shopping with LendingTree or by prequalifying on lenders’ websites.

Can you refinance a car loan with bad credit?

Yes, you may be able to refinance with a bad credit score. However, you’ll likely have to do some shopping around, and your loan may come with high annual percentage rates (APRs) (which include interest rates and fees).

Still, depending on your credit score when you first got your car loan, you might qualify for a lower rate.

A LendingTree study found that refinancing your car loan could save you an average of $142 a month and $1,346 over the life of your loan. If you refinance for a shorter loan term, you could save significantly more — $6,291 on average.

Even if you have bad credit, refinancing may be worth it. You might qualify for a lower rate and pay less interest by swapping a longer repayment term for a shorter one. Or, if you’re having trouble keeping up with payments, consider extending your loan term. This will give you a lower monthly payment. In trade, you’ll pay more interest.

How bad can your score be to refinance?

OpenRoad refinances car loans for people with credit scores as low as 460. Others might set the bar slightly higher at 500 or 560. Loan options exist; the hard part is knowing where to look. Bad credit auto refinancing isn’t exactly something you see advertised on TV.

LendingTree is one of the nation’s longest-standing loan marketplaces, and we understand that you’re more than just your score. We’ll help you find lenders that specialize in what you need.

Can you qualify for a lower rate?

Qualifying for auto refinancing doesn’t mean that the rate will be lower than what you’re currently paying.

To get an idea, compare your current rate with the average offers LendingTree users received in the third quarter of 2025. If it looks like you qualify for something better, use our auto refinance calculator to see how much you may save.

| Credit tier | Average APR | Average loan amount | Average loan term |

|---|---|---|---|

| Under 580 (Poor) | 13.39% | $27,354 | 67 months |

| 580-669 (Fair) | 10.10% | $29,128 | 66 months |

| 670-739 (Good) | 7.50% | $30,196 | 66 months |

| 740-799 (Very good) | 6.48% | $35,892 | 66 months |

| 800 and above (Excellent) | 6.30% | $33,249 | 67 months |

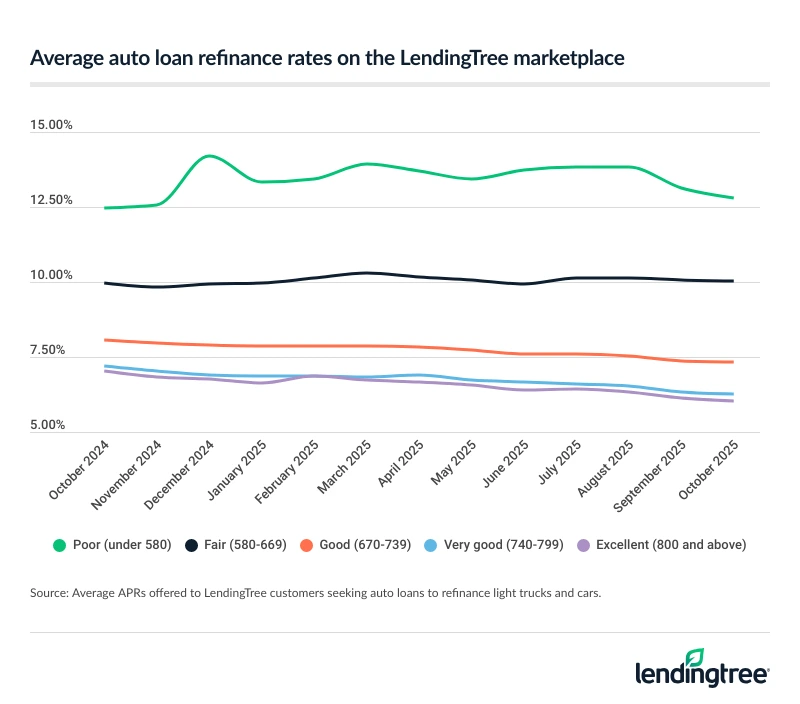

Tracking bad credit car refinancing rates over time

Auto loan refinance rates have been holding fairly steady. But no one truly knows how tariffs and the Fed will impact auto refinancing rates going forward.

Believe it or not, but tariffs could improve your approval odds for auto refinancing. Here’s why:

- Tariffs may cause all car values to rise. Either directly or indirectly through increased material costs, tariffs can impact car prices across the board. The most noticeable difference will be on certain brand-new cars, if imported.

- Used car demand may go up. More people may opt for a used car to skip tariffs. As the demand for used cars goes up, so does their value.

- A better loan-to-value (LTV) ratio means better approval odds. If your car goes up in value, your loan-to-value (LTV) ratio will go down. This is a good thing for lenders. LTV measures how much you owe compared to how much your car is worth.

Putting it all together, imagine you owe $18,000 on a $16,000 car. This is an LTV of 113%, and LTVs above 100% are a red flag.

After tariffs, your car rises in value to $18,500, giving you an LTV of 97%. Lenders may be more willing to refinance since you are no longer upside down on your car loan. LTV is a common eligibility refinancing requirement, regardless of credit score.

How auto refinancing can help, even with bad credit

To illustrate how refinancing a car with bad credit can help, here’s a hypothetical scenario.

Meet John. When his car broke down, he bought a car at a buy here, pay here lot with a 500 credit score. His loan came with an 18% APR and weekly payments, which were tough to keep up with.

A year later, John refinanced. His new lender offered the same rate (18%) and the same term, but switched him to monthly payments instead of weekly.

John didn’t save money on interest, but refinancing made his payments easier to manage. More importantly, he’s now with a traditional lender that reports his payments to the credit bureaus. Buy here, pay here doesn’t. This will give him a better chance to refinance again and get lower rates in the future.

Should I refinance my car if I have bad credit?

Your credit score isn’t the only thing that matters when it comes to auto refinancing. Even if your credit is bad, it could still be the right time to refinance your car.

Consider refinancing if…

- You’ve improved your credit score: Even if your credit score is low, you might qualify for a better loan if your score is better than it was when you took out your current loan.

- Your car has equity: Compare the value of your car with how much you owe on your car loan. If your car is worth more than you owe, you have equity, and lenders will be more likely to approve you for refinancing.

- You can’t afford your current payments: Refinancing can reduce your monthly car payment by stretching out your payments over a longer term. You will likely pay more money in interest over the life of the loan, but refinancing could be worth it if it’s the only way you can afford to keep up with your car payments.

- You can add a cosigner: Having an auto loan cosigner could help you get a better interest rate. Just make sure your cosigner understands that they’re agreeing to be 100% responsible for any loan payments you miss.

Avoid refinancing if…

- Your credit score has dropped: If your credit score has fallen since you took on your car loan, you probably won’t get a better deal on a refinance.

- High market rates: When interest rates go up, it gets more expensive to borrow money. If auto refinance rates are higher than when you took out your loan, you’ll have a hard time finding a cheaper refinance option.

- You’re near the end of your loan: Refinancing is less likely to save you money if you only have a year or two of payments left. In fact, it could end up costing more due to new lender fees and higher interest charges early on. That’s because auto refinance loans are amortized, meaning you pay more interest at the beginning of the term and more principal toward the end. Restarting your loan resets that cycle.

Compare car refinance loans with Lending Tree

Tell us what you need

Take two minutes to tell us what you need to refinance. We’ll take care of the rest. It’s free, simple and secure.

Shop your offers

We’ll send you offers from up to five trusted lenders. Compare them to see if you can save money or lower your car payment.

Get refinanced

Choose an offer, finalize your loan and you could have the money you need within 24 hours.

Where to refinance a car loan with bad credit

| Lender | Min. credit score | Starting APR | Loan amounts | |

|---|---|---|---|---|

| 460 | 6.49% | $7,500-$100,000 | |

| 500 | Not specified | $7,500-$75,000 | |

| 500 | 5.29% | $5,000-$150,000 | |

| 520 | 8.59% | $7,500-$99,999 | |

| 560 | 5.20% | $5,000-$150,000 |

What if I can’t afford my car loan and don’t qualify for refinancing?

It might not feel like it, but you do have options if you can’t afford your car and you can’t get refinanced.

First, call your lender and see if it offers a hardship program. You may be able to extend your existing loan term. This means you’ll likely pay more overall interest but a lower monthly payment. But you won’t have to qualify for a new loan.

If your lender won’t modify your loan, you could:

- Sell your car (but you will need to pay the difference if you owe more than you can sell it for)

- Request a voluntary repossession (this will hurt your credit, but usually less so than if it were involuntary)

- File for bankruptcy (if you also have other debt you can’t afford)

To learn more, read How To Get Out of a Car Loan You Can’t Afford.

Frequently asked questions

Yes. Some lenders offer auto refinancing for credit scores of 500 or lower. OpenRoad, Capital One and RefiJet are examples.

However, the interest rates on these loans are usually high, so you may not save money by refinancing. Keep an eye out for predatory lenders that take advantage of people with bad credit.

You can refinance a car loan with a credit score near or below 500. But the lower your score, the harder it is to get approved, even with bad credit car loan lenders. If you aren’t sure what your score is, check it for free with LendingTree Spring. We’ll also give you personalized tips that can help you improve your credit score.

Lenders have different car loan eligibility requirements. You could be disqualified for having bad credit or a high debt-to-income ratio (DTI ratio). It’s common for lenders to restrict a car’s age and mileage, and many won’t refinance cars 10 years or older or that have more than 100,000 to 150,000 miles.

Yes, refinancing hurts your credit score, but any damage to your credit because it requires a hard credit hit. This drop will likely be small and temporary as long as you make your car payments on time. In the long run, your credit can actually improve if you stay current on your loan payments.